|

市场调查报告书

商品编码

1643017

无线连接:市场占有率分析、行业趋势和统计、成长预测 2025-2030Wireless Connectivity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

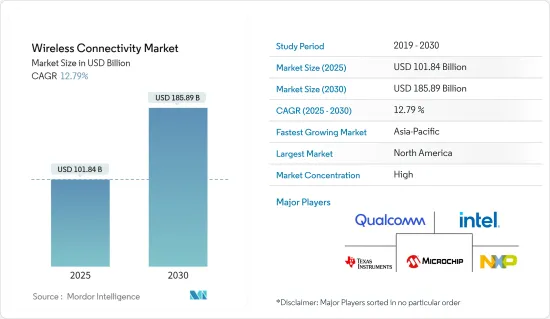

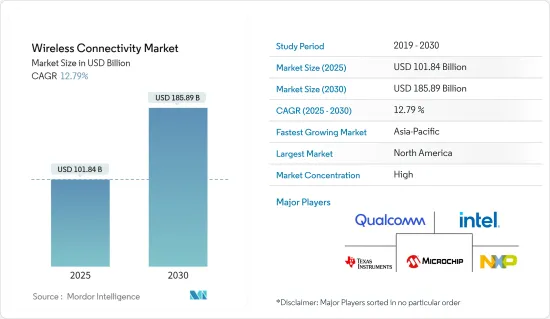

无线连接市场规模预计在 2025 年达到 1,018.4 亿美元,预计到 2030 年将达到 1,858.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.79%。

主要亮点

- 无线连接市场正在经历显着增长,原因是对互联设备的需求不断增长,这些设备涵盖 Wi-Fi、蓝牙和 Zigbee 等一系列技术,可实现无缝互联网访问和资料传输,而无需电缆。

- 医疗保健和智慧家庭等各个领域的连网型设备的激增,推动了对蓝牙和 Zigbee 等低功耗、短距离连接解决方案的需求。例如,亚马逊的智慧扬声器 Echo 使用 Wi-Fi 和蓝牙技术来增强连接性。此外,消费者对智慧恆温器、照明和安全系统等智慧家庭设备的兴趣日益浓厚,推动了对无线连接的需求。

- 对家用电子电器的不断增长的需求正在推动市场成长。人工智慧、物联网、扩增实境和虚拟实境等先进技术的采用也加速了各个工业领域对无线连接的需求。全球智慧基础设施的发展也是推动无线连线需求增加的主要因素。

- 此外,全球各国政府对使用无线连接进行各种应用的智慧城市计划的投资不断增加,也推动了市场的成长。例如,2023 年 10 月,资讯科技与电子通讯部 (DITE&C) 宣布计划在全州建立和营运 100 多个 Wi-Fi 热点,以提供免费且无缝的网路服务。热点将设立在政府办公室、公车站、公共公园和市民服务中心等人潮众多的地方。

- 然而,由于无线网路容易受到网路攻击,安全问题正在限制无线连线市场的成长。随着无线通讯在各个行业和应用领域的不断增长,强大的安全措施对于防止资料外洩和恶意软体攻击至关重要。不良的加密通讯协定、薄弱的身份验证机制和薄弱的网路配置可能会洩漏敏感资讯并危害无线系统的安全。

- 例如,根据无线宽频联盟(WBA)在其《2023 年 WBA 年度产业报告》中进行的一项调查,超过三分之一(33%)的服务供应商、技术供应商和企业已经计划在 2023年终前部署 Wi-Fi 7。此外,44% 的受访者计划在未来 12 到 18 个月内采用 Wi-Fi 6E。 Wi-Fi 普及率不断提高的前景预计将推动无线连线市场大幅成长。

无线连线市场趋势

汽车产业可望推动市场成长

- 蓝牙无线连接越来越多地被各种汽车系统设备采用,以实现免持通话、音讯串流、车载资讯娱乐系统等的无线通讯和连接。使用 Wi-Fi 和蓝牙等无线连接,用户可以将他们的智慧型手机和其他智慧型装置连接到资讯娱乐系统。因此,预计汽车销售的成长将推动对无线连接解决方案的需求。

- 现代汽车越来越像移动物联网 (IoT) 设备,使用一系列感测器收集内部和外部资讯并采取行动,以提高驾驶员的安全性和舒适度。无线通讯在汽车技术进步中发挥着不可或缺的作用,ADAS(高级驾驶辅助系统)和车载资讯娱乐等应用产生的资料量不断增加,推动着蓝牙、Wi-Fi 和蜂窝等无线技术的创新,从而促进市场成长。

- 自动驾驶和联网汽车在消费者中越来越受欢迎,预计将继续成长。展出的高级驾驶辅助系统 (ADAS) 旨在缩小当今和未来车辆之间的差距。此外,随着汽车行业技术创新的不断发展,终端消费者愿意在最新技术上投入更多,以增强驾驶体验并提高驾驶员和乘客的安全性。预计这将推动对自动驾驶汽车无线连接解决方案的需求。

- 此外,通用汽车中东公司还推出了与Google合作开发的新型车载技术,增强了其在连接领域的领导地位并提升了客户体验。通用汽车中东公司宣布推出嵌入Google的资讯娱乐系统,作为其车辆智慧技术目标的一部分。这些新功能增强了整体客户体验,使客户更容易将他们的数位生活带入未来的联网汽车。

- Google 内建服务将成为 LT 装饰及以上车型的标准配置,并将在所有配备 OnStar 模组系统的通用汽车品牌中广泛推广。这意味着科威特和阿联酋的客户可以透过他们的 Wi-Fi 计划享受 Google 的内建服务,而科威特和巴林的客户可以透过他们的个人行动 Wi-Fi 热点进行连线。

亚太地区可望创下高成长

- 该地区的市场成长主要受益于消费者支出的成长和智慧家庭的日益普及。根据软体公司Utimaco在2023年4月进行的数位调查,新加坡智慧家庭设备的使用率大幅增加,61%的受访者表示使用智慧电视,43%表示使用家用电器,33%表示使用节能设备、虚拟助理和吸尘机器人。这是该地区越来越多地采用无线连接解决方案的主要成长要素。

- 智慧城市日益发展的趋势正在鼓励公司和机构开发新产品和解决方案,促进该地区智慧城市的发展。例如,2023 年 10 月,IIIT 海德拉巴智慧城市生活实验室与安全智慧无线技术领导者 Silicon Labs 合作,宣布部署覆盖校园的 Wi-SUN 网络,以支援物联网 (IoT) 和智慧城市的研究和解决方案。这些发展正加速整个全部区域对于无线连线的需求。

- 此外,该地区 5G 网路的扩张预计将成为直接和间接推动市场成长的主要因素之一。根据GSMA最新报告,预计2030年,5G将为东亚和太平洋新兴经济体贡献约9,600亿美元。 5G有望成为该地区部署自动化智慧工厂的主要动力。

- 物联网(IoT)平台的采用在中国正在迅速成长。中国在半导体生产和製造领域的主导地位及其在工业物联网(lIoT)推进和应用方面的参与和发展预计将在终端用户行业中创造对无线连接的需求。

无线连线产业概况

无线连接市场的竞争格局较为分散,市场上有许多参与者竞争,包括高通公司、英特尔公司、德州仪器公司、恩智浦半导体公司和微晶片科技公司。市场正在透过产品推出、合併和收购进行策略探索,以获得竞争优势。

- 2024年2月,全球物联网解决方案供应商移远通讯宣布推出两款新型Wi-Fi模组FCU741R和FCS950R,以及蓝牙模组HCM010S和HCM111Z。随着蓝牙和Wi-Fi模组的推出,该公司旨在为设计人员和开发人员提供多种选择,以满足尺寸、成本和功率效率的不同需求。

- 2024 年 1 月,Ceva Inc.(一家使智慧边缘设备能够可靠且有效率地连接、感知和推断资料的硅和软体 IP 授权商)与凌阳科技(一家多媒体和汽车应用晶片提供者)扩大了合作,将 Ceva 最新一代 RivieraWaves 蓝牙音讯解决方案整合到无线系统 airlyra HD 无线设备系列中,该系列针对其他扬声器和连接蓝牙装置。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 物联网和连网型设备的兴起为强大的无线连接解决方案提供了助力

- 建构智慧基础设施对无线感测器网路的需求不断增加

- 市场挑战

- 资料隐私和安全问题

- 缺乏基础建设、实施成本庞大、缺乏技术诀窍

第六章 市场细分

- 依技术分类

- Wi-Fi

- Bluetooth

- Zigbee

- 其他技术

- 按最终用户产业

- 车

- 产业

- 卫生保健

- 活力

- 基础设施

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Qualcomm Incorporated

- Intel Corporation

- Texas Instruments Inc.

- NXP Semiconductors NV

- Microchip Technology Inc.

- MediaTek Inc.

- Rensas Electronics Corporation

- Broadcom Inc.

- STMicroelectronics

- Nordic Semiconductor

第八章投资分析

第九章:市场的未来

The Wireless Connectivity Market size is estimated at USD 101.84 billion in 2025, and is expected to reach USD 185.89 billion by 2030, at a CAGR of 12.79% during the forecast period (2025-2030).

Key Highlights

- The wireless connectivity market is experiencing significant growth, driven by the increasing demand for seamless internet access and interconnected devices encompassing various technologies, including Wi-Fi, Bluetooth, and Zigbee, enabling data transmission without requiring cables.

- The proliferation of connected devices across various sectors like healthcare and smart homes drives demand for low-power, short-range connectivity solutions, such as Bluetooth and Zigbee. For instance, Amazon's growing portfolio of Echo smart speakers leverages Wi-Fi and Bluetooth technology for connectivity. In addition, the growing consumer interest in smart home devices, such as smart thermostats, lighting, and security systems, is boosting the demand for wireless connectivity.

- The increasing demand for consumer electronic devices drives the market's growth. Adopting advanced technologies like AI, IoT, AR, and VR is also accelerating demand for wireless connectivity across various industry verticals. The global development of smart infrastructure is also a significant factor in the increasing demand for wireless connectivity.

- Moreover, the increasing investment by governments globally in smart city projects that use wireless connectivity for various applications is propelling the market's growth. For instance, in October 2023, the Department of Information Technology, Electronics & Communication (DITE&C) announced a plan to set up and operationalize more than 100 Wi-Fi hotspots across the state to provide free and seamless internet services. The hotspots will be at selected government offices, bus stands, public parks, citizen service centers, and other locations with high footfalls.

- However, security concerns are restraining the wireless connectivity market's growth as wireless networks are vulnerable to cyberattacks. As wireless communication continues to grow across industries and applications, strong security measures are essential to prevent data breaches and malware attacks. Poor encryption protocols, weak authentication mechanisms, and vulnerable network configurations can reveal sensitive information and compromise the security of wireless systems.

- For instance, according to a survey by the Wireless Broadband Alliance (WBA) as part of the WBA Annual Industry Report 2023, more than a third (33%) of service providers, technology vendors, and enterprises already plan to deploy Wi-Fi 7 by the end of 2023. Further, 44% are planning to adopt Wi-Fi 6E in the next 12-18 months. Such growth prospects in adopting Wi-Fi are anticipated to add significant growth to the wireless connectivity market.

Wireless Connectivity Market Trends

The Automotive Industry is Expected to Drive the Market's Growth

- Bluetooth wireless connectivity is increasingly used in various automotive system equipment to enable wireless communication and connectivity, including hands-free calling, audio streaming, and in-car infotainment systems. By using wireless connectivity like wi-fi and bluetooth, users are able to connect their smartphones and other smart devices to their infotainment systems. Thus, the growth in the sales of automotive vehicles would drive demand for wireless connectivity solutions.

- Modern automobiles increasingly resemble mobile internet of things (IoT) devices and increasingly use a wide range of sensors to enhance driver safety and comfort by collecting and responding to internal and external information. As wireless communications play an essential role in advancing automotive technology, the increasing amount of data produced by applications like advanced driver assistance systems (ADAS) and in-vehicle infotainment is driving innovations in wireless technologies like bluetooth and wi-fi, as well as cellular and adding growth to the market.

- Autonomous vehicles and connected cars are becoming more popular among consumers and are expected to continue to grow over the coming years. The advanced driving assistance systems (ADAS) on display aim to bridge the gap between the cars of today and the cars of tomorrow. In addition, with more technological innovation in the auto industry, end consumers are willing to spend more money on the newest technology that enhances the driving experience and enhances the safety of drivers and passengers. This would drive demand for wireless connectivity solutions for autonomous vehicles.

- Moreover, GM Middle East launched new in-vehicle technology with Google built-in, strengthening connectivity leadership and enhancing the customer experience. General Motors Middle East announced the introduction of infotainment systems with Google built in as part of its vehicle intelligence technology goals. These new features would augment the overall customer experience and make it easier for customers to bring their digital lives into future connected vehicles.

- The Google built-in services would be standard on LT and higher trims, with widespread deployment across all GM vehicle brands equipped with the OnStar module system. Thus, customers in Kuwait and the UAE can utilize Google built-in via their wi-fi plans, while those in KSA and Bahrain can connect through their personal mobile wi-fi hotspots.

Asia-Pacific is Expected to Register High Growth Rate

- The market expansion in the region is primarily driven by consumers' increased spending and the growing adoption of smart homes. According to a digital survey conducted by Utimaco, a software company, in April 2023, the use of smart home devices has significantly increased in Singapore, with 61% of respondents stating that they are using smart TVs, 43% using home appliances, and 33% using energy saving devices, virtual assistants, and vacuum cleaner robots. This becomes a primary growth factor for the region's increasing adoption of wireless connectivity solutions.

- The rise in the trend towards smart cities is pushing firms or institutions to develop new products or solutions to ease the development of smart cities in the region. For instance, in October 2023, the Living Lab IIIT Hyderabad Smart City, in collaboration with Silicon Labs, a leader in secure, intelligent wireless technology, announced the introduction of a campus-wide Wi-SUN network to support research and solutions for the internet of things (IoT) and smart cities. Such developments are accelerating the demand for wireless connectivity across the region.

- Additionally, the expansion of 5G networks in the region is expected to be one of the major factors driving the growth of market, both directly and indirectly. According to the GSMA's latest report, 5G is expected to contribute about USD 960 billion to the developed economies of East Asia and the Pacific by 2030. 5G is expected to be a significant driving force in automated smart factory deployments in the region.

- The widespread use of the internet of things (IoT) platform in China is increasing rapidly. Given China's leading role in the production of semiconductors and manufacturing, its participation in the advancement and application of the industrial internet of things (lIoT) and the development are expected to create demand for wireless connectivity across end-user industries.

Wireless Connectivity Industry Overview

The competitive landscape for the wireless connectivity market is fragmented, with a large number of players competing in the market, including Qualcomm Incorporated, Intel Corporation, Texas Instruments Inc., NXP Semiconductors NV, and Microchip Technology Inc. The market is witnessing strategic developments, such as product launches, mergers, and acquisitions, to gain a competitive edge.

- In February 2024, Quectel Wireless Solutions, a global IoT solutions provider, launched two new wi-fi modules, the FCU741R and the FCS950R, and bluetooth modules, the HCM010S and the HCM111Z. Through this launch of bluetooth and wi-fi modules, the company aims to empower designers and developers with multiple options, catering to diverse needs in terms of size, cost, and power efficiency.

- In January 2024, Ceva Inc., the licensor of silicon and software IP that enables Smart Edge devices to connect, sense, and infer data reliably and efficiently, and Sunplus Technology Co. Ltd, a chip provider for multimedia and automotive applications have expanded their collaboration to integrate Ceva's latest generation RivieraWaves Bluetooth audio solution into the Sunplus airlyra family of HD audio processors targeting wireless speakers, soundbars and other premium wireless audio devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of IoT and Connected Devices for Robust Wireless Connectivity Solutions

- 5.1.2 Increased Demand for Wireless Sensor Networks to Create Smart Infrastructure

- 5.2 Market Challenges

- 5.2.1 Data Privacy and Security Concerns

- 5.2.2 Lack of Infrastructure, Huge Implementation Cost, and Absence of Technology Know-how

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Wi-Fi

- 6.1.2 Bluetooth

- 6.1.3 Zigbee

- 6.1.4 Other Technologies

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Industrial

- 6.2.3 Healthcare

- 6.2.4 Energy

- 6.2.5 Infrastructure

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Incorporated

- 7.1.2 Intel Corporation

- 7.1.3 Texas Instruments Inc.

- 7.1.4 NXP Semiconductors NV

- 7.1.5 Microchip Technology Inc.

- 7.1.6 MediaTek Inc.

- 7.1.7 Rensas Electronics Corporation

- 7.1.8 Broadcom Inc.

- 7.1.9 STMicroelectronics

- 7.1.10 Nordic Semiconductor