|

市场调查报告书

商品编码

1640627

云端电视 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cloud TV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

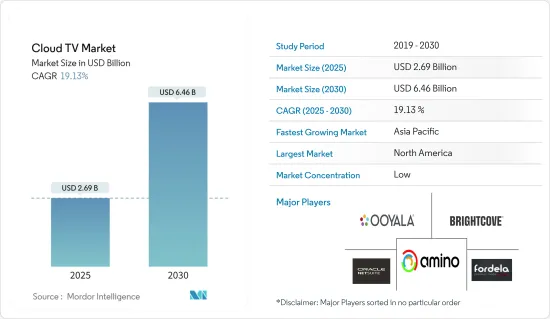

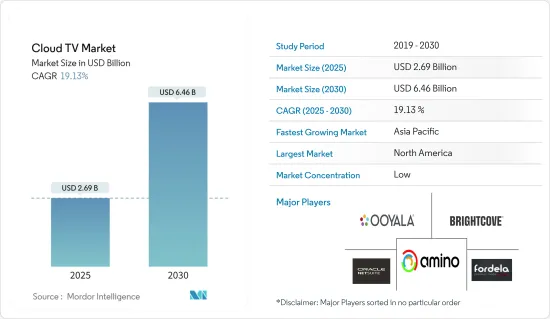

预计 2025 年云端电视市场规模为 26.9 亿美元,到 2030 年将达到 64.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 19.13%。

云端电视是云端基础的应用程序,可播放电视频道、电影、节目和音乐等内容。云端电视应用程式可以轻鬆安装在个人电子设备上,并且不需要大量记忆体。

关键亮点

- 云端电视允许电视用户无论身在何处都可以播放其储存的录影。您也可以将内容下载到智慧型手机或平板电脑上以供离线观看。云端电视创新正在增强观众的娱乐体验。将您喜爱的内容储存在云端从未如此简单。此外,云端电视功能的更新也将即时提供给用户。云端电视提供更个人化的观看体验,因为用户可以在任何装置上观看自己喜欢的节目和电影,无论何时何地。

- 串流媒体行业需要可扩展且灵活的解决方案来满足所有类别的观众的需求,预计该公司及其市场顶级竞争对手的快速增长将在预测期内推动市场发展。云端电视在增加观看时间、观众成长和消费的影片内容数量方面的可扩展性和灵活性正在推动全球市场的采用。

- 此外,基于物联网的媒体设备的日益普及也对云端电视服务产生了巨大的需求。不断增加的产品创新,例如 Amazon Fire TV 棒和 Roku 盒子,正在推动云端电视平台的成长。

- 不过,儘管云端电视供应商可能能够覆盖全球观众,但他们可能需要提供服务的权利。每个市场都有自己的内容版权限制,这可能导致实际的突破困难,这可能对市场成长带来挑战。此外,云端电视需要网路连接,但世界农村地区缺乏高速网路限制了它的普及。

- 新冠疫情对云端电视市场产生了积极影响,观众透过线上订阅在家消费更多内容。这加速了该格式的成长。此外,越来越多的消费者拥有数位电视,这为媒体购买者创造了一个令人兴奋的机会来利用不断变化的消费趋势。

云端电视(TV)市场趋势

中小企业推动成长

- 广播媒体产业对云端技术的采用持续成长,大多数媒体公司都采用了云端技术。 COVID-19 的出现大大加速了该行业对云端技术的需求不断增长。

- 随着采用云端来满足各种业务需求的趋势,越来越多的媒体广播产业中小型企业正在采用云端电视来接触客户。虚拟基础设施的扩展和对网路内容的需求不断增长也在影响云端电视的采用。

- 云端电视在内容传送方面为中小型企业提供了优势,因为与传统电视相比,它需要的前期基础设施投资更少。采用云端电视需要最少的内部基础设施,从而最大限度地减少硬体设备、安装和维护方面的投资。

- 云端电视可协助企业透过快速简便的部署来扩展现有市场。这也有助于大幅减少施工和维护所需的时间和成本。 Google Cloud 和 Microsoft Azure 等云端运算平台的强大功能正在帮助客户加速成长,透过提供从规划到交付个人化内容、安装和实施线上视讯服务以及推出中型云端电视服务的整合解决方案。了一个精简的云端电视平台,从

- 此外,云端电视具有足够的可扩展性和灵活性,可满足不同受众群体的需求,确保增加收视率和影片内容消费量。这使得中小型企业能够采用云端电视。

预计亚太地区将占很大份额

- 由于观众越来越多地采用影片串流服务,预计亚太地区将在整个预测期内显着增长。不断增长的直播需求使得市场参与者能够开发出强大的产品和服务,进一步推动市场成长。此外,该全部区域基础设施和可靠网路连线的发展也大大推动了云端电视的需求。

- 此外,基于互联网的内容消费的整体成长正在极大地改变亚洲的视讯市场。据 Media Partners Asia 称,到 2023 年,线上影片占影片产业总收益的比例预计将从 2017 年的 9% 增长到 20% 的 20%。线上影片的全面成长是推动亚洲影片市场成长的最重要趋势之一。

- 在印度、马来西亚和柬埔寨等新兴经济体联网电视数量不断增长的推动下,亚太地区各大主要参与企业正在加强其在云端电视多种应用领域的客户影响力。他们正在投资透过併购、收购等方式进入市场。

- 例如,2022 年 10 月,领先的营运商级云端电视和视讯串流娱乐平台 WeWatch 宣布与柬埔寨优质网路服务供应商Online(COGETEL Ltd)达成新的协定。

- 此外,QYOU Media Inc. 宣布,其印地语青年频道 The Q India 将与 CloudTV 合作,向 63 个印度家庭推出其旗舰频道 The Q 以及新频道 Q Marathi、Q Kahaniyan 和 Q Comedistaan新的智慧型电视。该系统将开始目前,印度有超过 1.25 亿电视家庭观看 Q India 节目,行动、OTT 和应用平台上有超过 6.8 亿用户观看该节目。

云端电视产业概览

云端电视市场细分化,由多个市场参与企业组成。随着市场机会的不断扩大、行动互联网服务和覆盖范围的增强以及显示品质的提高,预计将有大量新的供应商进入市场。借助即时资料,这些公司正在进行创新并占领相当大的市场占有率。这些新兴市场的发展预计将支持云端电视市场的成长。为了增加市场占有率和盈利,该市场中的公司依靠战略合作计划。

2022 年 9 月,串流媒体技术提供商 Brightcove Inc. 和串流媒体和数位订阅业务的客户管理和收益提供商 Evergent 宣布扩大合作。此次合作使 Brightcove 客户能够在平台内测试和采用灵活的收益方法,将 Evergent 的敏捷收益解决方案带到 Brightcove Beacon 以Over-the-Top影片串流。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 技术简介

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 智慧型装置日益普及

- 独立于频宽的云端串流服务的演变

- 科技不断发展,提供高效率、快速的服务

- 市场限制

- 4G用户不足,无法普及

- 某些地区网路普及率不足

- 市场机会

- 技术进步使定製成为可能

- 非洲和印度尚未开发的市场

第六章 市场细分

- 按部署

- 公共云端

- 私有云端

- 混合云端

- 依设备类型

- STB

- 行动电话

- 联网电视

- 按应用

- 电信

- 娱乐和媒体

- 资讯科技

- 消费电视

- 其他的

- 按组织规模

- 中小型企业

- 大型企业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Ooyala Inc.

- Brightcove Inc.

- NetSuite Inc.

- Fordela Corp.

- Amino Technologies PLC

- DaCast LLC

- Kaltura Inc.

- MatrixStream Technologies Inc.

- MUVI Television Ltd.

- Minoto Video Inc.

- Monetize Media Inc.

- UpLynk LLC

- PCCW Limited

- Spectrum(Charter Communications)

- Liberty Global PLC

第八章投资分析

第九章 市场机会与未来趋势

The Cloud TV Market size is estimated at USD 2.69 billion in 2025, and is expected to reach USD 6.46 billion by 2030, at a CAGR of 19.13% during the forecast period (2025-2030).

Cloud TV is a cloud-based application that streams content such as TV channels, movies, shows, music, etc. Cloud TV applications are easily installed on personal electronic devices and do not require much memory.

Key Highlights

- Cloud TV allows television subscribers to stream their saved recordings regardless of place. They can also download content to a smartphone or tablet to watch offline. The innovations in cloud TV deliver an improved entertainment experience for the viewers. Having the users' favorite content saved in the cloud is easier than ever. Moreover, updates to cloud TV functionality can be made available to users in real time. Cloud TV delivers a more personalized viewing experience as subscribers can enjoy their favorite shows and movies irrespective of the time and place on any device.

- The need for scalable and flexible solutions in the streaming industry to cater to all categories of audiences to ensure that the company grows fast with top competitors in the market drives the market during the forecast period. Cloud TV is scalable and flexible regarding increasing watch hours, an increase in viewership, and the volume of video content consumed, fueling the market adoption worldwide.

- Moreover, the increasing penetration of IoT-based media devices is creating considerable demand for cloud TV services. Increasing product innovations, such as the Amazon Fire TV stick and Roku box, are fueling the growth of the cloud TV platform.

- However, Cloud TV providers may be able to reach audiences across the globe, but they may need the rights to deliver their services. Each market has its own content rights restrictions, and breaking these can lead to real difficulties, which could challenge the market growth. In addition, cloud TV needs an internet connection, and the absence of high-speed internet in rural areas worldwide restricts its adoption.

- The COVID-19 pandemic positively impacted the cloud TV market as audiences started consuming more content at home via online subscriptions. This has accelerated the growth of this format. In addition, increasing numbers of consumers have a digital TV in their pocket, presenting an exciting opportunity for media buyers to take advantage of changing consumer trends.

Cloud Television (TV) Market Trends

Small and Medium Enterprise to Witness the Growth

- The adoption of cloud in the broadcast and media industry is continuing to grow, with most media businesses adopting cloud technology. The onset of COVID-19 significantly augmented this increasing need for cloud technology in the industry.

- With the trend toward adopting the cloud for various business needs, small and medium enterprises in the media and broadcasting industry have been increasingly adopting cloud TV to reach their customers. An expanding virtualized infrastructure and increasing demand for content over the internet have also influenced the adoption of cloud TV.

- Cloud TV offers small and medium enterprises an advantage in delivering content as it requires less investment to set up the initial infrastructure than traditional television. Cloud TV adoption requires minimal in-house infrastructure, which results in minimal investment in hardware equipment, installation, and maintenance.

- Cloud TVs assist businesses with rapid and straightforward deployments, expanding their existing markets. They also contribute to significant time and cost savings in building and maintenance. The power of cloud computing platforms like Google Cloud and Microsoft Azure can be leveraged by integrated solutions to offer a streamlined cloud TV platform from planning to delivery of personalized content, installation and implementation of online video services, and embracing the growth for customers launching medium-scale cloud TV services.

- Furthermore, cloud TV offers scalability and flexibility to cater to varied audience segments, thus ensuring growth in viewership and the volume of video content consumed. This enables SMEs to adopt cloud TV.

Asia-Pacific is Expected to Hold Significant Share

- The Asia-Pacific region is projected to experience tremendous growth throughout the forecast period, owing to viewers' rising adoption of video streaming services. There has been a growing demand for live streaming that allows the market players to develop robust products and services, further augmenting the market's growth. In addition, the developing infrastructure and reliable internet connectivity throughout the region are also significantly driving the demand for cloud TV.

- Moreover, the overall growth of the consumption of internet-based content is drastically changing Asia's video markets. According to Media Partners Asia, online video is anticipated to expand to 20% of total video industry revenues by 2023 from 9% in 2017. This rise in the overall growth of online video is one of the most significant trends proliferating Asia's video markets.

- Various key players are investing in the market through mergers, acquisitions, and other means to grow their presence among customers and better serve their customers' needs across multiple applications of cloud TVs in the APAC region, supported by the growth of the number of connected TVs in the developing economies, such, India, Malaysia, Cambodia, etc.

- For instance, in October 2022, WeWatch, a leading carrier-grade cloud TV and video streaming entertainment platform, announced an exciting new deal with Cambodia's Premium Internet service provider, Online (COGETEL Ltd), that would deliver next-generation Cloud TV services over Online Internet to both residential and business users in the country.

- Additionally, QYOU Media Inc. declared that The Q India, the company's Hindi language youth-oriented channel, will launch flagship channel The Q, along with new channels Q Marathi, Q Kahaniyan, and Q Comedistaan on 63 new smart TV systems in partnership with CloudTV. The Q India is currently available to more than 125 million TV households and over 680 million users via mobile, OTT, and app-based platforms in India.

Cloud Television (TV) Industry Overview

The cloud TV market is fragmented and consists of several market players. Numerous new vendors are anticipated to enter the market as a result of the steadily growing market opportunity, enhanced mobile internet services and coverage, and increased display quality. By utilizing real-time data, these companies are innovating and utilizing innovative ways to capture a sizeable market share. These developments are anticipated to support the growth of the cloud TV market. To improve their market share and profitability, the businesses in the market are relying on strategic collaboration projects.

In September 2022, Brightcove Inc., the provider of streaming technology, and Evergent, the customer management and monetization provider for streaming and digital subscription businesses, declared an extended cooperation. Brightcove's clients can test and apply flexible monetization approaches within the platform through this partnership, bringing Evergent's agile monetization solution to Brightcove Beacon for over-the-top video streaming.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Technological Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Smart Devices

- 5.1.2 Evolution of Bandwidth-independent Cloud Streaming Services

- 5.1.3 Increasing Technological Development Leading to Efficient and Quicker Service

- 5.2 Market Restraints

- 5.2.1 Failure of the Widespread Adoption of 4G Services Due to Insufficient Users

- 5.2.2 Lack of Internet Penetration in Certain Areas

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements Leading to the Possibility of Customization

- 5.3.2 Untapped Market in Africa and India

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Public Cloud

- 6.1.2 Private Cloud

- 6.1.3 Hybrid Cloud

- 6.2 By Device Type

- 6.2.1 STB

- 6.2.2 Mobile Phones

- 6.2.3 Connected TV

- 6.3 By Applications

- 6.3.1 Telecom

- 6.3.2 Entertainment and Media

- 6.3.3 Information Technology

- 6.3.4 Consumer Television

- 6.3.5 Other Applications

- 6.4 By Organization Size

- 6.4.1 Small and Medium Enterprise

- 6.4.2 Large Enterprise

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ooyala Inc.

- 7.1.2 Brightcove Inc.

- 7.1.3 NetSuite Inc.

- 7.1.4 Fordela Corp.

- 7.1.5 Amino Technologies PLC

- 7.1.6 DaCast LLC

- 7.1.7 Kaltura Inc.

- 7.1.8 MatrixStream Technologies Inc.

- 7.1.9 MUVI Television Ltd.

- 7.1.10 Minoto Video Inc.

- 7.1.11 Monetize Media Inc.

- 7.1.12 UpLynk LLC

- 7.1.13 PCCW Limited

- 7.1.14 Spectrum (Charter Communications)

- 7.1.15 Liberty Global PLC