|

市场调查报告书

商品编码

1643071

亚太地区机器人流程自动化:市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia-Pacific Robotic Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

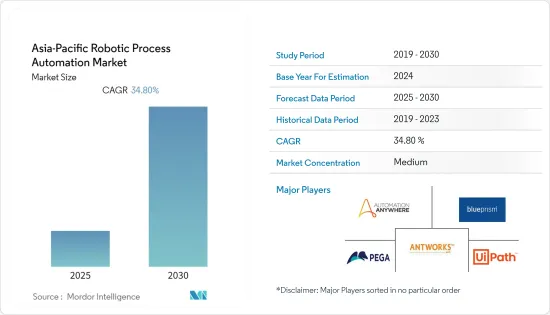

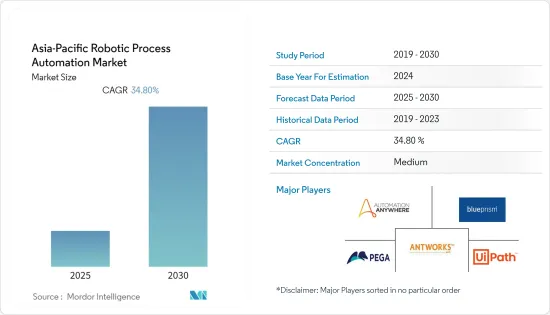

预测期内,亚太地区机器人流程自动化市场预计将以 34.8% 的复合年增长率成长。

关键亮点

- 由于对数位化劳动力的关注度和采用度不断提高,以及 RPA 解决方案对各个终端用户行业的业务流程自动化的功能优势不断提升,机器人流程自动化 (RPA) 市场预计将在亚洲各国实现成长。

- 该地区采用 RPA 的动力源于跨行业复杂业务流程自动化的需求、业务便利性以及自动化软体和服务成本的下降。

- 市场上的供应商正在透过添加新功能(例如 Citrix 自动化、自动化生命週期管理、工作负载管理、凭证管理、基于 SLA 的自动化和新的资料API)来改进其产品。这些改进正在吸引那些需要更多营运和安全功能的新兴产业。

- 此外,在面临旧有系统挑战和效率低下的企业中,RPA 的采用也正在增加。 SPA 提供的好处不仅可以提高您组织的生产力,还可以让您专注于核心业务活动。

- 社交工程攻击是攻击者获取敏感资料的主要手段。

- 由于 COVID-19 的爆发,由于社交距离规范的加强,机器人流程自动化解决方案的利用率增加,机器人流程自动化市场显示出显着成长。

亚太地区机器人流程自动化 (RPA) 市场趋势

采矿业推动市场成长

- 机器人流程自动化可降低成本、缩短时间并提高采矿工人的技能。它也从根本上重塑了员工的工作环境,特别是对于较大的劳动力队伍而言。

- 亚洲国家的一些领先矿业公司已积极将重点转向转型,并已在数位化。自动化也使采矿业能够实现更好的业务成果。

- 例如,伊藤忠商事株式会社已经实施了 RPA 解决方案来提高效率并实现日常手动任务的自动化。透过自动化 PC 操作取代人工,我们能够减少工作时间并提高准确性。该公司还透露,计划不仅在自己公司内部部署 RPA,还将在整个伊藤忠集团内部署。

- 许多供应商正在扩大其市场影响力,以抓住亚洲国家采矿业日益增长的商机。例如,UiPath在东京设立了日本子公司UiPath株式会社。 UiPath 是第一家在日本设立子公司的全球主要 RPA 供应商。

- 印度采矿业也正在不断提高自动化数位化,以提高生产力并应对该行业面临的挑战。这很可能推动预测期内研究市场的成长。

- 此外,人工智慧、机器学习和工业物联网领域的技术突破都有可能到 2025 年挽救约 3730 亿美元的资金并挽救数百人的生命,具体方式包括实现机器操作和规划及调度的自动化;促进预测性维护;提高人员、材料和资产的可视性链;利用实时资料和分析的力量;以及提供从矿山到市场的市场价值的视觉性。

中国占最大市场占有率

- 随着亚太地区自动化技术的日益普及,中国对 RPA 的采用也日益增加。为了抵消该全部区域一段时间以来的人口下降趋势,该国的自动化应用正在稳步增长。

- 此外,中国已成为世界上最廉价劳动力的所在地。但近年来,一些企业和政府机构已经开始借助科技来提高效率。

- 中国是推动RPA应用和AI开拓的重要市场。许多当地企业正踏上RPA之旅,以控製成本、提升商业价值。

- 製造业是中国经济的标誌之一,正经历快速转型。这一大规模转型正在帮助中国成为全球领先的製造业市场。

- 中国製造业正向物理机器人工业自动化迈进。製造业对机器人流程自动化等颠覆性技术的需求也日益增加,这使得企业能够专注于产品创新和核心竞争力,而不是重要但平凡的日常重复任务。

亚太地区机器人流程自动化 (RPA) 产业概览

亚太地区机器人流程自动化市场竞争适中,由多个参与企业组成。这些公司正在利用创新的合资企业来增加市场占有率和盈利。其他着名参与者包括 Automation Anywhere Inc.、Blue Prism Group PLC 和 AntWorks Pte Ltd.

2022 年 9 月,IBM 在古吉拉突邦国际金融科技城(GIFT City)的 Fintech One 开设了新的软体实验室,研发中心,成为该市大型开发案中首批全球营运公司之一。同时,该中心将专注于安全、永续软体、资料和人工智慧以及机器人自动化领域的产品工程、新产品和解决方案的设计和开发,并与该地区的技术生态系统合作,共同开发针对全球产业的解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- 政府改革以及各种 RPA 供应商的文件、支援系统和介面的本地化

- 简化业务流程和技术进步的需求日益增加

- 市场问题

- 资料安全问题

- COVID-19 工业影响评估

第六章 市场细分

- 解决方案

- 软体

- 服务

- 公司规模

- 中小型企业

- 大型企业

- 最终用户产业

- 资讯科技和电讯

- BFSI

- 医疗

- 零售

- 製造业

- 矿业

- 其他的

- 国家

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Automation Anywhere Inc.

- Blue Prism Group PLC

- AntWorks Pte Ltd

- Pegasystems Inc.

- UIPath Inc.

- Datamatics Global Services Limited

- AutomationEdge Technologies Inc.

- Kofax Inc.(Thoma Bravo LLC)

- WorFusion Inc.

- Softomotive Ltd

- HelpSystems LLC(HGGC)

- Nice Ltd

- Kryon System Ltd

- NTT Data Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Asia-Pacific Robotic Process Automation Market is expected to register a CAGR of 34.8% during the forecast period.

Key Highlights

- The robotic process automation (RPA) market is expected to grow in Asian countries owing to increasing focus on and adoption of a digital workforce and rising functional benefits of RPA solutions for business process automation across various end-user industries.

- RPA adoption in the region is fueled by the need to automate intricate business processes across various industries, the convenience of doing business, and the falling costs of automation software and services.

- Vendors in the market are improving their products by including new features in Citrix automation, automation lifecycle management, workload management, credential management, SLA-based automation, and new data APIs. These improvements are drawing in new sectors of industry that demand more operational and security capabilities.

- Moreover, the adoption rate of RPA in enterprises facing challenges and inefficiencies with legacy systems is rising. The benefits offered by the SPA not only increase the organization's productivity but also enable them to focus on its core business activities.

- There will be data security concerns such as data breaches; social engineering attacks are the primary medium used by attackers to gain access to sensitive data might hamper the market.

- With the outbreak of COVID-19, the robotic process automation market is had witnessed significant growth, owing to an increased usage of robotic process automation solutions by an increase in social distancing norms.

APAC Robotic Process Automation (RPA) Market Trends

Mining Sector will Drive the Market Growth

- Robotic process automation reduces costs, saves time, and upskills workers in mining. It also fundamentally reshapes employees' work environment, especially for larger workforces.

- Some major mining companies in Asian countries are shifting their focus on transformation with a progressive stance and proving digitization. Also, with automation mining industry can achieve much better operational outcomes.

- For instance, ITOCHU Corporation has implemented RPA solutions to increase efficiency and automate routine manual tasks. It automates PC operations rather than using people to reduce working hours and improve accuracy. The company also revealed its plan to deploy RPA beyond the company and throughout the ITOCHU Group.

- Many vendors in the market are expanding their presence to seize the growing opportunity in the mining sector in Asian countries. For instance, UiPath has established a Japanese subsidiary, UiPath K.K., in Tokyo, Japan. UiPath is the first leading global RPA vendor to develop a legal entity in Japan.

- India is also experiencing automation and digitization in its mining sector aimed at enhancing productivity and addressing the challenges faced by the industry. This can fuel the growth of the studied market in the forecast period.

- Further, innovations in artificial intelligence, machine learning, and the industrial internet of things all have the potential to save the sector an estimated USD 373 billion and hundreds of lives by 2025 by automating machinery operation, planning and scheduling, facilitating predictive maintenance, improving man, material and asset traceability, harnessing the power of real-time data and analytics, and providing visibility across the mine-to-market value chain.

China to Hold the Largest Market Share

- China is witnessing growth in adopting RPA, owing to the growing adoption of automation technologies in the Asia-Pacific region. Automation adoption has seen a steady increase in the country to offset an era of population decline across the region.

- Moreover, China has been the hub for the cheapest labor in the world. But in recent years, several companies and government agencies have started to enhance their efficiency with the help of technology.

- China is an important market for boosting RPA adoption and AI development. Many local Chinese businesses have started their RPA journey to manage costs and improve business value.

- Manufacturing is one of the prominent features of the Chinese economy, and it is undergoing a rapid transformation. This large-scale transformation has aided the country in becoming a leading nation in the manufacturing market globally.

- The Chinese manufacturing industry has seen industrial automation empowered by physical robots. It has also augmented a need for disruptive technology like Robotic Process Automation in manufacturing that helps businesses focus more on product innovation and core strengths instead of daily repetitive tasks that are critical but mundane.

APAC Robotic Process Automation (RPA) Industry Overview

The Asia-Pacific robotic process automation market is moderately competitive and consists of several players. These businesses use innovative joint ventures to boost their market share and profitability. Other significant participants are Automation Anywhere Inc., Blue Prism Group PLC, and AntWorks Pte Ltd.

In September 2022, IBM launched its new Software Lab, a state-of-the-art global innovation center at Fintech One, Gujarat International Finance Tec-City (GIFT City), making it one of the first global operations within the mega-development in the City. At the same time, the center will focus on product engineering, design, and development of new products and solutions in the areas of Security, Sustainability Software, Data & AI, and Robotic Automation and collaborate with the technology ecosystem in the region to co-create solutions for the global industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reforms by Government and Localization of Documents, Support Systems, and Interfaces of various RPA Vendors

- 5.1.2 Increasing Need to Streamline Business Processes and Technological Advancements

- 5.2 Market Challenges

- 5.2.1 Data Security Concerns

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 Solution

- 6.1.1 Software

- 6.1.2 Service

- 6.2 Size of Enterprise

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 End-user Industry

- 6.3.1 IT and Telecom

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Manufacturing

- 6.3.6 Mining

- 6.3.7 Other End-user Industries

- 6.4 Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

- 6.4.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Automation Anywhere Inc.

- 7.1.2 Blue Prism Group PLC

- 7.1.3 AntWorks Pte Ltd

- 7.1.4 Pegasystems Inc.

- 7.1.5 UIPath Inc.

- 7.1.6 Datamatics Global Services Limited

- 7.1.7 AutomationEdge Technologies Inc.

- 7.1.8 Kofax Inc. (Thoma Bravo LLC)

- 7.1.9 WorFusion Inc.

- 7.1.10 Softomotive Ltd

- 7.1.11 HelpSystems LLC (HGGC)

- 7.1.12 Nice Ltd

- 7.1.13 Kryon System Ltd

- 7.1.14 NTT Data Inc.