|

市场调查报告书

商品编码

1640604

亚太地区软包装:市场占有率分析、产业趋势与成长预测(2025-2030 年)APAC Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

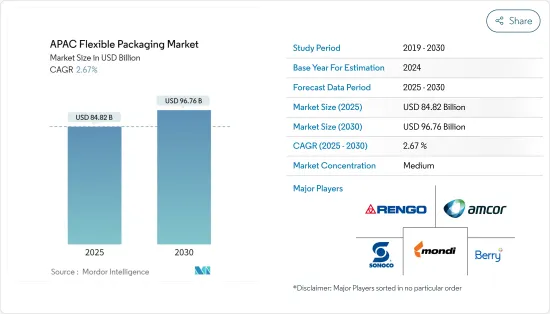

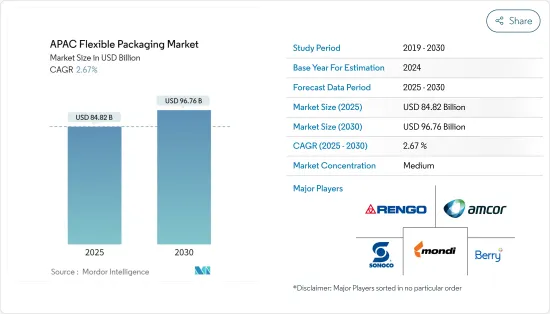

亚太地区软包装市场规模预计在 2025 年为 848.2 亿美元,预计到 2030 年将达到 967.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.67%。

关键亮点

- 预计预测期内亚太地区的软包装将保持稳定的成长。该地区的一些知名供应商正在加快步伐,透过在包装生命週期的三个阶段(生产、运输和处置)采用高效的製造技术,解决日益增长的环境永续性问题。 。

- 随着零售额的飙升,市场趋于扩大,新产品不断推出,现有产品的覆盖范围也不断扩大。从食品饮料到药品和个人护理等各行各业都使用软包装。因此,零售额的成长将会增强软包装市场的各个部分。日本经济产业省报告显示,2023年日本零售业销售额预计将实现约163兆日元,创15年来最高水准。

- 在亚太地区,中国和印度等新兴经济体的快速都市化正推动国内对软包装的庞大需求。该地区终端用户的健康成长进一步推动了对软包装产品的需求,主要是在包装和包装袋领域,主要是为了满足该地区不断增长的中等收入人口的小批量零售需求。

- 软包装产品的需求主要由该地区的千禧世代消费者推动,他们热衷于单份、便携的食品和饮料。这些产品通常设计为便携、耐用和轻巧的,使得软包装成为一种流行的选择。成长最快的零食食品(包括生鲜食品和加工食品)预计将主导食品和饮料行业的软包装需求。在印度的膨化零嘴零食公司中,Bingo 和 Kurkure 在 2023 年的市场占有率均超过 10%。紧随其后的是Taka Tak,同期的市场占有率为 6%。

- 饮料行业为整个全部区域的软包装提供了潜在的成长机会。为了满足日益增长的需求,食品公司正在跨地域、跨产品线扩张。例如,寿全斋是中国最古老的食品公司之一,成立于1760年,现已透过新的即饮产品系列扩展到饮料产业。

- 2024年1月:中国饮料品牌透过提供一致的高品质产品和服务,在国际市场取得突破,并在当地社区站稳脚步。米雪集团是一家总部位于河南郑州、全球拥有超过 36,000 家门市的公司,该公司已申请在香港首次股票公开发行,迈出了重要一步。饮料业的这种扩张可能会进一步推动市场成长。

- 俄乌战争导致全球油价波动,直接影响了软包装所使用原料的成本,如塑胶、聚乙烯、聚丙烯等石化衍生物。这些原料对于生产软包装所使用的薄膜、袋子和包装纸至关重要。石油基产品成本的上升增加了该地区软包装製造商的生产成本,从而导致最终产品价格上涨。

亚太软包装市场趋势

食品业扩张可望推动市场成长

- 软包装通常用于冰沙、小吃、乳製品和糖果零食等食品。典型的柔性食品包装应用包括用于包装起司、肉类、麵包、蔬菜等的薄膜、小袋、铝盖和纸袋。这种软包装不仅可用作一次包装,在某些情况下还可用作二次包装。

- 在食品加工技术创新和消费者生活方式改变的推动下,包装食品产业正在经历成长。预计这些趋势最终将在预测期内刺激产品需求并推动市场成长。例如,百事印度公司于 2024 年 2 月在其薯片产品线中推出了新的子品牌乐事 Shapez。这款创新产品推出了由马铃薯製成的心形颗粒。

- 同样在 2024 年 8 月,斯里兰卡历史最悠久的糖果零食製造商 Uswatte Confectionery Works Pvt. Ltd 宣布重启其着名洋芋片品牌 Chirpy Chips。由于政府采取措施限制优质马铃薯的进口,该公司先前已停止生产该品牌。斯里兰卡糖果零食製造商重新进入马铃薯零食市场预计将支持市场成长。

- 多层薄膜和层压板等软包装材料具有重要的阻隔性能,可保护食品免受湿气、氧气和污染物的侵害。这有助于延长乳製品、肉类和烘焙点心等生鲜产品的保质期。消费者和食品製造商都在寻找既能保持产品新鲜度又能确保食品安全的包装解决方案,因此软包装成为首选。

- 到 2023 年,日本软性饮料的线上零售额将达到约 26 亿美元,成为食品电子商务产业中最大的细分市场。根据中国国家统计局预测,2023年中国餐饮业年销售额将达到约5.3兆元。这与前一年同期比较增长了约 20%。电子商务和食品宅配服务的扩张加速了对能够承受运输严格考验的轻质、耐用的保护包装的需求。软包装非常适合这些需求,因为它具有成本效益,并且可以容纳干燥流质食品。

印度:预计市场将大幅成长

- 印度由于其经济、社会和工业的快速发展,在推动软包装市场成长方面发挥关键作用。印度人口超过14亿,是全球最大的消费市场之一。快速的都市化正在改变人们的生活方式,越来越多的人迁入城市,对包装商品的需求也随之增加。 Bikaji 表示,到 2026 年,包装食品市场规模可能会超过 5 兆印度卢比。

- 由于消费者偏好的改变以及对加工和包装食品的支出增加,印度食品和饮料行业正在经历显着增长。该行业是该国最大的软包装终端用户。 2023 年,热饮在印度天然健康饮料零售中最高,超过 11 亿美元。此外,同年天然保健饮料的零售超过16亿美元。

- 零嘴零食市场在印度等新兴经济体中不断扩大,由于软包装在零嘴零食袋、保鲜膜、袋子等製造中的应用,为市场供应商创造了成长机会。此外,印度零食品牌 Bikaji 报告称,2023 年 7 月印度咸味零食市场有所成长。

- 印度在全球製药业占有重要地位,这导致对软包装的需求不断增长。软包装为锭剂、胶囊、糖浆等药品提供防篡改、防潮和保护解决方案。随着医疗保健产业的扩大以及人们对卫生和安全的关注度不断提高,尤其是在新冠肺炎疫情之后,软包装在确保产品完整性和安全性方面发挥着越来越重要的作用。

- 印度消费者和企业越来越意识到永续性和减少塑胶废弃物的重要性。这推动了对环保和可回收软包装材料的需求。印度政府已推出禁止使用一次性塑胶等措施并推出提倡永续做法的措施。这些法规正在推动製造商走向创新的包装解决方案,例如生物分解性和可堆肥的软包装。

亚太地区软包装产业概况

亚太地区软包装市场由 Amcor Ltd、Berry Plastics Corporation、Mondi Group、Sonoco Products Company 和 Rengo 等重要参与者组成。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估主要宏观经济趋势的市场影响

第五章 市场动态

- 市场驱动因素

- 便捷包装需求不断成长

- 对更长保质期和创新包装的需求

- 市场限制

- 环境和包装回收问题

第六章 市场细分

- 按类型

- 小袋

- 包包

- 裹

- 其他的

- 按材质

- 塑胶

- 纸

- 铝/复合材料

- 按最终用户产业

- 食物

- 饮料

- 製药和医疗

- 家庭和个人护理

- 其他的

- 按国家

- 中国

- 印度

- 日本

- 澳洲

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Amcor Ltd

- Berry Plastics Corporation

- Mondi Group

- Sonoco Products Company

- Rengo Co. Ltd

- Sealed Air Corporation

- Formosa Flexible Packaging Corp

- Wapo Corporation Ltd

- Chuan Peng Enterprise Co. Ltd

- TCPL Packaging Ltd

- Ester Industries Ltd(Wilemina Finance Corporation)

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 55595

The APAC Flexible Packaging Market size is estimated at USD 84.82 billion in 2025, and is expected to reach USD 96.76 billion by 2030, at a CAGR of 2.67% during the forecast period (2025-2030).

Key Highlights

- Flexible packaging in Asia-Pacific is expected to witness a stable growth rate during the forecast period. Some of the prominent vendors in the region are focusing on the ever-growing concern regarding environmental sustainability by adopting efficient manufacturing techniques throughout the three stages of the packaging life cycle: manufacturing, transportation, and disposal.

- As retail sales surge, markets tend to expand, introducing new products and broadening the reach of existing ones. Diverse industries, ranging from food and beverages to pharmaceuticals and personal care, utilize flexible packaging due to its versatility across various product categories. Consequently, a rise in retail sales stands to bolster various segments of the flexible packaging market. In 2023, Japan's retail industry achieved sales of approximately JPY 163 trillion, marking its highest value over the previous 15 years, as reported by METI (Japan).

- There is a considerable increase in domestic demand for flexible packaging in Asia-Pacific, owing to the rapid urbanization across emerging economies, such as China and India. Healthy growth across end users in the region is further driving the need for flexible packaging products, primarily in the wraps and pouches segment, majorly to address the small quantity retailing needs of the rising middle-income population in the region.

- The demand for flexible packaging products is mainly driven by millennial consumers in the region, as they have an avid preference for single-serving and on-the-go style food and beverage products. As these products are generally designed to be portable, durable, and lightweight, flexible packaging is a popular option. The fastest-growing areas of snack foods, both in terms of fresh items and processed foods, are expected to govern the demand for flexible packaging from the food and beverage industry. In 2023, Bingo and Kurkure had the highest market share of over 10% each among the puffed snacks companies in India. This was followed by Taka Tak, with a 6% market share during the same period.

- The beverage industry offers potential growth opportunities for flexible packaging across the region. Food companies are expanding their businesses in terms of geography and product lines to cater to this rising demand. For instance, Shou Quan Zhai, founded in 1760 and one of the oldest food companies in China, expanded into the beverage industry with a new line of ready-to-drink products.

- In January 2024, Chinese beverage brands made strides in international markets, embedding themselves into local communities by offering consistent quality products and services. Mixue Group, hailing from Zhengzhou in Henan province and boasting a network of over 36,000 stores globally, took a significant step by filing for an initial public offering in Hong Kong. Such expansion in the beverage industry may further propel market growth.

- The Russia-Ukraine War caused fluctuations in global oil prices, directly impacting the cost of raw materials used in flexible packaging, such as plastics, polyethylene, polypropylene, and other petrochemical derivatives. These materials are essential for producing films, pouches, and wraps used in flexible packaging. The increased cost of petroleum-based products raised the production costs for flexible packaging manufacturers in the region, leading to price increases for end products.

APAC Flexible Packaging Market Trends

Expanding Food Industry Expected to Drive Market Growth

- Flexible packaging is commonly used for food products such as smoothies, snacks, dairy, confectionery, etc. Typical flexible food packaging applications include films, pouches, aluminum lids, and paper bags to package cheeses, meats, bread, and vegetables. This flexible packaging can be used as primary packaging as well as secondary packaging in some cases.

- The packaged food industry has been witnessing growth owing to innovations in food processing techniques and changes in consumer lifestyles. These trends are anticipated to eventually boost product demand, propelling the growth of the market during the forecast period. For instance, in February 2024, PepsiCo India introduced a new sub-brand, Lay's Shapez, to its potato chips lineup. The innovative product showcases heart-shaped pellets made from potatoes.

- Also, in August 2024, Uswatte Confectionery Works Pvt. Ltd, Sri Lanka's oldest confectionery manufacturer, announced the revival of its famous potato chip brand, Chirpy Chips. The company had previously discontinued the brand due to government policies restricting the import of high-quality potatoes into the country. This re-entry of potato snacks by confectionery manufacturers in Sri Lanka is expected to support market growth.

- Flexible packaging materials, such as multilayer films and laminates, provide significant barrier properties that protect food from moisture, oxygen, and contaminants. This helps to extend the shelf life of perishable items like dairy products, meat, and baked goods. Consumers and food manufacturers alike seek packaging solutions that maintain product freshness while also ensuring food safety, making flexible packaging a preferred choice.

- In 2023, online retail sales of soft drinks in Japan amounted to around USD 2.6 billion, making it the largest segment within the food-based e-commerce industry. According to the National Bureau of Statistics of China, in 2023, the annual revenue of the foodservice industry in China amounted to around CNY 5.3 trillion. This indicated an increase in revenue of approximately 20% compared to the previous year. Such expansion of e-commerce and food delivery services has accelerated the need for lightweight, durable, and protective packaging that can withstand the rigors of shipping. Flexible packaging fits these needs by being cost-effective and adaptable for both dry and liquid food products.

India Is Expected to Witness Significant Market Growth

- India is playing a significant role in driving the growth of the flexible packaging market due to its rapidly evolving economic, social, and industrial landscape. With a population of over 1.4 billion, India is one of the largest consumer markets in the world. Rapid urbanization is leading to lifestyle changes, with more people moving to cities and a higher demand for packaged goods. According to Bikaji, the market value of packaged food is likely to surpass INR 5 trillion by 2026.

- India's food and beverage industry is experiencing significant growth, driven by changing consumer preferences and increasing spending on processed and packaged foods. This industry is the largest end user of flexible packaging in the country. In 2023, the retail sales value of naturally healthy beverages in India was the highest for hot drinks at over USD 1.1 billion. Furthermore, the retail sales value of the naturally healthy beverages surpassed USD 1.6 billion that same year.

- The snacks market has been expanding in emerging economies, including India, creating a growth opportunity for market vendors due to the application of flexible packaging in making snack pouches, wraps, bags, and others. Additionally, Bikaji, a snack brand in India, reported that the savory snacks market in India witnessed growth in July 2023.

- India is a significant player in the global pharmaceutical industry, and the demand for flexible packaging is growing. Flexible packaging offers tamper-evident, moisture-resistant, and protective solutions for pharmaceutical products, including tablets, capsules, and syrups. As the healthcare sector expands, especially with the increasing focus on hygiene and safety post-COVID-19, flexible packaging plays an increasingly crucial role in ensuring product integrity and safety.

- There is growing awareness among Indian consumers and companies about the importance of sustainability and reducing plastic waste. This has led to improved demand for eco-friendly and recyclable flexible packaging materials. The Indian government has introduced policies such as the ban on single-use plastics and initiatives promoting sustainable practices. These regulations are pushing manufacturers toward innovative packaging solutions like biodegradable and compostable flexible packaging.

APAC Flexible Packaging Industry Overview

The APAC flexible packaging market is fragmented, with the presence of significant companies like Amcor Ltd, Berry Plastics Corporation, Mondi Group, Sonoco Products Company, and Rengo Co. Ltd. The companies continuously invest in strategic collaborations and product developments to gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Convenient Packaging

- 5.1.2 Demand for Longer Shelf Life and Innovative Packaging

- 5.2 Market Restraints

- 5.2.1 Concerns About the Environment and Recycling of Packaging Material

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pouches

- 6.1.2 Bags

- 6.1.3 Wraps

- 6.1.4 Other Types

- 6.2 By Material

- 6.2.1 Plastic

- 6.2.2 Paper

- 6.2.3 Aluminum/Composites

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.2 Beverages

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Industries

- 6.4 By Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 Australia

- 6.4.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Ltd

- 7.1.2 Berry Plastics Corporation

- 7.1.3 Mondi Group

- 7.1.4 Sonoco Products Company

- 7.1.5 Rengo Co. Ltd

- 7.1.6 Sealed Air Corporation

- 7.1.7 Formosa Flexible Packaging Corp

- 7.1.8 Wapo Corporation Ltd

- 7.1.9 Chuan Peng Enterprise Co. Ltd

- 7.1.10 TCPL Packaging Ltd

- 7.1.11 Ester Industries Ltd (Wilemina Finance Corporation)

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219