|

市场调查报告书

商品编码

1642997

美国合约物流:市场占有率分析、行业趋势和成长预测(2025-2030 年)United States Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

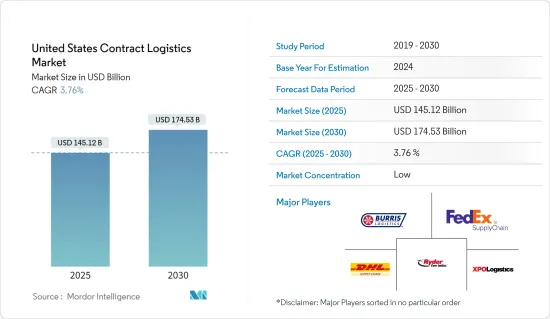

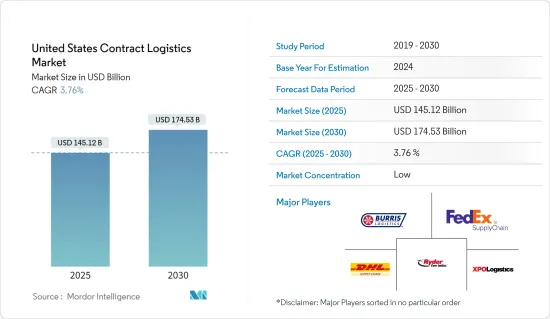

预计 2025 年美国合约物流市场规模为 1,451.2 亿美元,到 2030 年将达到 1,745.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.76%。

主要亮点

- 美国合约物流行业已经做好转型的准备,因为该行业在战略上有望从蓬勃发展的电子商务和技术进步中获益。这种演变很大程度上是由网路购物的爆炸式增长所推动的,网上购物正在重塑消费行为和物流要求。

- 为了满足不断增长的需求,物流公司正在大力投资扩大其仓库网路。预测表明,美国将需要额外的 5 亿平方英尺的仓库空间来管理不断增长的库存并满足当日送达的期望。领先的物流公司正在利用自动化和机器人等最尖端科技升级其基础设施,以提高效率并加快产品流动速度。

- 截至 2024 年,美国合约物流市场专注于永续性数位化。公司正在采用节能的运输方式和尖端的追踪技术来增强业务能力,同时减少对环境的影响。此外,它已成为北美合约物流市场的主要贡献者。

- 人工智慧和机器学习在供应链优化方面的整合成为推动这一市场扩张的关键因素。公司正在使用人工智慧来改善路线规划、加强库存管理并执行预测分析。例如,XPO 物流正在利用路线优化和即时追踪技术来增强其服务产品并巩固其作为合约物流主要企业的地位。

- 例如,C.H.Robinson 使用预测分析来监督其车队的性能,确保及时维护并减少服务中断。这些应用程式使公司能够最大限度地减少效率低下并更准确地预测需求。

美国合约物流市场趋势

电子商务销售激增推动市场扩张

在美国,电子商务的兴起极大地推动了合约物流的成长,刺激了对精简仓储、配送和最后一哩交付服务的需求增加。随着网路购物的激增,物流供应商不断扩大其基础设施并采用最尖端科技来满足履约需求。

2023年美国交付指标明显改善。根据Statista的报告,签发率年减3.6%至6.4%,准时送达率维持稳定在98%,一次送达功率与前一年同期比较与前一年同期比较12.2%至97%,国内平均在途时间与前一年同期比较减少24%至2.56天。

预计这一趋势将持续到 2024 年,平均运输时间预计将进一步减少至 2.32 天。即使面临经济逆风,产业预测仍显示,2024 年美国零售电子商务销售额将较 2023 年成长 10.5%。

随着电子商务的蓬勃发展,联邦快递、美国邮政服务和 UPS 等物流巨头正在透过优化路线、加强基础设施和实施先进的包裹追踪来加快小包裹递送速度。 2024年,联邦快递的平均运输时间为2.08天,而UPS的平均运输时间为2.22天。同时,儘管尽了最大努力,美国邮政服务的平均运输时间仍然增加到 2.55 天。

总之,电子商务的持续成长正在大力推动美国合约物流市场的发展。随着物流供应商和运输商适应日益增长的需求,该行业的效率和交付绩效将进一步提高。

汽车和製造业推动的合约物流市场

随着製造商不断提高其核心竞争力,越来越多的公司将其物流业务外包给第三方供应商。这种转变在汽车产业尤其明显,该产业企业越来越依赖专业物流服务来驾驭复杂的供应链。例如,福特和通用汽车等主要汽车製造商已与 XPO 物流和 DHL Supply Chain 等物流供应商合作。该合作旨在简化供应链、提高业务效率并降低成本。

包括联邦快递和 DHL 在内的大型物流公司将在 2024 年扩大其在美国战略位置的仓库容量。此次扩张是为了直接回应汽车製造商不断增长的需求。物流基础设施,尤其是仓库和配送中心,正在进行大量投资,以满足製造业和汽车产业不断变化的需求。

全球物流领导者 DHL 在美国开设了最新的电动车(EV)卓越中心(CoE)。该中心致力于指导汽车出行产业及其相关公司推进电气化进程。新的美国中心是更广泛的全球网路的一部分,该网路对位于墨西哥、印尼、中国、阿拉伯联合大公国、义大利和英国等战略定位的现有电动车卓越中心进行了补充。

总之,由于汽车和製造业对第三方物流供应商的依赖日益增加,合约物流市场正经历显着成长。随着企业优化供应链并采用新技术,预计这一趋势将会持续下去。

美国合约物流行业概况

市场较分散,主要企业包括 XPO Logistics、Ryder System Inc.、FedEx Supply Chain、Burris Logistics、UPS Supply Chain Solutions 和 KUEHNE+NAGEL。物流自动化、物联网、应用感测器和无人机侦测卡车人为损坏等技术进步,以及人工智慧在配送和物流中的作用,彻底改变了这个产业。市场仍然分散,国内外参与者多元。

为了提高效率,各公司正联合起来。例如,国内领先的海运短程运输供应商IMC 物流已与长期客户Kuehne+Nagel建立了策略伙伴关係。根据美通社报道,Kuehne+Nagel 将收购 IMC Logistics 51% 的股份。此次合作旨在满足日益增长的综合货运服务需求,促进美国各地海港、铁路枢纽、客户设施和内陆地区之间的旅行。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态与洞察

- 当前市场状况

- 市场动态

- 市场驱动因素

- 电子商务的成长

- 技术进步

- 市场限制

- 劳动力短缺

- 燃料和运输成本上涨

- 市场机会

- 致力于永续性

- 客製化和量身定制的解决方案

- 市场驱动因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- 产业监管和政策见解

- 技术整合洞察

- 区域电子商务产业洞察(国内和跨境)

- 了解合约物流参与者提供的各种服务(综合仓储和运输、供应链服务和其他附加价值服务)

- 精选 - 运费/运费费率

- 地缘政治与疫情将如何影响市场

第五章 市场区隔

- 按类型

- 内部采购

- 外包

- 按最终用户

- 製造/汽车

- 消费品和零售

- 高科技

- 医疗保健和医药

- 其他最终用户(能源、建筑、航太等)

第六章 竞争格局

- 市场集中度概览

- 公司简介

- XPO Logistics

- Ryder Supply Chain Solutions

- DHL Supply Chain North America

- FedEx Logistics

- Burris Logistics

- Kuehne+Nagel

- GXO Logistics

- UPS

- GAC United States

- GEODIS

- Hellmann Worldwide Logistics

- DB Schenker

- Hub Group*

- 其他公司

第七章:未来市场展望

第 8 章 附录

- 宏观经济指标(GDP分布,依活动划分)

- 经济统计 - 交通运输及仓储业的经济贡献

- 对外贸易统计 - 按商品、目的地和原产国分類的进出口数据

The United States Contract Logistics Market size is estimated at USD 145.12 billion in 2025, and is expected to reach USD 174.53 billion by 2030, at a CAGR of 3.76% during the forecast period (2025-2030).

Key Highlights

- Strategically poised to benefit from the burgeoning e-commerce landscape and technological advancements, the United States contract logistics sector is witnessing a transformation. This evolution is largely fueled by a surge in online shopping, reshaping both consumer behavior and logistics requirements.

- In response to surging demand, logistics firms are significantly investing in expanding their warehousing networks. Projections indicate that the U.S. will need an additional 500 million square feet of warehouse space to manage growing inventories and meet same-day delivery expectations. Leading logistics companies are upgrading their infrastructure with cutting-edge technologies like automation and robotics to boost efficiency and accelerate product flow.

- As of 2024, the U.S. contract logistics market is placing a heightened focus on sustainability and digitalization. Firms are embracing energy-efficient transportation methods and state-of-the-art tracking technologies, aiming to bolster operational capabilities while reducing environmental impact. Furthermore, the nation emerges as the leading contributor to North America's contract logistics market.

- AI and ML integration for supply chain optimization stands out as a pivotal driver of this market's expansion. Businesses are leveraging AI to enhance route planning, strengthen inventory management, and perform predictive analyses. For instance, XPO Logistics utilizes technology for route optimization and real-time tracking, enhancing its service offerings and solidifying its position as a key player in the contract logistics landscape.

- For instance, C.H. Robinson employs predictive analytics to oversee its fleet's performance, guaranteeing timely maintenance and reducing service disruptions. These applications empower companies to minimize inefficiencies and forecast demands with greater precision

United States Contract Logistics Market Trends

Surge in E-Commerce Sales Fuels Market Expansion

In the U.S., the rise of E-Commerce has significantly propelled the growth of contract logistics, spurring heightened demand for streamlined warehousing, distribution, and last-mile delivery services. As online shopping surged, logistics providers expanded their infrastructures and adopted cutting-edge technologies to meet fulfillment demands.

Delivery metrics in the U.S. showed marked improvements in 2023: the issue ratio dipped 3.6% year-over-year (YoY) to 6.4%, the on-time delivery ratio held steady at 98%, the first-attempt delivery success rate jumped 12.2% YoY to 97%, and average domestic transit times shortened by 24% YoY to 2.56 days, as reported by Statista.

This momentum carried into 2024, with average transit times further refining to 2.32 days. Even amidst economic headwinds, U.S. retail e-commerce sales in 2024 are set to rise by 10.5% from 2023, as per industry forecasts.

In tandem with the E-Commerce surge, major logistics players like FedEx, USPS, and UPS have bolstered parcel delivery speeds via route optimization, infrastructure enhancements, and state-of-the-art package tracking. In 2024, FedEx and UPS achieved average transit times of 2.08 days and 2.22 days respectively. Conversely, USPS, despite their concerted efforts, saw an uptick in average transit time to 2.55 days.

In conclusion, the continuous growth of E-Commerce is driving significant advancements in the U.S. contract logistics market. As logistics providers and carriers adapt to increasing demands, the sector is poised for further improvements in efficiency and delivery performance.

Contract Logistics Market Propelled by the Automotive and Manufacturing Sectors

As manufacturers hone in on their core competencies, a growing number are turning to third-party providers for logistics operations. This shift is especially evident in the automotive sector, where firms increasingly rely on specialized logistics services to navigate their intricate supply chains. For example, leading automotive giants Ford and General Motors have teamed up with logistics providers like XPO Logistics and DHL Supply Chain. This collaboration aims to streamline their supply chains, boosting operational efficiency and driving down costs.

Major logistics companies, including FedEx and DHL, are expanding their warehouse capacities at strategic U.S. locations in 2024. This expansion is a direct response to the surging demands from automotive manufacturers. Significant investments are being made in logistics infrastructure, particularly in warehouses and distribution centers, to meet the evolving needs of the manufacturing and automotive sectors.

DHL, a prominent player in the global logistics arena, has inaugurated its latest Electric Vehicle (EV) Center of Excellence (CoE) in the U.S. This center is poised to guide the auto-mobility sector and its affiliates on their electrification journey. The newly established U.S. center is part of a broader global network, complementing existing EV Centers of Excellence in strategic locations such as Mexico, Indonesia, China, the UAE, Italy, and the UK.

In conclusion, the contract logistics market is experiencing significant growth, driven by the increasing reliance of the automotive and manufacturing sectors on third-party logistics providers. This trend is expected to continue as companies seek to optimize their supply chains and embrace new technologies.

United States Contract Logistics Industry Overview

The market is fragmented, with XPO Logistics, Ryder System Inc., FedEx Supply Chain, Burris Logistics, UPS Supply Chain Solutions, KUEHNE+NAGEL, etc as its major players. Technological advancements, such as logistic automation, IoT, and the application of sensors and UAVs for detecting human-made damages on tracks, alongside AI's role in delivery and logistics, have revolutionized the industry. The market remains fragmented, featuring a diverse mix of local and international players.

In a bid to boost effectiveness, companies are joining hands. For instance, IMC Logistics, the nation's leading marine drayage provider, has entered into a strategic partnership with its long-standing client, Kuehne+Nagel. As reported by PR Newswire, Kuehne+Nagel is set to acquire a 51% stake in IMC Logistics. This collaboration aims to meet the surging demand for comprehensive cargo transportation services, facilitating movement to and from seaports, rail hubs, customer facilities, and inland locations across the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 E Commerce Growth

- 4.2.1.2 Technological Advancements

- 4.2.2 Market Restraints

- 4.2.2.1 Labor Shortage

- 4.2.2.2 Rising Fuel and Transportation costs

- 4.2.3 Market Opportunities

- 4.2.3.1 Sustainability Initiatives

- 4.2.3.2 Customization and Tailored Solutions

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Insights on Industry Policies and Regulations

- 4.6 Insights on Technological Integration

- 4.7 Insights on E-commerce Industry in the Region (Domestic and Cross-border)

- 4.8 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing and Transportation, Supply Chain Services, and Other Value-Added Services)

- 4.9 Spotlight - Freight Transportation Costs/Freight Rates

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End-User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Consumer Goods and Retail

- 5.2.3 High-tech

- 5.2.4 Healthcare and Pharmaceuticals

- 5.2.5 Other End-Users(Energy, Construction, Aerospace, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 XPO Logistics

- 6.2.2 Ryder Supply Chain Solutions

- 6.2.3 DHL Supply Chain North America

- 6.2.4 FedEx Logistics

- 6.2.5 Burris Logistics

- 6.2.6 Kuehne + Nagel

- 6.2.7 GXO Logistics

- 6.2.8 UPS

- 6.2.9 GAC United States

- 6.2.10 GEODIS

- 6.2.11 Hellmann Worldwide Logistics

- 6.2.12 DB Schenker

- 6.2.13 Hub Group*

- 6.3 Other Companies

7 FUTURE OUTLOOK OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin