|

市场调查报告书

商品编码

1644466

亚太企业合作:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Enterprise Collaboration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

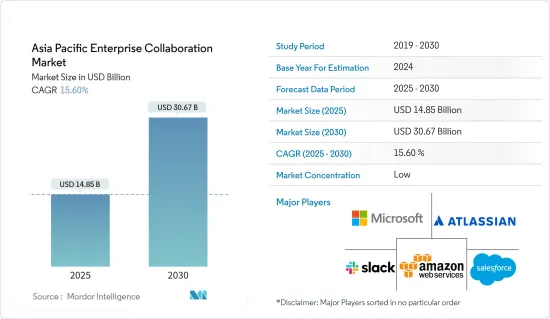

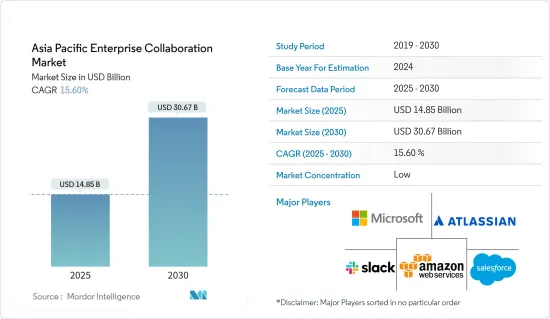

亚太企业协作市场规模预计在 2025 年为 148.5 亿美元,预计到 2030 年将达到 306.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 15.6%。

该市场的成长归功于提供最高生产力、业务敏捷性和灵活性的企业协作解决方案。

主要亮点

- 企业协作透过提供简化流程和促进协作的技术,使员工能够在职场内外互动和交流。随着劳动力变得更加分散,许多员工在远距工作,其他员工在传统办公室工作,企业可能会采用市场领先的解决方案。

- 企业协作工具使员工能够轻鬆了解和管理计划,鼓励个人责任,并建立更牢固的信任纽带。该平台为您组织内的所有沟通和团队合作需求提供了一个中心位置。透过消除具有重迭功能冗余的应用程式来提高效率。

- 由于疫情导致企业将收购新商业空间的决定推迟至少四分之一至一半,办公空间的需求可能会下降。因此,许多公司可能会继续选择 WFH 来确保业务永续营运。因此,对于提供更安全的企业对企业协作的解决方案的需求显着增加。例如,由于WFH攻势,IGEL最近透过为连接到VMware、 Citrix系统、Microsoft和Amazon的Linux OS提供数万个席位,增加了销售额。此外,亚洲对 UD Pocket 的需求从未如此高涨。

- 此外,企业协作市场收益的成长预计主要得益于行动装置使用量的不断增长,而社群网站也有望促进市场扩张。推动市场发展的关键因素是在单一空间内进行内部和外部协作的需求,以及组织越来越重视促进不同地区的多个相关人员之间的沟通和协作。

- 此外,随着印度 BFSI 行业的快速扩张,该地区的企业协作市场可能会以更快的速度成长。例如,印度国家投资委员会(Niti Aayog)报告称,印度财政部长已将2021-2022年预算中保险业的外国直接投资限额从49%提高到74%。因此,预计未来几年 BFSI 产业将实现显着成长。

- 企业协作技术非常适合从客户、合作伙伴、相关人员和供应商获取即时回馈,从而实现更有效的回应并提高创造力。科技的快速发展、新兴网站的兴起以及使用行动装置进行协作也是可能对市场扩张产生积极影响的因素。

- 企业也正关注认知协作。认知协作是透过将认知学习和资讯共用引入到每个互动领域,将人工智慧应用于业务知识和工作流程。面向客户的认知技术包括自然语言处理、预测分析和智慧路由。

- 在整个预测期内,企业对企业协作市场的成长预计会受到社群网站使用量成长的影响。此外,扩大企业协作的主要障碍预计是其高昂的实施成本以及难以避免法律和发现风险。

- 由于多个亚洲国家为对抗疫情采取了封锁和保持社交距离的策略,预计 COVID-19 疫情在全球爆发将增加员工在家工作(WFH) 的需求。在 COVID-19 疫情期间,对企业协作解决方案的需求显着增加。不同组织的员工之间的沟通需求导致了企业协作解决方案的兴起。

亚太地区企业协作市场趋势

云端基础的部署推动市场

- 企业协作解决方案已发展成为商业沟通和协作的基本组成部分。云端的扩展消除了管理内部设备的要求,并提高了办公室协作工具的可存取性。远距就业机会的发展正在推动云端协作的普及。云端运算使地理位置分散的员工能够与同事即时协作。

- 根据 Yotta 于 2020 年进行的一项调查显示,约有 37% 的印度公司将其数位基础设施託管在云端。预计到 2022 年,超过 60% 的基础设施将迁移到云端,因此无需专属式可用性和第三方託管。

- 云端基础的服务已成为组织对冲风险的可行选择。由于云端基础的EFSS 解决方案,系统的IT基础设施需要更少的资金进行更新和改进。随着电子和IT技术的快速更新,投资有可能在产生回报之前就过时。

- 预计生成的资料的稳定成长将成为云端基础的工作负载部署的主要驱动力。各行各业都处理大量资料。资料中心适合需要运行涉及各种应用程式和跨公司协作的复杂工作负载的企业。

- 此外,许多国家都有法律或政策规定某些类型的资料必须保留在特定的区域或国家边界内。中国、澳洲、香港和新加坡对政府文件和医疗记录等资讯都有资料居住法律。此外,许多专业协会,包括会计、金融、法律、抵押贷款仲介和银行业,都为其成员制定了专业标准,涵盖资料驻留要求,以管理云端服务供应商如何使用资讯并将其储存在其特定的地理管辖范围内。

- 营运商也重视认知协作,将认知学习融入业务知识和工作流程中,并应用人工智慧。例如,2021年10月,IBM 与技术业务管理 SaaS 应用程式市场领导者 Apptio 建立了合作。根据合作关係,两家公司将加速采用红帽公司 OpenShift 和 IBM 的开放混合云端方法,并协助客户增强其混合云技术决策。

- 预计产生的资料量的持续增加将成为云端基础的工作负载部署的主要驱动力。许多行业都需要处理大量资料。资料中心适合运行多个应用程式和复杂工作负载以进行企业协作的企业。它可以提高生产效率并允许所有应用工具存取即时资料。

- 此外,Google于 2022 年 3 月与印度跨国企业集团马恆达集团 (Mahindra Group) 建立合作。此次合作旨在鼓励集团各业务部门的创新。此外,作为 RISE with SAP 计画的一部分,Mahindra 将把其关键任务应用程式以及资料湖和资料仓储从其内部资料中心迁移到 Google Cloud。

零售和消费品预计将占据较大市场占有率

- 消费品需求的不断增长、电子商务的兴起以及数位转型都在推动零售业的显着增长。因此,巨量资料解决方案正被用于为该行业产生资料。实体零售店和网路商店的员工可以透过单一协作平台连接从使用者到装置移动的内容(透过文件和应用程式),从而做出更快的决策。

- 根据 HCL Tech 的资料,超过一半的零售商和雇主需要与不同部门和地理位置的个人频繁合作。使用零售企业协作解决方案的业务优势包括改善使用者体验、加快决策流程和提高沟通品质。此外,它还能提升品牌完整性,增加销售和利润。

- 加快零售、消费和物流领域的资讯流将能够及时补充库存,为商业做出巨大贡献。电子资料交换可协助供应链中的各个成员即时交换与采购、销售和采购相关的资讯。

- 零售业文件共用的企业协作使每个员工都能存取资讯以及资料和内容管理、安全和同步。这确保了持续的服务,可以随时随地解答顾客的问题并确保他们的购物车满载。

- Retail Watch 是全球零售电脑视觉解决方案和分析供应商 Traxx 推出的商店监控和智慧解决方案,已在中国正式推出。 Trax 日前在上海第二十二届中国零售业展览会(ChinaShop)上对中国市场首次发布了其全新的货架监控机器人解决方案及协作平台。

- 一些社交媒体平台还可以充当线上市场,允许用户无需离开平台即可进行购买。行动商务在全部区域越来越受欢迎,其中印尼、泰国和菲律宾的消费者对行动商务的采用率最高。随着这些发展和全球网路用户数量的不断增长,对所谓的线上协作工具(允许团队在线上交流的软体)的需求将会增加。

亚太企业协作产业概况

亚太企业协作市场竞争激烈,国内和国际市场上都有多家供应商营运。市场似乎变得分散。主要企业正在采取合併、收购和扩张的手段来扩大其地理覆盖范围并保持竞争力。市场的主要企业包括微软公司、亚马逊网路服务和 Salesforce.Com Inc.市场的最新趋势包括:

- 2024 年 1 月-Capgemini SA宣布与 AWS 达成多年期策略合作协议,旨在加速各种规模的组织采用生成式 AI 解决方案和技术。透过此次合作,Capgemini SA和 AWS 致力于协助客户实现采用生成式人工智慧的商业价值,同时克服成本、规模和信任方面的挑战。此外,透过利用Capgemini SA现有的 AWS 卓越中心 (CoE) 网络,该公司将协助联合客户将他们的投资从单独的试点和概念验证转移到生产规模。

- 2023 年 11 月 - Eviden 是 Atos 集团的一部分,是数位、云端、巨量资料和安全领域的领导者,已宣布与 AWS 达成新的策略合作协议 (SCA)。 SCA 标誌着 Eviden 和 AWS 的联合承诺,提供多方面的解决方案、咨询和创新支援计划,帮助客户快速获得其云端和 AI 转型计划所需的专业知识,并加快其价值实现时间。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 企业协作工具的演变

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- API 整合以提高效率

- 整个企业中行动装置的使用增加

- 远距工作等

- 市场挑战

- 有关资料协作的安全性问题

- 全球及亚太企业协作市场对比

- COVID-19 产业影响评估

第六章 市场细分

- 依部署类型

- 本地

- 云端基础

- 按公司规模

- 中小型企业

- 大型企业

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 卫生保健

- 零售和消费品

- 其他行业(教育、交通物流、製造业、政府机构)

- 按国家

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区(东南亚、A&Z)

第七章 竞争格局

- 公司简介

- Microsoft Corporation

- Amazon Web Services

- Atlassian Corporation PLC

- Slack Technologies Inc.

- Salesforce.Com Inc.

- Google(Workspace)

- Cisco System Inc.

- Zoho Corporation Pvt Ltd.

- Jive Software Inc.

- Asana

第八章投资分析

第九章 市场机会与未来趋势

The Asia Pacific Enterprise Collaboration Market size is estimated at USD 14.85 billion in 2025, and is expected to reach USD 30.67 billion by 2030, at a CAGR of 15.6% during the forecast period (2025-2030).

The growth of the market is attributed to the enterprise collaboration solutions' provision of maximum productivity, business agility, and flexibility.

Key Highlights

- Enterprise collaboration enables employees to interact and communicate within and outside their work environment by providing access to technology that can streamline processes and encourage collaboration. Organizations are anticipated to adopt market-leading solutions as the workforce becomes more distributed, with many workers working remotely and others from conventional offices.

- With enterprise collaboration tools, staff members can easily keep track of and manage projects, encourage individual responsibility, and build stronger bonds of trust, all of which contribute to greater transparency within the workplace. The platform provides a centralized location for all communication and teamwork requirements within the organization. It boosts efficiency by eliminating redundant applications with overlapping features.

- The office demand was likely to decline during the pandemic due to corporates delaying their decisions on new offtake of commercial spaces by at least a quarter or two. As a result, significant corporates will continue to choose WFH for their business continuity. The demand for solutions that offer safer enterprise collaboration has greatly increased as a result. For instance, Due to the WFH assault, IGEL has recently experienced increased sales, providing tens of thousands of seats for its Linux OS connected to VMware, Citrix Systems, Microsoft, and Amazon. In addition, IGEL has also experienced unprecedented demand for its UD Pocket offering in Asia.

- Additionally, the rise in market revenue for enterprise collaboration is largely due to the growing use of mobile devices, and networking websites are also expected to contribute to market expansion. The main factors propelling the market are the need to combine internal and external collaboration in a single space and organizations' increased focus on fostering communication and collaboration among multiple stakeholders across different geographies.

- Furthermore, the enterprise collaboration market in this region will grow much faster because of India's rapidly expanding BFSI sector. For instance, the Niti Aayog of India reported that the Indian Finance Minister increased the FDI cap for the insurance sector in the 2021-2022 budget from 49% to 74%. As a result, the BFSI sector is anticipated to experience significant growth over the coming years.

- Technologies for enterprise collaboration are ideal for getting real-time feedback from customers, partners, stakeholders, and vendors, enabling more effective responses and improved creativity. The rapid development of technology, the rise in networking websites, and the use of mobile devices for collaboration are additional factors likely to positively affect the market's expansion.

- The companies are also focusing on cognitive collaboration, which is applying artificial intelligence to business knowledge and workflows by bringing cognitive learning and information sharing to all areas of interactions. Cognitive-powered customer interaction technologies include Natural Language Processing, Predictive Analysis, and intelligent routing.

- Throughout the forecast period, the growth of the enterprise collaboration market is anticipated to be impacted by the increase in the use of networking websites. Moreover, the main barriers to expanding enterprise collaboration are expected to be its high implementation costs and difficulty avoiding legal and discovery risks.

- The outbreak of the COVID-19 pandemic virus worldwide was anticipated to augment the demand for employees' work from home (WFH), owing to the lockdown and social distancing strategy adopted across several counties of Asia to fight the pandemic. During the COVID-19 pandemic, the demand for enterprise collaboration solutions significantly increased. Due to the need for communication among employees in various organizations, enterprise collaboration solutions increased.

APAC Enterprise Collaboration Market Trends

Increasing Adoption of Cloud-based Deployment Drive the Market

- Enterprise collaboration solutions have evolved into foundational business communications and collaboration components. The expansion of the cloud has improved accessibility to office collaboration tools by removing the management requirements of on-premises equipment. The development of remote employment opportunities has boosted the popularity of cloud collaboration. The cloud allows geographically dispersed employees to collaborate with coworkers in real-time.

- Yotta claims that a survey carried out in 2020 revealed that about 37% of Indian businesses had their digital infrastructure housed in the cloud. By 2022, it was predicted that more than 60% of the infrastructure would be in the cloud, negating the need for captive availability and third-party co-location.

- Cloud-based services have become a viable option for assisting an organization to navigate risks. Because of cloud-based EFSS solutions, the system's IT infrastructure no longer requires as much capital to be updated and improved. The investment risks becoming outdated before it generates a return due to the rapid updating of electronic and IT technology.

- The steady increase in data generated is anticipated to serve as the primary driver of cloud-based workload deployment. Many different industry verticals deal with a massive amount of data. A data center is better suited for a company that needs to run various applications and complex workloads involving enterprise collaboration.

- In addition, many nations have laws or policies that specify certain types of data that must stay within the boundaries of a particular area or country. Data residency laws have been established in China, Australia, Hong Kong, and Singapore for information such as government documents and medical records. Furthermore, many professional associations, including those in accounting, finance, law, mortgage brokers, and banking, have professional standards for their members that cover data residency requirements to control how cloud service providers use the information and keep it within specific territorial jurisdictions.

- The businesses also emphasize cognitive collaboration, integrating cognitive learning into business knowledge and workflows to apply artificial intelligence. For instance, in October 2021, IBM partnered with Apptio, a market leader in SaaS applications for technology business management. After forming this partnership, the businesses would aid clients in promoting the adoption of Red Hat OpenShift and IBM's open hybrid cloud approach and enhancing hybrid cloud technology decision-making.

- The consistent growth in the amount of data generated is anticipated to be the primary driver of cloud-based workload deployment. Numerous industry verticals work with enormous amounts of data. A data center is better suited for a company that runs multiple applications and complex workloads for enterprise collaboration. It makes high productivity possible, and all application tools have access to real-time data.

- Additionally, Google partnered with the Indian multinational conglomerate Mahindra Group in March 2022. This partnership encouraged the group's various business units to innovate. Further, as part of the RISE with SAP program, Mahindra was expected to move its mission-critical applications from its on-premises data centers to Google Cloud, along with its data lake and data warehouse.

Retail and Consumer Goods is Expected to Account For Significant Market Share

- The growing demand for consumer goods, the volume of e-commerce, and digital transformation all contribute to the retail sector's significant growth. Big Data solutions have been used to generate data in the industry as a result of this. The physical retail or online store employees can make decisions more quickly by connecting the content moving from users, through documents or apps, to devices with a single collaboration platform.

- More than half of retailers and employers frequently need to collaborate with individuals from various departments and geographical locations, according to data from HCL Tech. The business advantages of using a Retail Enterprise Collaboration solution include improved user experience, faster decision-making processes, and improved communication quality. Additionally, brand integrity is promoted while sales and profits are increased.

- The faster transfer of information in the retail, consumer, and logistics sectors can help businesses enormously by timely replenishing the stock. Electronic data exchange can help different members of the supply chain exchange information in real-time for any procurement, sales, and purchases, thus cutting on the need for inventory stocking for a more extended period.

- Enterprise collaboration for File Sharing in retail provides data and content control, security, and synchronization, along with access to the information to all its employees. This ensures a continuous service to customers anywhere and anytime to answer their questions and fill carts.

- Retail Watch, a store monitoring and intelligence solution from Trax, a global provider of retail computer vision solutions and analytics, has officially launched in China. Trax recently debuted at the 22nd China Retail Trade Fair (ChinaShop) in Shanghai with its brand-new shelf monitoring robotic solutions and collaboration platform for the China market, developed in collaboration with the regional robotics business Ecovacs.

- Some social media platforms also function as an online marketplace, allowing users to purchase without leaving the platform. M-commerce has grown in popularity throughout the region, with Indonesian, Thai, and Filipino consumers showing the highest levels of m-commerce adoption. As a result of these developments and the growing number of internet users globally, there will be an increased demand for Software called online collaboration tools that enables teams to communicate online.

APAC Enterprise Collaboration Industry Overview

The Asia-Pacific Enterprise Collaboration Market is highly competitive due to multiple vendors operating in the domestic and international markets. The market appears to be fragmented. The significant players adopt mergers, acquisitions, and expansions to expand their geographic reach and stay competitive. Some major players in the market are Microsoft Corporation, Amazon Web Services, and Salesforce.Com Inc., among others. Some of the recent developments in the market are:

- January 2024 - Capgemini announced the signing of a multi-year strategic collaboration agreement with AWS, designed to accelerate the adoption of generative AI solutions and technologies amongst organizations of all sizes. Through this collaboration, Capgemini and AWS are focused on helping clients realize the business value of adopting generative AI while navigating challenges, including cost, scale, and trust. It will enable joint clients to move their investments from individual pilots and proof of concepts to scale production by leveraging Capgemini's existing network of AWS Centers of Excellence (CoEs).

- November 2023 - Eviden, the Atos Group business leading in digital, cloud, big data and security, announced a new Strategic Collaboration Agreement (SCA) with AWS. The SCA is a joint commitment for Eviden and AWS to deliver a multi-faceted program of solutions, consultancy, and innovation support to help customers quickly access critical expertise for cloud and AI transformation projects and increase their time to value.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Evolution of Enterprise Collaboration Tools

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers/Consumers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 API Integration for Greater Efficiency

- 5.1.2 Increase in Usage of Mobile Devices across Enterprises

- 5.1.3 Remote Working Conditions etc.

- 5.2 Market Challenges

- 5.2.1 Security Concerns in Data Collaboration etc.

- 5.2.2 Comparison of Global and Asia-Pacific Enterprise Collaboration market

- 5.2.3 Assessment of COVID-19 Impact on the industry

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Size of Enterprise

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Telecommunications and IT

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Retail and Consumer Goods

- 6.3.5 Other End-user Industry Verticals (Education, Transportation and Logistics, Manufacturing, Government)

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 South Korea

- 6.4.5 Rest of Asia-Pacific (Southeast Asia, A&Z)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Amazon Web Services

- 7.1.3 Atlassian Corporation PLC

- 7.1.4 Slack Technologies Inc.

- 7.1.5 Salesforce.Com Inc.

- 7.1.6 Google (Workspace)

- 7.1.7 Cisco System Inc.

- 7.1.8 Zoho Corporation Pvt Ltd.

- 7.1.9 Jive Software Inc.

- 7.1.10 Asana