|

市场调查报告书

商品编码

1644367

拉丁美洲资料中心建置:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Latin America Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

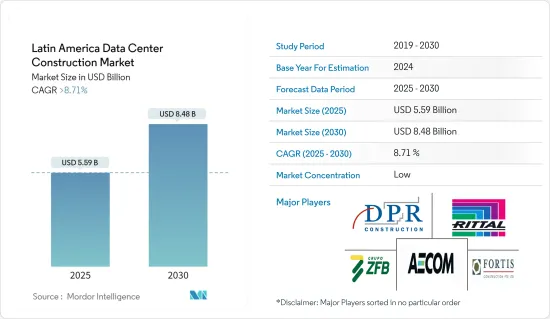

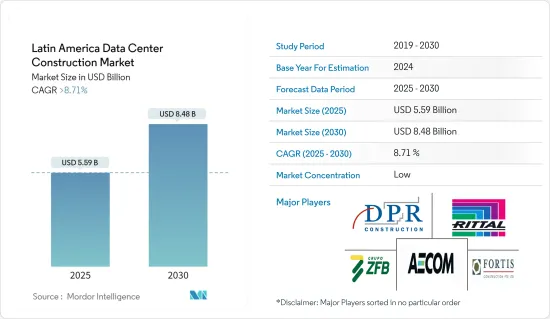

拉丁美洲资料中心建设市场规模预计在 2025 年为 55.9 亿美元,预计到 2030 年将达到 84.8 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 8.71%。

软体定义资料中心、物联网(IoT)、灾难復原等新兴技术的成长推动了拉丁美洲对资料中心建设的需求。

主要亮点

- 建立资料中心是一项非常复杂的工作,需要对电气、位置和机械要求进行广泛的规划。此外,由于资料中心执行任务,不良的电源管理和建筑设计可能导致灾难性的后果,给企业带来巨大损失。

- 近年来,随着云端服务的普及,数位基础设施的成长以及对资料中心的需求也日益增加。在此期间,资料中心可用的储存量有限,限制了云端服务的扩展。

- 随后,超大规模和资料资料的概念出现了。超大规模和主机託管资料资料的资料预计将推动未来资料中心建置的需求。

- 行动装置和高速宽频连线的快速普及正在推动拉丁美洲资料中心建设市场的成长。此外,对连网型设备的需求不断增长以及物联网、云端基础的服务和巨量资料分析等新技术的采用正在推动该地区对新设施的需求。

- 2023 年 9 月,超大规模市场领先的拉丁美洲永续资料中心平台之一 Saala Data Centers 宣布成为 Datacloud USA 2023 的独家永续性合作伙伴。与 Datacloud USA 的合作加强了其永续倡议,并凸显了 Scala 在拉丁美洲超大规模永续资料中心的发展。

- 预计在预测期内,包括巴西在内的拉丁美洲国家对新资料中心建设的投资增加将推动市场成长。作为与管理系统供应商 Sankhya 合作扩张的一部分,巴西现代技术机构 (AMT) 选择 CenturyLink 为其里约热内卢提供资料中心服务,以满足日益增长的云端服务需求。 CenturyLink 位于里约热内卢的模组化资料中心为客户提供了旨在提供高可用性、更高品质和更快速存取世界其他地区的处理环境。

- 儘管遭遇新冠疫情危机,拉丁美洲对资料中心和先进资讯处理结构的投资仍在加速。在这个市场,各家公司都宣布了建造资料中心的措施。

拉丁美洲资料中心建设市场趋势

IT和通讯领域占据了很大的市场份额

- 该地区正吸引来自 IT 和通讯供应商的大量投资。事实证明,大规模采用数位科技可以透过各种管道有效减少家庭层面的收入不平等,包括提高连结性和数位服务的可及性。数位金融服务克服了资格和负担能力障碍,使企业能够为人们提供安全可靠的储蓄、借贷和防范风险的方式。

- 云端处理、物联网服务和巨量资料的大规模采用,以及对社交网路和线上视讯服务日益增长的需求,正在推动该地区的通讯服务供应商建立网路主干网路。谷歌已将其海底电缆「居里」停靠在智利瓦尔帕莱索。这条电缆直接连接到位于加州洛杉矶的 Equinix LA4资料中心。预计约有 10 个海底电缆计划将推动资料中心投资与前一年同期比较。

- 拉丁美洲的资料中心设计能够承受高机架密度。 IT基础设施利用率的提高使得拉丁美洲资料中心的机架功率密度达到平均4-6kW。对高效能运算 (HPC) 和虚拟等解决方案的需求不断增长,将推动拉丁美洲资料中心建设市场的发展,预测期内机架功率密度将增加到 8-10 kW 之间。

- 拉丁美洲国家在强大数位经济所需的几个支柱方面拥有强劲前景。有意义的——安全、高效和负担得起的——互联网连接和资料访问是数位经济的基础。併购也有助于提升拉丁美洲 IT 和电信公司的市场占有率。

巴西可望占据主导市场占有率

- 云端运算的扩张(由于 COVID-19 而进一步加速)、外国云端供应商的不断渗透、政府对资料安全的监管以及国内参与者的投资增加是推动该国资料中心需求的一些主要因素。该国大约有 120 个资料中心。

- 对低延迟和高效能的需求,加上最近由于全国封锁而产生的在家工作文化,加速了将资料中心部署到更靠近客户和企业的倡议,主要是为了实现混合多重云端生态系统。

- 据巴西软体协会(ABES)称,巴西是拉丁美洲最大的技术生态系统。此外,根据Equinix发布的资料,拉丁美洲的IT支出与前一年同期比较增1.3%,预计未来几年将成长4-5%。巴西在IT和通讯领域的投资预计分别达到400至500亿美元左右。预计这将极大地激发云端处理市场,并最终激发资料中心市场。

- 巴西政府在发展当地资料中心基础设施方面也发挥着重要作用。据政府称,该国的《通用资料保护法》(LGPD)即将生效,预计将迫使该国许多公司将云端存取转移到私人网路并更新其加密服务以加强用户资料保护。

- 此外,COVID-19 也给终端用户企业带来了巨大压力,迫使他们支援远端工作,加快云端运算数位化进程。 IBM 和微软等公司声称,这将促进巴西的资料中心市场,因为资料中心的扩张将使组织和政府机构能够透过合法的方式管理资料资料维护资料主权。

- 随着合规性和保护条例不断加强,巴西企业寻求资料获得更大的控制权,IBM 等资料中心供应商正透过提供云端功能以及混合多重云端环境来瞄准客户。

拉丁美洲资料中心建设产业概况

拉丁美洲资料中心建设市场分散且竞争激烈。该市场的主要企业包括 AECOM、Cisco、Kogan Corporation、DPR Construction、Holder Construction 和戴尔科技。这个市场对多种应用的差异化产品的需求日益增长,让您透过技术创新创造可持续的竞争优势。透过研发、併购和策略联盟,这些公司在市场上取得了更强的地位。这些参与者透过提供最尖端科技不断扩大其市场占有率,从而提高了其市场收益。

2022年11月,拉丁美洲资料中心市场领导者Ascenty宣布开始建造五个新设施,进一步巩固了其在巴西、智利、墨西哥和现在的哥伦比亚总合33个基础设施的领导地位。新的资料中心将位于圣地牙哥 3 号资料中心(面积 21,000 平方米,容量 16MW)、波哥大 1 号和 2 号资料中心(面积 9,000 平方米,容量 12MW)以及圣保罗 5 号和 6 号资料中心(面积 7,000 平方米,容量 19MW)。

2022 年 8 月,该地区超大规模市场领先的绿色资料中心平台 Scala Data Centers推出了拉丁美洲最大的垂直资料中心 SGRUTB04,总容量为 18 兆瓦。 SGRUTB04所在的坦博尔校区是该公司在巴西大圣保罗地区拥有的一栋综合大楼。 SGRUTB04 将分配给单一超大规模客户,预计将全面运作10 年以上。新的 Scala资料中心高五米,共有七层,其中四层为资料厅专用,总建筑面积超过 140,000 平方英尺,拥有超过 1,500 个机架。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 该地区网路连接改善,数位转型相关技术的采用增加

- 地方政府推出税收优惠政策,吸引更多外资

- 领先的资料中心建设公司继续整合以支持业务扩张

- 提高对模组化配置和增加机架密度的认识

- 市场挑战(成本和基础设施问题)

- 成本和基础设施仍是问题

- 劳动力挑战

- 市场机会

- 电力、冷冻和能源技术进步推动建设活动

- 对边缘资料中心的需求不断增加

- 巴西和墨西哥继续成为该地区最大的市场

- COVID-19 对资料中心建设产业的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

第五章 市场区隔

- 依基础设施类型

- 电力基础设施

- UPS 系统

- 其他电力基础设施

- 机械基础设施

- 冷却系统

- 架子

- 其他机械基础设施

- 一般建筑

- 电力基础设施

- 依层级类型

- 层级和二级

- 第三层级

- IV层级

- 按公司规模

- 中小型企业

- 大型企业

- 按最终用户

- 银行、金融服务和保险

- 资讯科技/通讯

- 政府和国防

- 卫生保健

- 其他最终用户

- 按国家

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲国家

第六章 竞争格局

- 公司简介

- Turner Construction Co.

- DPR Construction Inc.

- Fortis Construction

- ZFB Group

- Aceco TI

- AECOM Limited

- Constructora Sudamericana SA

- HostDime Brasil

- CyrusOne Inc.

- RITTAL Sistemas Eletromecanicos Ltda.(Rittal GmbH & Co. KG)

- Legrand

- Delta Group

- Ascenty Data Centers E Telecomunicacoes

- Equnix Inc.

第七章投资分析

第八章 市场机会与未来趋势

The Latin America Data Center Construction Market size is estimated at USD 5.59 billion in 2025, and is expected to reach USD 8.48 billion by 2030, at a CAGR of greater than 8.71% during the forecast period (2025-2030).

The growth of advanced technologies such as software-defined data centers, the Internet of Things (IoT), and disaster recovery fed the demand for the construction of data centers in Latin America.

Key Highlights

- Data center construction is a very complex task requiring extensive planning of electrical, location, and mechanical requirements. Moreover, the data centers carry out mission tasks, due to which any imperfection in power management to building design could be catastrophic and could result in increased costs to the companies.

- The need for data centers has increased in recent years, with the growth of digital infrastructure due to the high adoption of cloud services. During that period, the widespread expansion of cloud services was restrained by the limited storage available at the data centers.

- Subsequently, the concept of hyperscale data centers and colocation data centers emerged. The construction of hyperscale data centers and colocations data centers is expected to drive the demand for data center construction in the future.

- The rapid proliferation of mobile devices and high-speed broadband connectivity is attributed to the growth of the data center construction market in the Latin American region. Moreover, the increasing demand for connected devices and the introduction of new technologies, such as IoT, cloud-based services, and big data analytics, are boosting the demand for new facilities in the region.

- In September 2023, Saala Data Centers, one of the leading Latin American platforms of sustainable data centers in the Hyperscale market, announced its role as the exclusive Sustainability Partner at Datacloud USA 2023. The collaboration with Datacloud USA reinforces sustainable initiatives and underscores scala's hyperscale sustainable data center evolution in Latin America

- The increasing investment in building new data centers in Latin American countries, such as Brazil, is expected to drive market growth over the forecast period. Brazilian company AMT (Agencia Moderna Tecnologia) selected CenturyLink to meet its growing demand for cloud services as part of business expansion with management systems provider Sankhya for data center services in Rio de Janeiro. The CenturyLink modular data center in Rio de Janeiro provides customers with a processing environment designed to offer high levels of availability, improved quality, and greater access speeds to the rest of the world.

- The investments in data centers and advanced information processing structures have accelerated in Latin America, despite the COVID-19 crisis. Various companies in the market have announced their moves for the construction of data centers.

Latin America Data Center Construction Market Trends

IT and Telecommunications Segment to Hold a Significant Share of the Market

- The region is undergoing some massive investment from IT & Telecom providers. Adoption of digital technology at a large scale has been demonstrated to have good effects on lowering income inequality at the household level through a variety of routes, including increased connection and access to digital services. Digital financial services assist companies in overcoming eligibility and affordability barriers and give people secure and dependable ways to save money, borrow money, and insure against risk.

- The massive adoption of cloud computing, IoT services, and big data, along with the growth in social networking and the need for online video services, has aided telecommunication service providers in the region to establish their internet backbone. Google docked its private submarine cable, Curie, in Valparaiso, Chile. The cable is directly joined to the Equinix LA4 data center in Los Angeles, California. About 10 submarine cable projects will yield high data center investments year-over-year.

- The data centers in Latin America are being designed to withstand high rack density. The increasing utilization of IT infrastructure has increased the rack power density to an average of 4-6 kW among data centers in Latin America. The growing need for solutions such as high-performance computing (HPC) and virtualization will continue to grow the rack power density between 8-10 kW during the forecast period, consequently driving the data center construction market in Latin America.

- Latin American nations have excellent prospects across several essential pillars of a strong digital economy. Access to a meaningful (safe, productive, and inexpensive) internet connection and data is the foundation of the digital economy. Owing to mergers and acquisitions, the increase in market share of IT & Telecom companies is also rising sharply in Latin America.

Brazil is expected to Dominate Market Share

- The growing cloud computing (further fuelled due to COVID-19), increasing penetration of foreign cloud vendors, government regulations for local data security, and increasing investment by domestic players are some of the major factors driving the demand for data centers in the country. There are almost 120 data centers in the country.

- The demand for low latency and high performance, along with the recent work-from-home culture due to nationwide lockdown, is mainly accelerating the adoption of data centers near customers and businesses to enable hybrid multi-cloud ecosystems.

- According to the Brazilian Software Association (ABES), Brazil is Latin America's largest technology ecosystem. Also, according to the data published by Equinix, the IT investment in Latin America witnessed a 1.3% growth in previous years and is expected to have an upswing of 4-5% in the coming years. Brazilians' investment in the IT industry and telecom sector will be around USD 40-50 billion, respectively. This is expected to provide a massive boost to the cloud computing market and hence to the data center market too.

- The Brazilian government is also playing a significant role in developing local data center infrastructure. According to the government, the country's General Data Protection Act (LGPD) will implement, which is expected to force many enterprises in the country to migrate their cloud access to private networks and update their encryption services to extend user data protection.

- Furthermore, COVID-19 put high pressure on end-user companies to support remote working and are fast-tracking their cloud and digitization journeys. Companies like IBM and Microsoft claim that this will boost the data center market in the country as data center expansion enables organizations and government institutions to uphold data sovereignty by keeping data within their legal basis.

- As companies in Brazil look to gain greater control of their data in the face of upcoming tighter compliance and protection regulations, data center vendors, like IBM, are targeting customers by providing cloud capabilities along with a hybrid multi-cloud environment.

Latin America Data Center Construction Industry Overview

The Latin America Data Center Construction Market is fragmented, and the competitive rivalry is high. The key players in this market are AECOM, Cisco Systems, Inc., Corgan Inc., DPR Construction, Holder Construction Company, and Dell Technologies Inc., among others. Sustainable competing advantage can be accomplished through innovation in this market, owing to the increasing need for differentiated products for multiple applications. Through research & development, mergers & acquisitions, and strategic partnerships, they have been able to gain a stronger hold in the market. These players are continually expanding their presence in the market by offering the most advanced technologies, thereby boosting their revenues in the market.

In November 2022, Ascenty, the market leader in Latin America for datacenters, announced the commencement of construction on five new facilities, further solidifying its dominance with a total of 33 infrastructures across Brazil, Chile, Mexico, and now Colombia. The new data centers are located in Santiago 3, with 21,000 m2 and 16 MW; Bogota 1 and 2, with 9,000 m2 and 12 MW each; and So Paulo 5 and 6, with an area of 7,000 m2 and a capacity of 19 MW each.

In August 2022, The largest vertical data center in Latin America, SGRUTB04, with a total capacity of 18MW, was launched by Scala Data Centers, the region's top platform for environmentally friendly data centers in the hyperscale market. The Tambore Campus, a complex owned by the firm in Greater So Paulo, Brazil, is where SGRUTB04 is situated. It is devoted to a single hyperscale client and will operate at full capacity for more than ten years. This new Scala data center is 5 meters tall, has seven floors, four of which are dedicated to data halls, and has a total built-out space of over 140,000 square feet, or more than 1,500 racks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Network Connectivity and Increased Adoption of Digital Transformation Related Technologies in the Region

- 4.2.2 Favorable tax Incentive Structure Introduced by Local Governments has Led to the Higher Participation from International Players

- 4.2.3 Ongoing Consolidation Efforts by Major Data Center Construction Companies to Aid their Expansion Activities

- 4.2.4 Growing Awareness on Modular Deployments and Increasing Rack Density

- 4.3 Market Challenges (Cost and Infrastructural Concerns)

- 4.3.1 Cost and Infrastructural Concerns Continue to be a Concern

- 4.3.2 Workforce-Related Challenges

- 4.4 Market Opportunities

- 4.4.1 Technological Advancements in Power, Cooling & Energy Segments to Drive Construction Activity

- 4.4.2 Growing Demand for Edge Data Center Deployments

- 4.4.3 Brazil & Mexico to Continue their Emergence as the Largest Markets in the Region

- 4.5 Impact of COVID-19 on the Data center Construction Industry

- 4.6 Industry Attractiveness -Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 Infrastructure Type

- 5.1.1 Electrical Infrastructure

- 5.1.1.1 UPS Systems

- 5.1.1.2 Others Electrical Infrastructure

- 5.1.2 Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.2 Racks

- 5.1.2.3 Other Mechanical Infrastructure

- 5.1.3 General Construction

- 5.1.1 Electrical Infrastructure

- 5.2 Tier Type

- 5.2.1 Tier-I and II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 Size of Enterprise

- 5.3.1 Small and Medium-scale Enterprise

- 5.3.2 Large-Scale Enterprise

- 5.4 End User

- 5.4.1 Banking, Financial Services, and Insurance

- 5.4.2 IT and Telecommunications

- 5.4.3 Government and Defense

- 5.4.4 Healthcare

- 5.4.5 Other End Users

- 5.5 Country

- 5.5.1 Mexico

- 5.5.2 Brazil

- 5.5.3 Argentina

- 5.5.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Turner Construction Co.

- 6.1.2 DPR Construction Inc.

- 6.1.3 Fortis Construction

- 6.1.4 ZFB Group

- 6.1.5 Aceco TI

- 6.1.6 AECOM Limited

- 6.1.7 Constructora Sudamericana S.A

- 6.1.8 HostDime Brasil

- 6.1.9 CyrusOne Inc.

- 6.1.10 RITTAL Sistemas Eletromecanicos Ltda. (Rittal GmbH & Co. KG)

- 6.1.11 Legrand

- 6.1.12 Delta Group

- 6.1.13 Ascenty Data Centers E Telecomunicacoes

- 6.1.14 Equnix Inc.