|

市场调查报告书

商品编码

1644528

风力发电机叶片回收:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Wind Turbine Blade Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

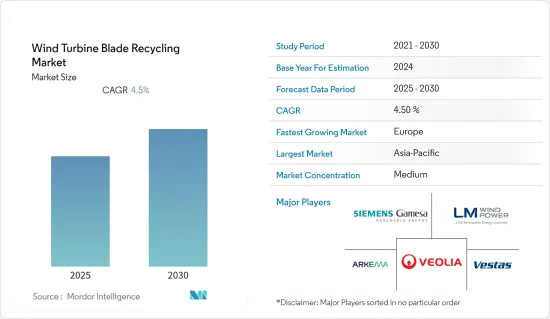

预计预测期内风力发电机叶片回收市场的复合年增长率将达到 4.5%。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 从长远来看,越来越多的海上和陆上风力发电厂即将除役,预计将推动市场成长。

- 另一方面,风力发电机叶片回收过程中出现的环境和经济因素正在阻碍市场的成长。

- 剑桥大学最近的一项研究估计,到2050年将产生4,300万吨风力发电机叶片废弃物。预计这将在不久的将来为风力发电机叶片回收市场创造充足的机会。

- 预测期内,欧洲风力发电机叶片回收市场可能会显着成长,这主要归功于政府对该全部区域风力发电机叶片回收的积极倡议。

风力发电机叶片回收市场趋势

热化学回收製程(热解)将主导市场

- 风力发电是当今成长最快的能源来源之一,可以成为解决石化燃料短缺和气候变迁问题的宝贵且经济的永续解决方案。截至2021年,全球风电装置容量为837GW。风力发电不会排放二氧化碳排放,大约 85% 的涡轮机零件(包括钢材、铜线、电子设备和齿轮)都可以回收或再利用。

- 根据欧盟最近的指令,混合废弃物的回收和再利用可能是最好的选择,而掩埋则是最后选择。

- 热化学回收受到领先公司的青睐,因为它是一种先进的技术,可以使用热方法或化学方法来回收增强纤维并分解基质(通常是热固性材料)。

- 2022 年 10 月,热解公司 Carbon Rivers 将一项从退役风力发电机叶片中回收机械完整的玻璃纤维的工艺商业化。该计划由美国能源局(DOE) 资助并与田纳西大学合作进行,成功扩大了捕获过程的规模,能够转移数千吨原本要送往掩埋的废弃物。

- 此外,2022 年 3 月,考纳斯理工大学 (KTU) 和立陶宛能源实验室发明了一项透过热化学回收製程回收风力发电机叶片的技术。

- 鑑于上述情况,热化学回收(热解)製程是主导风力发电机叶片回收市场的最佳技术。

欧洲可能主导市场

- 欧洲是世界上风电装置容量最大的地区之一。该地区是世界领先的海上和陆上风电生产区之一。最近,该公司一直致力于关闭大部分老化的风电场。

- 作为其中的一部分,欧洲各国政府于 2021 年 6 月宣布,该地区将在 2025 年前每年淘汰约 25,000 吨叶片,到 2030 年前每年淘汰 52,000 吨叶片。总部位于布鲁塞尔、致力于推动欧洲风能利用的组织「欧洲风能组织」呼吁,到2025年,禁止掩埋废弃的风力发电机。该倡议还包括欧洲风能产业对所有废弃叶片进行回收、再利用和再生利用的承诺。该禁令将于2025年生效。这将很快带动风力发电机叶片回收市场的成长。

- 此外,2022年10月,西班牙宣布的首个叶片回收工厂计划得到了欧盟(EU)的认可,参与该计划的财团获得了超过1,200万欧元的奖励。新的回收工厂将建在莱昂的库比略斯德尔西尔 (Cubillos del Sil),这是 Endesa 对目前正在拆除的 Compostilla 发电厂未来规划的一部分。

- 此外,包括德国、英国和西班牙在内的许多国家都承诺不会在欧洲以外地区除役欧洲製造的叶片。西班牙是欧洲第二大风力发电市场,并与欧洲风能协会 (WindEurope) 共同参与此倡议。奥地利、德国、芬兰和荷兰已经禁止掩埋。

- 鑑于上述情况,预测期内欧洲很可能主导风力发电机叶片回收市场。

风力发电机叶片回收产业概况

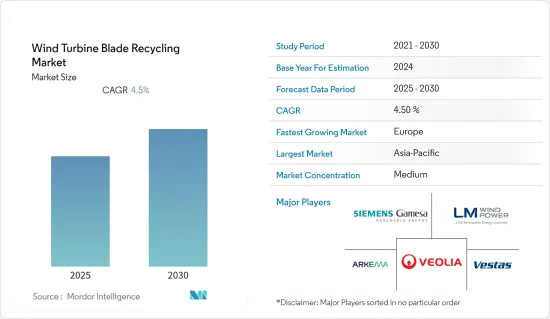

风力发电机叶片回收市场适度细分。主要企业(不分先后顺序)包括 LM Wind Power(通用电气再生能源业务部门)、西门子歌美飒再生能源公司、维斯塔斯风力系统公司、威立雅环境公司和阿科玛公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 风力发电机叶轮价格分析

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 刀片材质

- 碳纤维

- 玻璃纤维

- 其他刀片材料

- 再生利用型

- 实体回收

- 热化学回收(热解)

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- LM Wind Power(通用电气再生能源业务)

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- Veolia Environnement SA

- Arkema SA

第七章 市场机会与未来趋势

第 8 章 此列表并不详尽。

第九章 在公共领域发表

简介目录

Product Code: 90605

The Wind Turbine Blade Recycling Market is expected to register a CAGR of 4.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the increasing number of offshore and onshore wind energy plants for decommissioning is expected to drive the growth of the market.

- On the other note, rising environmental and economic factors due to the wind turbine blade recycling process are hampering the market's growth.

- Nevertheless, according to a recent survey by the University of Cambridge, it is estimated that 43 million tonnes of wind turbine blade waste will be generated by the year 2050. This will create ample opportunities for the wind turbine blade recycling market in the near future.

- Europe is likely to witness significant growth in the wind turbine blade recycling market during the forecast period, mainly due to its favorable government initiatives toward wind turbine blade recycling across the region.

Wind Turbine Blade Recycling Market Trends

Thermo-Chemical Recycling Process (Pyrolysis) to the Dominate the Market

- Wind energy is nowadays one of the energy sources with the fastest growth rate, and it can represent a valuable and economically sustainable solution to the problems of the shortage of fossil fuels and climate change. Global wind energy installed capacity accounted for 837 GW as of 2021. It is carbon-free, and about 85% of turbine components, including steel, copper wire, electronics, and gearing, can be recycled or reused.

- Recycling and reusing composite waste is probably the best choice based on the recent EU directives, while landfilling is the last option.

- Major companies are preferring for thermochemical recycling since it is an advanced technique in which the recovery of the reinforcing fibers through thermal or chemical methods and the matrix (generally with thermosetting nature) is decomposed.

- In October 2022, Carbon Rivers, Inc., a company involved in pyrolysis, commercialized its process to recover mechanically intact glass fiber from decommissioned wind turbine blades. The project is funded by the United States Department of Energy (DOE) in collaboration with the University of Tennessee and successfully scaled up a recovery process that has the capability to divert thousands of tons of waste that would otherwise be destined for landfills.

- Moreover, in March 2022, Kaunas University of Technology (KTU) and the Lithuanian Energy Institute invented a technique for recycling wind turbine blades through a thermochemical recycling process, which involves the breaking of composite materials into basic parts, i.e., fiber and phenol using pyrolysis, this method is essentially waste-free.

- Owing to the above points thermochemical recycling (pyrolysis) process is the best technique that dominates the Wind Turbine Blade Recycling Market.

Europe is Likely to Dominate the Market

- Europe has one of the largest wind power installed capacities across the globe. The region is rich in offshore and onshore wind energy generation across the globe. Recently, it has aimed to decommission most of its aged wind plants.

- As a part of this, on June 2021, European Government announced that the region will decommission around 25,000 tonnes of blades per year by 2025 and 52,000 tonnes a year by 2030. Also, WindEurope, an association based in Brussels that promotes the use of wind power in Europe, has called on landfills to ban decommissioned wind turbine blades by 2025. The initiative includes the commitment of the European wind industry to recycle, reuse or reclaim all decommissioned blades. The ban will become effective by 2025. This, in turn, culminates in the growth of the wind turbine blade recycling market shortly.

- Moreover, in October 2022, The first blade recycling plant project presented in Spain received recognition from the European Union, granting more than EUR 12 million to the consortium in which the project is immersed. The new recycling plant that will be located in Cubillos del Sil (Leon) is part of Endesa's Future Plan for the Compostilla thermal power plant currently being dismantled.

- Furthermore, many countries such as Germany, the United Kingdom, and Spain have pledged not to decommission European blades outside of Europe. Spain is the second-largest market for wind energy in Europe, joining Wind Europe in this initiative. There is already a ban on landfills in Austria, Germany, Finland, and the Netherlands.

- Owing to the above points, Europe is likely to dominate the wind turbine blade recycling market during the forecast period.

Wind Turbine Blade Recycling Industry Overview

The Wind Turbine Blade Recycling Market is moderately fragmented. Some of the major companies (in no particular order) include LM Wind Power (a GE Renewable Energy business), Siemens Gamesa Renewable Energy SA, Vestas Wind Systems A/S, Veolia Environnement S.A., and Arkema S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Wind Turbine Rotor Blades Price Analysis

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Blade Material

- 5.1.1 Carbon Fiber

- 5.1.2 Glass Fiber

- 5.1.3 Other Blade Materials

- 5.2 Recycling Type

- 5.2.1 Physical Recycling

- 5.2.2 Thermo-Chemical Recycling (Pyrolysis)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LM Wind Power (a GE Renewable Energy business)

- 6.3.2 Siemens Gamesa Renewable Energy SA

- 6.3.3 Vestas Wind Systems A/S

- 6.3.4 Veolia Environnement S.A

- 6.3.5 Arkema S.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 List Not Exhaustive

9 Subject to Availability on Public Domain

02-2729-4219

+886-2-2729-4219