|

市场调查报告书

商品编码

1642217

自立袋:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Stand-Up Pouches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

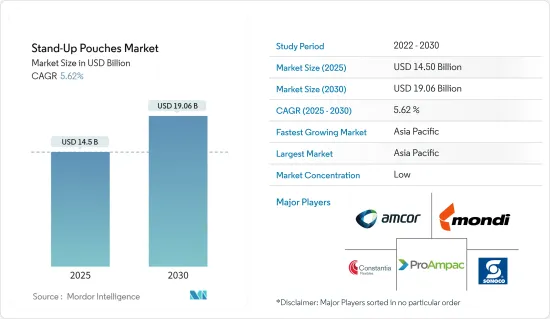

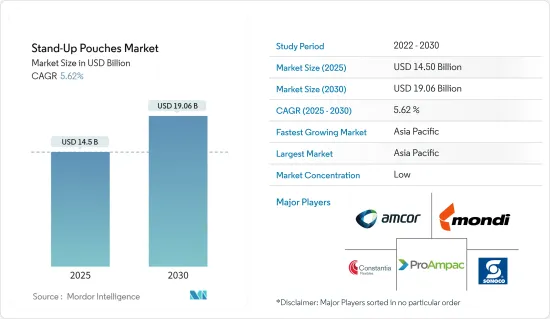

自立袋市场规模预计在 2025 年为 145 亿美元,预计到 2030 年将达到 190.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.62%。

主要亮点

- 自立袋是软质包装解决方案,具有较宽的底座,可使袋子站立而不塌陷。这些袋子由多层阻隔材料製成,这些阻隔材料被层压在一起形成一张连续的片材。这一层可保护和保存内容物免受外界因素的影响,因此自立袋的需求正在上升。

- 自立袋重量轻,省去了包装和运输的麻烦,对製造商来说是一种经济高效的解决方案。为了优化品牌行销倡议,对食品和饮料包装自立袋的需求不断增长,推动了全球市场的成长。自立袋由于其灵活性、耐用性以及保持内容物新鲜度的能力而越来越多地在宠物产品中使用,预计将在预测期内推动市场成长。

- 随着人们对便携零食的需求日益增长,对可重复密封的自立袋的需求也随之增加,为消费者提供了便利。自立袋的使用越来越多,可以保持食物新鲜并防止其受潮,有助于延长保质期,从而推动市场成长。消费者生活方式和饮食偏好的改变,加上食品技术的变化,正在创造进一步的市场需求。

- 包装创新为个人护理包装产业创造了丰厚的利润。方便、易于使用的分配和运输功能使 Amcor 的可回收自立袋成为液体、乳霜和凝胶的绝佳选择。安姆科 (Amcor) 和欧莱雅 (L'Oreal) 合作开发采用可回收聚乙烯 (PE) 薄膜的环保包装洗髮精填充用。自合作以来,欧莱雅已改用可回收自立袋,减少了 75% 的塑胶消费量。

- 然而,由于消费者对环境问题的认识不断提高、监管规范不断变化、永续性的持续努力以及对先进回收设施的需求,导致回收率低,对市场成长构成了挑战。

- 人们对永续性的日益关注正推动供应商转向可回收和永续的自立袋。预计市场将见证对永续产品创新和新兴回收产业成长的资本投资。例如,2023 年 11 月,软包装公司 ProAmpac LLC 推出了 ProActive PCR杀菌袋,作为传统袋的永续替代品。 ProActive PCR杀菌袋含有 30% 的消费后回收 (PCR) 材料,旨在帮助品牌实现永续性目标。

自立袋的市场趋势

食品和饮料行业越来越多地采用软质包装解决方案

- 人口成长、消费者生活方式改变和消费能力增强推动了北美、欧洲和亚太地区食品和饮料产业的快速扩张。生活方式的改变和健康和营养资讯的便捷获取正在推动对偏好健康食品、方便食品和单份食品的需求。食品和饮料行业的快速变化催生了对自立袋等便捷包装选择的需求。

- 根据有机贸易协会的数据,美国有机包装食品和饮料的消费量预计将从 2022 年的 247.8 亿美元成长到 2025 年的 278.6 亿美元。预计这将推动对包括站立袋的经济高效且灵活的包装解决方案的需求。

- 站立袋包装可以增强您的企业品牌形象并增强您的视觉行销。小袋用途广泛、灵活且美观,可以宣传您的品牌并增加销售量。根据您业务的具体需求,数位印刷站立袋可以显着提升您的品牌形象。公司可以利用袋子的整个表面积来展示令人兴奋的图形、标誌、品牌讯息或产品细节。

- 消费者现在将自立袋视为品质的标誌,供应商需要透过这种包装形式传达优质化的讯息。自立袋可以隔绝湿气、光线、空气和细菌,为您的食物提供更优质的保护。

- 由于包装食品以及食品和饮料因其便利性和价格实惠而导致的需求不断增加等因素,市场持续扩大。自立袋通常由轻质材料製成,可大幅降低运输成本。由于袋子配有各种封闭选项(如喷口、拉炼、撕口等),因此需求也得到了推动,进一步促进了市场成长。

- 多家行业製造商专注于推出永续的解决方案,并始终致力于满足客户和市场的需求。例如,2024年1月,美国包装公司API Group及其子公司Accredo Packaging与Fresh-Lock团队合作,推出了一种由50%消费后回收(PCR)材料製成的用于食品包装的柔性自立袋。该产品采用 ChildGuard Slider 技术,提供儿童防护闭合保护并促进循环经济。

亚太地区可望成为自立袋成长最快的市场

- 自立袋在该地区不断发展的食品加工行业中越来越受欢迎。随着生活方式变得越来越忙碌,消费者越来越青睐轻便、易于携带的零食包装来满足他们的出行需求。紧凑尺寸且具有拉炼等可重新密封功能的产品很受欢迎,满足了人们对易于携带的需求。这个市场主要受便携式食品和日益增长的对保持货架稳定性的蒸馏包装产品的偏好所驱动。

- 有组织的食品零售商的扩张发挥着至关重要的作用,以诱人的折扣价格向消费者提供各种各样的产品。随着技术和社会的进步,印度食品加工产业正在经历变革时期。因此,对方便、即食产品的需求凸显了袋装等高效创新包装解决方案的重要性。

- 即食食品和零食等加工食品越来越受欢迎,尤其是在都市区。据印度品牌股权基金会称,到 2030 年,印度家庭年加工食品消费量预计将增长两倍,使该国成为一个利润丰厚的市场。

- 2023 年 4 月,SIG 宣布将在印度帕尔加尔开设第二家生产工厂。该工厂生产 SIG 的衬袋纸盒和带嘴袋包装,之前以 Scholle IPN 和 Bossar 的名称出售。

- 由于人口结构变化和收入水平提高导致宠物拥有量增加,亚洲的宠物护理行业实现了正增长。政府机构动物卫生组织估计,到 2024年终,中国将成为世界上宠物数量最多的国家,预计将推动中国对自立袋的需求。

- 泰国宠物食品出口市场的成长为袋装包装行业带来了巨大的机会,因为宠物人性化推动了对优质包装解决方案的需求。袋装包装着重于便利性和新鲜度,在满足宠物食品产业国内和出口市场不断变化的需求方面发挥着至关重要的作用。

自立袋产业概况

市场较为分散,多家全球企业占相当一部分市场占有率。领先的市场参与者不断升级产品系列,并采用各种有机和无机策略(如新产品发布、合作伙伴关係和收购)来占领市场。

- 2024年2月,安姆科集团有限公司(Amcor Group GmbH)与美国Stonyfield Organic合作,推出了有史以来第一款全聚丙烯(PP)带嘴袋。这些包装袋是 Stonyfield 冷藏优格产品 YoBaby 的环保设计。

- 2023 年 8 月 Mondi PLC 宣布正在与欧洲宠物食品供应商 Fressnapf 合作,为干宠物食品产品提供一系列可回收、单一材料包装解决方案。这种单一材料包装可回收并设计为自立袋。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估地缘政治情势对产业的影响

第五章 市场动态

- 市场驱动因素

- 对方便食品和已调理食品的需求不断增加

- 对经济高效的软包装解决方案和品牌提升的需求不断增加

- 市场限制

- 严格的政府法规和日益严重的环境问题

第六章 市场细分

- 按材质

- 塑胶

- 聚对苯二甲酸乙二醇酯(PET)

- 聚乙烯 (PE)

- 聚丙烯(PP)

- 乙烯 - 乙烯醇(EVOH)

- 其他塑胶材质

- 纸

- 金属(箔)

- 塑胶

- 按应用

- 饮食

- 居家护理

- 卫生保健

- 宠物护理

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Amcor Group GmbH

- Mondi PLC

- Sonoco Products Company

- Constantia Flexibles GmbH

- Smurfit Kappa Group PLC

- ProAmpac LLC

- Swiss PAC USA

- Winpak Ltd

- Uflex Limited

- Glenroy Inc.

- FLAIR Flexible Packaging Corporation

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 67683

The Stand-Up Pouches Market size is estimated at USD 14.50 billion in 2025, and is expected to reach USD 19.06 billion by 2030, at a CAGR of 5.62% during the forecast period (2025-2030).

Key Highlights

- The stand-up pouch is a flexible packaging solution with a wide bottom gusset that allows the pouch to stand prominently without collapsing. The pouch comprises multiple layers of barrier material, which are laminated to create one continuous sheet. The layers protect and preserve the contents from any external element, thus propelling the demand for stand-up pouches.

- Stand-up pouches are lightweight, which reduces packaging and transportation, making them a cost-effective solution for manufacturers. The growing demand for stand-up pouches for food and beverage packaging to optimize brand marketing initiatives drives global market growth. The increasing usage of stand-up pouches for pet products due to their flexibility, durability, and ability to keep the contents fresh is expected to boost the growth of the market during the forecast period.

- The rising demand for on-the-go snacks led to the need for re-closable stand-up pouches, which offer convenience to consumers. The growing use of stand-up pouches to keep food items fresh and secure from moisture helps to extend the shelf life, thus boosting the market growth. The changing lifestyle and food preferences among consumers, coupled with changing food technology, further create demand in the market.

- Innovation in packaging is introducing lucrative opportunities for the personal care packaging industry. Amcor's recyclable stand-up pouches' convenient and easy-to-use dispensing and transportability make them an excellent choice for liquids, creams, and gels. Amcor and L'Oreal partnered to create a refill eco-pack shampoo made of recyclable polyethylene (PE) monosodium bicarbonate film. Since the partnership, L'Oreal has switched to the recyclable stand-up pouch, which reduces plastic consumption by 75%.

- However, increasing consumer awareness of environmental concerns, dynamic regulatory standards, the ongoing drive for sustainability, and the poor recycling rate due to the need for advanced recycling facilities are challenging market growth.

- The growing concern over sustainability further pushes the vendors toward recyclable and sustainable stand-up pouches. The market is expected to witness capital investment in sustainable product innovation and the growth of new recycling industries. For instance, in November 2023, ProAmpac LLC, a flexible packaging company, launched its ProActive PCR retort pouches as a sustainable alternative to conventional pouches. The ProActive PCR pouches contain 30% post-consumer recycled (PCR) material designed to help brands achieve sustainability goals.

Stand-Up Pouches Market Trends

Rising Adoption of Flexible Packaging Solutions for Packaged Food and Beverage

- The rapidly expanding food and beverage sector in North America, Europe, and Asia-Pacific is attributable to the growing population, changing consumer lifestyle, and growing spending capacity. Lifestyle changes and easy access to information on health and nutrition are increasing the demand for indulgent and healthy foods, convenience foods, and single-serve options. These rapid changes in the food and beverage landscape create demand for convenient packaging options like stand-up pouches.

- According to the Organic Trade Association, the consumption of organic packaged food and beverages in the United States is projected to reach USD 27.86 billion in 2025 from USD 24.78 billion in 2022. This is expected to fuel the demand for cost-effective, flexible packaging solutions, including stand-up pouches.

- Stand-pouch packaging enhances business brand identity and strengthens visual marketing. Pouches are versatile, flexible, and attractive, promoting the brand and increasing sales. Stand-up pouches that are digitally printed can significantly elevate a brand's identity per the specific desires of the business. The company can utilize the whole surface of the pouch to display exciting graphics, logos, branding messages, or product details.

- Consumers now consider stand-up pouches a signifier of quality, making it necessary for vendors to communicate premiumization through such a form of packaging. Stand-up pouches offer superior protection for foods, keeping them safe from moisture, light, air, and bacteria.

- The ongoing expansion of the market can be attributed to factors such as the increasing demand for packaged food and beverages driven by convenience and affordability. Stand-up pouches are usually made with lightweight materials, significantly lowering transportation costs. The demand is also fueled by the fact that pouches come with various closure options, including a spout, zipper, and tear notch, further boosting the growth of the market.

- Several industry manufacturers focus on introducing sustainable solutions and have constantly worked on customer and market needs. For instance, in January 2024, API Group, a US-based packaging company, and its subsidiary Accredo Packaging, collaborated with the Fresh-Lock team to introduce a flexible stand-up pouch made with 50% post-consumer recycled (PCR) material for food packaging. The product is available with child-guard slider technology, resulting in child-safe closure protection and promoting a circular economy.

Asia-Pacific is Expected to be the Fastest-growing Market for Stand-up Pouches

- Stand-up pouches are gaining popularity in the region's growing food processing industry. Due to increasingly busy lifestyles, consumers favor lightweight, portable snack packaging to accommodate their on-the-go needs. Compact sizes with resealable features such as zippers are popular, meeting the demand for convenient on-the-go options. The market is driven by the growing preference for mostly on-the-go food products and retort-packed goods to maintain shelf stability.

- The expansion of organized food retail outlets plays a pivotal role, offering consumers diverse products with enticing discounts. The food processing industry in India is undergoing a transformative phase, embracing technological and social advancements. Thus, the demand for convenient and ready-to-consume products underscores the significance of efficient and innovative packaging solutions like pouches.

- Urban areas, particularly, witness a surge in the popularity of processed foods like ready-to-eat products and snacks. According to the India Brand Equity Foundation, the annual household consumption of processed foods in India is expected to triple by 2030, establishing the country as a lucrative market.

- In April 2023, SIG announced the inauguration of a second production plant in Palghar, India. The plant produces SIG's bag-in-box and spouted pouch packaging, previously marketed under Scholle IPN and Bossar.

- The pet care industry in Asia registered positive growth due to increasing pet ownership, driven by demographic changes and the rising income levels of the population. Health for Animals, a government organization, estimated that China will have the most pets in the world by the end of 2024, which is expected to drive the demand for stand-up pouches in the country.

- The growth of the Thai pet food export market presents a significant opportunity for the pouch packaging industry, as pet humanization drives demand for premium packaging solutions. With a focus on convenience and freshness, pouch packaging plays a pivotal role in meeting the evolving needs of domestic and export markets within the pet food industry.

Stand-Up Pouches Industry Overview

The market is fragmented, with many global players operating in the market, constituting considerable market share. The leading market players are constantly upgrading their product portfolios and adopting various organic and inorganic strategies, such as new product launches, collaborations, and acquisitions, to dominate the market.

- February 2024: Amcor Group GmbH partnered with Stonyfield Organic, a US-based company, to introduce the first-ever all-polypropylene (PP) spouted pouch. The pouch has an eco-friendly design for Stonyfield's YoBaby refrigerated yogurt product.

- August 2023: Mondi PLC announced its collaboration with Fressnapf, a European pet food supplier, to provide a new range of mono-material recyclable packaging solutions for the dry pet food range. The mono-material packaging is recyclable and is designed in stand-up pouches.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Geopolitical Scenario Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenience and Ready-to-eat Food

- 5.1.2 Growing Requirements for Cost Effective Flexible Packaging Solutions and Brand Enhancement

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations and Growing Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.1.1 Polyethylene Terephthalate (PET)

- 6.1.1.2 Polyethylene (PE)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Ethylene-vinyl Alcohol (EVOH)

- 6.1.1.5 Other Plastic Materials

- 6.1.2 Paper

- 6.1.3 Metal (Foil)

- 6.1.1 Plastic

- 6.2 By Application

- 6.2.1 Food and Beverage

- 6.2.2 Home Care

- 6.2.3 Healthcare

- 6.2.4 Pet Care

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Middle East and Africa

- 6.3.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Mondi PLC

- 7.1.3 Sonoco Products Company

- 7.1.4 Constantia Flexibles GmbH

- 7.1.5 Smurfit Kappa Group PLC

- 7.1.6 ProAmpac LLC

- 7.1.7 Swiss PAC USA

- 7.1.8 Winpak Ltd

- 7.1.9 Uflex Limited

- 7.1.10 Glenroy Inc.

- 7.1.11 FLAIR Flexible Packaging Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219