|

市场调查报告书

商品编码

1644506

亚太地区共享办公空间:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Co-Working Office Spaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

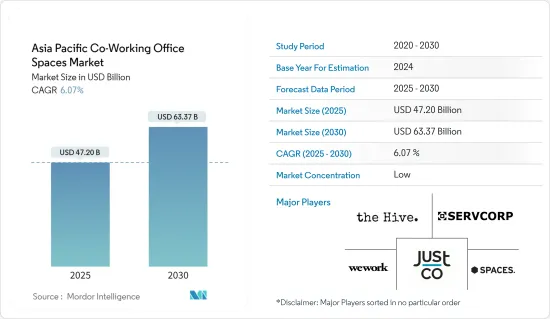

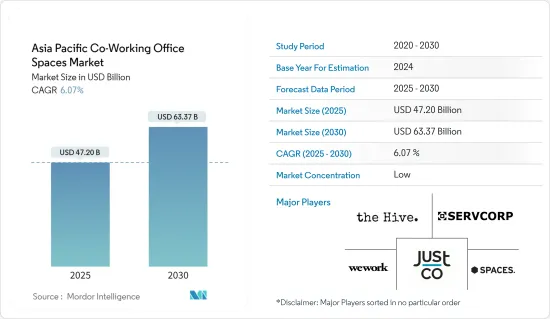

亚太地区共享办公空间市场规模预计在 2025 年为 472 亿美元,预计到 2030 年将达到 633.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.07%。

主要亮点

- 由于共享办公室理念可以降低成本、提高弹性,越来越多的企业开始采用这种理念。据预测,到2024年终,全球共享办公空间数量将达到约41,975个。

- 自由工作者、中小型企业(SME)和新兴新兴企业是共享办公空间产业的主要推动力。甚至一些大型企业也开始转向共享办公空间,因为其一流的设施和有竞争力的价格吸引了人们。资金雄厚的新兴企业大量涌现推动了该行业的快速成长。此外,中国和印度等国家的数位游民数量正在成长,进一步推动了共享办公空间的扩张。

- 根据产业组织报告显示,到2025年,亚太地区预计将拥有386万个弹性办公空间办公桌。墨尔本、新加坡、香港和孟买等主要城市处于领先地位,见证了灵活办公室和共同工作中心的显着增长。

亚太地区共享办公空间市场趋势

灵活的管理办公室推动市场成长

随着该地区对适应性工作空间的需求不断飙升,灵活的託管办公室正迅速成为优先考虑灵活性和成本效益的企业的首选解决方案。该行业的兴起是市场扩张的一个主要因素。弹性的工作方式让员工可以选择工作地点、工作时间和工作方式。提供多种工作空间类型可让公司更能掌控其团队的职场环境。

该行业组织在2024年的一项调查发现,超过60%的本地企业保持办公室出勤率稳定,显示灵活和混合模式被广泛接受为未来的常态。有趣的是,32%的公司预计其办公室使用率将增加,而只有 4% 的公司预计其办公室使用率将减少。此外,研究发现,43%的亚太公司已实现惊人的80%或以上的利用率。这些趋势为公司提供了一个机会,可以重新组织工作场所,以更好地适应不断变化的工作模式并更好地吸引顶尖人才。

各大城市都出现了灵活、管理式办公室数量的激增,新兴企业和成熟企业都倾向于选择这种办公室,以更好地容纳企划为基础的团队并促进协作。例如,根据房地产服务公司 Zoltan Properties 在 2024 年 8 月发布的报告,班加罗尔在亚太地区弹性办公空间领域名列前茅,击败了上海、首尔和东京等知名城市。到 2024 年中期,班加罗尔将拥有 1550 万平方英尺的灵活办公空间,巩固其作为寻求灵活职场环境的企业首选城市的地位。

总之,对灵活管理办公室的日益增长的偏好正在重塑市场格局。越来越多的企业采用适应性工作空间来满足员工不断变化的需求,并在动态的商业环境中保持竞争优势。

中国和日本在该领域正在经历显着的成长

由于新兴企业数量激增以及员工和企业对灵活性的需求不断增长,中国和日本的共享办公空间数量正在迅速增加。共享办公空间为传统办公室提供了一种经济高效的替代方案。值得注意的是,一些中国当地房东正在寻求进入香港的弹性工作市场,该市场迄今一直由国内外投资者主导。此举被视为进入广大办公大楼市场的低风险切入点。

在日本,共享办公空间越来越受到自由工作者、Start-Ups和中小型企业的欢迎。这些空间拥有优质的设施,例如高速网路、24 小时开放、会议室以及带家具和不带家具的选择。根据《Digital Nomads Asia》在 2024 年 10 月报道,截至 2024 年,S-Tokyo(日本桥)已成为提供满足多样化需求的独特设施的领跑者。

2024年第一季,香港中环甲级办公室平均月租金为122.59美元/平方米,是香港最昂贵的办公室。与亚太区其他大城市相比,香港甲级办公室租金排名最高。这种溢价很大程度上是由于共享办公空间在年轻、快速发展的公司中很受欢迎,尤其是在网路、数位服务和媒体等进入门槛明显较低的行业。

过去几年,共享办公空间蓬勃发展,许多自僱人士、新兴企业和小型企业充分利用了这些设施。总之,在现代企业不断变化的需求和对灵活职场环境日益增长的需求的推动下,中国和日本的共享办公空间产业有望继续成长。这一趋势可能会重塑该地区传统的办公室市场格局。

亚太地区共享办公空间产业概况

亚太地区的共享办公空间市场以全球公司和本地公司混合为主。为了满足人们对休閒办公环境日益增长的需求,许多新参与企业纷纷涌现。为了保持竞争力,公司正积极推行合作、合併和收购等成长策略。该领域的知名参与者包括 JustCo、WeWork Management LLC、Spaces 和 Hive Worldwide Ltd。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态与洞察

- 当前市场状况

- 科技趋势

- 产业价值链分析

- 政府法规和倡议

- 洞察亚太地区共享办公室新兴企业

- 市场动态

- 市场驱动因素

- 新兴企业和小型企业的崛起

- 改变职场动态

- 市场限制

- 经济不确定性

- 房地产成本高

- 市场机会

- 技术整合

- 永续性与健康

- 市场驱动因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 地缘政治与疫情将如何影响市场

第五章 市场区隔

- 按最终用户

- 资讯科技(IT 和 ITES)

- BFSI(银行、金融服务、保险)

- 商业咨询和专业服务

- 其他服务(零售、生命科学、能源、法律服务)

- 按用户

- 自由工作者

- 企业

- Start-Ups

- 其他的

- 按地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

第六章 竞争格局

- 目前市场集中度

- 公司简介

- the Hive Worldwide Ltd.

- WeWork Management LLC

- Spaces

- JustCo

- Servcorp

- Compass Offices

- The Work Project Management Pte Ltd.

- GARAGE SOCIETY

- THE GREAT ROOM

- IWG

- WOTSO Limited

- The Executive Centre

第七章:市场的未来

第 8 章 附录

- 宏观经济指标(GDP分布,依活动划分)

- 经济统计 - 运输及仓储业对经济的贡献

- 对外贸易统计 - 按商品、目的地和原产国分類的进出口数据

The Asia Pacific Co-Working Office Spaces Market size is estimated at USD 47.20 billion in 2025, and is expected to reach USD 63.37 billion by 2030, at a CAGR of 6.07% during the forecast period (2025-2030).

Key Highlights

- Corporate companies are increasingly embracing the coworking concept, driven by reduced costs and enhanced flexibility. Projections indicate that by the end of 2024, the global tally of coworking spaces will reach approximately 41,975.

- Freelancers, small and medium-sized enterprises (SMEs), and emerging startups are the primary drivers of the co-working space sector. Even large corporations are increasingly turning to co-working spaces, attracted by their premium facilities at competitive prices. The rapid growth of the sector can be attributed to a surge in well-funded startups. Additionally, the rising population of digital nomads in nations such as China and India further propels the expansion of co-working spaces.

- The Asia-Pacific region, demonstrating a strong interest in flexible office spaces, is home to nearly one-third of all co-working spaces globally.As reported by Industry Associations, projections indicate that by 2025, the Asia-Pacific region will boast 3.86 million flexible workspace desks. Major cities like Melbourne, Singapore, Hong Kong, and Mumbai are at the forefront, witnessing significant growth in flexible and co-working office centers.

APAC Co-Working Office Spaces Market Trends

Flexible Managed Offices Propel Market Growth

As demand for adaptable workspaces surges in the region, flexible managed offices are becoming the go-to solution for businesses prioritizing agility and cost-effectiveness. This sector's rise is a key driver of the market's expansion. Flexible work empowers employees with choices about where, when, and how they operate. By offering diverse workspace types, companies grant their teams enhanced control over their work environments.

In 2024 Industry Association survey indicates that over 60% of regional companies have stabilized their office attendance, signaling a broad acceptance of flexible and hybrid models as the future norm. Interestingly, while 32% of firms foresee an uptick in office usage, a mere 4% predict a decline. Furthermore, the survey notes that 43% of Asia Pacific firms have hit an impressive utilization rate of 80% or more. Such trends offer companies a chance to realign their workplaces with shifting work styles, enhancing their appeal to top talent.

Major cities are witnessing a surge, with both startups and established firms gravitating towards flexible managed offices to better accommodate project-based teams and promote collaboration. For example, Bengaluru has taken the lead in the Asia Pacific's flexible office space arena, surpassing renowned cities like Shanghai, Seoul, and Tokyo, as highlighted by Zoltan Properties (a real estate service company) in August 2024. With a commanding 15.5 million square feet of flexible office space by mid-2024, Bengaluru cements its status as the go-to city for businesses in search of adaptable work environments.

In conclusion, the growing preference for flexible managed offices is reshaping the market landscape. Companies are increasingly adopting these adaptable workspaces to meet evolving employee needs and stay competitive in a dynamic business environment.

China and Japan Witnessing Significant Growth in the Sector

China and Japan are witnessing a swift rise in the number of co-working spaces, driven by the surge of start-ups and a growing demand for flexibility among employees and companies. Co-working spaces offer a cost-effective alternative to traditional offices. Notably, many landlords from mainland China are eyeing entry into Hong Kong's flexible working market, a domain historically ruled by local and international investors. This move is seen as a low-risk gateway to the expansive office market.

In Japan, co-working spaces are increasingly favored by freelancers, start-ups, and small to medium-sized enterprises (SMEs). These spaces boast premium features, including high-speed internet, round-the-clock access, meeting rooms, and both furnished and unfurnished options. As of 2024, S-Tokyo (Nihobashi) has emerged as a frontrunner, offering distinctive amenities tailored to diverse needs, as highlighted by Digital Nomad Asia in October 2024.

In Q1 2024, Hong Kong's Central district recorded an average monthly rent of USD 122.59 per square meter for grade A office spaces, making it the priciest office real estate in the city. When stacked against other major cities in the Asia-Pacific, Hong Kong's grade A office rents topped the charts. This premium is largely attributed to the popularity of co-working spaces among youthful, burgeoning businesses, especially in sectors like internet, digital services, and media, where entry barriers are notably low.

Co-working office spaces have seen a meteoric rise over the years, with a significant chunk of independent contractors, nascent businesses, and SMEs making the most of these facilities. In conclusion, the co-working space sector in China and Japan is poised for continued growth, driven by the evolving needs of modern businesses and the increasing demand for flexible working environments. This trend is likely to reshape the traditional office market landscape in the region.

APAC Co-Working Office Spaces Industry Overview

The Asia-Pacific co-working office space market features a mix of global and local players. Responding to the surging demand for casual office environments, numerous newcomers are making their mark. To secure a competitive edge, companies are actively pursuing growth strategies, including partnerships, mergers, and acquisitions. Notable players in this arena encompass JustCo, WeWork Management LLC, Spaces, and Hive Worldwide Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

- 4.5 Insights on Co-working Start-ups in Asia-Pacific

- 4.6 Market Dynamics

- 4.6.1 Market Drivers

- 4.6.1.1 Grwoth of Startups and SMEs

- 4.6.1.2 Changing Workplace Dynamics

- 4.6.2 Market Restraints

- 4.6.2.1 Economic Uncertainty

- 4.6.2.2 High Real Estate Costs

- 4.6.3 Market Opportunities

- 4.6.3.1 Technology Integration

- 4.6.3.2 Sustainability and Wellness

- 4.6.1 Market Drivers

- 4.7 Industry Attractiveness- Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Information Technology (IT and ITES)

- 5.1.2 BFSI (Banking, Financial Services, and Insurance)

- 5.1.3 Business Consulting & Professional Services

- 5.1.4 Other Services (Retail, Lifesciences, Energy, Legal Services)

- 5.2 By User

- 5.2.1 Freelancers

- 5.2.2 Enterprises

- 5.2.3 Start Ups

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Australia

- 5.3.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Current Market Concentration

- 6.2 Company Profiles

- 6.2.1 the Hive Worldwide Ltd.

- 6.2.2 WeWork Management LLC

- 6.2.3 Spaces

- 6.2.4 JustCo

- 6.2.5 Servcorp

- 6.2.6 Compass Offices

- 6.2.7 The Work Project Management Pte Ltd.

- 6.2.8 GARAGE SOCIETY

- 6.2.9 THE GREAT ROOM

- 6.2.10 IWG

- 6.2.11 WOTSO Limited

- 6.2.12 The Executive Centre*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin