|

市场调查报告书

商品编码

1642215

智慧锁 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Lock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

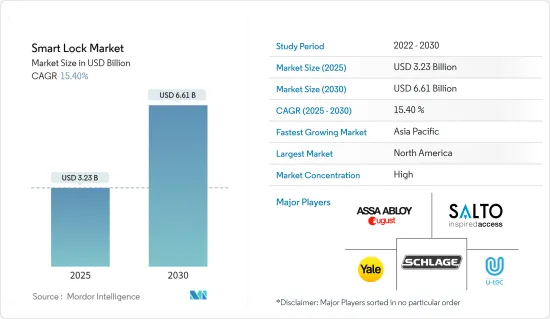

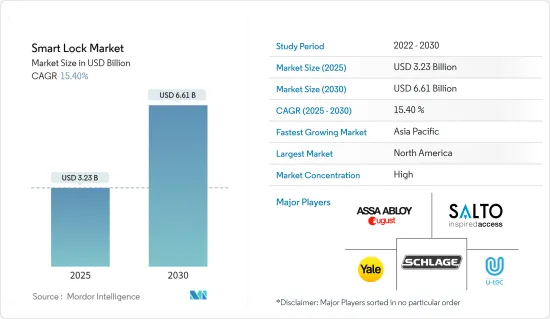

智慧锁市场规模在2025年预计为32.3亿美元,预计到2030年将达到66.1亿美元,预测期内(2025-2030年)的复合年增长率为15.4%。

全球范围内智慧家庭架构的采用日益广泛,其中包括远端存取、语音控制和无缝连接等功能,这进一步推动了住宅智慧锁的采用。此外,住宅也赞成不再随身携带机械钥匙。

关键亮点

- 全球智慧家庭的日益普及以及提供家庭自动化技术的公司不断涌现是推动智慧锁需求成长的进一步因素。产业参与者专注于开发尖端技术和商业性可行的产品,例如窗户、门和门的远端锁定和解锁。

- 此外,随着拥有语音助理的家庭数量稳定增加以及语音控制锁成为可能,製造商将把他们的产品与此类设备配对。随着客户对锁定和解锁解决方案的需求日益复杂和直观,这些进步预计会越来越受欢迎。越来越多的场所需要进行身分验证和认证,包括私人住宅、饭店、超级市场、银行、金融机构、企业大楼和商业大楼。

- 此外,智慧型手机的广泛应用正在推动连网型设备的成长,允许用户使用各种相关的行动应用程式远端存取和解锁门锁。据电子商务公司Oberlo称,目前全球有35亿智慧型手机用户,约占全球77亿人口的45.4%。简而言之,现在世界上每十个人就有四个人拥有智慧型手机。

- 在各种驱动因素中,智慧锁市场的成长可能会因普遍存在的骇客攻击漏洞和日益增加的网路犯罪威胁而面临挑战。例如,今年 7 月,NCC 集团的安全研究人员报告了影响 Nuki 智慧锁系统的 11 个安全问题,其中一个问题可能允许入侵者解锁门。此类案例让一般用户感到担忧。

- 新冠肺炎疫情导致ICT产业投资大幅下降,特别是物联网、5G技术等新兴技术投资。智慧锁市场的参与企业被迫限制其营运成本。就业和资本预算也被削减。此外,这种情况下消费者的可自由支配支出也抑制了智慧锁的销售。该市场的前景黯淡,预计经济将放缓,并且这种趋势将持续到去年第二季。

智慧锁市场趋势

商业用途预计将大幅成长

- 透过远端存取安全轻鬆地管理各个入口点以及追踪场所内安全的能力等因素推动了这些空间中智慧锁的采用成长,从而促使各相关人员进行大量投资。这些数据强调了这些场所(主要是学校和教堂)的组织在当前公共场所大规模枪击事件频繁的情况下要求最高级别的安全保障的必要性。

- 但在餐旅服务业,客户服务和体验发挥关键作用。饭店管理确保顾客住得舒适。过程中,各饭店计划在饭店内安装蓝牙锁和Wi-Fi锁,取代智慧卡RFID锁,以提高饭店场所的安全性。

- 酒店业正在迅速采用智慧锁来解决顾客访问期间日益增长的安全问题。随着饭店希望提高客房的安全性,无钥匙进入系统预计在未来几年将变得越来越受欢迎。市场主要企业为饭店业提供创新的解决方案。 Hoomvip 是基于应用程式的租赁物件出入服务,它部署了 TESA 的 ENTR 智慧门锁(ASSA ABLOY 商标),以增强安全性并确保无忧出入租赁住宅。

- 此外,由于大量人需要使用相同的设施,因此企业和办公空间的新型智慧锁具有很高的成长潜力。增强安全性的需求迫使管理员简化授权使用者的开门过程。例如,U-tec 预计将推出一款主要用于办公室门的新型生物辨识智慧锁。

预计美国将实现强劲成长

- 与其他智慧家庭设备相比,智慧锁在美国尚未普及。根据美国消费科技协会(CTA)最近的一项调查,大约 69% 的美国家庭(相当于 8,300 万户家庭)拥有至少一台智慧家庭设备。这些统计数据凸显了市场参与企业遵循正确行销策略的机会。

- 美国市场主要企业向其他地区,尤其是欧洲国家的扩张,预计也将成为市场成长的强劲动力。例如,August Inc.和Yale Locks(美国智慧锁製造商)宣布,他们将在其产品系列中增加一款新的智慧锁,并以「Yale Access module」的名义向欧洲、中东和非洲的新旧Yale智慧锁用户提供该产品。

- August Inc. 的新产品 Wi-Fi 智慧锁要求双重验证和两层加密,可以透过该公司的应用程式和云端进行远端系统管理。同样,浓啤酒的新产品 Linus 智慧锁配备了 DoorSense 技术,可在门锁或解锁时监控并通知您。它还支援从您的智慧型手机解锁。此外,智慧型手机的广泛普及推动了连网型设备的成长,用户可以使用各种连网的行动应用程式远端存取和解锁门锁。

- 高客户购买力和对安全的日益关注,特别是在关键基础设施和家庭应用方面,为智慧锁的采用创造了有利的法规环境。例如,美国正在经历快速成长,目前已有超过1,200万户家庭配备了智慧锁。今天,Parks Associates 发布了一份白皮书,概述了智慧锁在美国的采用情况以及拥有智慧锁的好处。

智慧锁产业概况

由于智慧锁在全球范围内的采用率仍较低且处于早期阶段,因此智慧锁市场正在整合。然而,随着对家庭和建筑安全的需求不断增加,智慧锁供应商拥有多种成长机会。因此,August Inc.、Yale Locks & Hardware、Allegion PLC、Salto Systems、SL 和 U-TEC Group Inc. 等市场参与企业正在持续进行创新活动,向市场提供创新产品,以在预测期内获得最大的市场吸引力。

- 2022 年 2 月 - AtiQx Holding BV 被 Dormakaba 全资收购,扩大了在荷兰的核心营运和服务业务。 AtiQx 是相关市场领先的电子门禁和劳动力管理供应商之一。

- 2022 年 4 月 – Wyze Lock Bolt 在 Wyze 网站 (wyze.com) 上正式发布。使用 Lockin 的最新安全技术。两家企业之间的第三个联名品牌项目是 Wyze Lock Bolt。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 市场驱动因素

- 人们对安全和保障的兴趣日益浓厚

- 智慧家庭架构的采用率不断提高

- 市场问题

- 网路安全和骇客威胁日益增加

第五章 COVID-19 影响评估

- 市场概况:趋势、发展、市场预测

- 市场驱动因素

- 市场问题

第六章 市场细分

- 通讯科技

- Wi-Fi

- Bluetooth

- Zigbee

- Z-Wave

- 身份验证方法

- 生物识别

- PIN 码

- RFID 卡

- 最终用户应用程式

- 商业的

- 教育及政府机构

- 工业的

- 地区

- 欧洲

- 亚太地区

- 北美洲

- 其他的

第七章 竞争格局

- 公司简介

- August Inc.

- Yale Locks & Hardware

- Allegion PLC(Schlage)

- Salto Systems SL

- Hanman International Pte Ltd

- Dormakaba Group

- U-TEC Group Inc.

- Kwikset(Spectrum Brands Inc.)

- Lockly

- Master Lock Company LLC

- Nuki Home Solutions

- Netatmo(Legrand)

第八章投资分析

第九章:市场的未来

The Smart Lock Market size is estimated at USD 3.23 billion in 2025, and is expected to reach USD 6.61 billion by 2030, at a CAGR of 15.4% during the forecast period (2025-2030).

The increasing adoption of smart home architecture worldwide, including features like remote access, voice control, and seamless connectivity, is further propelling the adoption of smart locks for residential premises. Additionally, the eliminated need to carry the mechanical keys around has attracted the likes of residential owners.

Key Highlights

- The expansion of smart home adoption on a global scale and the rise of businesses that offer home automation technology are further factors in the rising demand for smart locks. The industry's participants concentrate on developing cutting-edge techniques and commercially viable goods, such as remote locking and opening windows, doors, and doors.

- Additionally, manufacturers pair their products with such devices as the number of households with voice assistants increases steadily, enabling voice control of locks. Customers are anticipated to become more popular due to these advancements as they increasingly look for sophisticated and straightforward locking/unlocking solutions. A growing number of properties must be identified and certified, including individual homes, hotels, supermarkets, banks, financial institutions, corporate buildings, and commercial buildings.

- The increasing penetration of smartphones is also stimulating the growth of connected devices, which enable users to remotely access their door locks and unlock the doors using various related mobile apps. According to Oberlo, an e-commerce company, there are currently 3.5 billion smartphone users worldwide, and the penetration rate is approximately 45.4% of the global population of 7.7 billion people. Simply put, four out of every ten people in the world are currently equipped with a smartphone.

- Amid various driving factors, the growth of the smart locks market could face challenges, owing to the prevailing vulnerability to hacking and increasing threats of cybercrimes, as smart locks, in particular, is a popular target for cybercriminals. For instance, in July this year, According to security researchers with NCC Group, there were 11 security problems affecting Nuki intelligent lock systems, including ones that could let intruders unlock doors. Such instances instill a sense of insecurity among casual users.

- The COVID-19 pandemic has led to a nosedive in investments in the ICT industry, particularly in the Internet of Things, 5G technologies, and other emerging technologies. Players in the smart lock market are forced to restrict their operational expenses. They have witnessed a reduction in hiring and capital budgets as well. Moreover, discretionary consumer spending in this scenario has also lowered the sales of smart locks. The scenario for this market looks bleak, and it is expected to witness a slowdown, which is projected to continue until the second quarter of the last year.

Smart Lock Market Trends

Commercial Adoption is Expected to Grow Significantly

- Factors such as secure and easy management of various entry points through remote access and the ability to track the security of the premises have enabled the growth of smart lock adoption in these spaces, thus, propelling various stakeholders to invest significant amounts. Such statistics highlight the need for organizations in these spaces (mainly schools and churches) to seek the highest security level possible in the age of mass shootings in public places.

- However, customer service and experience play a vital role in the hospitality industry. Hotel management ensures that customers' stay at their place is pleasant. In the process, various hotels are planning to adopt Bluetooth-enabled or Wi-Fi-enabled locks in place of RFID locks accessible by IC cards for their hotels to improve the security of their premises.

- The hospitality industry has quickly adopted smart locks to address the growing security concerns of customers while they are in the store. In the upcoming years, keyless entry systems are projected to become more popular as hotels are required to increase in-room security. Leading market companies are providing creative solutions for the hotel sector. Hoomvip, an app-based rental property access service, installed an ENTR smart door lock by TESA, one of Assa Abloy's trademarks, to increase security and ensure hassle-free access to rental homes.

- Further, the new smart lock launches aimed at businesses and office spaces have high growth potential as numerous people require access to the same facility. The need for enhanced safety has forced the management to simplify the door-unlocking process for authorized users. For instance, U-tec is expected to launch a new biometric smart lock designed primarily for their application in office doors.

United States is Expected to Grow Significantly

- The adoption of smart locks still needs to be prevalent in the United States compared to the adoption of other smart home devices. According to a recent Consumer Technology Association (CTA) study, about 69% (translates to 83 million households) of U.S. households now own at least one smart home device. Of which, the adoption of smart speakers in the country is high, with a rate of 28%, whereas the adoption of smart locks is only 10%-statistics such as this highlight the opportunity for market players to follow proper marketing strategies.

- Expanding the key players in the U.S. market to other regions, especially in European nations, is also expected to provide a strong impetus for market growth. For instance, August Inc. and Yale Locks (smart lock manufacturers based out of the United States) announced new smart locks in their product portfolios and the availability of their products for new and existing owners of Yale Smart Lock in the EMEA region under the name 'Yale Access module.'

- The new product 'Wi-Fi Smart Lock' from August Inc. mandates two-factor authentication and two-layer encryption and can be remotely managed through their App and cloud. Similarly, a new Linus Smart Lock from Yale is equipped with DoorSense technology that can monitor the lock/unlock position of the door and notifies. It also supports unlocking doors via smartphones. Also, the increasing penetration of smartphones is augmenting the growth of connected devices, which enable users to remotely access their door locks and unlock the doors using various connected mobile apps.

- A favorable regulatory climate for smart lock adoption has been created due to customers' high purchasing power and growing safety concerns, particularly in essential infrastructure and household applications. For instance, over 12 million homes in the U.S. have smart locks installed due to their rapid growth. Today, Parks Associates published a whitepaper outlining the adoption of smart locks in the U.S. and the benefits of having a smart lock.

Smart Lock Industry Overview

The Smart Lock Market is consolidated as it is still in its nascent stage with fewer adoptions across the globe. However, the market poses various growth opportunities to smart lock providers due to the increasing need for home and building security. Hence, the market players, such as August Inc., Yale Locks & Hardware, Allegion PLC, Salto Systems, S.L., and U-TEC Group Inc., are consistently innovating to provide innovative products in the market to gain maximum market traction in the forecast period.

- February 2022 - AtiQx Holding B.V. has been fully acquired by Dormakaba, expanding its core business and services operations in the Netherlands. AtiQx is one of the leading suppliers of electronic access control and labor management in the relevant market.

- April 2022 - On Wyze's website, Wyze Lock Bolt was officially released (wyze.com). The latest security technology from Lockin is used to create the new product. The third co-branding venture between the two businesses is Wyze Lock Bolt.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Increasing Safety and Security Concerns

- 4.4.2 Increasing Adoption of Smart Home Architecture

- 4.5 Market Challenges

- 4.5.1 Increasing Cyber Security and Hacking Threats

5 ASSESSMENT OF COVID-19 IMPACT

- 5.1 Market Overview - Trends, Developments, and Market Projections

- 5.2 Market Drivers

- 5.3 Market Challenges

6 MARKET SEGMENTATION

- 6.1 Communication Technology

- 6.1.1 Wi-Fi

- 6.1.2 Bluetooth

- 6.1.3 Zigbee

- 6.1.4 Z-Wave

- 6.2 Authentication Method

- 6.2.1 Biometric

- 6.2.2 Pin Code

- 6.2.3 RFID Cards

- 6.3 End-user Application

- 6.3.1 Commercial

- 6.3.2 Educational Institutions & Government

- 6.3.3 Industrial

- 6.4 Geography

- 6.4.1 Europe

- 6.4.2 Asia Pacific

- 6.4.3 North America

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 August Inc.

- 7.1.2 Yale Locks & Hardware

- 7.1.3 Allegion PLC (Schlage)

- 7.1.4 Salto Systems SL

- 7.1.5 Hanman International Pte Ltd

- 7.1.6 Dormakaba Group

- 7.1.7 U-TEC Group Inc.

- 7.1.8 Kwikset (Spectrum Brands Inc.)

- 7.1.9 Lockly

- 7.1.10 Master Lock Company LLC

- 7.1.11 Nuki Home Solutions

- 7.1.12 Netatmo (Legrand)