|

市场调查报告书

商品编码

1643075

英国3D 列印 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)United Kingdom 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

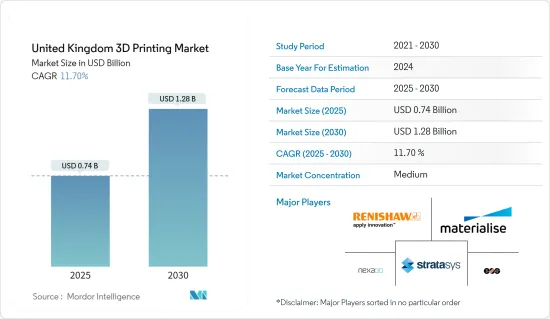

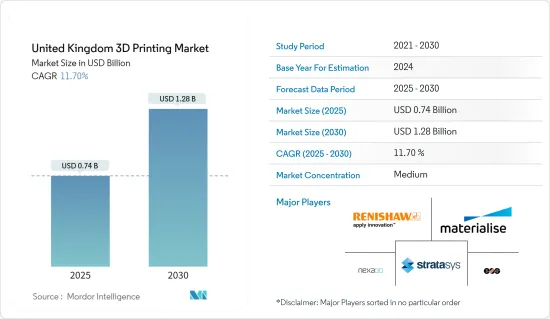

英国3D 列印市场规模预计在 2025 年为 7.4 亿美元,预计到 2030 年将达到 12.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.7%。

随着越来越多的产业采用积层製造,英国在功能更强大的印表机、改进技术和完善政府政策上投入的资金越来越多,英国3D 列印市场正在不断成长。

关键亮点

- 3D 列印的重点正在从设计和原型製作转向製造有价值的物品。与传统製造技术相比,3D列印不需要模具,从而克服了工具成本高昂等各种障碍。传统製造的单件成本较低,但高昂的初始工具成本使小批量生产的成本很高。透过逐层建造组件,3D 列印可以减少製造过程中产生的废弃物量。 3D 列印相对于传统製造业的另一个优势是大规模定制,尤其是在交货时间短的情况下。

- 随着3D列印为企业和消费者带来全面且不断扩大的技术和经济效益,製造过程的模式正在从人事费用约束的集中式工厂大规模生产转变为透过分散式製造实现大规模个人化。这就是为什么几乎所有领域的采用都在成长的原因。近日,劳斯莱斯发布了采用3D列印製造的最重要的金属零件。这是 Trent XWB-97 飞机引擎的零件。

- 过去五年来,研发投入的增加刺激了技术创新,并推动了 3D 列印的需求。为了为脱欧后的英国经济提供生命线,英国政府已向增材製造业投资超过 2 亿美元,旨在到 2025 年将该国在全球 3D 列印市场的市场占有率从 5% 提高到 8%。

- 此外,新冠肺炎疫情已在全球感染超过 25,000 人,造成超过 17,000 人死亡。光是在英国就有 1,000 多人感染,而且口罩等重要防护工具短缺。许多3D列印公司正在尝试使用积层製造技术生产口罩来解决这个问题。一些公司已经生产了数千个 3D 列印口罩,并将其捐赠给医院、药房、急救人员、社会福利机构等。此外,由安宁疗护医生詹姆斯·考克森 (James Coxon) 创立的英国组织 3DCrowd 透过 GoFundMe群众集资宣传活动筹集了 4 万美元,用于对抗疫情。迄今为止,该组织已成功筹集到所需资金的一半。

- 然而,中小企业对原型製作程序的普遍误解阻碍了积层製造的采用。从事设计的公司,尤其是中小型企业,在尝试了解原型设计的利弊之前,先想知道原型设计是否是一项好的投资。这些公司的典型思维模式是,原型製作只是生产前的昂贵步骤。对原型的误解、缺乏技术知识以及缺乏传统流程控制都可能减缓市场成长。

英国3D 列印市场趋势

工业 3D 列印机需求不断成长

- 工业 3D 列印将颠覆英国长期以来的製造业,从夹具、固定装置到最终的工具。公司现在可以以传统方法成本的一小部分製造专业化、小批量的设备和装置,让设计师和工程师有更多的时间进行更盈利的计划。大型国际製造商现在可以从专业 3D 列印机中获得与购物中心的小型製造商相同的益处。这有助于改善和加快业务,同时减少停机时间。

- 英国商务部数据显示,去年英国私人企业约有551万家,其中约914,475家从事建设业,约762,480家从事专业、科学和技术行业。这将为许多公司创造机会开发新产品,为工业3D列印参与企业抢占市场占有率。

- 汽车产业在积层製造技术方面处于领先地位,奥迪等知名品牌都使用 3D 列印机。不只奥迪,各汽车厂商的赛车队、 OEM厂商也都使用3D列印机。汽车製造商是最早采用 3D 列印来製造夹具和工具以辅助製造的行业之一。汽车行业最常见的印刷零件是夹具、支架和原型。这些产品必须坚固、耐用且使用寿命长。

- 从可自订性到轻量化特性,多种属性使其成为出色的机器人部件,并很好地补充了 3D 列印功能。它们的製造成本很高,并且需要针对广泛应用的夹持器和感测器支架等组件进行专门的设计。机器人专业人士正在使用 3D 列印机製作端臂工具和最终用途部件,从夹持手指到整个机器人组件,从而减轻产品的整体重量并允许工具移动得更快并承载更重的负载。

- 为了满足不同客户的需求,公司提供一系列工业级 3D 列印机。例如,Stratasys 提供 Fortus 450mc 工业 FDM 3D 列印机、F900 工业 3D 列印机等。 Stratasys FDM 3D 列印机提供最高精度、速度和热塑性材料范围。

预测期内,医疗保健产业将显着成长

- 3D 列印应用在医疗领域迅速扩展,预计将彻底改变医疗保健领域。医疗产业在几个大类中应用 3D 列印,包括组织和器官製造、客製化矫正器具、植入、解剖模型、药物配方和输送以及与发现相关的药物研究。其中一些好处包括医疗产品、药品和设备的客製化和个人化、成本效益和高效的生产力。根据国家统计局的数据,去年英国的医疗保健支出约为 2,900 亿美元。

- 随着对 3D 列印、个人化和性能更佳的植入的需求不断飙升,医院和组织正在联手提供 3D 列印机并为医疗专业人员提供培训以开发这些设备。例如,医疗製造服务供应商Axial3 与英国纽卡斯尔医院合作,提供现场 3D 列印实验室。该实验室主要供整形外科和脊椎外科的医生使用,以列印针对特定患者的模型,用于术前规划。

- 3D 列印提供的设计弹性正在推动对更高效能 3D 列印植入的需求。植入可以设计成具有多孔表面结构,从而允许活骨与人工植入更快结合。 3DLifePrint 获得 120 万美元投资,以扩大其在医院和诊所的嵌入式医疗 3D 列印中心组合,并僱用更多的生物医学工程师和 3D 技术人员进行持续研究和开发。

- 3D 列印在现代矫正器具製造的应用日益广泛,降低了成本,并导致用户采用率激增。据估计,英国约有 6 万人在截肢或先天性肢体缺失后前往专门的復健中心。英国NHS每年在復健服务上花费约6,000万美元。这凸显了英国医疗保健领域 3D 列印市场的巨大机会。

- 此外,巴斯大学和布里斯託大学的研究小组开发了一种利用超音波的 3D 生物列印技术。这种新方法利用多个超音波驻波的迭加来产生可控制的声音辐射力,驱动空气中的液滴积聚到精确的池中,从而能够快速创建和修改独特的生物材料微结构。

英国3D列印产业概况

英国3D 列印市场竞争激烈,由 Renishaw PLC、Stratasys Limited、EOS GmbH、Materialise NV 和 AnisoPrint 等大公司主导。这些占据了压倒性市场占有率的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。然而,随着技术进步和产品创新,中小企业透过赢得新契约和探索新市场来扩大其市场占有率。

2022 年 10 月:Fieldmade AS 和 Mark3D UK 宣布建立策略合作伙伴关係,Mark3D UK 将在英国独家经销 Fieldmade Nomad LW可携式3D 列印机。此公告标誌着基于 Markforged 的 Fieldmade Nomad LW 系列的供应、支援和服务市场方式的重大转变。

2022年5月:连续纤维3D列印解决方案供应商Anisoprint与参与国际太空站(ISS)商业用途的私人太空服务公司Nanoracks Space Outpost Europe签署了谅解备忘录,加强了其作为太空技术开发商的地位,并旨在进入低地球轨道(LEO)和月球经济国家。 Anisoprint 在被 ESRICStart-Ups支援计画选中进行预孵化以使其连续纤维 3D 列印技术适应微重力环境后,正大步扩展其资源网路。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 政府政策的有利变化

- 工业 3D 列印机需求不断成长

- 市场限制

- 价格竞争和竞争对手的价格上涨

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

第五章 市场区隔

- 印表机类型

- 工业的

- 桌面

- 材料类型

- 金属

- 塑胶

- 陶瓷製品

- 其他的

- 应用

- 车

- 航太和国防

- 医疗

- 建筑学

- 其他的

第六章 竞争格局

- 公司简介

- Renishaw PLC

- Stratasys Limited

- EOS GmbH

- Materialise NV

- AnisoPrint

- Nexa 3D Inc.

- Protolabs

- HP Development Company LP

- GE Additives

第七章投资分析

第八章 市场机会与未来趋势

The United Kingdom 3D Printing Market size is estimated at USD 0.74 billion in 2025, and is expected to reach USD 1.28 billion by 2030, at a CAGR of 11.7% during the forecast period (2025-2030).

The 3D printing market in the UK is growing because more industries are using additive manufacturing, more money is being spent on printers with higher capacities, technology is getting better, and government policies are getting better.

Key Highlights

- The focus of 3D printing has shifted from design and prototyping to manufacturing valuable items. In contrast to traditional manufacturing techniques, 3D printing does not require tooling; thus, it can help overcome various obstacles, such as high tooling costs. Although conventional manufacturing has lower per-unit costs, the initial tooling expenses are high, making low-volume manufacturing more expensive. By building components layer by layer, 3D printing reduces the amount of waste generated during the manufacturing process. Another area where 3D printing is better than traditional manufacturing is mass customization, especially for short production runs.

- As 3D printing presents companies and consumers with a comprehensive and expanding range of technical and economic benefits, it has changed the paradigm for manufacturing processes from mass production in centralized factories constrained by tooling and low-cost labor rates to mass personalization with distributed manufacture. It has fueled its adoption in almost every sector. Recently, Rolls-Royce unveiled the most significant metal part made by 3D printing, which is a component for a Trent XWB-97 aircraft engine.

- Over the past five years, increased investment in research and development has encouraged innovation and boosted demand for 3D printing. The government has invested over USD 200 million into additive manufacturing to increase its market share from 5% to 8% in 2025 in the 3D printing market worldwide as it offers a lifeline to the British economy after Brexit.

- Moreover, the COVID-19 outbreak has infected more than 25 lakh people worldwide and caused more than 1.7 lakh fatalities. More than one lakh people are affected in the United Kingdom alone, resulting in a scarcity of critical protective equipment such as face masks.Many 3D-printer organizations are trying to resolve the problem by using an additive manufacturing method to produce facemasks. Some companies have already produced thousands of 3D-printed masks that are donated to hospitals, pharmacies, paramedics, and social-care homes. Further, the 3DCrowd UK group was set up by palliative-medicine doctor James Coxon to raise USD 40,000 through a GoFundMe crowdfunding campaign that will be used for the pandemic. Up until now, the group has successfully raised half the desired funds.

- However, small and medium-sized firms' common misconceptions about prototype procedures are impeding the adoption of additive manufacturing. Companies involved in the design, especially small and medium-sized businesses, are thinking about whether prototyping investments are good investments before trying to figure out what the pros and cons of the prototype are. The typical belief among these businesses is that prototyping is only an expensive step before manufacturing. Misconceptions about prototypes, a lack of technical knowledge, and a lack of traditional process controls are all things that are likely to slow the growth of the market.

United Kingdom 3D Printing Market Trends

Growing Demand for Industrial-grade 3D Printers

- Industrial 3D printers are upending the long-established manufacturing industry in the United Kingdom, from jigs and fixtures to final tooling. Companies may now build specialized, low-volume equipment and fixtures for a fraction of the cost of traditional methods, freeing up designers' and engineers' time for more profitable projects. Large, international manufacturers can now get the same benefits from a professional 3D printer as small manufacturers in a mall. This helps to improve and speed up operations while cutting down on downtime.

- According to the UK Department for Business, in the last year, there were around 5.51 million private sector enterprises in the United Kingdom, with approximately 914,475 of them being construction businesses and 762,480 being professional, scientific, and technological businesses. Many companies would create an opportunity for industrial 3D printing players to develop new products to capture market share.

- The automobile industry has led the way in additive manufacturing, with renowned firms such as Audi using 3D printers. Not only are the Audis of the world using 3D printers, but race car teams and original equipment manufacturers from every automaker are also. The earliest application of 3D printing for vehicle manufacturers was to create fixtures and tools to aid manufacturing. The most common parts printed by the vehicle industry are fixtures, cradles, and prototypes. These products must be solid, durable, and long-lasting.

- Several properties, ranging from customizability to reduced weight, make excellent robotics parts and complement 3D printing capabilities nicely. It is costly to manufacture and requires specialized designs for components such as grippers and sensor mounts for diverse applications. Robotics professionals use 3D printers for end-of-arm tooling and end-use parts ranging from gripper fingers to whole robot components to reduce total product weight and enable tools to move faster and carry heavier loads.

- To meet the various demands of the customer, the firms are providing various industrial-grade 3D printers. For example, Stratasys provides the Fortus 450mc Industrial FDM 3D Printer, the F900 Industrial 3D Printer, and many more. Stratasys FDM 3D Printers have the highest accuracy, speed, and variety of thermoplastic materials.

Healthcare Industry will Experience Significant Growth in Forecast Period

- 3D printing applications are expanding rapidly in the medical sector and are expected to revolutionize health care. The medical industry uses 3D printing in several broad categories, including tissue and organ fabrication, customized prosthetics, implants, anatomical models, and pharmaceutical research related to drug dosage forms, delivery, and discovery. It provides several benefits, such as customization and personalization of medical products, drugs, and equipment, cost-effectiveness, and efficient productivity. According to the national statistics office, healthcare expenditure in the UK accounted for approximately USD 290 billion last year.

- The surging need for 3D-printed, personalized, and better-performing implants has fueled the collaboration of hospitals and organizations to offer 3D printers and training to health professionals to develop the devices. For example, Axial3, a medical manufacturing service provider, has partnered with Newcastle Hospitals in England to provide an on-site 3D printing lab that practitioners will primarily use in orthopedics and spinal surgery to print patient-specific models for presurgical planning.

- The design flexibility offered by 3D printing is driving the demand for 3D-printed implants with higher performance. Implants can be designed with porous surface structures, which facilitates faster integration between a living bone and the artificial implant. The 3DLifePrint has secured an investment of USD 1.2 million to expand its portfolio of embedded medical 3D printing hubs across hospitals and clinics and to recruit additional bio-medical engineers and 3D technologists to continue research and development.

- Increasing the application of 3D printing to produce modern prosthetics has decreased costs and surged its adaptation among users. The number of patients with an amputation or congenital limb deficiency attending specialist rehabilitation service centers in the United Kingdom is estimated to be around 60,000. The NHS in England spends about USD 60 million per year on rehabilitation services.This reveals the tremendous opportunity for the 3D printing market in the healthcare segment of the United Kingdom.

- Further, a team of researchers from the University of Bath and the University of Bristol leveraged ultrasound to develop a 3D bioprinting technique. The new approach superimposed several ultrasonic standing waves to generate controllable acoustic radiation forces that could direct airborne droplets to accumulate into precise pools, enabling unique biomaterial microarchitectures to be produced and modified rapidly.

United Kingdom 3D Printing Industry Overview

The United Kingdom 3D printing market is competitive and is dominated by significant players like Renishaw PLC, Stratasys Limited, EOS GmbH, Materialise NV , and AnisoPrint. With a prominent market share, these major players focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and by tapping new markets.

October 2022: Fieldmade AS and Mark3D UK have announced a strategic collaboration arrangement to see Mark3D UK exclusively sell Fieldmade Nomad LW portable 3D printers in the UK. The announcement marks a significant shift in the go-to-market approach for the Markforged-based Fieldmade Nomad LW range's supply, support, and servicing.

May 2022: Anisoprint, a provider of continuous fiber 3D printing solutions, has signed a memorandum of understanding (MOU) with Nanoracks Space Outpost Europe, a private in-space services company involved in the commercial utilization of the International Space Station (ISS), to strengthen its position as a space technology developer and enter the low-Earth orbit (LEO) and lunar economies. Anisoprint has made significant gains toward growing the resources network after being selected for pre-incubation in ESRIC's Startup Support Program to adapt continuous fiber 3D printing technology for microgravity settings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Favorable Changes in Government Policies

- 4.2.2 Growing Demand for Industrial-grade 3D Printers

- 4.3 Market Restraints

- 4.3.1 High Price Competition and High Commodity Prices

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 Printer Type

- 5.1.1 Industrial

- 5.1.2 Desktop

- 5.2 Material Type

- 5.2.1 Metal

- 5.2.2 Plastic

- 5.2.3 Ceramics

- 5.2.4 Other Material Types

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Healthcare

- 5.3.4 Construction and Architecture

- 5.3.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Renishaw PLC

- 6.1.2 Stratasys Limited

- 6.1.3 EOS GmbH

- 6.1.4 Materialise NV

- 6.1.5 AnisoPrint

- 6.1.6 Nexa 3D Inc.

- 6.1.7 Protolabs

- 6.1.8 HP Development Company LP

- 6.1.9 GE Additives