|

市场调查报告书

商品编码

1644415

欧洲火力发电 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Thermal Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

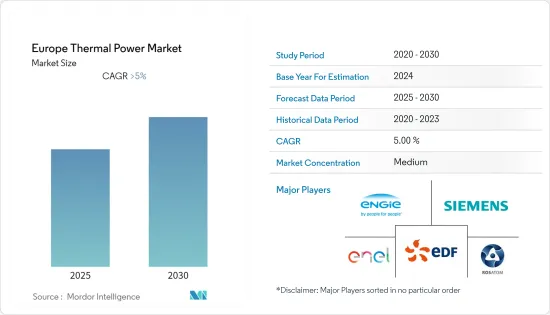

预计预测期内欧洲火力发电市场将以超过 5% 的复合年增长率成长。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从中期来看,预计电力需求的上升和燃煤发电厂的退出将增加对燃气发电的需求。预计这将在预测期内推动欧洲火力发电市场的发展。

- 另一方面,太阳能和风力发电等再生能源来源的日益普及预计将阻碍欧洲火力发电市场的成长。

- 净煤技术和即将建成的天然气发电厂预计将为未来欧洲火力发电市场提供重大机会。

- 由于能源需求和人口不断增长,预计德国将在预测期内占据市场主导地位。

欧洲火力发电市场趋势

天然气火力发电将大幅成长

- 天然气是最清洁的燃料之一,可以廉价地大规模提供电力。预计未来几十年燃气发电将取代燃煤发电。此外,预计再生能源投资将激增,这意味着燃气发电提供的灵活性仍将受到很高的需求。

- 使用天然气发电厂作为风能和太阳能等可再生能源的备用电源是采用天然气发电厂的最重要驱动因素之一。天然气发电厂可靠,因为它们可以快速启动,从而提高电网可靠性并促进市场扩张。

- 2022年2月,爱尔兰政府宣布计画在2024年新建9座燃气发电厂,以满足日益增长的电力需求,避免岛上出现电力短缺。威斯特米斯郡、戈尔韦郡和都柏林郡计划新增的发电站将在电网营运商 Eirgrid 和其北爱尔兰同行 SONI 最近联合进行的容量竞标后建造。

- 此外,天然气发电是欧洲能源结构的重要组成部分。 2021年天然气总发电量为799.3TWh,较2020年成长4.7%。然而,俄乌战争对天然气供应产生了重大影响。预计欧洲天然气发电将受到严重影响。

- 天然气具有比煤炭排放更低、比核能有害影响更小等优势,在发电市场占有率可能会成长。

德国占据市场主导地位

- 儘管德国制定了环保目标,但仍严重依赖天然气,尤其是在供暖方面。然而,该国也拥有大量以天然气为基础的发电能力,预计在预测期内将会成长。据估计,在实现气候变迁目标和摆脱煤炭和核能的同时,还需要额外增加 20-30 吉瓦的天然气发电容量来满足国内需求。

- 截至 2022 年,约有 2,720 万千瓦的燃气发电计划正在建设中,预计 2021 年至 2022 年期间还将安装 240 万千瓦的燃气发电项目。几座电厂将于 2023 年投入运作,包括大众的沃尔夫斯堡 CCGT(400 兆瓦)、Uniper 的 Scholben 装置(135 兆瓦)和 Stagg 的 Herne 6(625 兆瓦)。

- 此外,根据英国石油公司(BP)的《2021年世界能源统计评论》,2021年至2020年间,该国能源来源发电量增加了近9%。

- 此外,俄罗斯与乌克兰战争导致天然气供应不稳定,严重影响了德国。政府已经运作了该国现有的燃煤电厂。

- 例如,2022年8月,营运商Uniper宣布,位于德国北部汉诺威附近彼得斯哈根的海登核电厂计画于8月29日运作,并运作至4月底。海登发电厂的发电容量为 875 兆瓦,是德国最强大的燃煤发电厂之一。

- 因此,基于上述事实,预计德国将在预测期内占据火力发电领域的主导地位。

欧洲火力发电产业概况

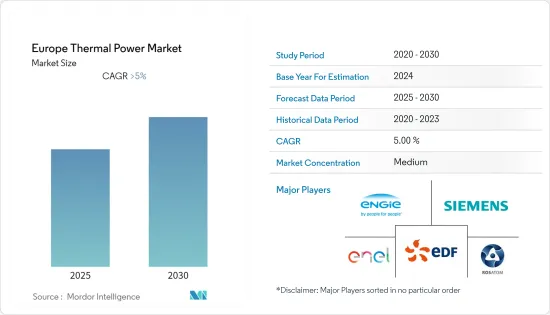

欧洲火电市场中等程度细分。市场的主要企业(不分先后顺序)包括西门子股份公司、义大利国家电力公司、法国国家电力公司、Engie SA 和俄罗斯国家原子能公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2028 年装置容量及预测(单位:吉瓦)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 来源

- 煤炭

- 天然气

- 油

- 核能

- 市场分析:2028 年前各地区市场规模及需求预测(按地区)

- 英国

- 法国

- 德国

- 俄罗斯

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Engie SA

- Enel SpA

- Rosatom State Atomic Energy Corporation

- Electricite de France SA

- Siemens AG

- Iberdrola SA

- Endesa SA

- Uniper SE

第七章 市场机会与未来趋势

简介目录

Product Code: 71635

The Europe Thermal Power Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing power demands and decommissioning coal power plants will likely increase demand for gas-powered power generation. It is expected to drive the Europe thermal power market during the forecast period.

- On the other hand, the increasing adaption of renewable energy sources like solar and wind energy is expected to hinder Europe's thermal power market growth.

- Nevertheless, clean coal technology and upcoming natural gas-fired power plants are expected to create significant opportunities in Europe's thermal power market in the future.

- Germany is expected to dominate the market during the forecasted period due to the increasing demand for energy and population.

Europe Thermal Power Market Trends

Natural Gas Based Thermal Power to Witness Significant Growth

- Natural gas is one of the cleanest fuels that can affordably supply electricity on a large scale. In the future decades, gas-fired power generation will likely displace coal capacity in the region. Furthermore, investments in renewables are predicted to skyrocket, and the flexibility provided by gas-fired power generation is expected to remain in high demand.

- Using natural gas thermal power plants as backup power for unreliable renewable sources such as wind and solar is one of the most significant factors driving their adoption. The ability of natural gas plants to initiate quickly makes them highly dependable, thus improving the reliability of the utility grid and promoting the market's expansion.

- In February 2022, the government of Ireland announced that they plan to build nine new gas-fired power plants by 2024 to meet rising electricity demand and avoid a power shortfall on the island. The proposed additional plants in Westmeath, Galway, and Dublin will be built due to a recent capacity auction undertaken jointly by the grid operator Eirgrid and its Northern Ireland equivalent, SONI.

- Moreover, Natural gas electricity generation is a significant part of the energy mix in Europe. In 2021 the total electricity generation through natural gas was recorded at 799.3 TWh, an increase of 4.7% compared to 2020. However, the natural gas supply was severely affected due to the Russia-Ukraine war. It is estimated to affect electricity generation through natural gas in Europe heavily.

- With advantages like low emissions compared to coal and fewer harms compared to nuclear, the market share of natural gas in power generation is likely to grow.

Germany to Dominate the Market

- Despite Germany's commitment to environmental goals, the country heavily relies on natural gas, particularly heating. However, the country also includes a significant capacity for natural gas-powered electricity production, which is anticipated to increase in the projected period. It is estimated that an additional 20-30 GW of gas-fired capacity will be necessary to satisfy domestic demand while meeting climate targets and transitioning away from coal and nuclear energy.

- As of 2022, there are approximately 27.2 GW of gas-powered projects in the pipeline, with an additional 2.4 GW expected to be installed between 2021 and 2022. Several plants, including VW's Wolfsburg CCGTs (400 MW), Uniper's Scholven unit (135 MW), and Steag's Herne 6 (625 MW), are scheduled to come online in 2023.

- Furthermore, according to BP's statistical review of world energy in 2021, the country's electricity generation through thermal energy sources increased by almost 9% between 2021 and 2020.

- Moreover, the irregular natural gas supply severely affected Germany due to the Russia-Ukraine war. The government reactivated the existing coal power plant facility in the country.

- For instance, in August 2022, the Heyden facility in Petershagen, near Hanover in northern Germany, was set to reopen on August 29 and remain operational until the end of April, according to operator Uniperannounced. Heyden, with a capacity of 875 MW, is one of Germany's most powerful coal-fired power stations.

- Therefore, due to the abovementioned facts, Germany is expected to dominate the thermal power segment during the forecasted period.

Europe Thermal Power Industry Overview

The Europe thermal power market is moderately fragmented. Some of the major players in the market (in no particular order) include Siemens AG, Enel S.p.A, Electricite de France SA, Engie SA, and Rosatom State Atomic Energy Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Coal

- 5.1.2 Natural Gas

- 5.1.3 Oil

- 5.1.4 Nuclear

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 United Kingdom

- 5.2.2 France

- 5.2.3 Germany

- 5.2.4 Russia

- 5.2.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 Enel S.p.A

- 6.3.3 Rosatom State Atomic Energy Corporation

- 6.3.4 Electricite de France SA

- 6.3.5 Siemens AG

- 6.3.6 Iberdrola SA

- 6.3.7 Endesa SA

- 6.3.8 Uniper SE

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219