|

市场调查报告书

商品编码

1643197

亚太光伏 (PV) -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asia-Pacific Solar Photovoltaic (PV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

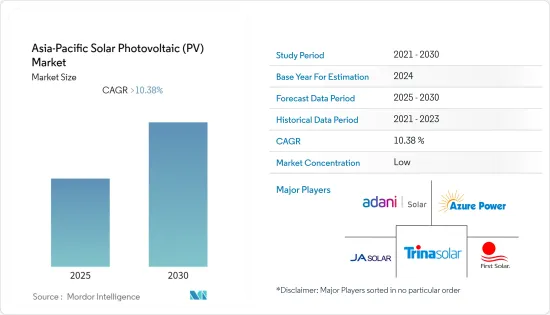

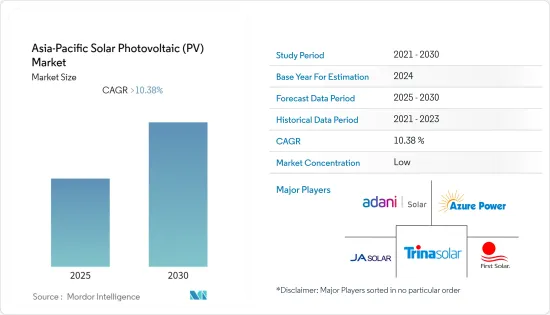

预计预测期内亚太太阳能光伏 (PV) 市场的复合年增长率将超过 10.38%。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 从长期来看,推动全球太阳能光电市场的主要因素是太阳能光电模组价格的下跌。预计这也将对该地区太阳能光伏(PV)市场的成长产生积极影响。

- 另一方面,高昂的安装成本和糟糕的维护正在抑制太阳能市场的成长。此外,替代再生能源来源的日益普及也有望阻碍市场成长。

- 商业和工业部门越来越多地转向分散式太阳能发电,以获得各种经济效益,并将其作为恆定的能源来源,以消除传统电网电压波动造成的停机和设备损坏。预计这将在不久的将来为该地区的分散式太阳能发电市场创造巨大的商机。

- 在日益增长的环境问题和国内太阳能发电的经济效益的推动下,中国预计将主导市场。

亚太地区光电市场趋势

地面安装部分占据市场主导地位

- 地面安装太阳能电池板是安装在地面上的太阳能电池阵列。这些系统通常比屋顶安装更昂贵,但可以最大限度地提高能源产量。 2021年,地面光电市场占有率达到装置容量的50%以上。

- 由于规模经济、大规模安装以及营运和维护效率,用于商业和公共产业的地面安装太阳能发电是经济的。另一方面,屋顶太阳能光电用于1MW以下的小型住宅计划。

- 大型公共产业计划中竞争的加剧和技术的进步正在推动安装成本和营运维护成本的下降。截至 2021 年,亚洲太阳能发电装置容量已达 484.93 吉瓦,较 2020 年的 409.25 吉瓦成长 18.49%。

- 展望未来,2021 年 12 月,印度新可再生能源部 (MNRE) 邀请各方对併网屋顶太阳能发电计画第二阶段的评估提出意向书 (EOI)。该计划是国家太阳能计划 (NSM) 的一部分,旨在到 2022年终安装 40 吉瓦的併网屋顶太阳能发电系统。

- 2022年1月,信实工业与古吉拉突邦政府签署协议,在未来10-15年内在古吉拉突邦投资6,030亿美元,建立10吉瓦的可再生能源发电发电厂和绿色氢能生态系统。可再生能源发电包括公用事业规模的太阳能发电厂。 RIL 计划投资 6,000 亿印度卢比,为其即将开展的可再生计划建立太阳能光伏模组、电解槽、电池和燃料电池製造设施。

- 此外,2022 年 9 月,日立阿斯特莫在马哈拉斯特拉邦的贾尔冈製造工厂建立了印度首座太阳能发电厂。该3兆瓦太阳能发电厂将建于占地43,301平方公尺的土地上。该地面太阳能发电厂将由 7,128 块地面太阳能板和 10 台逆变器组成,预计将于 2023 年投入运作。

- 因此,预计预测期内地面安装太阳能板将主导亚太太阳能市场。

中国主导市场

- 中国是全球最大的太阳能光电市场,2021年累积设置容量占全球市场的40%以上。截至年终,太阳能光电在中国可再生能源发电结构中的份额为 2.82 亿千瓦。政府正在推出各种倡议,以在不久的将来增加太阳能的份额。

- 截至 2021 年,中国太阳能发电装置容量达 306.403 吉瓦,较 2020 年安装的 253.418 吉瓦成长 20.91%。中国也推出了针对太阳能和风能无补贴计划的新政策。推出这项措施是为了利用建筑成本的快速下降来应对付款积压和计划堵塞电网的问题。

- 2021年,中国向电网新增太阳能发电装置容量54.9吉瓦,创历史新高。根据中国国家能源局的数据,中国发电量与前一年同期比较增加了 14%,占总发电量的 31%。根据国家能源局统计,截至2021年终,中国太阳能发电装置容量达3.0656亿千瓦,相当于德国全年发电量。

- 此外,2022年6月,协合新能源在中国将一座新的70MW太阳能发电厂併网。该计划以池塘为基础,也支持鱼虾养殖。天合光能为装置提供了 670W 的太阳能板。

- 此外,2022 年 10 月,国家电力投资公司 (SPIC) 宣布已在中国四川省郑州市附近建造一座试点太阳能发电厂。星川示范太阳能发电厂是国家电投在该地区建设的 600 兆瓦计划的首座机组,耗资 4.442 亿美元。

- 因此,预计预测期内中国将主导亚太太阳能市场。

亚太光伏产业概况

亚太地区太阳能光电市场较为分散。该市场的主要企业(不分先后顺序)包括晶澳太阳能控股有限公司、天合光能有限公司、阿达尼绿色能源有限公司、Azure Power Global Limited 和 First Solar Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 装置容量及至2027年预测(单位:GW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 产品类型

- 薄膜

- 多晶

- 硅晶型

- 最终用户

- 住宅

- 商业的

- 公共产业

- 扩张

- 地面安装

- 屋顶太阳能

- 地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- JA Solar Holdings Co

- Trina Solar Ltd

- Adani Green Energy Ltd

- Azure Power Global Limited

- First Solar Inc

- ReneSola Ltd.

- Zhejiang Chint Electrics Co Ltd

- Yingli Green Energy Holding Co Ltd

- Hanwha Q CELLS Co. Ltd

- SMA Solar Technology AG

- JinkoSolar Holdings Co. Ltd

第七章 市场机会与未来趋势

简介目录

Product Code: 70219

The Asia-Pacific Solar Photovoltaic Market is expected to register a CAGR of greater than 10.38% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major factor driving the global solar PV market is the declining cost of solar PV module prices. This, in turn, is likely to have a positive impact on the growth of the solar photovoltaic (PV) market in the region.

- On the other note, the high installation cost and poor maintenance practices are restraining factors for the growth of the solar photovoltaic market. Moreover, the increasing deployment of alternative renewable energy sources is expected to hinder the market's growth.

- Nevertheless, commercial and industrial sectors are showing a growing interest in distributed solar power generation due to various economic benefits and a constant source of energy to eliminate downtimes and equipment damage due to voltage fluctuations in conventional power grids. This is expected to create a huge opportunity for distributed solar PV market in the region in the near future.

- China is expected to dominate the market over rising environmental concerns and economic benefits of domestic solar power generation.

Asia-Pacific Solar Photovoltaic Market Trends

Ground Mounted Segment to Dominate the Market

- Ground-mounted solar panels are solar arrays that are installed at the ground level. These systems are usually more expensive than rooftop installations but could maximize energy production at a larger level. In 2021, the market share of ground-mounted solar PVs was more than 50% of the total installed solar PV capacity, as they are mainly deployed for commercial and utility purposes.

- Ground-mounted solar for commercial or utility projects is economical due to the economies of scale, large-scale installations, and operation and maintenance efficiencies. On the other hand, rooftop solar is used in small residential projects, less than 1 MW.

- Increasing competition and technical advancements in large-scale utility projects have led to cost reductions in both installation and operation & maintenance prices. As of 2021, Asia has reached 484.93 GW of solar PV installed capacity, which has grown 18.49% more compared to 409.25 GW installed in 2020.

- Going forward, in December 2021, the Indian Ministry of New and Renewable Energy (MNRE) invited applications for the Expression of Interest (EOI) to evaluate Phase II of the Grid Connected Rooftop Solar Program. The program is a part of the National Solar Mission (NSM), which aims at installing 40 GW capacity of grid-connected solar rooftop installation systems by the end of 2022.

- In January 2022, Reliance Industries signed an agreement with the Gujarat government to invest USD 603 billion in Gujarat over 10-15 years to set up 100 GW renewable energy power plants and a green hydrogen ecosystem. Renewable energy power plants include solar power plants at a utility-scale. RIL is expected to invest INR 60,000 crore in setting up manufacturing facilities for solar PV modules, electrolyzers, batteries, and fuel cells for the upcoming renewable projects.

- Moreover, in September 2022, Hitachi Astemo installed India's first solar PV plant at the Jalgaon manufacturing plant in Maharashtra. The 3 MW solar power plant will be built in an area of 43301 sqm. The ground-mounted solar power plant will consist of 7128 ground-mounted solar panels and ten inverters and is expected to get commissioned by 2023.

- Owing to the above points, the ground-mounted segment is expected to dominate the Asia-Pacific Solar Photovoltaic (PV) Market during the forecast period.

China to Dominate the Market

- China is the largest market for solar PV across the globe, with a cumulative installed capacity that accounted for more than 40% of the global market in 2021. The solar power share in China's renewable power generation mix was recorded as 282 million kilowatts at the end of 2021. The government has envisaged various initiatives to increase this share of solar energy in the near future.

- As of 2021, China recorded a solar PV capacity of 306.403 GW, which has grown 20.91% higher than the 253.418 GW installed in 2020. Also, China revealed new solar and wind policies for subsidy-free projects. The policy was introduced to take advantage of a rapid fall in construction costs and to resolve payment backlog issues and grid logjam projects.

- In the year 2021, the country hit a breaking record of solar power capacity with 54.9 gigawatts to its grid. According to China's energy authority (CEA), the country managed to increase its capacity by 14 per cent compared to the capacity made by the previous year while gaining 31 percent of its total capacity additions over the year. By the end of the year 2021, China obtained a total solar capacity of 306.56 GW, which can cover the power generation of Germany, based on the National Energy Administration.

- Moreover, in June 2022, Concord New Energy connected a new 70 MW solar plant to the grid in China. The project, which is situated on a pond, also supports fish and shrimp aquaculture. Trina Solar supplied 670 W solar panels for the installation.

- Furthermore, in October 2022, State Power Investment Corp. (SPIC) announced that it had completed the pilot solar power plant near the town of Zhengdou in China's Sichuan province. The Xingchuan Demonstration Photovoltaic Power Station is the first unit of a 600 MW project that SPIC is building in the area at a planned cost of USD 444.2 million.

- Owing to the above points, China is expected to dominate the Asia-Pacific Solar Photovoltaic (PV) market during the forecast period.

Asia-Pacific Solar Photovoltaic Industry Overview

The Asia-Pacific Solar Photovoltaic (PV) Market is fragmented. Some of the key players in this market (not in a particular order) include JA Solar Holdings Co., Trina Solar Ltd, Adani Green Energy Ltd., Azure Power Global Limited, and First Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar PV Installed Capacity and Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Thin Film

- 5.1.2 Multicrystalline Silicon

- 5.1.3 Monocrystalline Silicon

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Utility

- 5.3 Deployment

- 5.3.1 Ground Mounted

- 5.3.2 Rooftop Solar

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 JA Solar Holdings Co

- 6.3.2 Trina Solar Ltd

- 6.3.3 Adani Green Energy Ltd

- 6.3.4 Azure Power Global Limited

- 6.3.5 First Solar Inc

- 6.3.6 ReneSola Ltd.

- 6.3.7 Zhejiang Chint Electrics Co Ltd

- 6.3.8 Yingli Green Energy Holding Co Ltd

- 6.3.9 Hanwha Q CELLS Co. Ltd

- 6.3.10 SMA Solar Technology AG

- 6.3.11 JinkoSolar Holdings Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219