|

市场调查报告书

商品编码

1642936

美国暖通空调服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)US HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

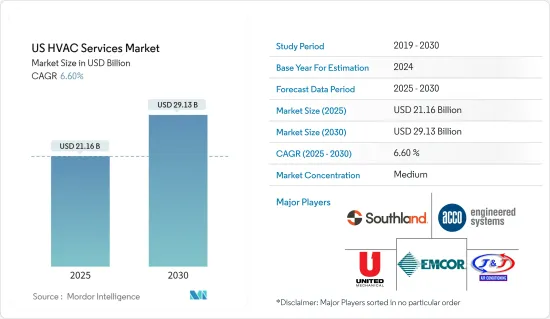

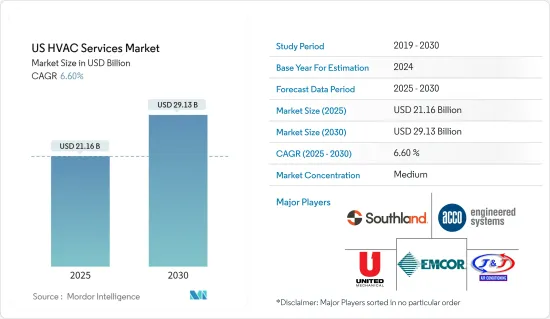

预计 2025 年美国HVAC 服务市场规模为 211.6 亿美元,到 2030 年将达到 291.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.6%。

在暖通空调系统方面,美国排名很高。例如,根据国际能源总署的数据,美国90% 以上的家庭都装有空调,而全球最热地区 28 亿人口中只有 8% 的家庭装有空调。在美国,家庭和办公室中空调的使用越来越多,这是该地区对暖通空调服务需求增加的主要因素之一。

关键亮点

- 根据美国能源资讯署 (EIA) 的住宅能源消耗调查 (RECS) ,美国居住(占总数的 64%)使用中央空调。约有 1,300 万户家庭(11%)使用热泵进行暖气和冷气。到 2023 年,在美国销售的所有新住宅空调和空气源热泵系统都必须符合最新的能源效率标准,从而刺激暖通空调服务的成长。

- 随着美国物联网的日益融入,暖通空调产业正朝向智慧科技迈进。国家法规和政策也控制着该国对 HVAC 服务的需求。例如,根据 Aeroseal, LLC 的说法,美国北部的熔炉效率要求达到 90%,而南部各州只要求熔炉效率达到 80%。这显示暖通空调服务产业往往受地方和区域法规的驱动。

- 此外,HVAC 系统由于其多种优势,尤其是其节能技术,在美国得到越来越广泛的应用。推动市场发展的关键因素是商业和工业领域建筑支出的增加。

- 此外,美国公司正在进行战略投资,并推动该地区对新的 HVAC 服务要求的需求。例如,2022年2月,专注于投资美国市场领先的住宅暖通空调、管道和电气服务公司的住宅服务公司Redwood Services宣布投资Arlinghaus Plumbing, Heating & Air Conditioning。这些努力进一步支持了市场成长。

- 该国目前正在实施各种安装 HVAC 设备的计划。例如,2022 年 10 月,Lennox Industries 与美国37 个州和加拿大各省的 180 家 HVAC 经销商合作,免费向当地英雄提供新的暖气和冷气设备和安装。

美国暖通空调服务市场趋势

工业和商业领域强劲成长

- 製造工厂和商业建筑的能源消耗占美国全部能源消耗的近一半,每年造成美国约 2,000 亿美元的损失。由于对安装和维护的需求不断增加以提高现有系统的能源效率,HVAC 服务正在经历成长。

- 商务用HVAC 单位需要大量空间,通常安装在购物中心、饭店、大型餐厅、剧院和商业办公室等建筑物的屋顶上。人们意识到室内环境如何影响人们的思维、感觉和行为,这引发了建筑健康趋势,并影响了办公室、饭店和其他商业空间的暖通空调服务的成长。

- 此外,在美国,由于政府对商业建筑能源排放的监管越来越严格,智慧 HVAC(暖气、通风和空调)系统变得越来越普遍。例如,美国总务管理局在联邦政府能源消费量最高的50栋建筑中安装了智慧建筑技术。

- 对于安装在商业建筑中的 HVAC 系统,已经开发了服务以提供专门的现场操作人员和能源咨询服务。这降低了营运成本并提高了整个建筑的暖通空调性能。

- 光是在美国,2021年工业能源消费量将达到32,090兆英热单位,需要采取周到的措施来减少对环境的影响。

新安装部分预计将促进成长

- 由于住宅、商业和工业领域的建设活动不断增加,对 HVAC 服务的需求也随之增加。美国建筑承包商协会的资料显示,2022年4月建筑支出达到年化1.74兆美元,创下历史新高,较2021年4月成长12.3%。

- 根据美国人口普查局的数据,2022 年 8 月该地区的建筑支出仍然强劲。经调整后的年率为 17813 亿美元,较 2021 年 8 月的 16416 亿美元增长 8.5%。

- 在施工期间安装 HVAC 时,必须遵守多项法规和标准。例如,建筑物防水外墙使用的黏合剂、密封剂、胶泥、底漆、油漆和被覆剂必须满足低排放气体要求。我们实施维修计划,以确保所有组件(包括马达、帮浦、风扇、压缩机、管道、过滤器等)完好无损且有效运作。

- 新型节能 HVAC 系统正在取代需要大量劳动力安装的传统 HVAC 系统。 HVAC 系统需要新技术来提高能源效率、降低能源成本和减少碳排放。

- 根据 Construct Connect 的数据,2022 年 3 月(不含住宅工程)的建筑量为 344 亿美元,较 2 月的 261 亿美元成长 31.8%。预计预测期内住宅、工业和商业领域的新建设计划将为市场创造机会。

美国暖通空调服务产业概况

美国HVAC 服务市场适度整合,只有少数供应商在美国提供服务。供应商将策略联盟和收购视为实现全球扩张和市场影响的有利途径。美国公司正在采取重要措施并进行大量投资以扩张全球业务。

- 2022 年 7 月:Southern HVAC Corporation 宣布收购 Allen's Air Conditioning and Heating。 Allen's 一直是伊丽莎白镇、霍金维尔、巴兹敦、莱奇菲尔德和南路易斯维尔市场值得信赖的家庭舒适解决方案供应商。 Southern HVAC 对 Allen's 的收购标誌着其在肯塔基州的首次投资。

- 2022 年 5 月:Halmos Capital Partners 和 Trivest Partners 宣布与 Thermal Concepts 建立合作并进行投资,后者是南佛罗里达州一家商业 HVAC 系统维护、维修和安装服务提供者。此次合作将加速该公司在佛罗里达州和东南部地区的发展。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 建设活动成长

- 提高对能源意识系统的认识

- 国内 HVAC 设备安装基数大

- 市场问题

- 初始安装成本高

- 关键指标分析(美国建设活动| 主要商业领域(仓库、冷藏仓库等))|住宅建筑

- 美国暖通空调产业 - 目前就业人数、公司数量、美国主要热点、连合收益(包括安装量)分析

第六章 市场细分

- 按最终用户

- 住宅

- 工业和商业

- 按类型

- 新安装

- 维修

第七章 竞争格局

- 公司简介

- EMCOR Services

- Southland Industrial Energy

- J&J Air Conditioning Services

- United Mechanical

- ACCO Engineered Systems

- National HVAC Services

- Lennox International Inc

- Nortek Global HVAC

- Carrier Corporation

- Goodman Manufacturing Company

第八章投资分析

第九章:市场的未来

The US HVAC Services Market size is estimated at USD 21.16 billion in 2025, and is expected to reach USD 29.13 billion by 2030, at a CAGR of 6.6% during the forecast period (2025-2030).

The United States ranks high when it comes to HVAC systems. For instance, according to IEA, in the United States, more than 90% of households have air conditioning equipment compared to 8% of the 2.8 billion people residing in the hottest parts of the globe. The increasing use of air conditioners in homes and offices around the United States will be one of the top drivers stressing the need for HVAC services in the region.

Key Highlights

- Further, the US Energy Information Administration's (EIA) Residential Energy Consumption Survey (RECS) estimates that 76 million primarily occupied US homes (64% of the total) use central air-conditioning equipment. About 13 million households (11%) use heat pumps for heating or cooling. By 2023, all new residential air-conditioning and air-source heat pump systems sold in the United States will require meeting the latest energy efficiency standards, fueling the growth of HVAC services.

- The HVAC industry is moving toward smart technologies in the United States, as the region is witnessing a high level of IoT integrations. State policies and regulations also govern the demand for HVAC services in the country. For instance, according to Aeroseal, LLC, furnaces in the northern United States must have a 90% efficiency rating, but in southern states, only an 80% efficiency rating is required. This indicates that the HVAC services industry tends to be fueled by local and regional regulations.

- Moreover, HVAC systems are gaining widespread adoption across the United States due to their multiple advantages, most notably the power-saving techniques. Major factors driving the market include increased construction expenditure across commercial and industrial sectors.

- Companies in the United States are also involved in strategic investments, thus evolving the need for new HVAC service requirements in the region. For instance, in February 2022, Redwood Services, a home service firm focused on investing in leading residential HVAC, plumbing, and electrical services companies in US markets, announced its investment in Arlinghaus plumbing, heating, and air conditioning. Such initiatives are further boosting the growth of the market.

- Various programs are being carried out in the country to install the HVAC equipment. For instance, in October 2022, Lennox Industries partnered with 180 HVAC dealers throughout 37 states of the United States and Canadian provinces to award new heating/cooling equipment and installation at no charge to the community heroes.

US HVAC Services Market Trends

Industrial and Commercial Segment to Grow Significantly

- Energy consumption in manufacturing facilities and commercial buildings accounts for nearly half of all energy consumed in the United States, costing approximately USD 200 billion annually. HVAC services are witnessing growth, owing to the increasing need to install and maintain the existing system's energy efficiency.

- Commercial HVAC units require a significant amount of space and are generally located on the rooftops of buildings, such as shopping malls, hotels, big restaurants, theaters, and commercial offices. Awareness about the impact of the indoor environment on the way people think, feel, and act has triggered the trend of building wellness, thereby impacting the growth of HVAC services in offices, hotels, and other commercial spaces.

- Additionally, the smart HVAC (heating, ventilation, and air conditioning) systems increase penetration in the United States, owing to increasing government regulation regarding energy emissions from commercial buildings across the country. For instance, the US General Services Administration installed a smart building technology in 50 of the federal government's most energy-consuming buildings.

- Services for HVAC systems installed in commercial buildings are being developed to provide full-time on-site operation staff and energy consulting services. This will reduce operational costs and improve the overall HVAC performance in buildings.

- The overall industrial energy consumption in the United States alone stood at 32.09 quadrillion Btu in 2021, requiring the country to take considerate measures to reduce the environmental impact.

New Installations Segment is Expected to Contribute to the Growth

- The demand for HVAC services has been on the rise owing to the increase in construction activities in the residential, commercial, and industrial sectors. According to data from the Associated General Contractors of America, construction expenditure hit an annual rate of USD 1.74 trillion in April 2022, 12.3% higher than in April 2021.

- According to the US Census Bureau, in August 2022, construction spending in the region remained strong. It was estimated at an adjusted annual rate of USD 1,781.3 billion, with an 8.5% increase compared to USD 1,641.6 billion in August 2021.

- Implementing HVAC during construction should comply with several regulations and standards. For instance, adhesives, sealants, mastics, primers, paints, and coatings applied within the building waterproofing envelope should comply with low-emission requirements. Further, the proper maintenance of system components keeps HVACs operating at peak efficiency - implement a maintenance program to ensure that all parts, including motors, pumps, fans, compressors, ducting, and filters, are intact and working effectively.

- New energy-efficient HVAC systems are replacing traditional HVAC systems, which need installations. New technologies are required in the HVAC system to increase energy efficiency, reduce energy costs, and lower carbon emissions.

- According to Construct Connect, March 2022's volume of construction, excluding residential work, was USD 34.4 billion, an increase of 31.8% compared with February's figure of USD 26.1 billion. The new construction projects across residential, industrial, and commercial industries are expected to create opportunities for the market over the forecast period.

US HVAC Services Industry Overview

The US HVAC services market is moderately consolidated due to the presence of a few vendors providing the services in the United States. The market vendors view strategic partnerships and acquisitions as a lucrative path toward global expansion and market presence. Companies in the United States are taking significant steps and making substantial investments in expanding to various parts of the globe.

- July 2022: Southern HVAC Corporation announced the acquisition of Allen's Air Conditioning and Heating. Allen's has been the trusted name in home comfort solutions for homeowners in the greater Elizabethtown, Hodgenville, Bardstown, Leitchfield, and south Louisville markets. The acquisition of Allen's by Southern HVAC represents its first investment in Kentucky.

- May 2022: Halmos Capital Partners and Trivest Partners announced their partnership and investment in Thermal Concepts, a maintenance, repair, and installation service provider for commercial HVAC systems across South Florida. The partnership will accelerate the company's growth throughout Florida and the Southeast.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Construction Activity

- 5.1.2 Higher Awareness on Energy Awareness Systems

- 5.1.3 Large Installed Base of HVAC Equipment in the Country

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Installation

- 5.3 Key Base Indicator Analysis (Construction Activity in the US| Major Commercial Segments - Warehouses, Cold Storage units, etc.| Residential Construction)

- 5.4 HVAC Industry in the US - Current Employment, Number of Enterprises, Major Hotpsots in the US and Consolidated Revenue (including Equipment) Analysis

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Residential

- 6.1.2 Industrial and Commercial

- 6.2 By Type

- 6.2.1 New Installations

- 6.2.2 Retrofits

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EMCOR Services

- 7.1.2 Southland Industrial Energy

- 7.1.3 J&J Air Conditioning Services

- 7.1.4 United Mechanical

- 7.1.5 ACCO Engineered Systems

- 7.1.6 National HVAC Services

- 7.1.7 Lennox International Inc

- 7.1.8 Nortek Global HVAC

- 7.1.9 Carrier Corporation

- 7.1.10 Goodman Manufacturing Company