|

市场调查报告书

商品编码

1644493

印度屋顶:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Roofing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

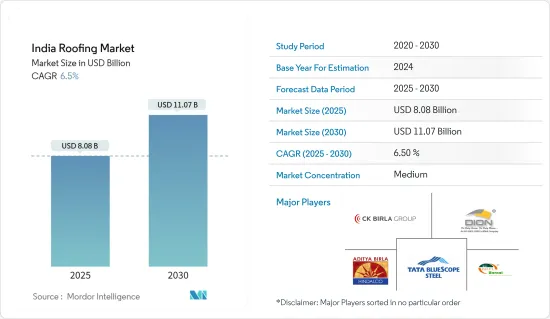

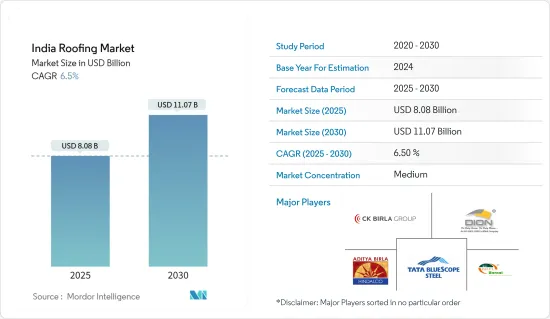

印度屋顶市场规模预计在 2025 年为 80.8 亿美元,预计到 2030 年将达到 110.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.5%。

受快速都市化、工业发展和大型基础设施计划的推动,印度屋顶材料市场正在经历强劲增长。随着政府优先考虑智慧城市、机场和高速公路等倡议,住宅、商业和工业领域对优质屋顶解决方案的需求正在飙升。为了应对这一趋势,製造商正在推出创新、耐用且节能的产品,以满足多样化的市场需求。

印度收入水准的提高促使消费者从传统屋顶材料转向更可靠的替代品,从而显着促进了市场成长。聚碳酸酯屋顶板由于易于安装在工业和大型商业建筑上而变得越来越受欢迎。聚碳酸酯屋顶材料具有很强的耐候性,具有多种纹理和设计,并且维护成本低。除了传统的应用外,它还用于天窗、游泳池、人行道、标誌等。聚碳酸酯屋顶材料用途广泛且耐用,因此用于各种用途,从而导致市场对其的需求不断增长。

据行业报告称,技术创新,尤其是新屋顶技术的出现,将推动印度屋顶市场的成长。绿色屋顶尤其引人注目,具有吸收雨水、隔热和改善美观等好处。绿屋顶不仅提高能源效率,还有助于城市生物多样性并减少城市热岛效应。此外,预计在预测期内,实现屋顶材料无缝安装和现有基础设施升级的先进机械和设备将加速市场的发展。尖端机械的整合确保了屋顶施工计划的精确性和效率,进一步促进了市场扩张。

印度屋顶市场趋势

印度蓬勃发展的建筑与城市发展:外国直接投资成长与未来前景

房地产部分包括住宅、办公、零售、旅馆、休閒公园等。同时,城市发展部分包括供水、卫生、城市交通、学校、医疗保健等。根据2023年产业报告,到2047年,印度人口预计将达到16.4亿,其中51%将居住在都市区。 2000 年 4 月至 2024 年 3 月期间,建筑业(基础设施)共吸引了 339.1 亿美元的外国直接投资(FDI)流入,成为该国最大的 FDI 接受产业之一。

根据自动化路线,已完成的城镇、商场、购物中心和商业机构的营运和管理计划允许 100% 的外国直接投资。同样,城市交通、供水、排污和污水处理等城市基础设施领域也允许透过自动途径进行 100% 的外国直接投资。

预测表明,到 2047 年,印度一半以上的人口将居住在都市区,这将增加对住宅、商业和基础设施计划的需求。此外,印度政府的优惠政策,例如允许透过自动途径进行 100% 外国直接投资 (FDI),使这些领域对全球投资者更具吸引力。随着外国直接投资稳步流入基础设施和房地产领域,印度建筑业预计将继续扩张和快速成长。

政府主导的经济适用住宅:印度屋顶材料市场的关键催化剂

根据一家领先的行业融资平台报道,2022 年国家预算强调了政府对住宅行业的承诺,向住房与城市发展部(MoHUA)拨款 5000 亿印度卢比(61114.3 亿美元),并设立 35 亿美元的基金来推动停滞的住宅计划。到 2030 年,印度的都市化预计将从 33% 上升到 40% 以上,Invest India 预计印度将需要额外 2,500 万套中檔和经济适用住宅。

2023 年,根据 Pradhan Mantri Awas Yojana (PMAY)(也称为总理住宅计划),都市区已建成 540 万套住宅。然而,到2020年,都市区贫困阶级的住宅需求预计将达到约1,100万套。

政府的承诺透过大量的财政投资和 PMAY 等项目来体现,凸显了其解决住宅短缺问题的决心。都市化的加快以及对住宅的需求不断增长,住宅这一领域成为投资和开发的有利可图的途径。但要真正满足日益增长的城市居民的住宅需求,还必须持续努力填补现有的缺口。

印度屋顶产业概况

圣戈班、Mongia Roofing、JSW Steel、Boral Roofing、Etex 和 Visaka Industries 等主要企业在国内和国际上占据主导地位。这些公司透过持续提供优质的屋顶解决方案并不断提高其市场占有率,确立了其主要企业。

金属屋顶、沥青瓦、粘土屋顶瓦、混凝土屋顶、沥青膜和绿色屋顶等多种屋顶材料正在推动市场的发展。每种材料都具有耐用性、成本效益和环境永续性等独特优势,以满足不同消费者的偏好和需求。

屋顶材料市场高度分散,既有大型製造商,也有当地供应商。这些製造商满足不同细分市场的需求,从高端屋顶材料到经济实惠的屋顶材料。这种分散性导致了竞争格局的蓬勃发展,技术创新和以客户为中心的解决方案为消费者提供了广泛的选择,以满足他们的特定需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 屋顶领域的技术创新

- 产业价值链/供应链分析

- 政府法规和倡议对建筑业的影响

- 审查并说明政府基础设施发展计划

- 地缘政治与疫情将如何影响市场

第五章 市场动态

- 市场驱动因素

- 可支配所得增加,中阶扩大

- 屋顶解决方案意识不断增强

- 市场限制

- 仿冒品伪劣屋顶材料是一大挑战

- 屋顶产业面临技术纯熟劳工短缺的问题

- 市场机会

- 快速都市化与建筑热潮

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第六章 市场细分

- 按行业

- 商业建设

- 住宅建筑

- 工业建筑

- 按材质

- 沥青

- 瓦

- 金属

- 其他的

- 按屋顶类型

- 平屋顶

- 斜屋顶

第七章 竞争格局

- 公司简介

- Tata Bluescope Steel

- CK Birla Group

- Hindalco Ind Ltd

- Bansal Roofing Products Limited

- Dion Incorporation

- Everest Industries Limited

- Moon Pvc Roofing

- Aqua Star

- Indian Roofing Industries Pvt. Ltd

- Metecno India Pvt. Limited*

- 其他公司

第八章 市场机会与未来趋势

第 9 章 附录

The India Roofing Market size is estimated at USD 8.08 billion in 2025, and is expected to reach USD 11.07 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

The Indian roofing market is experiencing robust growth, propelled by swift urbanization, industrial growth, and extensive infrastructure projects. As the government prioritizes initiatives like smart cities, airports, and highways, the demand for premium roofing solutions surges across residential, commercial, and industrial domains. In response, manufacturers are rolling out innovative, durable, and energy-efficient products tailored to diverse market demands.

In India, rising income levels are prompting consumers to shift from traditional roofing materials to more reliable alternatives, significantly driving market growth. Polycarbonate roofing sheets, favored for their easy installation in industrial and large-scale commercial buildings, are becoming increasingly popular. These sheets are weather-resistant, come in various textures and designs, and boast low maintenance costs. Beyond traditional uses, they're also employed in skylights, swimming pools, walkways, and display signboards. The versatility and durability of polycarbonate roofing sheets make them a preferred choice for various applications, contributing to their growing demand in the market.

According to an industry report, technological innovations, especially the emergence of new roofing technologies, are set to propel the growth of the roofing market in India. Notably, green roofing stands out, offering benefits like rainwater absorption, insulation, and enhanced aesthetic appeal. Green roofing systems not only improve energy efficiency but also contribute to urban biodiversity and reduce the urban heat island effect. Furthermore, the market is expected to gain momentum during the forecast period, thanks to the seamless installation of roofing components and upgrades to existing infrastructure, facilitated by advanced machinery. The integration of cutting-edge machinery ensures precision and efficiency in roofing projects, further driving market expansion.

India Roofing Market Trends

Booming Construction and Urban Development in India: FDI Growth and Future Projections

The real estate segment includes residential properties, offices, retail spaces, hotels, and leisure parks. In contrast, the urban development segment covers areas such as water supply, sanitation, urban transport, schools, and healthcare. As per industry reports from 2023, India's population was expected to reach 1.64 billion by 2047, with an estimated 51% residing in urban centers. From April 2000 to March 2024, the construction (infrastructure) sector attracted foreign direct investment (FDI) inflows totaling USD 33.91 billion, making it one of the top recipients of FDI in the country.

Under the automatic route, 100% FDI is permitted in completed projects for the operations and management of townships, malls, shopping complexes, and business constructions. Similarly, 100% FDI is also allowed for urban infrastructures, including urban transport, water supply, sewerage, and sewage treatment, all under the automatic route.

Projections indicate that by 2047, more than half of India's populace will reside in urban locales, amplifying the demand for residential, commercial, and infrastructural projects. Furthermore, the Indian government's favorable policies, such as permitting 100% Foreign Direct Investment (FDI) through the automatic route, enhance the allure of these sectors for global investors. With a steady influx of FDI into both infrastructure and real estate, India's construction landscape is primed for ongoing expansion and burgeoning opportunities.

Government-Driven Growth in Affordable Housing: A Key Catalyst for the Roofing Market in India

As reported by an industry-leading financial platform, the 2022 national budget underscored the government's commitment to the housing sector, allocating INR 50,000 crore (USD 6111.43 billion) to the Ministry of Housing and Urban Development (MoHUA) and establishing a USD 3.5 billion fund to expedite stalled housing projects. With urbanization in India projected to rise from 33% to over 40% by 2030, Invest India estimates a demand for an additional 25 million mid-range and affordable housing units.

In 2023, under the Pradhan Mantri Awas Yojana (PMAY), also known as The Prime Minister's Housing Plan, India saw the completion of 5.4 million houses in urban areas. However, in 2020, the demand for housing among the urban poor was estimated at around 11 million housing complexes.

The government's commitment is evident through substantial financial investments and programs like PMAY, underscoring its determination to address the housing shortage. As urbanization accelerates and the demand for mid-range and affordable housing intensifies, the sector emerges as a lucrative avenue for investment and development. Yet, to truly cater to the housing needs of India's burgeoning urban populace, sustained efforts are essential to bridge the existing deficit.

India Roofing Industry Overview

Leading companies, including Saint-Gobain, Mongia Roofing, JSW Steel, Boral Roofing, Etex, and Visaka Industries, hold a dominant position in the market, boasting both national and international reach. These companies have established themselves as key players by consistently delivering high-quality roofing solutions and expanding their market presence.

Diverse roofing materials, including metal roofing, asphalt shingles, clay tiles, concrete roofing, bituminous membranes, and green roofing solutions, drive the market. Each material offers unique benefits, such as durability, cost-effectiveness, and environmental sustainability, catering to the varied preferences and needs of consumers.

The roofing market exhibits high fragmentation, accommodating both large-scale manufacturers and local suppliers. These players cater to a spectrum of segments, ranging from premium to budget-friendly roofing materials. This fragmentation allows for a competitive landscape where innovation and customer-centric solutions thrive, ensuring that consumers have access to a wide range of options to meet their specific requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Innovations in the Roofing Sector

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of Government Regulations and Initiatives taken in the Construction Industry

- 4.5 Review and Commentary on the Extent of Government Infrastructure Development Schemes

- 4.6 Impact of Geopolitics and Pandemics on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Disposable Income and Middle-Class Expansion

- 5.1.2 Increased Awareness of Roofing Solutions

- 5.2 Market Restraints

- 5.2.1 The presence of counterfeit or substandard roofing materials in the market poses a significant challenge

- 5.2.2 The roofing industry faces a shortage of skilled labor

- 5.3 Market Opportunities

- 5.3.1 Rapid Urbanization and Construction Boom

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Sector

- 6.1.1 Commercial Construction

- 6.1.2 Residential Construction

- 6.1.3 Industrial Construction

- 6.2 By Material

- 6.2.1 Bituminous

- 6.2.2 Tiles

- 6.2.3 Metal

- 6.2.4 Other Materials

- 6.3 By Roofing Type

- 6.3.1 Flat Roof

- 6.3.2 Slope Roof

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tata Bluescope Steel

- 7.1.2 CK Birla Group

- 7.1.3 Hindalco Ind Ltd

- 7.1.4 Bansal Roofing Products Limited

- 7.1.5 Dion Incorporation

- 7.1.6 Everest Industries Limited

- 7.1.7 Moon Pvc Roofing

- 7.1.8 Aqua Star

- 7.1.9 Indian Roofing Industries Pvt. Ltd

- 7.1.10 Metecno India Pvt. Limited*

- 7.2 Other Companies