|

市场调查报告书

商品编码

1640626

下一代电晶体:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Next-Generation Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

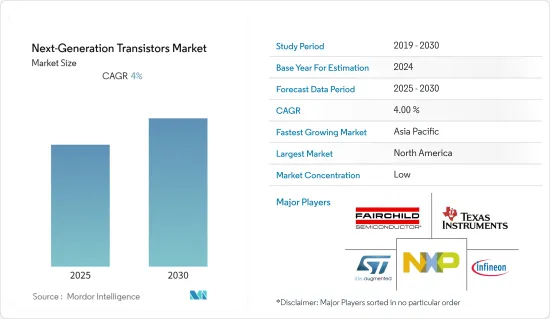

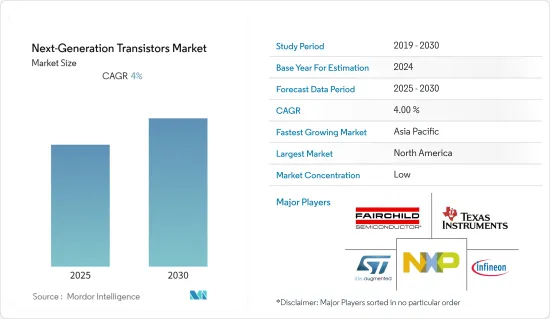

预测期内,下一代电晶体市场预计复合年增长率为 4%

关键亮点

- 半导体材料是电子产业的关键技术创新之一。这是因为它具有高电子迁移率、宽温度限制和低能耗。根据SEMI预测,2022年全球半导体製造设备对目标商标产品製造商的销售额预计将达到创纪录的1175亿美元,较2021年的1025亿美元增长14.7%,2023年将达到1208亿美元。

- 消费性设备中日益增多的先进功能也推动了快速即时处理的需求。此外,随着物联网的出现,人工智慧、资料分析、即时资料传输和处理等功能正在成为任何先进设备的基本必需品,为研究市场的供应商创造了巨大的机会。此外,台积电在 2022 年北美技术研讨会上展示了即将推出的製造流程技术,其中的亮点是其下一代 2nm 节点的细节,内部称为「N2」。该公司将于 2022年终开始生产 3nm 节点。

- 2022年4月,科学家开发出第一个磁电晶体管,这可能有助于提高电子产品的功率效率。该团队的设计不仅降低了内建微电子装置的能耗,而且还将储存特定资料所需的电晶体数量减少了 75%,从而使装置体积更小。它还可以为微电子装置提供“窃取记忆”,这意味着即使在关机或突然断电后,它们也能准确地记住用户上次停止的位置。

- 此外,许多市场参与企业正转向在其製造流程中采用奈米片。例如,2022 年 6 月,台湾晶片製造商台积电披露了其期待已久的 2nm 製造製程节点的细节,该节点将于 2025 年到来,采用奈米片电晶体架构并增强其 3nm 技术。据该公司介绍,新一代硅半导体晶片的速度预计会更快。随着製程节点的缩小以及科技业继续努力遵循摩尔定律,预计其能源效率将更高。

- 此外,后疫情时代也对半导体和其他电子元件产业的生产和製造能力产生了影响。例如,根据中国报纸报道,2022 年 6 月,深圳奥密克龙的停工导致全球最大的电子市场之一华强北再次部分关闭。华强北位于深圳市福田区,是半导体、行动电话等电子设备的供应中心。根据财经媒体财联社报道,随着深圳加强措施遏止高传染性新冠肺炎疫情的蔓延,华强北的一些商贩已暂时停止营业。这些商户包括华强电子世界1号店和2号店。

下一代晶体管市场趋势

高电子移动性电晶体(HEMT) 的采用日益增多

- 高电子移动性电晶体产生高增益,使其非常适合用作放大器。它还允许高速切换。此外,这些电晶体的电流波动相对较小,因此杂讯係数较低。

- 许多公司正在开发比传统电晶体工作频率更高的 HEMT 设备。例如,Nanoscience Technologies 于 2022 年 11 月宣布推出新型低 RDS(on) 650V E-mode GaN HEMT 装置。 INN650D080BS 功率电晶体采用标准 8x8 DFN 封装,导通电阻为 80mΩ(典型值 60mΩ),可用于图腾柱 LLC 架构和快速电池充电器等高功率应用。

- 例如,Ampleon 于 2022 年 9 月发布了其新型 CLL3H0914L-700 GaN-SiC高电子移动性电晶体。这种强大的 GaN 电晶体针对需要长脉衝宽度和高占空比的雷达应用进行了最佳化。此电晶体的设计目标是在 50V 电压下工作时,单一电晶体的峰值输出功率超过 700W,效率超过 70%,脉衝宽度(约 2 毫秒),达到行业领先水平。脉衝宽度(波长)(300 s)和20% 占空比。

- 此外,家用电子电器的需求不断增长以及高电子移动性电晶体的适用性正在推动市场成长。据IBEF称,印度家用电子电器和家用电子电器产业最近的价值为98.4亿美元,预计到2025年将成长一倍以上,达到14.8亿印度卢比(211.8亿美元)。此类家用电子电器产品的发展预计将进一步推动研究市场的成长。

- 此外,义法半导体最近宣布推出一系列名为 STi2GaN(ST 智慧整合 GaN)的 GaN 装置。此零件采用 ST 的无键合线封装技术,具有坚固性和可靠性。新产品系列旨在利用 GaN 的高功率密度和效率来提供 100 V 和 650 V高电子移动性电晶体(HEMT) 装置。

亚太地区市场显着成长

- 亚太地区是电子产业的中心,每年有数十亿台电子设备在该地区生产并销售。然而,亚太地区在全球电子元件出口中发挥着至关重要的作用。该地区家用电子电器市场的快速成长是亚太地区在全球下一代电晶体市场的主要成长要素。

- 此外,中国和日本等新兴经济体拥有大型电子製造地,有潜力成为电晶体市场的重要参与企业。而且下一代行动电话可能会更加重视提升行动电话的效能,并拥有更好的规格。预计更多晶体管的整合将使行动电话体积更小、处理速度更快,从而完全满足消费者的需求。根据IBEF统计,2022年第一季「印度製造」智慧型手机出货量年增7%,超过4,800万部,印度製造的智慧型手机出货量超过1.9亿部。

- 据IBEF称,2019年国家电子政策的目标是到2025年生产10亿支行动电话(价值1900亿美元),其中6亿部(价值1000亿美元)将出口。

- 此外,为了改变这种状况,中国已将半导体产业的发展作为「中国製造2025」计画的重要组成部分。中国的目标是扩大市场占有率,而国内晶片生产可以满足国内 14 亿公民日常使用的智慧型手机、个人电脑和其他设备的 80% 需求。预计所有这些因素都将支持市场扩张。

- 此外,该地区也是三星、英特尔和台积电等半导体市场参与企业的所在地。两家公司承认,从 2023 年起,采用 3nm 或 2nm 技术的逻辑装置生产将逐步从主导的 FinFET 电晶体架构转变为类似奈米片的架构。

- 此外,2022年4月,韩国第三大企业集团SK集团宣布,将收购三星电子有限公司的全资子公司三星电子有限公司,以加强其电池相关业务。全资子公司三星电子有限公司,以加强其电池相关业务。 SK 表示将购买管理股权并额外斥资 1,200 亿韩元(9,500 万美元)收购 Yes Powertechnix 95.8% 的股份。此外,SK最近投资268亿韩元收购了Yes Powertechnix 33.6%的股份。这些发展可能会刺激该地区的需求。

下一代晶体管产业概况

下一代晶体管市场竞争激烈。半导体产业本身正在经历专业化阶段。从历史上看,半导体产业专注于生产能够执行一些通用功能的电脑晶片。这些晶片彼此之间有一定的关联。然而,如今半导体应用变得更加细緻入微和差异化,从而催生出大量在各行各业拥有专业知识的利基参与企业。此外,在这个行业中,除了英特尔等少数主要参与企业设计、製造和生产半导体产品外,许多参与企业都将其职能外包。因此,该产业与全球供应链深度交织,既存在激烈的竞争,也存在着深度的合作。

- 2022 年 6 月 - 跨国 GaN(氮化镓)功率半导体领导者 GaN Systems 宣布推出业界最广泛的 GaN 功率电晶体产品组合中的一款新型电晶体。 GS-065-018-2-L 扩展了GaN Systems 的高性能、低成本电晶体产品组合,具有更低的导通电阻、更高的稳健性和热性能以及850V VDS(瞬态)额定值。是。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 拥抱市场动态

- 市场驱动因素

- 技术进步导致对更高密度设备的需求

- 消费性电子产品的普及

- 市场限制

- 维持摩尔定律的成本越来越高,但报酬却越来越低

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 高电子移动性电晶体(HEMT)

- 双极接面电晶体 (BJT)

- 场效电晶体(FET)

- 多射极电晶体(MET)

- 双栅极金属氧化物半导体场场效电晶体

- 按最终用户产业

- 航太和国防

- 工业的

- 通讯

- 家用电子电器

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- NXP Semiconductors NV

- Infineon Technologies AG

- STMicroelectronics NV

- Fairchild Semiconductor International, Inc.(ON Semiconductor Corp.)

- Texas Instruments Incorporated

- Intel Corporation

- GLOBALFOUNDRIES Inc.

- Taiwan Semiconductor Manufacturing Company

- Samsung Electronics Co., Ltd

- Microchip Technology Inc.

第七章投资分析

第 8 章:市场的未来

The Next-Generation Transistors Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- Semiconductor materials represent one of the significant innovations in the electronics industry. This can be accredited to their high electron mobility, wide temperature limits, and low energy consumption. According to SEMI, worldwide sales of total semiconductor manufacturing equipment by original equipment manufacturers reached a record USD 117.5 billion in 2022, rising 14.7% from the previous industry high of USD 102.5 billion in 2021 and forecasted to increase by USD 120.8 billion in 2023.

- The growing scope of advanced features in consumer devices is also fueling the need for fast and real-time processing. Furthermore, with the advent of IoT, features like AI, data analytics, real-time data transfer, and processing are becoming a basic necessity for any advanced devices, creating a massive opportunity for the studied market vendors. Furthermore, TSMC showcased its upcoming manufacturing process technology at the company's 2022 North America Technology Symposium, with the highlight being details of its next-generation 2nm node, known internally as N2. The company will go into production with the 3nm node at the end of 2022.

- Moreover, in April 2022, Scientists created what they believe is the first magneto-electric transistor that could help to make electronics more power-efficient. Along with curbing the energy consumption of any microelectronics that incorporate it, the team's design could reduce the number of transistors needed to store specific data by as much as 75 percent leading to smaller devices. It could also lend those microelectronics "steel-trap memory" that remembers exactly where its users leave off, even after being shut down or abruptly losing power.

- Further, many players in the market are shifting towards employing nanosheets in their manufacturing process. For instance, in June 2022, Taiwanese chipmaker TSMC revealed details of its much-anticipated 2nm production process node - set to arrive in 2025 - which will use a nanosheet transistor architecture and enhancements to its 3nm technology. According to the company. The newer generations of silicon semiconductor chips are expected to increase speed. They will be more energy efficient as process nodes shrink and the tech industry continues to fight to hang onto Moore's Law.

- Moreover, Post Covid 19 is affecting the production and manufacturing capacity of the semiconductor and other electronics components industry. For instance, in June 2022, according to sources in the Chinese Press, Shenzhen's Omicron lockout forced Huaqiangbei, one of the world's biggest electronics markets, to partially close once again. Huaqiangbei, a center for the supply of semiconductors, cellphones, and other electronics, is situated in the Futian District of Shenzhen. According to financial media Cailianshe, certain vendors in Huaqiangbeihave temporarily ceased operations as Shenzhen intensified measures to control the spread of the highly contagious Omicron Covid-19. These vendors include the first and second stores of HuaqiangElectronics World.

Next-Generation Transistors Market Trends

Increasing adoption of High Electron Mobility Transistor (HEMT)

- High electron mobility transistors produce high gain, making these transistors very useful as amplifiers. They can quickly switch speeds. And shallow noise values are produced as the current variations in these transistors are relatively low.

- Many companies are developing HEMT devices that operate at higher frequencies than conventional transistors. For instance, in November 2022, Nanoscience Technology announced a new low RDS(on) 650V E-mode GaN HEMT device. In a standard 8x8 DFN package, INN650D080BS power transistors have an on-resistance of 80m (60m typical), enabling higher power applications such as totem pole LLC architectures or fast battery chargers.

- For instance, in September 2022, Ampleon Launched a new CLL3H0914L-700 GaN-SiC High-electron-mobility transistor. This rugged GaN transistor is optimized for radar executions where long pulse width and high-duty cycles are needed. The transistor was engineered to accomplish over 700W of peak output power from a single transistor while operating at a voltage of 50V with industry-leading efficiency of over 70%, as well as developed thermally for long pulse applications, such as pulse widths (~2 milliseconds) and 20% duty cycles.

- Moreover, the growing demand for consumer electronics and the applicability of high electron mobility transistors drive market growth. According to IBEF, the Indian appliances and consumer electronics industry stood at USD 9.84 billion recently and is expected to more than double to reach INR 1.48 lakh crore (USD 21.18 billion) by 2025. Such developments in consumer electronics will further drive the studied market growth.

- Furthermore, STMicroelectronics recently announced a new family of GaN parts designated STi2GaN, which stands for ST Intelligent and Integrated GaN. The pieces use ST's bond-wire-free packaging technology to provide robustness and reliability. The new product family aims to leverage the high-power density and efficiency of GaN to offer a range of 100- and 650-V high-electron-mobility transistor (HEMT) devices.

Asia Pacific to Experience Significant Market Growth

- The Asia Pacific region is an electronics hub with billions of electronic devices manufactured annually for consumption, specifically in this region. However, the Asia-Pacific region plays a significant role in exporting electronic components across the globe. The rapid growth in the consumer electronics market in this region is the key growth factor for the Asia-Pacific region in the Global Next Generation Transistor Market.

- Furthermore, the developing economies of the region, such as China and Japan, have massive electronics manufacturing bases and hold the potential to become significant players in the transistors market. Further, the next-generation phones would be entirely focused on improving the performance of phones with better specifications. Integrating more transistors is expected to direct to smaller phones with faster processing, which caters perfectly to consumer needs. According to IBEF, Shipments of "Made-in-India" smartphones rose 7% YoY in Q1 2022 to reach over 48 million units, while over 190 million smartphones made in India were shipped.

- According to IBEF, The National Policy on Electronics 2019 targets the production of one billion mobile handsets valued at USD 190 billion by 2025, out of which 600 million handsets valued at USD 100 billion are likely to be exported.

- Furthermore, China has made the growth of its semiconductor industry a key component of its Made in China 2025 agenda to alter this situation. China intends to increase its market share in electronics while having local chip production meet 80% of domestic demand for the numerous smartphones, PCs, and other devices that its 1.4 billion citizens use daily. All of these elements are anticipated to support market expansion.

- Moreover, the region has several players in the semiconductor market, like Samsung, Intel, and TSMC. These firms have acknowledged that starting in 2023, the production of logic devices using the 3nm or 2nm technology generations will gradually switch from the workhorse FinFETtransistor architectures to nanosheet-like architectures.

- Furthermore, in April 2022, The third-largest conglomerate in South Korea, SK Group, will acquire Yes Powertechnix, the only domestic manufacturer of power semiconductors based on a component of silicon and carbide (SiC), which are emerging as a key component of electric vehicles, as part of a group-wide effort to strengthen its battery-related business. SK Inc. said it would purchase management rights and a further KRW 120 billion (USD 95 million) to acquire 95.8% of Yes Powertechnix. Further, the business recently invested KRW 26.8 billion to acquire a 33.6% ownership in Yes Powertechnix. Such development may fuel the region's demand.

Next-Generation Transistors Industry Overview

The next-generation transistors market is highly competitive. The semiconductor industry itself is going through a phase of specialization. Historically, the industry has concentrated on producing computer chips that could perform several generalized functions. These chips were related to each other to some extent. But today, the applications of semiconductors are more nuanced and differentiated, leading to the proliferation of niche players with specialized expertise across various verticals. Moreover, in this industry, many players outsource their functionalities except a few major players like Intel, who design, fabricate, and manufacture semiconductor products. This makes the sector deeply connected to global supply chains and has made this industry fiercely competitive and deeply collaborative.

- June 2022 - GaN Systems, the multinational player in GaN (gallium nitride) power semiconductors, introduced a new transistor in the industry's broadest portfolio of GaN power transistors. The GS-065-018-2-L expands the firm's high-performance, low-cost transistor portfolio and features lower on-resistance, raised robustness and thermal performance, and an 850V VDS (transient) rating.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Dynamics

- 4.3 Market Drivers

- 4.3.1 Technological Advancements Leading To Demand for Increasing Device Densities

- 4.3.2 Proliferation of Consumer Electronics

- 4.4 Market Restraints

- 4.4.1 Cost of Maintaining Moore's Law is Getting Higher with Low Returns

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 High Electron Mobility Transistor (HEMT)

- 5.1.2 Bipolar Junction Transistor (BJT)

- 5.1.3 Field Effect Transistors (FET)

- 5.1.4 Multiple Emitter Transistor (MET)

- 5.1.5 Dual Gate Metal Oxide Semiconductor Field Effective Transistor

- 5.2 By End User Industry

- 5.2.1 Aerospace & Defense

- 5.2.2 Industrial

- 5.2.3 Telecommunications

- 5.2.4 Consumer Electronics

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 NXP Semiconductors N.V.

- 6.1.2 Infineon Technologies AG

- 6.1.3 STMicroelectronics N.V.

- 6.1.4 Fairchild Semiconductor International, Inc. (ON Semiconductor Corp.)

- 6.1.5 Texas Instruments Incorporated

- 6.1.6 Intel Corporation

- 6.1.7 GLOBALFOUNDRIES Inc.

- 6.1.8 Taiwan Semiconductor Manufacturing Company

- 6.1.9 Samsung Electronics Co., Ltd

- 6.1.10 Microchip Technology Inc.