|

市场调查报告书

商品编码

1643057

欧洲风电 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

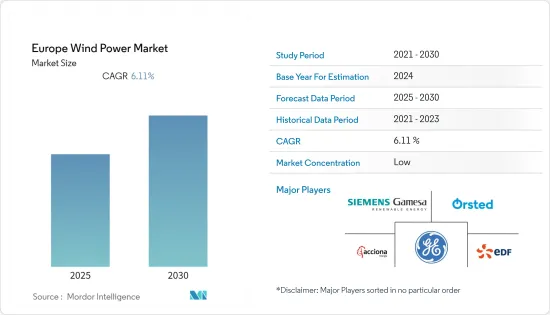

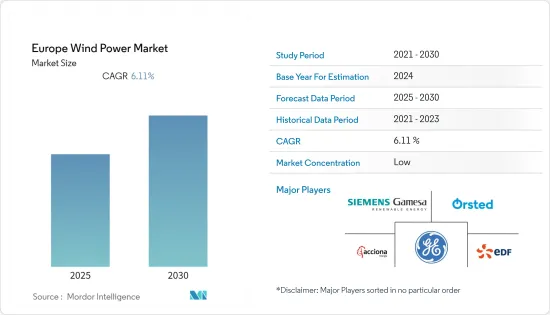

预计预测期内欧洲风电市场复合年增长率为 6.11%。

2020 年,市场并未受到 COVID-19 的任何重大影响。现在,市场可能会达到疫情前的水准。

关键亮点

- 从长远来看,风电成本下降、对环境问题敏感性的提高以及世界各国政府透过财政奖励提供的支持等因素预计将在预测期内增加对风电的需求。

- 另一方面,预计太阳能和燃气发电厂的替代将继续抑制市场。太阳能产业的成本降低速度远高于风力发电产业。

- 海上风力发电机效率技术的进步和生产成本的下降预计将为欧洲市场参与企业创造充足的机会。

- 在欧洲国家中,德国在2021年的装置容量最高,预计在预测期内将成为最大的市场,这得益于陆上风电装置容量的扩大和即将到来的离岸风发电工程的一定增长。

欧洲风电市场趋势

海上市场大幅成长

- 欧洲在离岸风电领域处于领先地位,拥有世界上最大的在运作电场。该地区的海上发电能力足以满足欧洲的电力需求,预计未来几年将进一步成长。

- 由于风速高于陆上风速,离岸风电场安装正成为一个利润丰厚的市场。

- 展望未来,引进离岸风电将成为实现欧洲绿色交易的关键。鑑于欧盟到2030年每年需要新增32吉瓦风电装置容量才能达到2050年达到碳中和的目标,欧洲累积离岸风力发电装置容量将在2021年终达到最高28吉瓦左右。

- 欧盟委员会也于2022年1月启动了关于可再生能源许可证的公开咨询,以加速实现2030年40%可再生能源的目标。这将带动全国风电装置容量增加。

- 此外,2022年4月,英国首相鲍里斯·约翰逊宣布了加强英国能源安全的计划,包括到2030年将离岸风电运作的目标提高到50吉瓦。这将支持英国各地离岸风电的发展。

- 此外,2022 年 7 月,英国商业、能源和工业战略部授予 Orsted 一份 Hornsea 3 离岸风电场的合约。该计划的发电能力为 2,852 兆瓦,可生产足够的低成本、清洁、再生能源,为 320 万英国家庭供电。

- 因此,预计预测期内离岸风电市场将实现正成长。

德国将主导市场

- 德国拥有丰富的优质、具成本竞争力的风力发电资源蕴藏量。这持有德国成为欧洲风电装置容量最大的国家,2021年总设备容量将达到63.8吉瓦。此装置容量足以为该国350多万户家庭供电。

- 随着对廉价、可靠、清洁和多样化电力的需求不断增长,全国各地的政府和公用事业公司都开始将风力发电作为解决方案。此外,该国拥有无与伦比的风能资源,有充足的机会最大限度地实现风力发电开发带来的经济和环境效益。

- 此外,该国也制定了65%电力来自可再生能源的目标,并计画在2022年关闭核能发电厂,到2038年逐步淘汰燃煤发电。离岸风电产业的预期成长不足以实现这一目标。此外,陆域风电产业发展放缓也是实现可再生能源目标的一个主要问题。

- 2022年9月,Vattenfall AB行使其进入权并获得了德国北海沿岸N-7.2离岸发电工程的开发权。该计划计划于 2027 年试运行,装置容量为 980 兆瓦,每年可产生足够的电力为超过一百万德国家庭消费量。

- 2021 年 11 月,BASF与 Orsted 签署了一份为期 25 年的购电协议,根据该协议,BASF将从 Orsted 计划在德国北海的 Borkum Riffgrund 3 离岸风电场购买 186 兆瓦电力。

- 有鑑于此,预计德国将在预测期内主导欧洲风力发电市场。

欧洲风电产业概况

欧洲风电市场适度细分。主要参与企业(不分先后顺序)包括 Acciona Energia SA、Orsted AS、EDF SA、通用电气公司、Vestas Wind Systems AS、E.ON SE 和西门子歌美飒可再生能源。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 风电装置容量及预测(GW,至2027年)

- 风力发电机安装量(2019-2027)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 位置

- 陆上

- 海上

- 地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- 风力发电厂营运商

- Acciona Energia SA

- Orsted AS

- EDF SA

- E.ON SE

- 设备供应商

- General Electric Company

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems AS

- 风力发电厂营运商

第七章 市场机会与未来趋势

简介目录

Product Code: 69533

The Europe Wind Power Market is expected to register a CAGR of 6.11% during the forecast period.

The market didn't witness any significant impact due to COVID-19 in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, factors such as the declining cost of wind power generation, growing sensitivity toward environmental issues, and support from various governments worldwide through financial incentives are expected to increase the demand for wind power during the forecast period.

- On the flip side, substitution from solar energy and gas-fired power plants is expected to continue restraining the market. The solar energy industry achieved cost reduction at a significantly higher rate than the wind energy sector.

- The technological advancements in efficiency and decrease in the production cost of offshore wind turbines are expected to create ample opportunity for European market players.

- Among European countries, Germany had the highest installed capacity in 2021 and is expected to be the largest market during the forecast period, bolstered by constant growth in onshore wind power additions and upcoming offshore wind power projects.

Europe Wind Power Market Trends

Offshore Segment to Witness Significant Growth in the Market

- Europe is the leader in offshore wind and is home to the largest operational wind farms across the globe. The region's offshore capacity is large enough to meet the electricity needs in Europe, which will only continue to grow within the upcoming years.

- Installation of wind farms in the offshore area is becoming a lucrative market because of the higher wind speed compared to onshore wind speed.

- In the future, deploying offshore wind energy is at the core of delivering the European Green Deal. Europe's cumulative offshore wind energy capacity reached a peak of around 28 gigawatts at the end of 2021, considering that the European Union needs 32 GW of new wind capacity each year until 2030 to reach its carbon neutrality target by 2050.

- Also, the European Commission launched a public consultation on renewables permitting in January 2022 to accelerate progress towards the 40% renewable energy target by 2030. This, in turn, culminates in the growth of wind power installations across the country.

- Moreover, in April 2022, UK Prime Minister Boris Johnson presented a plan to boost Britain's energy security, including an increased target of up to 50 GW of operating offshore wind capacity by 2030. This will, in turn, support the growth of offshore wind energy generation across the country.

- Furthermore, in July 2022, the United Kingdom Department for Business, Energy, and Industrial Strategy awarded Orsted a contract for difference for its Hornsea 3 offshore wind farm. The project has a capacity of 2,852 MW and will produce enough low-cost, clean, renewable electricity to power 3.2 million UK homes.

- Hence, the offshore wind power market is expected to be positive during the forecast period.

Germany Likely to Dominate the Market

- Germany has vast reserves of high-quality, cost-competitive wind energy resources. Owing to this, Germany held the first-largest installed wind power capacity in the European region, with a total installed capacity of 63.8 GW in 2021. This installed capacity is enough to power more than 3.5 million homes in the country.

- With the increasing need for an affordable, reliable, clean, and diverse electricity supply, the government and utilities across the nation are increasingly considering wind power as a solution. Moreover, with the country's unparalleled wind resources, there are ample opportunities to maximize the economic and environmental benefits associated with wind energy development.

- Moreover, the country has set a target to achieve 65% of the power generation from renewable energy and plans to shut down nuclear power plants by 2022 and phase-out coal power by 2038. The expected growth in the offshore wind industry is insufficient for achieving this target. Adding to this, the slowdown in the onshore wind industry has become a significant concern for meeting the renewable energy target.

- In September 2022, Vattenfall AB obtained the right to develop the N-7.2 offshore wind power project off the German North Sea coast after having exercised its right of entry. The project is expected to get commissioned by 2027, and will be having an output of 980 MW with annual generation corresponding to the consumption of more than one million German households.

- In November 2021, BASF and Orsted concluded a 25-year power purchase agreement, under which BASF will offtake the output of 186 MW from Orsted's planned Borkum Riffgrund 3 Offshore Wind Farm in the German North Sea.

- Owing to the such points, Germany is expected to dominate the European Wind Energy Market during the forecast period.

Europe Wind Power Industry Overview

The Europe Wind Power Market is moderately fragmented. Some of the key players (not in particular order) are Acciona Energia SA, Orsted AS, EDF SA, General Electric Company, Vestas Wind Systems AS, E.ON SE, and Siemens Gamesa Renewable Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Power Installed Capacity and Forecast in GW, until 2027

- 4.3 Number of Wind Turbines Installed, 2019-2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 France

- 5.2.4 Italy

- 5.2.5 Spain

- 5.2.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Wind Farm Operators

- 6.3.1.1 Acciona Energia SA

- 6.3.1.2 Orsted AS

- 6.3.1.3 EDF SA

- 6.3.1.4 E.ON SE

- 6.3.2 Equipment Suppliers

- 6.3.2.1 General Electric Company

- 6.3.2.2 Siemens Gamesa Renewable Energy

- 6.3.2.3 Vestas Wind Systems AS

- 6.3.1 Wind Farm Operators

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219