|

市场调查报告书

商品编码

1687280

暖通空调服务:市场占有率分析、产业趋势与统计、成长预测(2024-2029 年)HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

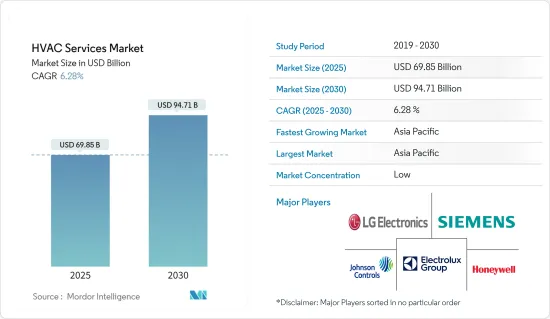

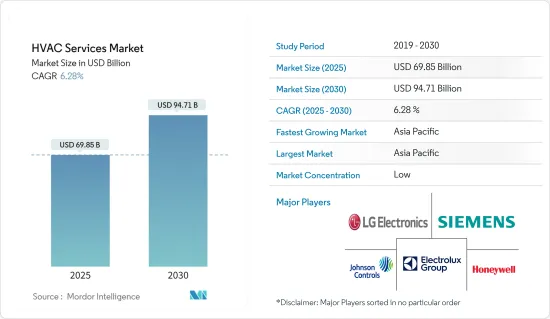

预计 2024 年 HVAC 服务市场规模为 657.2 亿美元,到 2029 年将达到 891.1 亿美元,预测期内(2024-2029 年)的复合年增长率为 6.28%。

人们对健康的担忧日益加剧,导致对 HVAC 设备的需求增加、住宅和商业区建设增加以及资料中心市场的成长,从而推动了 HVAC 市场的发展。

关键亮点

- 区域供热、热泵、使用可再生能源和氢气供热等清洁供热技术正在全球范围内得到越来越广泛的应用,以满足永续发展情景(SDS),这推动了服务的采用并对市场需求产生积极影响。

- 此外,世界各地的建筑业也呈指数级增长。公共和私营部门都正在接受绿色建筑的概念,为暖通空调服务创造了巨大的成长机会。

- 资料中心的爆炸性需求吸引了各类投资者的关注:成长资本、收购、房地产以及最近的基础设施投资者。资料中心通常由银行、云端供应商、通讯业者等大型公司或主机託管公司拥有和经营,用于各种目的。后者出租空间并列出网路容量、电力和冷却设备以保持伺服器凉爽。租户自备 IT 设备。

- 劳动力短缺被视为发展暖通空调服务市场面临的关键挑战。然而,儘管面临这些挑战,但由于製造商和其他服务提供者采取了各种必要措施,市场仍然蓬勃发展。

- 在新冠疫情爆发后,世界各国政府都增加了医疗保健支出并发展了高效的基础设施。例如,印度政府正在用现代设备和技术维修旧的政府医院。预计这将增加对 HVAC 服务的需求。然而,通货膨胀和利率上升进一步减少了消费者支出,阻碍了暖通空调设备的年比销售,并限制了暖通空调服务的成长。

暖通空调市场趋势

住宅领域占据主要市场占有率

- 人口实验室估计,世界人口将从2022年的79亿增加到2023年的80.1亿。预计2023年都市化程度将达57%,并有望在未来几年继续增加。由于人口增长、都市化和住宅,住宅领域对暖通空调服务的需求很高,导致新系统的安装。各个社区正在采取预防性措施来保护住宅,以避免未来出现问题。这包括维护和修理住宅HVAC 系统,包括解决洩漏、腐蚀以及冷热空气循环问题。

- 在住宅领域,定期维护和维修对于确保 HVAC 系统的最佳性能至关重要。定期进行 HVAC 维护和维修的主要好处之一是能够最大限度地提高系统的效率。如果没有适当的维护,您的系统可能难以正常运行,从长远来看,这可能会导致能源消费量增加和成本上升。随着住宅领域对高效实践的需求不断增加,对 HVAC 服务的需求也可能增加。

- 在欧洲、美国和亚洲等各个地区,越来越多的消费者正在减少二氧化碳的消费量,以应对全球暖化。为了尽量减少对环境的影响,这些消费者选择 HVAC 服务来升级或维护现有的 HVAC 系统以用于暖气和冷气。

- 例如,在欧洲,永续能源办公室向安装热泵系统的住宅提供财务奖励,使他们能够降低能源成本并减少碳排放。这些促进 HVAC 服务采用的措施预计将提升整个住宅领域的市场潜力。

- 印度和中国等国家对节能暖通空调设备的需求激增是由于该地区住宅和人口不断增加。随着越来越多的住宅建成,对这些设备和服务的需求也在增加。此外,新基础设施开发计划的推出预计将增加对节能 HVAC 解决方案的需求,从而增加对基本 HVAC 服务的需求。

亚太地区预计将创下最快成长

- 中国「十四五」计画强调水利、能源、交通和都市化等领域的新基础建设计划。 「十四五」期间(2021-2025年)新基建投资总额预计将达到约27兆元人民币(4.2兆美元)。新规划强调了绿色建筑发展和能源效率的九个重点领域。要求维修建筑3.5亿平方公尺以上,新建净零能耗建筑5000万平方公尺以上。预计将扩大研究市场。

- 印度的IT基础设施正在快速发展,各大公司都在积极投资新的资料中心。例如,亚马逊网路服务宣布于 2022 年 11 月推出AWS 亚太地区(海得拉巴)区域,这是其在印度的第二个基础设施区域。第二个基础设施区域为客户提供了更多选择,以更高的弹性和可用性运行他们的工作负载,在印度安全地储存资料,并以更低的延迟为他们的最终用户提供服务。 AWS 估计,到 2030 年,海得拉巴地区将透过印度计画投资超过 44 亿美元,每年维持超过 48,000 个全职工作。

- 由于在可再生能源、通讯和製造业领域的多项投资,以及政府到2050年减少温室气体排放并实现碳中和的目标,日本的建筑业正在经历强劲增长。

- 印尼是亚洲领先的空调市场之一,随着经济成长和中等收入阶层的增加,家用空调市场预计将进一步成长。在印尼,大部分市场由小型车型组成,这些车型很容易适应当地的电力和住宅条件。

- 因此,变频空调这类节能效果高、能满足市场需求的产品,市场前景看好。根据EIA预测,到2030年,印尼家庭预计将新增2,000万台空调。

暖通空调产业概况

HVAC 服务市场分散且竞争激烈,有几家主要企业。市场参与企业专注于扩大其在消费群。这些公司正在利用策略合作措施来增加市场占有率和盈利。西门子股份公司、霍尼韦尔国际公司、LG 电子公司、伊莱克斯公司和江森自控国际有限公司等该市场的参与者正在收购从事 HVAC 服务技术的新兴企业,以增强其生产能力。

- 2023 年 10 月 - Lennox International Inc. 宣布收购 AES Industries Inc. 和 AES Mechanical Service Group Inc.,併入其建筑气候解决方案部门。 AES 将成为 Lennox Commercial 业务部门的一部分,使该公司能够为 AES 和 Lennox 客户提供「前端到后端」生命週期整合服务。

- 2023 年 7 月 - 大金舒适科技公司的子公司 AirReps 收购了两家公司,Integrated Systems and Controls LLC 和 InControl。这些收购与 AirReps 一起将有助于大金满足商业市场对整合服务的需求。这些整合功能涵盖大金的 VRV 和小型商用企业,包括服务功能、远端监控和预测性维护计划。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 宏观经济因素如何影响市场

第五章市场动态

- 市场驱动因素

- 主要新兴国家建筑业的成长

- 资料中心市场成长

- 市场问题

- 劳力短缺/技术纯熟劳工成本高

第六章市场区隔

- 依实施类型

- 新建筑

- 维修的建筑

- 按最终用户

- 住宅

- 商业设施

- 工业的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 比荷卢经济联盟

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

第七章竞争格局

- 公司简介

- Siemens AG

- Honeywell International Inc.

- LG Electronics Inc.

- Electrolux AB

- Johnson Controls International PLC

- Lennox International Inc.

- Fujitsu General Ltd

- Robert Bosch GmbH

- Ingersoll-Rand PLC

- Carrier Corporation

- Daikin Industries Ltd

- Nortek Global HVAC

第八章投资分析

第九章:市场的未来

The HVAC Services Market size is estimated at USD 65.72 billion in 2024, and is expected to reach USD 89.11 billion by 2029, growing at a CAGR of 6.28% during the forecast period (2024-2029).

The HVAC market is driven by the growing demand for HVAC equipment due to growing health concerns, increasing construction of residential buildings and commercial spaces, and the growing data center market.

Key Highlights

- Clean heating technologies, including district heating, heat pumps, and renewable and hydrogen-based heating, are gaining traction worldwide to meet the Sustainable Development Scenario (SDS), which drives the implementation services and positively influences the market demand.

- The construction industry across the globe is also growing exponentially. The public and private sectors embrace the concept of green building, which presents a significant growth opportunity for HVAC Services.

- The explosion in demand for data centers has attracted the attention of investors of all types, namely growth capital, buyout, real estate, and, increasingly, infrastructure investors. Data centers are generally owned and operated either by big companies such as banks, cloud vendors, or telcos for their purposes or by co-location companies. The latter leases the space and provides network capacity, power, and cooling equipment to lower server temperatures. Tenants bring their IT equipment.

- Labor shortage may be observed as a significant challenge evolving out of the HVAC services market. However, despite these challenges, the market has flourished due to various essential steps manufacturers and other service-providing companies took.

- Post-COVID-19 pandemic, governments wrdwide have increased healthcare spending and built efficient infrastructure. For example, the Government of India is retrofitting old government hospitals with the latest equipment and technology. This is expected to increase the demand for HVAC services. However, rising inflation and interest rates have further decreased consumer spending and hampered the sales of HVAC equipment in the previous year, restricting the growth of HVAC services.

HVAC Market Trends

Residential Segment Holds Major Market Share

- The Population Reference Bureau estimated the global population to be 8.01 billion in 2023 from 7.9 billion in 2022. The degree of urbanization was 57% in 2023, and it is expected to increase in the coming years. The growing population, urbanization, and residential construction have resulted in a high demand for HVAC services in the residential sector, leading to the installation of new systems. In various regions, a proactive and preventative approach is adopted to maintain residential buildings to avert future problems. This encompasses the maintenance and repair of residential HVAC systems, including resolving leaks, corrosion, and any hot or cold air distribution issues.

- Regular maintenance and repairs are essential in the residential sector to ensure optimal performance of HVAC systems. One of the major advantages of regular HVAC maintenance and repairs is the ability to maximize the system's efficiency. Without proper maintenance, the system may face difficulties in functioning, resulting in increased energy consumption and higher costs in the long run. As the demand for efficient practices continues to rise in the residential sector, the need for HVAC services will also increase.

- In various regions like Europe, the United States, Asia, and others, a growing number of consumers are reducing their carbon consumption to combat global warming. To minimize the environmental impact, these consumers opt for HVAC services to upgrade or maintain their existing HVAC systems for heating and cooling purposes.

- For instance, in Europe, the Sustainable Energy Authority offers financial incentives to homeowners who install heat pump systems, enabling them to reduce their energy costs and decrease their carbon emissions. Such initiatives driving the adoption of HVAC services will increase the market's potential across the residential sector.

- The surge in the requirement for energy-efficient HVAC units in nations like India and China can be attributed to the area's escalating housing and population growth. With the construction of more residential properties, the demand for these equipment and services is rising. Furthermore, introducing new infrastructure development projects is anticipated to amplify the need for energy-efficient HVAC solutions, consequently boosting the demand for essential HVAC services.

Asia-Pacific is Expected to Register the Fastest Growth

- China's 14th Five-Year Plan highlights new infrastructure projects in water systems, energy, transportation, and urbanization. According to estimates, overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) is likely to reach approximately CNY 27 trillion (USD 4.2 trillion). The new plan emphasizes nine key items for green building development and energy efficiency. It calls for retrofitting over 350 million sq m of buildings and constructing over 50 million sq m of net zero energy consumption buildings. This is expected to boost the market studied.

- In India, with the rapidly growing IT infrastructure, companies are rigorously investing in new data centers, which is expected to propel the studied market. For example, in November 2022, Amazon Web Services announced the launch of its second infrastructure region in India, the AWS Asia-Pacific (Hyderabad) region. This second infra region offers customers more options to run workloads with greater resilience and availability, securely store data in India, and serve end users with lower latency. AWS has estimated the Hyderabad region will sustain more than 48,000 full-time jobs yearly through a planned investment of more than USD 4.4 billion in India by 2030.

- The construction industry in Japan is witnessing robust growth due to several investments in renewable energy, telecommunication, and manufacturing sectors, as well as the government's aim to cut greenhouse gas emissions and achieve carbon neutrality by 2050.

- Indonesia has one of Asia's major air conditioning markets, with estimates for economic growth and an increase in the middle-income class fueling predictions for additional growth in the air conditioner market, primarily for domestic use. Small-sized models account for most of the market because of their adaptability to the local electric power situation and particular home types in Indonesia.

- As a result, Indonesia is a prospective market for goods that may display great energy-saving efficiency, such as inverter-type air conditioners, while still meeting market demands. According to EIA, Indonesian homes are expected to add another 20 million air conditioners by 2030.

HVAC Industry Overview

The HVAC services market is fragmented, favorably competitive, and has several prominent players. The market performers are focusing on expanding their consumer base across foreign countries. These enterprises leverage strategic collaborative initiatives to boost their market share and profitability. Companies such as Siemens AG, Honeywell International Inc., LG Electronics Inc., Electrolux AB, and Johnson Controls International PLC, performing in the market, are also acquiring start-ups working on HVAC services technologies to strengthen their production capacities.

- October 2023 - Lennox International Inc. announced the acquisition of AES Industries Inc. and AES Mechanical Service Group Inc. to the Building Climate Solutions segment. AES will be a part of the Lennox Commercial business segment and enable the delivery of "front-to-back" life-cycle integrated services to AES and Lennox customers.

- July 2023 - Daikin Comfort Technologies subsidiary AirReps acquired two companies, Integrated Systems and Controls LLC and InControl, enhancing the capabilities of AirReps and allowing the company to provide a more comprehensive array of services for its customers. These acquisitions will help Daikin, in conjunction with AirReps, to meet the commercial market's need for integrated services. These combined capabilities will offer Daikin's VRV and Light Commercial business, including service capability, remote monitoring, and predictive maintenance programs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Construction Business in Major Emerging Economies

- 5.1.2 Growing Data Center Market

- 5.2 Market Challenges

- 5.2.1 Labor Shortage/High Costs of Skilled Labor

6 MARKET SEGMENTATION

- 6.1 By Implementation Type

- 6.1.1 New Construction

- 6.1.2 Retrofit Buildings

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Benelux

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Honeywell International Inc.

- 7.1.3 LG Electronics Inc.

- 7.1.4 Electrolux AB

- 7.1.5 Johnson Controls International PLC

- 7.1.6 Lennox International Inc.

- 7.1.7 Fujitsu General Ltd

- 7.1.8 Robert Bosch GmbH

- 7.1.9 Ingersoll-Rand PLC

- 7.1.10 Carrier Corporation

- 7.1.11 Daikin Industries Ltd

- 7.1.12 Nortek Global HVAC