|

市场调查报告书

商品编码

1640573

北美金属罐:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

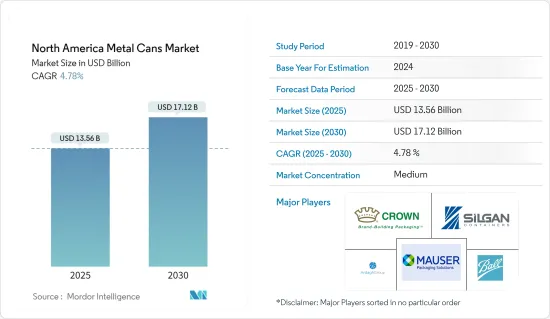

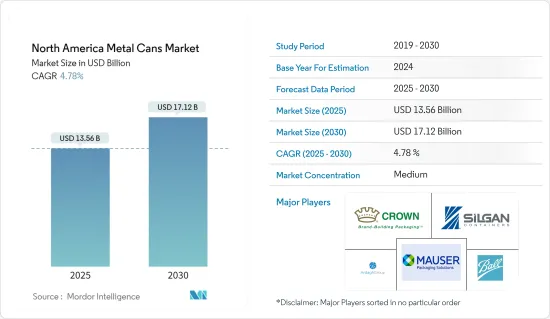

北美金属罐市场规模预计在 2025 年为 135.6 亿美元,预计到 2030 年将达到 171.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.78%。

食品和饮料行业占金属罐包装市场的大部分份额,由于属于必需品类别,在新冠疫情期间,该行业的需求量巨大。由于新冠肺炎疫情,全部区域实施了封锁,导致消费习惯发生了重大变化。包装食品、肉类、蔬菜和水果的需求正在增加。

主要亮点

- 金属罐是该地区许多消费者忙碌生活方式的首选包装解决方案之一,其最大优点是便利性。玻璃受到的限制主要是因为它容易破碎。此外,能量饮料的日益普及、新产品的推出、罐头的经济性和可回收性正在推动所研究市场的成长。

- 许多品牌正在推出新的能量饮料。例如,2020年,可口可乐北美公司推出了可口可乐品牌的首款能量饮料-可口可乐能量樱桃(此口味仅在美国贩售)。零卡路里版本将以 12 盎司 Sleek 罐装形式在全国范围内发售。

- 此外,根据美国铝业协会和美国罐头製造商协会(CMI)2020年的报告,美国铝罐的产业回收率为55.9%,而消费者回收率为46.1%。此外,材料价值为1,210美元/吨。

- 该地区的化妆品行业也推动了金属罐市场的成长,因为许多化妆品和个人护理製造商都倾向于使用金属罐包装他们的产品。例如,根据《Happi》杂誌的数据,2020 年美国主要除臭剂供应商联合利华、宝洁和高露洁棕榄的销售额分别为 3.2704 亿美元、2.1979 亿美元和 3849 万美元. 以美元计。

- 食品和饮料行业在金属罐包装市场占有较大份额,由于属于必需品类别,在新冠疫情期间,该行业的需求巨大。根据 Store Brands 发布的 2020 年研究,在新冠疫情期间,美国的罐头食品消费量增加了 96%。冷冻晚餐的消费量也增加了71%。

北美金属罐市场趋势

饮料预计将占据较大的市场占有率

- 金属罐是饮料最广泛使用的罐头。由于方便携带,北美的罐装葡萄酒、鸡尾酒、烈酒和软性饮料主要采用金属罐包装。金属罐在饮料业的用途根据饮料的性质大致分为酒精饮料和非酒精饮料。啤酒等酒精饮料历来使用金属罐,而葡萄酒等其他类型的酒精饮料传统上用玻璃瓶盛放,但越来越多地采用金属罐。

- 此外,饮料罐製造商正在透过减少製造罐所需的规格来减轻重量。金属罐可以承受包装苏打水所需的二氧化碳压力。金属罐还可以承受高达每平方英吋90磅的力量。这一因素使得罐头成为饮料行业包装的良好选择。

- 金属罐製造商正在提高北美的生产能力,以应对金属罐短缺带来的供应链中断。 Ball 总裁预测,到 2023 年,需求将持续超过供应。饮料业对金属罐的积极需求和成长引发了研究区域对该领域的多项投资。

- 例如,2021年9月,包装公司鲍尔公司宣布将在拉斯维加斯投资2.9亿美元建造新的铝饮料包装厂。该工厂将生产多种尺寸的罐头。该工厂预计将于 2022 年底投入生产,全面运作后将创造 180 个製造业职缺。

- 此外,Ardagh Group 于 2020 年 10 月宣布将在其位于密西西比州的生产工厂安装两条新的高速饮料生产线。该公司宣布,这项投资旨在生产取得专利的、时尚的设计系列的一系列饮料,包括硬苏打水、啤酒、能量饮料和茶。

美国占最大份额

- 在这个市场,由于疫情导致罐头短缺,许多公司正在现有工厂中增加新生产线,以提高生产力。例如,鲍尔公司于 2020 年 9 月宣布,将于 2021 年中期在宾夕法尼亚州匹兹顿开设一家铝饮料包装工厂,以服务北美市场,因为疫情导致北美家庭消费增加。该公司原计划在2021年将产量扩大至60亿罐。 Ball 计划在 2021年终前开设两家新工厂,并为其美国工厂增加两条生产线。

- 疫情导致许多餐厅、酒吧关闭,罐装酒精饮料销量大幅增加。此外,许多饮料製造商已将产品转向罐装,这给铝罐供应链带来了压力。为了满足罐头的需求,许多製造商正在开设工厂以满足不断增长的需求。

- 例如,2021年1月,皇冠控股在维吉尼亚亨利县和巴西东南部的米纳斯吉拉斯州投资了两家新的饮料罐工厂。维吉尼亚的工厂将为多种类别的饮料供应罐,包括苏打水、能量饮料、碳酸软性饮料、茶、机能饮料、硬苏打水、啤酒和鸡尾酒。透过该工厂,该公司将扩大其北美供应网络,以满足不断增长的标准和特殊饮料罐市场的需求。

- 此外,皇冠控股于 2021 年 4 月宣布了在美国建立第三家饮料罐生产工厂的计画。该工厂将生产苏打水、能量饮料、碳酸软性饮料、机能饮料和啤酒罐。

- CMI 的饮料罐和铝罐板成员致力于实现雄心勃勃的美国回收目标,包括在 2030 年实现 70% 的回收率。这些新目标提高了铝饮料罐的循环性,并向饮料製造商和消费者展示了该行业致力于确保铝饮料罐仍然是市场上最永续的包装。

北美金属罐产业概况

北美金属罐市场竞争适中。拥有较大市场份额的大公司正在各个地区扩大基本客群。此外,许多公司正在与多家公司製定策略合作计划,以增加市场占有率和盈利。市场的一些最新趋势:

- 2021 年 3 月 - 鲍尔公司与西班牙领先的饮料公司 Damm 合作,在北美推出 ASI(铝管理计画)铝罐,用于啤酒的储存和包装。预计这将有助于该公司提高销售业绩。

- 2021 年 2 月-Ardash Group 同意将其金属包装业务与 Gores Holdings V 合併,组成一家上市公司。根据协议,独特目的收购公司Gores Holdings V将与Ardagh的金属包装部门合併,组成新公司Ardagh Metals。交易完成后,Ardagh 将保留 AMP 80% 的股份,并获得高达 34 亿美元的现金。此次交易包括来自Gores Holdings V的最高5.25亿美元现金、由投资者主导的6亿美元私募以及AMP筹集的约23亿美元新债务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 金属包装回收率高

- 罐头食品方便又便宜

- 市场限制

- 替代包装解决方案的可用性

第六章 市场细分

- 依材料类型

- 铝

- 钢

- 按行业

- 食物

- 饮料

- 药品

- 化妆品和个人护理

- 其他行业

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Crown Holdings Inc.

- Ball Corporation

- Silgan Containers LLC

- Mauser Packaging Solutions

- Ardagh Group SA

- DS Containers Inc.

- CCL Container Inc.

- Independent Can Company

- Technocap Group

- Can-Pack SA

- Allstate Can Corporation

- Envases Group

第八章投资分析

第九章:未来市场展望

The North America Metal Cans Market size is estimated at USD 13.56 billion in 2025, and is expected to reach USD 17.12 billion by 2030, at a CAGR of 4.78% during the forecast period (2025-2030).

With a significant share in the metal can packaging market, the food and beverage industry is witnessing massive demand amidst the COVID-19 pandemic, as the industry falls under the essential commodity. The lockdown enforced across the region due to the COVID-19 pandemic has bought a significant change in consumption habits. There has been an increasing demand for packaged food products, meat, vegetables, and fruits.

Key Highlights

- Metal cans are one of the perfect packaging solutions for the on-the-go lifestyle of many consumers in the region, and their convenience is topping the benefits list. These can be easily transported or carried to festivals, beaches, and outdoor and sporting events, whereas glass is mainly restricted due to its breakability. In addition, the increasing popularity of energy drinks, the introduction of new products, and the price and recyclability of cans augment the studied market growth.

- Many brands are introducing new energy drinks. For instance, in 2020, Coca-Cola North America unveiled the first-ever energy drink under the Coke brand Coca-Cola Energy Cherry a flavor available exclusively in the United States. Their zero-calorie counterparts will be available nationwide in 12-oz. sleek cans.

- Furthermore, according to the Aluminum Association and Can Manufacturers Institute (CMI), 2020 report, the industry recycling rate of aluminum can account for 55.9% in the United States, and the Consumer recycling rate of aluminum can account for 46.1%. In addition, the value of material accounted for USD 1,210/tons.

- The cosmetic segment in the region is also driving the growth of the metal cans market in the area as many cosmetic and personal care manufacturers prefer metal cans packaging for their products. For instance, according to Happi Magazine, the unit sales of leading deodorant vendors such as Unilever, Procter, and Gamble, Colgate Palmolive in the United States in 2020 accounted for USD 327.04 million, USD 219.79 million, and USD 38.49 million, respectively.

- The food and beverage industry, with a major share in the metal, can packaging market, has witnessed huge demand amidst the COVID-19 pandemic, as the industry falls under the essential commodity. According to a 2020 survey published by Store Brands, the consumption of canned food due to the Covid-19 pandemic increased by 96% in the United States. Also, frozen dinners consumption also increased by 71%.

North America Metal Cans Market Trends

Beverage is Expected to Account For Significant Market Share

- Metal cans are most widely used for beverages. The most notable trend of canned wine, cocktails, hard drinks, and soft drinks is packaged in metal, driven by the need for portability in North America. The usage of metal cans in the beverage industry can be widely classified into alcoholic drinks and non-alcoholic drinks based on the nature of the beverage. Alcoholic beverages, such as beer, have historically used metal cans, while other kinds of liquor, like wine, traditionally served in glass bottles, are increasingly adopting metal cans.

- Moreover, beverage can manufacturers have reduced the weight by reducing the gauge required to fabricate the cans. Metal cans can support the carbonation pressure that is needed to package soda. Metal cans also resist forces up to 90 pounds per square inch. This factor makes the cans the favored choice for packaging in the beverage industry.

- Metal can manufacturers are increasing the production capacity in North America to address the supply chain disruption faced due to the shortage in metal cans. The President of the Ball Corporation has identified the demand to outstrip the supply until 2023. The aggressive demand and growth of metal cans in the beverage industry sparked multiple investments in the sector in the studied region.

- For instance, in September 2021, Packaging company Ball Corporation announced an investment of USD 290 million over the course of multiple years into a new aluminum beverage packaging plant in Las Vegas. The plant is expected to create a range of can sizes. The facility is scheduled to begin production in late 2022 and will create 180 manufacturing jobs when it is fully operational.

- Further, Ardagh Group announced in October 2020 that the two new high-speed beverages could manufacture lines in its production facility in Mississippi. The company announced that the investment is aimed to cater to the production of its patented sleek design line for various beverages, including hard seltzers, beer, energy drinks, and tea.

United States Accounts for the Largest Share

- Many companies in the market are adding new lines to existing plants and are making productivity enhancements because of the can shortage issues due to the pandemic. For instance, in September 2020, Ball Corporation announced that it would open an aluminum beverage packaging plant in Pittston, Pennsylvania, by mid-2021 to serve the North American market as the at-home consumption grows due to the pandemic. The company initially planned a 6 billion can output expansion by 2021. Ball Corporation is looking forward to opening two new plants and adding two production lines to the United States facilities by the end of 2021.

- Many restaurants and bars were closed with the pandemic, due to which canned alcoholic beverages witnessed a significant increase in sales. Also, many beverage manufacturers shifted their products into cans, which has put a strain on the aluminum can supply chain. To cater to the demand for cans, many manufacturers have been opening facilities to meet this ever-growing demand.

- For instance, in January 2021, Crown Holdings invested in the two new beverage can plant in Henry Country, Virginia, and Minas Gerais State, Southeast Brazil. The plant in Virginia will be supplying beverage cans to serve various categories, including sparkling water, energy drinks, carbonated soft drinks, tea, functional beverages, hard seltzers, beer, and cocktails. The company expands its North American supply network with the plant to address the growing standard and specialty beverage cans market.

- Additionally, in April 2021, Crown Holding unveiled its plan to build its third new beverage can production facility in the United States. The plant will produce cans for sparkling waters, energy drinks, carbonated soft drinks, functional beverages, beers, among other beverages.

- Can Manufacturers Institute (CMI) beverage can manufacturer and aluminum can sheet producer members are committing to achieving ambitious U.S. recycling rate targets, including a 70% recycling rate by 2030. These new targets will improve the circularity of the aluminum beverage can while demonstrating to beverage companies and consumers the industry's dedication to ensuring the aluminum beverage can remain the most sustainable package on the market.

North America Metal Cans Industry Overview

The North America Metal Cans market is moderately competitive. The major players with a significant share in the market are expanding their customer base across various regions. In addition, many companies are forming strategic and collaborative initiatives with multiple companies to increase their market share and profitability. Some of the recent developments in the market are:

- March 2021 - Ball Corporation, along with the partnered company Damm, one of the leading beverage companies in Spain, introduced ASI's(The aluminum stewardship initiative) aluminum cans for storage and packaging of beer in North America. This is expected to increase the sales performance of the company.

- February 2021 - Ardagh Group agreed to merge its metal packaging business with Gores Holdings V, creating a publicly listed company. The agreement will see Gores Holdings V, a unique purpose acquisition company, merge with Ardagh's metal packaging division to form the newly created Ardagh Metal. Ardagh will retain an 80% stake in AMP and receive up to USD 3.4 billion in cash when the transaction completes. The deal includes up to USD 525 million in cash from Gores Holdings V and USD 600 million in a private placement led by investors, along with approximately USD 2.3 billion of new debt raised by AMP.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID -19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Metal Packaging

- 5.1.2 Convenience and Lower Price Offered by Canned Food

- 5.2 Market Restraints

- 5.2.1 Presence of Alternate Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By End-user Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceuticals

- 6.2.4 Cosmetic and Personal Care

- 6.2.5 Other End-user Verticals

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings Inc.

- 7.1.2 Ball Corporation

- 7.1.3 Silgan Containers LLC

- 7.1.4 Mauser Packaging Solutions

- 7.1.5 Ardagh Group S.A.

- 7.1.6 DS Containers Inc.

- 7.1.7 CCL Container Inc.

- 7.1.8 Independent Can Company

- 7.1.9 Technocap Group

- 7.1.10 Can-Pack SA

- 7.1.11 Allstate Can Corporation

- 7.1.12 Envases Group