|

市场调查报告书

商品编码

1640601

欧洲软包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)Europe Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

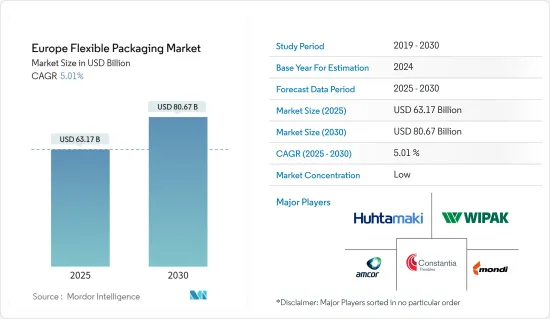

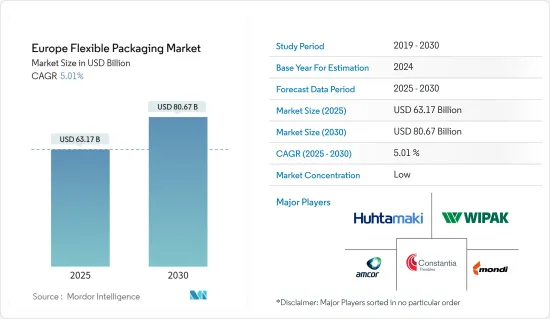

预计2025年欧洲软包装市场规模为631.7亿美元,到2030年预计将达到806.7亿美元,预测期内(2025-2030年)的复合年增长率为5.01%。

关键亮点

- 在欧洲,对加工食品、方便包装食品、已调理食品和零食的需求不断增长将推动市场成长。这一趋势也受到非洲大陆不断增长的城市人口和生活方式改变(如准备饭菜的时间减少)的推动。

- 此外,灵活的包装解决方案有望促进该国对包装、已调理食品、冷冻和优质食品的需求,因为它们可以延长此类产品的保质期。永续软包装解决方案的出现也受到消费者对产品个人化日益增长的需求以及食品和饮料行业对可回收、环保包装日益增长的需求的推动。

- 该地区生活方式的快速变化和经济扩张导致人们对加工和包装产品的偏好,从而推动了食品包装市场的发展。人们对加工食品的偏好日益增长,主要是由于人口从农村到都市区的转移。然而,该地区的塑胶包装废弃物数量正在增加(每年增加 2%)。欧盟委员会正在考虑禁止所有塑胶包装,预计将减缓市场扩张。据欧盟下一任环境专员维吉尼亚斯·辛克维丘斯(Virginius Sinkevicius)称,使用塑胶包装和再生塑胶将被禁止。

- 乳製品产业是众多使用塑胶的行业之一,并致力于减少塑胶的使用。英国食品和农村事务大臣卢克勋爵呼吁乳製品产业更永续发展,将牛奶包装中使用的塑胶量减少 50%。这表明,在一个已经展现出创新多样性的国家,绿色包装将继续扩大。

- 在法国,市场受到不断扩张的化妆品产业支撑。对于化妆品来说,一些知名品牌选择了软包装材料。与硬质塑胶相比,灵活的解决方案更经济实惠,且保质期更长。因此,化妆品行业的扩张预计将为软包装市场提供有利的潜力。

- 欧洲市场可能因金融危机对消费者购买力的影响、大宗商品价格上涨等问题而面临困难。回收塑胶包装废弃物的过程需要现代化的基础设施。这是一项耗时的任务,需要人力资源能力。

- 此外,由于塑胶材料在软包装中的广泛使用,有关可回收性和永续性的某些环境问题可能会在一定程度内限制市场的成长。许多欧洲国家的回收和处理规则越来越严格,这可能会为一些企业带来问题。所有这些都限制了欧洲软包装市场的成长。

欧洲软包装市场趋势

食品业可望引领该地区的软包装市场

- 软包装是一种轻量级的替代品,它允许材料加工者以更少的数量运送更多的产品,从而节省与生产、破损、零件、退货、浪费和运输相关的成本。这是食品包装的理想解决方案。此外,该地区的许多中小型企业正在寻求更长的保质期和更好地防止食物因空气、湿气和阳光等各种原因而腐败,从而增加了对软包装的需求。

- 随着上班族的时间越来越紧张,以及食品选择的便利性越来越高,对包装食品的需求正在迅速增长。包装食品具有更好的阻隔保护、遏製或累积、广告、详细的成分资讯、安全性、适用性和其他好处。因此,在整个预测期内,对包装食品的需求和对网路购物的日益增长的偏好将推动全球电子商务包装市场的成长。

- 根据 Voyado 的一项调查,疫情期间首次在网路上购买食品杂货的消费者比例在西班牙为 30%,在法国为 22%,在英国和义大利为 20%,在瑞典和丹麦为 14%,在芬兰为20%,英国和义大利为20%,波兰、荷兰、比利时和德国为10%,挪威为9%。此外,68% 的新食品杂货购物者表示他们计划在未来继续这样做。因此,人们习惯的这些改变正在对阻隔膜包装市场产生正面的影响。

- 《英国食品杂誌》发表的一项研究发现,改用冷冻食品的家庭的食物浪费减少了 47% 以上。因此,消费者也开始选择冷冻食品来减少浪费。预计向冷冻食品的转变将刺激市场扩张。由于生活方式的改变、可支配收入的增加和开发中国家快速的都市化,尤其是中阶人口的不断扩大等多种因素,对冷冻食品袋的需求正在增长。

- 电子商务的日益增长的趋势正在推动市场的成长。电子商务的扩张正在对欧洲的冷冻食品业务产生重大影响。线上零售商正在利用其广泛的数位能力,透过提供更多种类的冷冻食品并将其直接运送到消费者家中,使客户更容易购买和采购这些产品。宅配的便利、网路订购的便利性以及即时追踪订单的能力正在推动冷冻食品市场的扩张。

- 根据德国冷冻食品协会(Deutsches Tiefkuhlinstitut)的数据,到 2023 年,冷冻烘焙点心将占冷冻食品销售额的 27% 左右,成为这一类别中最大的细分市场。排名第二的是冷冻蔬菜,约占 13%,排名第三的是冷冻食品(包括炖菜和汤),约占 12%。

- 此外,杂货连锁店、超级市场、大卖场和便利商店的快速发展,商品的供应和品质的提升也是推动该产业发展的主要因素。此外,食品工业的强劲成长和就业率的上升也是欧洲冷冻食品产业快速成长的重要因素。

英国发现重大市场成长机会

- 根据英国国家统计局的数据,到2030年,伦敦人口预计将成长到940万,比2025年增加55万。人口不断增长,加上生活方式的改变,例如花在准备饭菜上的时间减少,正在推动人们转向更多加工、方便包装和已烹调食品和零食,这可能会推动所研究市场的增长。

- 此外,对包装、已调理食品、冷冻和优质食品的需求不断增长,预计将推动全国范围内对此类解决方案的需求,因为灵活的包装解决方案可以延长这些产品的保质期。

- 由于包装服务需求不断增长和工业部门的不断扩大,英国的包装行业正在经历急剧增长。英国包装联合会估计,该国包装製造业的年营业额为 110 亿英镑(135.9 亿美元)。该工厂就业人员超过 85,000 人,占英国製造业的 3%。

- 在预测期内,烟草、宠物食品和居家医疗产品对软包装解决方案的需求不断增加,可能会推动英国其他终端使用者垂直领域对软包装的需求。

- 此外,预计塑胶使用量的增加将对市场产生重大影响。例如,英国的塑胶包装税(PPT)将于2022年4月1日生效,对每吨含有30%或以下再生塑胶的塑胶包装征收200英镑(247.7美元)的税。该税旨在鼓励使用更环保的塑胶包装,促进再生塑胶的使用并帮助减少塑胶废弃物。

- 全国各地的消费者都认为,电子商务对生态不利,因为在配送和退货过程中会产生气体排放。 Aquapac 是一家开发促进循环经济产品的特殊聚合物製造商,该公司在 2022 年进行的一项调查发现,超过一半 (52%) 的美国消费者在购买服饰和配件时会考虑环保包装。说,他们愿意为此付出更高的金额。

- 愿意支付额外费用的受访者中,有三分之一表示,他们愿意支付1% 至4% 的高价来获得采用可持续包装的产品,而近五分之二(39%)的受访者表示愿意额外支付5%。 15%的受访者表示愿意多支付10%至20%,8%的受访者表示愿意多支付6%至9%。

欧洲软包装产业概况

欧洲软包装市场细分为多个市场,并由 Amcor PLC、Mondi Group、Wipak Group、Huhtamaki Oyj 和 Constantia Flexibles 等大型公司主导。这些领先的公司拥有显着的市场占有率,并致力于透过策略合作措施扩大基本客群,以增加市场占有率和盈利。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 加工食品需求稳定成长

- 轻量化趋势预计将刺激批量需求

- 市场重新启动

- 软包装市场竞争日益激烈,这可能会影响新参与企业的成长前景

- 与回收有关的环境问题

第六章 市场细分

- 依材料类型

- 聚乙烯 (PE)

- 双轴延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚氯乙烯(PVC)

- PET

- 其他材料类型(EVOH、EVA、PA 等)

- 依产品类型

- 小袋

- 包包

- 包装膜

- PE基

- BOPET

- CPP 和 BOPP

- PVC

- 其他影片类型

- 其他的

- 按最终用户产业

- 食物

- 冷冻食品

- 乳製品

- 水果和蔬菜

- 其他食品

- 饮料

- 医疗和製药

- 化妆品和个人护理

- 其他的

- 食物

- 按国家

- 西欧

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 东欧和中欧

- 波兰

- 捷克共和国

- 罗马尼亚

- 匈牙利

- 西欧

第七章 竞争格局

- 公司简介

- Amcor PLC

- Bak Ambalaj

- Bischof+Klein SE & Co. KG

- Constantia Flexibles GmbH

- Cellografica Gerosa SpA

- Coveris Management GmbH

- Danaflex Group

- Di Mauro Officine Grafiche SpA

- Gualapack SpA

- Huhtamaki Oyj

- ProAmpac LLC

- Wipak Group

- Sipospack Kft.

- ePac Holdings, LLC.

- Mondi Group

- Schur International A/S

第八章投资分析

第九章:未来市场展望

The Europe Flexible Packaging Market size is estimated at USD 63.17 billion in 2025, and is expected to reach USD 80.67 billion by 2030, at a CAGR of 5.01% during the forecast period (2025-2030).

Key Highlights

- Growing demand for processed, conveniently packaged, and pre-prepared foods and snacks in Europe will expand the market. This trend is also fueled by the continent's expanding urban population and shifting lifestyle habits, such as less time spent on meal preparation.

- Furthermore, because flexible packaging solutions can extend the shelf life of such products, the demand for packaged foods, ready-to-eat meals, frozen foods, and luxury foods is anticipated to rise in the nation. The emergence of sustainable, flexible packaging solutions has also been aided by rising consumer desire for product personalization and rising demand from food and beverage industries for recyclable and eco-friendly packaging.

- Owing to the region's fast-changing lifestyles and economic expansion, the preference for processed and packaged goods has driven the market for food packaging. The primary cause of the rising appetite for processed foods is the population's movement from rural to urban locations. However, the amount of plastic packaging waste in the area is rising (by 2% annually). The EU Commission is considering outlawing all plastic packaging, which is predicted to slow market expansion. According to Virginijus Sinkevicius, the incoming EU commissioner for the environment, plastic packaging and the use of recovered plastic would be outlawed.

- The dairy industry is one of many that uses plastic and concentrates on using less plastic. Lord Rooker, the United Kingdom's Food and Farming Minister, has urged the dairy industry to become more sustainable, with a 50% reduction in the number of plastics used in milk packaging. That suggests that greener packaging will continue to expand in a nation that has already demonstrated innovation diversity.

- The expanding cosmetics sector backs the market in France. For their cosmetic items, several well-known brands are choosing flexible packaging materials. Flexible solutions are more affordable and have a longer shelf life than stiff plastic. Consequently, the expanding cosmetics industry is anticipated to open up the lucrative potential for the flexible packaging market.

- The European market may face difficulties due to the financial crisis's effects on consumer spending power, rising commodity prices, and other similar concerns. Modern infrastructure is required for the process of recycling plastic packaging waste. It is a time-consuming operation that demands personnel competence.

- Additionally, due to the widespread usage of plastic material for flexible packaging, specific environmental issues regarding recyclability and sustainability may marginally restrict the market growth. Recycling and disposal rules are becoming stricter in a number of European nations, which could provide a problem for some merchants there. All of these things limit the expansion of the European flexible packaging market.

Europe Flexible Packaging Market Trends

Food Segment is Expected to Drive the Flexible Packaging Market in the Region

- Flexible packaging is a lightweight alternative that saves costs associated with production, damage, parts, returns, disposal, and transportation by allowing material processors to ship more products in less quantity. This is the ideal solution for food packaging. In addition, many small businesses in the region are looking for better protection with longer shelf life against various types of food spoilage, such as air, moisture, and sunlight, increasing the demand for flexible packaging.

- The demand for packaged food products is rising quickly due to working professionals' growing time limitations and the availability of more convenient food options. Packaged food products provide better barrier protection, containment or accumulation, advertising, detailed ingredient information, safety, appropriateness, and other benefits. As a result, the demand for packaged foods and the growing inclination for online shopping is expected to drive growth in the worldwide e-commerce packaging market throughout the forecast period.

- According to research conducted by Voyado, the proportion of consumers who made their first-ever online grocery purchases during the pandemic is Spain at 30%, France at 22%, the United Kingdom and Italy at 20%., Sweden and Denmark at 14%, Finland at 11%, Poland, Netherlands, Belgium, Germany at 10%, and Norway at 9%. Also, 68% of new customers who buy groceries online confirmed that keep doing so in the future. Consequently, this shift in people's habits has positively impacted the barrier film packaging market.

- A study published in the British Food Journal revealed that families that switched to frozen food reduced their food waste by over 47%. As a result, consumers are also moving to frozen food to reduce the amount of trash they produce. This shift to frozen food will spur market expansion. The demand for frozen food bags is rising due to several causes, including changing lifestyles, increasing disposable income, and the quick urbanization of developing nations, particularly the expanding middle-class population.

- The rising trend towards e-commerce is driving the growth of the market. The expansion of e-commerce has significantly impacted the frozen food business in Europe. Online retailers are leveraging extensive digital capabilities to offer a wider range of frozen foods and ship them directly to consumers' homes, making it easier for customers to purchase and source these products. The convenience of home delivery, the ease of online ordering, and the possibility of real-time order tracking are all driving the expansion of the frozen food market.

- According to Deutsches Tiefkuhlinstitut in the year 2023, frozen baked goods made up approximately 27% of frozen food sales - the largest portion in this category. Frozen vegetables came in second place with nearly 13% , while frozen meals (including stews and soups) came in third with about 12% across Germany.

- Moreover, the rapid development of grocery chains, supermarkets, hypermarkets, and convenience stores and the increasing availability and quality of products are some of the primary drivers of the industry. In addition, the strong growth of the food industry and the rising employment rate is also important for the rapid growth of the frozen food industry in Europe.

United Kingdom to Witnesses Significant Growth Opportunities in the market

- Growing urban populations in the United Kingdom According to the Office for National Statistics (UK) is projected that by 2030, the population of London will rise to 9.4 million, which represents a growth of 550,000 individuals from 2025. along with an increase in population and their altered lifestyle patterns, such as less time spent on meal preparation, are driving a shift towards more processed, conveniently packaged, and pre-prepared foods and snacks, which is anticipated to drive the growth of the market under study.

- Additionally, because flexible packaging solutions can extend the shelf life of such products, the rising demand for packaged foods, ready-to-eat foods, frozen foods, and luxury foods is projected to enhance the need for these solutions nationwide.

- The packaging industry is growing dramatically in the United Kingdom due to rising demand for packaging services and the increasing industrial sector. The Packaging Federation of the United Kingdom estimates that the country's packaging manufacturing sector had yearly sales of GBP 11 billion (USD 13.59 billion). More than 85,000 people are employed there, which is 3% of the manufacturing workforce in the United Kingdom.

- The increased demand for flexible packaging solutions for tobacco, pet food, and homecare products will drive the need for flexible packaging in the rest of the end-user verticals in the United Kingdom during the forecast period.

- In addition, the market is expected to be significantly impacted by the tightening of plastic usage laws. For instance, the United Kingdom's Plastic Packaging Tax (PPT), which went into effect on 1 April 2022, is charged at a rate of GBP 200 (USD 247.7) per metric ton of plastic packaging in the United Kingdom that has less than 30% recycled plastic content. The tax intends to promote the use of more environmentally friendly plastic packaging, boost the utilization of recycled plastic, and aid in reducing plastic waste.

- Consumers across the nation believe that e-commerce is not ecologically beneficial because of the gas emissions from deliveries and returns. In a survey conducted in 2022 by Aquapak, a manufacturer of specialized polymers that develops products to promote a circular economy, more than half (52%) of United Kingdom customers stated they would be ready to pay more for ecologically friendly packaging when buying clothing and accessories.

- One-third of those prepared to pay extra indicated they would increase the price by 1% to 4% to receive their items in sustainable packaging, while nearly two-fifths (39%) said they would pay an additional 5%. 15% of respondents said they would be willing to spend an extra 10% to 20%, while 8% said they would pay an additional 6% to 9%.

Europe Flexible Packaging Industry Overview

The Europe Flexible Packaging Market is fragmented and dominated by major players like Amcor PLC, Mondi Group, Wipak Group, Huhtamaki Oyj, and Constantia Flexibles. These major players have a prominent market share and focus on expanding their customer base by leveraging strategic collaborative initiatives to increase their market share and profitability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Rise in Demand for Processed Food

- 5.1.2 Move Toward Light Weighting Expected to Spur Volume Demand

- 5.2 Market Restarints

- 5.2.1 Flexible Packaging is Increasingly Turning into a Competitive Marketplace which Could Impact the Growth Prospects of New Entrants

- 5.2.2 Environmental Challenges Related to Recycling

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Polyethene (PE)

- 6.1.2 Biaxially Oriented Polypropylene (BOPP)

- 6.1.3 Cast Polypropylene (CPP)

- 6.1.4 Polyvinyl Chloride (PVC)

- 6.1.5 PET

- 6.1.6 Other Material Types (EVOH, EVA, PA, etc.)

- 6.2 By Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Packaging Films

- 6.2.3.1 PE-based

- 6.2.3.2 BOPET

- 6.2.3.3 CPP and BOPP

- 6.2.3.4 PVC

- 6.2.3.5 Other Film Types

- 6.2.4 Other Product Types

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.1.1 Frozen Food

- 6.3.1.2 Dairy Products

- 6.3.1.3 Fruits and Vegetables

- 6.3.1.4 Other Food Products

- 6.3.2 Beverage

- 6.3.3 Healthcare and Pharmaceuticals

- 6.3.4 Cosmetics and Personal Care

- 6.3.5 Other End-user Industries

- 6.3.1 Food

- 6.4 By Country

- 6.4.1 Western Europe

- 6.4.1.1 United Kingdom

- 6.4.1.2 Germany

- 6.4.1.3 France

- 6.4.1.4 Italy

- 6.4.1.5 Spain

- 6.4.2 Eastern and Central Europe

- 6.4.2.1 Poland

- 6.4.2.2 Czech Republic

- 6.4.2.3 Romania

- 6.4.2.4 Hungary

- 6.4.1 Western Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Bak Ambalaj

- 7.1.3 Bischof + Klein SE & Co. KG

- 7.1.4 Constantia Flexibles GmbH

- 7.1.5 Cellografica Gerosa SpA

- 7.1.6 Coveris Management GmbH

- 7.1.7 Danaflex Group

- 7.1.8 Di Mauro Officine Grafiche S.p.A.

- 7.1.9 Gualapack SpA

- 7.1.10 Huhtamaki Oyj

- 7.1.11 ProAmpac LLC

- 7.1.12 Wipak Group

- 7.1.13 Sipospack Kft.

- 7.1.14 ePac Holdings, LLC.

- 7.1.15 Mondi Group

- 7.1.16 Schur International A/S