|

市场调查报告书

商品编码

1642194

线上影片平台 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Online Video Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

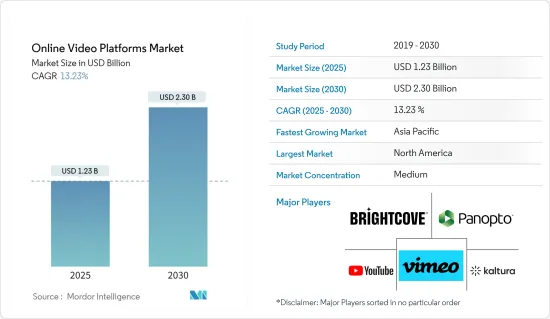

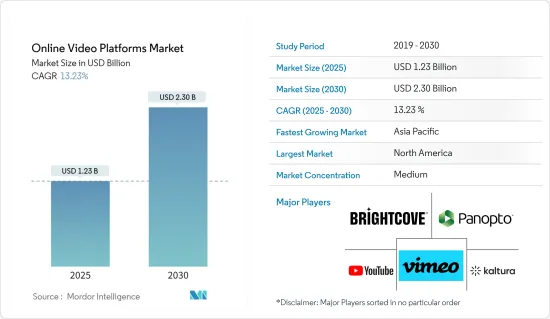

线上视讯平台市场规模预计在 2025 年为 12.3 亿美元,预计到 2030 年将达到 23 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.23%。

智慧型手机和平板电脑的普及正在推动市场成长。此外,线上影片平台允许用户託管、广播和串流影片。

关键亮点

- 人口老化加快、消费者需求增加、广告收入提高、3G 和 4G 使用率上升、5G 和行动装置的出现等因素推动了线上影片平台解决方案的需求。

- 影片分析也将很快获得相当大的市场占有率。供应商提供的现代分析工具可以收集有关观众及其观看习惯的详细资讯。例如,YouTube Analytics(位于 Studio 部分)提供随时间推移的跨管道流量,内容创作者可以透过这种方式发现他们可能想要纳入其持续策略的高峰和季节性。

- 此外,行动装置的拥有量在已开发国家已经十分普遍,新兴国家也正稳步赶上。因此,想要在线上影片平台上进行推广的企业正在客製化他们的广告,以使其更适合行动装置。

- 网路的普及极大地改变了产业和社会的动态。在现代互联网出现二十年后,各种重要的行业和企业都依靠软体运作并在线上提供服务。因此,网路在创造巨大的经济价值的同时也扰乱了许多市场。

- 后疫情时代对全球线上视讯平台市场的影响导致了采用率的提高、内容策略的变化和技术的开拓。随着消费者继续接受数位娱乐和串流媒体的可能性,线上影片平台预计将在决定媒体消费和内容传送的未来方面发挥更大的作用。

线上影片平台市场趋势

线上广告趋势预计将占据很大份额

- 新冠疫情导致串流媒体消费大幅增加。企业主透过采用线上广告来扩大消费群,从而获益匪浅。疫情也导致串流影片的人数大幅增加,人们透过各种显示器和装置观看的影片内容也越来越多。

- 随着线上串流内容需求的不断增长以及消费者偏好的变化,媒体服务供应商的用户大幅增长,多个细分领域的观看量也达到高峰。在同一市场竞争的企业将有许多机会向特定消费者促销。

- 此外,全球范围内技术进步的不断加快和企业数位化支出的不断增加也有望推动线上广告的发展。多年来,互联网的各种技术发展,加上其日益增长的商业用途和全球网路用户的快速增长,塑造了在线广告的转型,并创造了各种形式的数位广告形式。新的广告经营模式。

- 随着新平台和新形式的出现,影片的广告和行销可能性正在不断扩大。电视广告支出正在下降。预计未来在数位影片方面的支出将会增加。根据互动广告局 (IAB) 的数据,近三分之二的影片广告预算都花在了行动和桌面广告上。

- 2023年,ZDF和ARD报告称,近98%的德国消费者观看线上影片。在此期间,几乎所有线上影片平台的收视率都大幅飙升。

亚太地区可望占据主要市场占有率

- 中国、印度和日本等亚洲国家对直播电商的需求正在成长。例如,一些大型电子商务公司推出了串流媒体平台来促进他们的电子商务业务并满足这些需求。其中一个例子就是 Amazon Live,它有望透过吸引更多客户与传统的 QVC 零售平台竞争。许多汽车製造商也对该论坛感兴趣。

- 此外,随着韩国流行音乐、韩剧和韩国文化在全球的扩张,全球对韩国内容的需求庞大,从而推动了韩国国内市场的发展。据韩国通讯委员会称,目前韩国串流影片市场规模预计将超过6.8亿美元。

- 此外,未来五年韩国的用户渗透率预计将达到35-40%。市场ARPU预计为63美元。据韩国资讯社会发展研究院(KISDI)称,10-40 岁的韩国消费者在国内 Over-the-Top(OTT)市场渗透率最高。

- 此外,内容现在透过影片传递,推动了对影片内容管理系统的需求。印度政府开发的一些数位学习平台包括 Swayam、Diksha、e-ShhodSindhu、NPTEL、Swaam Prabha 等。

- 同时,澳洲拥有 30 多个数位学习平台,随着新冠疫情期间远距学习需求的增加,这些平台获得了更大的支援。此外,澳洲政府还实施了澳洲远端教育战略伙伴关係,以召集该国开放、远端教育和线上学习方面的专家。这些努力正在推动数位学习的发展并增加对线上影片平台的需求。

线上影片平台产业概况

线上影片平台参与企业由 Vimeo Inc. (InterActive Corp.)、YouTube LLC 和 Brightcove Inc. 主导。

- 2022 年 12 月—亚马逊打算发布独立的串流应用程式。此举符合亚马逊改善其 Prime Video 平台上体育内容选择的计画。体育是最受欢迎的直播类型之一,有助于提高 Amazon Prime 等服务的收视率。

- 2022 年 6 月 - 全球领先的一体化影片软体解决方案 Vimeo 宣布采用新的互动式影片功能。这是与 WIREWAX 功能集成功整合的结果,使用户能够创建可快速产生结果的动态影像。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场动态

- 市场驱动因素

- 网路广告成长趋势

- 线上观众不断增长

- 市场限制

- 来自开放原始码的竞争日益激烈

- 由于网路速度慢导致网路壅塞

第六章 市场细分

- 按类型

- 直播

- 影片内容管理系统

- 影片分析

- 按最终用户

- 数位学习

- 媒体和娱乐

- BFSI

- 零售

- 资讯科技和通讯

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Vimeo Inc.(Inter Active Corp.)

- YouTube LLC

- Brightcove Inc.

- Panopto Inc.

- Kaltura Inc.

- Vidyard(BuildScale Inc.)

- JW Player(Longtail Ad Solutions Inc.)

- Kollective Technology Inc.

- Wistia Inc.

- IBM Corporation

- Dacast Inc

第八章投资分析

第九章:市场的未来

The Online Video Platforms Market size is estimated at USD 1.23 billion in 2025, and is expected to reach USD 2.30 billion by 2030, at a CAGR of 13.23% during the forecast period (2025-2030).

The growing adoption of smartphones, tablets, and other devices drives the market's growth. The online video platforms would also allow users to host, broadcast, and stream their videos.

Key Highlights

- The demand for online video platform solutions has been driven by a rapidly aging population, increased consumer demand, and improving advertising income, and by rising 3G and 4G usage, the coming of 5G, and portable devices.

- Video analytics is also set to gain a significant market share shortly. Modern analytics tools offered by vendors allow for gathering detailed information on the audience and their viewing habits. For example, YouTube Analytics (found in the Studio section) provides overall channel traffic over time, which is one of the ways to spot any peaks and seasonality a content creator may want to incorporate into his ongoing strategy.

- Additionally, ownership of mobile devices is already widespread in industrialized nations and is steadily catching up in emerging economies. As a result, companies that wish to promote on online video platforms have tailored their advertising expressly to be more mobile-friendly.

- The increasing use of the Internet has significantly altered the dynamics of industry and society. After two decades of the modern Internet's growth, various significant industries and businesses now run on software and offer services online. The upshot is that the Internet is producing tremendous economic value, but it has also disrupted many different markets.

- The Post-COVID effect on the market for global online video platforms led to higher adoption rates, altered content strategies, and technological developments. Online video platforms are anticipated to play an even bigger role in determining the future of media consumption and content distribution as consumers continue to embrace digital entertainment and streaming possibilities.

Online Video Platform Market Trends

Increase in Trends in Online Advertisements is Expected to Hold Significant Share

- Due to the COVID-19 pandemic, streaming consumption has considerably increased. The company owners benefited from adopting online advertising to expand their consumer base. Although the pandemic also significantly increased the number of individuals streaming videos, far more video content is being seen on various displays and devices.

- As a result of the rising demand for online streaming content and shifting consumer preferences, media services providers have seen a significant increase in their subscriber base and a peak in viewing across several areas. For the businesses competing in the market, this should present several chances to promote to specific consumers.

- Moreover, the increasing technological advancements and rising digital spending by enterprises across the globe are also anticipated to drive online advertisement. Over the years, various technological developments regarding the internet, combined with its increasing commercial usage and the rapidly increasing number of internet users globally, have shaped the transformation of online advertising and created various forms of digital advertising formats but have also given rise to newer advertising business models.

- The possibilities for video-based advertising and marketing have increased with the emergence of new platforms and formats. The expenditure on television advertising is decreasing. More money is expected to be spent on digital video. According to the Interactive Advertising Bureau (IAB), nearly two-thirds of the total video ad advertising budget was spent on mobile and desktop advertising.

- In 2023, ZDF and ARD reported that nearly 98% of German consumers watched online videos. The viewership percentages surged across nearly all online video platforms during the period.

Asia Pacific is Expected to Hold Significant Market Share

- Demand for live-streaming e-commerce is rising in Asian nations like China, India, and Japan. For example, some large e-commerce giants launched their streaming platforms to promote their own e-commerce companies and meet these demands. Amazon Live is an example that is anticipated to compete with the traditional QVC retail platform with more customer participation. Numerous automakers are interested in the forum as well.

- Also, there is now a vast global demand for Korean content due to the global expansion of K-pop, K-drama, and Korean culture, motivating the domestic market. According to the Korea Communications Commission, the Korean video streaming market is expected to stand at over USD 680 million presently.

- Furthermore, it is anticipated that South Korea's user penetration will reach 35 to 40 Percent by the next five years. The market's ARPU is expected to be USD 63. Korean consumers between the ages of 10 and 40 have the most significant market penetration in the domestic Over the Top (OTT) market, according to the Korea Information Society Development Institute (KISDI).

- Moreover, the content was made available in videos, increasing the need for video content management systems. Some of the e-learning platforms developed by the government of India are Swayam, Diksha, e-ShodhSindhu, NPTEL, and Swaam Prabha.

- On the other hand, Australia is home to more than 30 e-learning platforms and gained more traction during the spread of the COVID-19 pandemic as the need for distance learning increased. Moreover, the government of Australia implemented Australian Strategic Partnerships in remote education to convene experts in open, distance, and online learning in the country. Such initiatives are driving e-learning and increasing the need for online video platforms.

Online Video Platform Industry Overview

The Online Video Platforms Market is semi-consolidated, with the presence of major players like Vimeo Inc. (InterActive Corp.), YouTube LLC, Brightcove Inc., Panopto Inc., and Kaltura Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Amazon intends to release a stand-alone streaming application. This action would align with Amazon's plan to improve the sports content options available on its Prime Video platform. Sports are one of the most popular live-streaming genres, and they can increase viewership on services like Amazon Prime.

- June 2022 - Vimeo, one of the world's leading all-in-one video software solutions, has announced the introduction of new interactive video capabilities with Vimeo; this derives from the successful integration of the WIREWAX feature-set and enables Users to produce dynamic films that generate results quickly. This will significantly advance in realizing video's full potential for all businesses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Trends in Online Advertisements

- 5.1.2 Increase in Popularity of Online Viewers

- 5.2 Market Restraints

- 5.2.1 Too Much Competition Due to the Open Source

- 5.2.2 Network Congestion Due to Slow Network

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Live Streaming

- 6.1.2 Video Content Management Systems

- 6.1.3 Video Analytics

- 6.2 By End User

- 6.2.1 E-learning

- 6.2.2 Media and Entertainment

- 6.2.3 BFSI

- 6.2.4 Retail

- 6.2.5 IT and Communications

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vimeo Inc. (Inter Active Corp.)

- 7.1.2 YouTube LLC

- 7.1.3 Brightcove Inc.

- 7.1.4 Panopto Inc.

- 7.1.5 Kaltura Inc.

- 7.1.6 Vidyard (BuildScale Inc.)

- 7.1.7 JW Player (Longtail Ad Solutions Inc.)

- 7.1.8 Kollective Technology Inc.

- 7.1.9 Wistia Inc.

- 7.1.10 IBM Corporation

- 7.1.11 Dacast Inc