|

市场调查报告书

商品编码

1643076

美国合约包装:市场占有率分析、行业趋势、成长预测(2025-2030 年)United States Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

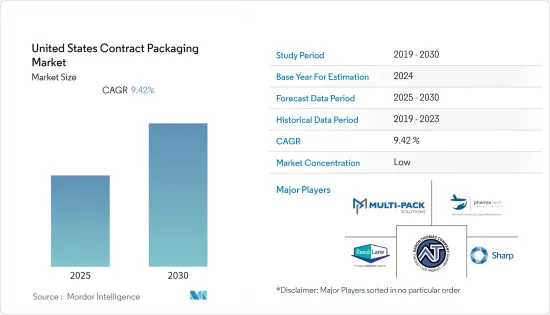

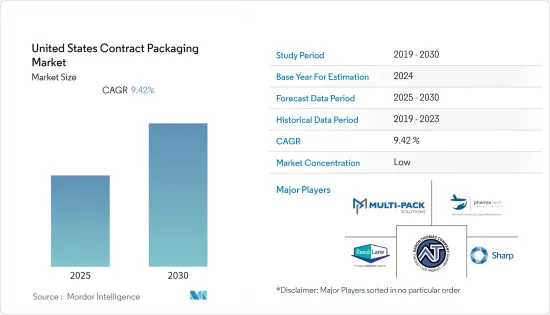

预计预测期内美国合约包装市场复合年增长率将达到 9.42%。

主要亮点

- 美国政府有各种法律法规,特别是有关药品标籤和包装的法律法规。这可能导致一些製药公司无法拥有内部包装设施,从而导致对合约包装的需求增加。

- 未来,随着序列化、数位印刷和先进机器人技术的出现,技术有望发挥关键作用,从而帮助企业。永续性和客製化预计将对合约包装市场产生正面影响,从而带动个人护理、食品和饮料等消费包装商品的成长。

- 此外,许多政府都制定了有关药品和食品标籤检视和包装的严格法律法规,进一步扩大了合约包装市场的范围。例如在美国,食品业对合约包装的需求日益增加。

- 国内各合约包装公司正适应严峻的商业环境。企业也认识到成本压力、激烈的竞争以及来自OEM的高度多变的需求。这种环境进一步支持了该国合约包装市场的成长。许多欧洲公司,例如Persson Innovation和Langen Group,也在美国投资。

- 多家物流公司的存在增加了运输中二级和三级包装的需求,为合约包装市场的成长铺平了道路。然而,高昂的回收成本和严格的政府包装材料相关法规阻碍了市场的成长。

- 由于製造活动受到限制以及生产线劳动力有限,COVID-19 疫情阻碍了美国合约包装市场的成长。但疫情过后,製造业全面復工,食品饮料、医药、个人照护、消费品等产业市场需求成长,市场前景光明。此外,俄罗斯和乌克兰之间的战争正在影响整个包装生态系统。

美国合约包装市场趋势

快速成长的製药业推动市场

- 美国已成为最大的医药市场,占医药和生技市场所有研发支出的近一半。因此,合约包装公司在这个市场中发挥关键作用,投资新设施和技术来满足广泛的外包商的需求。例如,根据代表美国主要生物工业美国公司的产业协会美国药品研究与製造商协会 (PhRMA) 的数据,2021 年其会员公司在全球的研发 (R&D) 支出达到约 1,020 亿美元。

- 为了满足快速变化的消费者偏好和日益增长的环境问题,创新包装方法的采用日益广泛,刺激了美国製药业对合约包装的需求。此外,自动化在医药合约包装中的渗透率不断提高,最大限度地降低了人为处理错误的风险,这也有助于该地区的市场成长。

- 此外,美国在医药市场的消费和发展方面都占据主导地位。据STAT称,美国处方药支出预计将从2019年的5000亿美元增长到2023年的6000亿美元,这将进一步推动美国合约包装市场的发展。

- 由于利润盈利且需求不断增长,该行业在该国的投资正在增加。例如,2022年1月,礼来公司计划投资超过10亿美元在北卡罗来纳州康科德建立新的製造地。新工厂将利用最新技术生产肠外(注射)产品和设备,提升公司的生产能力。

食品业预计将占很大份额

- 在美国,食品製造商不断增长的需求以及合约包装商偏好的变化,促使食品公司越来越注重成本优化和核心业务。

- 食品製造公司越来越注重降低成本和核心竞争力。此外,奈米技术在方便食品生产的应用,显着改善了保存、包装设计和成品加工等关键製程。预计这项技术将大幅增加美国企业将委託外包给提供合约包装服务的组织的需求。

- 随着对袋、包、盒、蛤壳等合约包装服务的需求不断增加,许多公司都在确保其产品符合美国FDA 法规。合约包装上随包装一起印刷的健康和营养声明也必须符合FDA的规定。例如,ActionPak 在新泽西州卡姆登开设了一个占地 175,000 平方英尺的新包装工厂,该工厂按照严格的 SQF 和 FDA 指南处理食品和非处方产品的初级和二次包装。

- 此外,随着 COVID-19 疫情的爆发,由于许多工人和其他人出于安全考虑依赖包装食品,出于安全和健康考虑,食品製造公司被迫委託包装服务外包给合约包装商。国际食品资讯委员会的数据显示,约有 36% 的美国声称,在美国因新冠肺炎疫情爆发冠状病毒疫情期间,他们购买了相同数量或更多的包装食品。

美国合约包装产业概况

美国合约包装市场比较分散,有许多大大小小的供应商。主要参与者包括 Aaron Thomas Company、Multipack Solutions、Pharma Tech Industries、Reed-Lane Inc. 和 Sharp Packaging Services。公司正在采取业务扩展、合併、收购、合作等倡议,以扩大其业务范围并增加其在各个终端用户市场的市场占有率。

- 2022 年 2 月—总部位于纽约的私募股权公司 GenNx360 Capital Partners 宣布投资 Nutra-Med Packaging Inc.,这是一家总部位于新泽西州的合约包装公司,专注于製药、健康和保健以及医疗设备市场的包装。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

- 全球合约包装市场概况

第五章 市场动态

- 市场驱动因素

- 科技快速进步

- 零售连锁发展

- 市场限制

- 内部包装

- 前置作业时间和物流成本增加

第六章 市场细分

- 按包装类型

- 基本的

- 次要

- 第三阶段

- 按最终用户产业

- 食物

- 饮料

- 药品

- 家庭护理/个人护理

- 车

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Aaron Thomas Company

- Multipack Solutions

- Pharma Tech Industries

- Reed-Lane Inc.

- Sharp Packaging Services

- UNICEP Packaging

- Bell-Carter Packaging

- Jones Packaging Inc.

- Stamar Packaging

- Genco(FedEx Supply Chain)

第八章投资分析

第九章:未来市场展望

The United States Contract Packaging Market is expected to register a CAGR of 9.42% during the forecast period.

Key Highlights

- The United States government has placed various laws and regulations on labeling and packaging, especially for drugs. This could lead to an increase in the demand for contract packaging, owing to the inability of an in-house packaging facility for a few pharmaceutical companies in this country.

- Technology is expected to play a vital role in the future, with the emergence of serialization, digital printing, and advanced robotics, thereby helping the companies. Sustainability and customization are expected to positively impact the contract packaging market, leading to growth in consumer-packaged goods, like personal care and food & beverages.

- Also, many governments are mandating stringent laws and regulations on the labeling and packaging of drugs and food products, further expanding the scope of the contract packaging market. For instance, the United States witnessed an increase in demand for contract packaging in the food industries, owing to the inability of an in-house packaging facility for a few companies in the country.

- Various contract packaging companies in the country are adapting to challenging business conditions. The companies are also getting awareness regarding the cost pressures, intense competition, and highly variable demand from OEMs. This environment is further supporting in the growth of contract packaging market in the country. Many European companies, such as Persson Innovation and Langen Group, have also invested in the United States.

- The presence of multiple logistics companies brings out a high demand for secondary and tertiary packaging, owing to their prominence in transportation, thus paving the way for the growth of the contract packaging market. However, the high recycling cost and singringent government regulations related to packaging materials are restarining market growth.

- The COVID-19 pandemic has hampered the growth of the United States Contract Packaging Market due to restrictions on manufacturing activities and limited workforce availability in the production line. However, post-pandemic, the reopening of manufacturing industries at their maximum capacities and growing market demand for food and beverage, pharmaceuticals, personal care, consumer goods, and other industry reflect a positive market outlook. Further, the Russia-Ukraine war has an impact on the overall packaging ecosystem.

US Contract Packaging Market Trends

Rapidly Growing Pharmaceutical Industry is Driving the Market

- The United States has emerged as the largest market for drugs and accounts for almost half of the R&D spending in pharmaceutical and biotechnology markets. Hence, contract packaging organizations play a critical role in this market and have invested in new facilities and technologies to cater to a wide range of outsourcers. For instance, According to the Pharmaceutical Research and Manufacturers of America (PhRMA) trade group that represents the leading biopharmaceutical research companies in the United States, in 2021, the research and development (R&D) expenditure of its member companies reached some USD 102 billion worldwide.

- The escalating adoption of innovative packaging methods to satisfy rapidly changing consumer preferences and rising environmental concerns have stimulated the demand for contract packaging in the pharmaceutical industry in the United States. In addition, the increasing penetration of automation in pharmaceutical contract packaging has minimized the risks of human handling errors, thereby catalyzing market growth in the region.

- The United States also dominates the pharmaceutical market, both in consumption and development. According to STAT, prescription drug spending in the nation is considered to add up to USD 600 billion by 2023, up from an estimated USD 500 billion in 2019, which is further expected to drive the United States contract packaging market.

- The industry has been witnessing increasing investments in the country owing to profitable business and growing demand. For instance, in January 2022, Eli Lilly and Company planned to invest over USD 1 billion to create a new manufacturing site in Concord, North Carolina. The new facility would utilize the latest technology to manufacture parenteral (injectable) products and devices and increase the company's manufacturing capacity.

Food Industry is Expected to Hold Major Share

- In the United States, with the rising demand and changing preference of food production firms toward contract packagers and the food companies increasingly focusing on cost optimization and their core business, most of them have been outsourcing their packaging services activities to third-party contract food packagers, owing to the demand in the market studied.

- Food manufacturing companies are increasingly focusing on cost reduction and core competencies. Furthermore, incorporating nanotechnology into the production of convenience foods has considerably improved critical processes such as preservation, package design, and finished goods processing. This technology is expected to significantly increase businesses' need to outsource their goods' packaging to organizations that provide contract packaging services in the United States.

- With the increasing demand for contract packaging services for pouches, bags, boxes, clamshells, etc., many companies are ensuring that their products comply with FDA regulations in the United States. Any health or nutritional value claims printed on the contract packaging along with the packaging must also align with FDA regulations. For instance, ActionPak has its new 175,000 sq ft packaging facility in Camden, New Jersey, to do both primary and secondary packaging of food and OTC products under strict SQF and FDA guidelines.

- Also, with the outbreak of COVID-19, many working professionals and others have been depending on packaged food for safety purposes, which owed food manufacturing companies to outsource their packaging services to contract packagers for safety and health concerns. According to International Food Information Council, due to the COVID-19 pandemic, around 36% of Americans claimed to have purchased the same amount or more packaged foods during the coronavirus outbreak in the United States.

US Contract Packaging Industry Overview

The United States contract packaging market is fragmented, with the presence of many small and large vendors. Some of the key players include Aaron Thomas Company, Multipack Solutions, Pharma Tech Industries, Reed-Lane Inc., and Sharp Packaging Services. Companies are increasing their market presence by expanding their business footprint across various end-user markets by undergoing initiatives such as expansion, merger, acquisition, collaboration, and others.

- February 2022 - GenNx360 Capital Partners, a New York-based private equity firm, announced its investment in Nutra-Med Packaging Inc., a New Jersey-based contract packaging organization focused on packaging for the pharmaceutical, health & wellness, and medical devices markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

- 4.5 Overview of the Global Contract Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Rapid Technological Advancements

- 5.1.2 Development in the Retail Chain

- 5.2 Market Restraints

- 5.2.1 In-house Packaging

- 5.2.2 Increasing Lead Time and Logistics Cost

6 MARKET SEGMENTATION

- 6.1 By Packaging Type

- 6.1.1 Primary

- 6.1.2 Secondary

- 6.1.3 Tertiary

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Home Care and Personal Care

- 6.2.5 Automotive

- 6.2.6 Other End-user Industry

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aaron Thomas Company

- 7.1.2 Multipack Solutions

- 7.1.3 Pharma Tech Industries

- 7.1.4 Reed-Lane Inc.

- 7.1.5 Sharp Packaging Services

- 7.1.6 UNICEP Packaging

- 7.1.7 Bell-Carter Packaging

- 7.1.8 Jones Packaging Inc.

- 7.1.9 Stamar Packaging

- 7.1.10 Genco (FedEx Supply Chain)