|

市场调查报告书

商品编码

1644386

中东 PLC:市场占有率分析、行业趋势和成长预测(2025-2030 年)Middle East PLC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

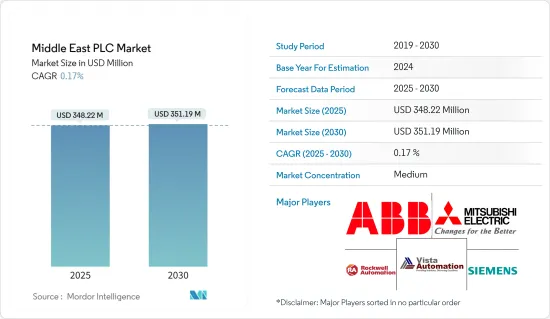

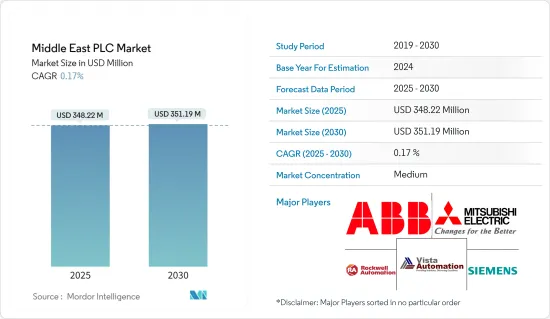

中东 PLC 市场规模预计在 2025 年为 3.4822 亿美元,预计到 2030 年将达到 3.5119 亿美元,预测期内(2025-2030 年)的复合年增长率为 0.17%。

PLC 系统的实施有助于识别和纠正错误,并在无需人工干预的情况下启动快速回应。因此,这种自动化 PLC 系统可以显着减少机器停机时间。此外,以色列的工业自动化和IT基础设施正在显着成长,为 PLC 市场扩大铺平了道路。

该地区石油和天然气行业的成长正在推动 PLC 市场的发展。根据美国能源资讯署(EIA)统计,全球十大产油国中有五个位于中东,占全球石油总产量的巨大份额。根据美国能源资讯署统计,光是沙乌地阿拉伯每天就生产约1,100万桶石油,占全球产量的近11%。由于生产量如此之高,生产商现在正在寻找更好的解决方案,例如可程式逻辑控制器 (PLC),它可以更有效率并有助于降低成本。这些控制器是模组化的且可扩展,以支援各种通讯和应用。

市场发展的动力来自製造、运输和仓储业、建设业和公共产业等各个终端用户垂直领域日益广泛地采用自动化系统。 PLC 是用于工业自动化的坚固型计算机,可自动化特定流程、机器功能或整个生产线。它从连接的传感器和输入设备接收讯息,处理资料,并根据预编程参数触发输出。

此外,阿拉伯联合大公国等国家正在杜拜等城市设立智慧安保,预计将进一步推动 PLC 的需求。例如,2022 年 4 月,杜拜电力和水务局启动了其 19 亿美元智慧电网战略的下一阶段,该战略涵盖 2021 年至 2035 年。

新冠肺炎疫情爆发影响到中东地区的重要产业,包括能源、食品饮料、石油等产业。石油生产和出口是中东地区经济稳定的主要来源。由于公共卫生危机导致的旅行限制,中东石油出口国面临原油价格大幅下跌的新衝击。然而,随着与疫情相关的限制措施的放鬆,预计未来几年市场将再次成长。

然而,由于该地区电子元件製造活动低迷,设备采用缓慢,抑制了市场的成长。

中东可程式逻辑控制器 (PLC) 市场趋势

石油板块占主要市场占有率

中东是世界主要产油区之一,能源蕴藏量丰富。例如,阿拉伯联合大公国持有丰富的能源蕴藏量。据石油输出国组织(OPEC)称,该国约30%的国内生产总值直接依赖石油和天然气生产。因此,大型石油和天然气产业对于 PLC 来说代表着一个巨大的市场。

在石油、天然气管道运输中,自动化系统的应用对于实现程式参数、同时监控整个线路的运作至关重要。这直接关係到管道输送的安全和稳定。

精製自动化系统旨在实现原油常压蒸馏过程的自动化,从生产渣油、柴油和汽油馏分到运送给客户。这些系统是使用一系列可程式逻辑控制器 (PLC) 和分散式控制架构实现的。

Vista Automation 是中东领先的工业自动化解决方案供应商之一,涵盖石油和天然气等广泛的应用和流程。该公司为离散、批量和连续製程提供基于 PLC/ SCADA型和 DCS 的解决方案。

此外,2022 年 5 月,阿布达比国家石油公司 (Adnoc) 宣布发现 6.5 亿桶陆上原油蕴藏量,其中包括在阿布达比最大的陆上油田 Bu Hasa 发现重要石油。预计此类发展将在未来增加对 PLC 的需求。

可再生能源将推动市场大幅成长

沙乌地阿拉伯 PLC 市场受益于政府和私人对能源和公共产业,例如 GE、伊顿、ABB 和艾默生。

此外,阿联酋2050能源策略的目标是到2050年将清洁能源在其总能源结构中的比例从25%提高到50%,同时将发电产生的二氧化碳排放减少70%。

由于电力公司希望提高效率、减少系统损耗和碳排放,预计未来十年中东地区将在智慧电网升级方面投入巨额资金。智慧电网是一种有效管理和分配太阳能、风能和氢能等可再生能源的动态解决方案。

智慧电錶是智慧电网的关键组成部分。智慧电錶是透过将PLC纳入电錶来实现的。在智慧电錶中使用 PLC 可提高通讯频宽、减少处理器扫描时间并优化吞吐量,从而提高程式码效率和效力。

此外,还利用可程式逻辑控制器(PLC)实现了双轴太阳能追踪系统。提案的系统使太阳能电池板在日出时与太阳保持一致,以最大限度地利用从太阳中提取的太阳能。在本研究中,设计并实施了采用 PLC 和直流马达的开放回路控制系统,用于太阳能电池的太阳追踪。未来对可再生能源的投资将使沙乌地阿拉伯能够满足高需求。

中东可程式逻辑控制器 (PLC) 产业概况

中东可程式逻辑控制器市场的竞争适中,由几家大公司组成。就市场占有率而言,目前少数几家大公司占据该地区主导地位。这些领先的公司凭藉着突出的市场份额,致力于扩大其在全部区域的基本客群。

2021 年 9 月—霍尼韦尔推出了新的机器人技术,旨在帮助仓库和配送中心实现手动托盘卸货任务的自动化,降低潜在伤害和劳动力短缺造成的业务风险。霍尼韦尔智慧柔性卸垛机利用机器学习以及感知和抓取技术的进步来分解托盘货物。

2021 年 4 月—罗克韦尔自动化宣布与中东领先的工业自动化解决方案供应商 Precast FZCO 建立伙伴关係。该协议将允许 Precast FZCO 在该地区销售罗克韦尔自动化的软体解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 新冠肺炎疫情对各行业的影响

第五章 市场动态

- 市场驱动因素

- 该地区石油和天然气行业的成长推动了 PLC 市场

- 各个终端使用者群体越来越多地使用自动化系统

- 市场问题

- 由于该地区製造业活动低迷,渗透率下降

- 产品客製化需求

第六章 市场细分

- 按类型

- 硬体

- 软体

- 服务

- 按最终用户产业

- 食品、烟草、食物及饮料

- 车

- 化工和石化

- 能源公共产业

- 药品

- 石油和天然气

- 其他的

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 以色列

- 阿曼

- 其他中东地区

第七章 竞争格局

- 公司简介

- ABB Ltd

- Mitsubishi Electric Corporation

- Vista Automation

- Rockwell Automation

- Siemens AG

- Honeywell International Inc.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Emerson Electric Co.(GE)

- Hitachi Ltd

- Control Tech

第八章投资分析

第九章:市场的未来

The Middle East PLC Market size is estimated at USD 348.22 million in 2025, and is expected to reach USD 351.19 million by 2030, at a CAGR of 0.17% during the forecast period (2025-2030).

The deployment of PLC systems helps identify and rectify errors and can initiate rapid responses without human intervention. Hence, these automated PLC systems can considerably reduce machine downtime. Moreover, a significant rise in industrial automation and IT infrastructure in Israel paves the way for development in the PLC market.

The growth of the oil and gas sector in the region is driving the PLC market. As per the U.S. Energy Information Administration (EIA), the Middle East includes five of the top ten oil-producing countries and is responsible for a significant share of the total oil production in the world. As per EIA, Saudi Arabia alone produces about 11 million barrels of oil per day which is nearly 11% of world output. With such high production, producers are now seeking a better solution, such as a programmable logic controller (PLC), to help them be more efficient and reduce costs. These controllers are modular, scalable, and capable of handling various communications and application support.

Increasing usage of automation systems in different end-user verticals, such as manufacturing and transportation & warehousing, construction, and utilities, is driving the market. PLC is a ruggedized computer used for industrial automation and can automate a specific process, machine function, or even an entire production line. It receives information through connected sensors or input devices, processes the data, and triggers outputs based on pre-programmed parameters.

Moreover, countries such as the United Arab Emirates are installing smart girds in cities like Dubai, which is expected to further expand the demand for PLCs. For instance, in April 2022, the Dubai Electricity and Water Authority launched the next phase of its USD 1.9 billion smart grid strategy, covering the years 2021 to 2035.

With the onset of the COVID-19 pandemic, significant industries in the Middle East, including energy, food & beverage, and oil sectors, among others, were impacted. Oil production and export are major sources of economic stabilization in the Middle East region. The oil exporters of the Middle East countries faced the additional shock of plummeting oil prices due to travel restrictions following the public health crisis. However, with the pandemic-related restrictions easing up, the market is expected to witness renewed growth in the coming years.

However, low manufacturing activities of electronic components in the region have resulted in slow adoption of the devices, which restricts the market's growth.

Middle-East Programmable Logic Controller (PLC) Market Trends

Oil Segment Accounts for Significant Market Share

The Middle East accounts for many energy reserves, among the world's top crude oil-producing regions. For instance, the United Arab Emirates holds significant energy reserves. About 30% of the country's Gross Domestic Product is directly based on oil and gas output, per the Organization of the Petroleum Exporting Countries (OPEC). Thus, large-scale oil and gas industries created a sizeable market for PLC.

In oil and gas pipeline transportation, the application of automation systems is essential to realize the process parameters while monitoring the operation of the whole line. It is directly related to the safety and stability of pipeline transmission.

Oil refinery automation systems are intended to automate crude oil atmospheric distillation processes to residual, diesel, and gasoline fractions and their shipment to customers. These systems are realized using a set of programmable logic controllers (PLC) and distributed control architecture.

Vista Automation is one of the leading Industrial Automation solutions providers in the Middle East and covers a wide range of applications and processes, including Oil & Gas. The company offers PLC/SCADA-based and DCS-based solutions for discrete, batch, and continuous processes.

Further, in May 2022, Abu Dhabi National Oil Company (Adnoc) announced the discovery of 650 million barrels of onshore crude oil reserves in Abu Dhabi, including a significant oil find at Bu Hasa, its largest producing onshore oilfield. Such developments will enhance the demand for PLC in the coming period.

Renewable Energy to Witness Significant Market Growth

The PLC market in Saudi Arabia has mostly benefited from the government and private players' investment in energy and utilities, like GE, Eaton, ABB, and Emerson, due to which there was high penetration of automation in the industries.

In addition, UAE's Energy Strategy 2050 aims to increase the contribution of clean energy in the total energy mix from 25% to 50% by 2050 while reducing the carbon footprint of power generation by 70%.

The Middle East is expected to spend heavily on upgrading smart grids in the coming decade as utilities seek to improve efficiency and reduce system losses and carbon emissions. A smart grid is a dynamic solution that effectively manages and distributes renewable energy sources such as solar, wind, and hydrogen.

Smart Meters form an important component of the smart grid. The smart meter is realized by incorporating the PLC within an electrical meter. Using a PLC within a smart meter improves communication bandwidth, lowers processor scan-time, and improves code efficiency and effectiveness by optimizing throughput.

Further, the trends toward the dual-axis solar tracking system have been implemented using a programmable logic controller (PLC). This proposed system keeps the solar panels aligned with the sun during sunrise to maximize solar power extracted from the sun. In this work, an open-loop control system has been designed and carried out using PLC and direct current motors for solar cell sun tracking. With future investment in renewable energy, Saudi Arabia caters to high demand.

Middle-East Programmable Logic Controller (PLC) Industry Overview

The Middle East Programmable Logic Controller market is moderately competitive and consists of several major players. In terms of market share, few major players currently dominate the region. These major players, with a prominent share in the market, are focusing on expanding their customer base across the middle east regions.

September 2021 - Honeywell introduced a new robotic technology designed to help warehouses and distribution centers automate the manual process of unloading pallets, reducing the operational risks of potential injuries and labor shortages. The Honeywell Smart Flexible Depalletizer uses machine learning and advances in perception and gripping technologies to break down pallet loads.

April 2021 - Rockwell Automation announced its partnership with Precast FZCO, a leading provider of industrial automation solutions in the Middle East. With this agreement, Precast FZCO is authorized to distribute Rockwell Automation's software solutions in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five. Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Oil and Gas Sector in the Region Driving the PLC Market

- 5.1.2 Increasing Usage of Automation System in Different End-user Verticals

- 5.2 Market Challenges

- 5.2.1 Slow Adoption Rate Due to Low Manufacturing Activities in the Region

- 5.2.2 Demand for Customization of Products

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By End-User Industry

- 6.2.1 Food, Tobacco, and Beverage

- 6.2.2 Automotive

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Energy and Utilities

- 6.2.5 Pharmaceutical

- 6.2.6 Oil and Gas

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Israel

- 6.3.4 Oman

- 6.3.5 Rest of Middle-East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Vista Automation

- 7.1.4 Rockwell Automation

- 7.1.5 Siemens AG

- 7.1.6 Honeywell International Inc.

- 7.1.7 Omron Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Emerson Electric Co. (GE)

- 7.1.11 Hitachi Ltd

- 7.1.12 Control Tech