|

市场调查报告书

商品编码

1644529

德国设施管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Germany Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

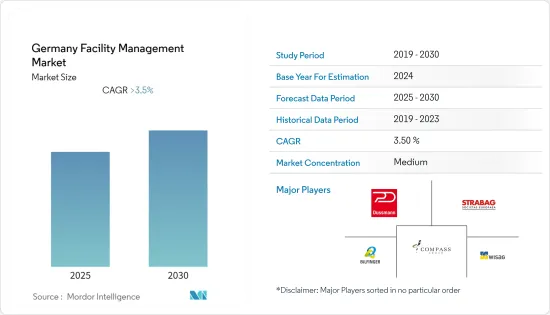

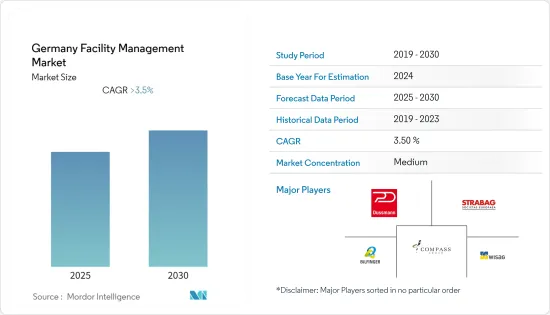

预计预测期内德国设施管理市场将以超过 3.5% 的复合年增长率成长。

主要亮点

- 预计商业房地产投资的增加将推动该地区对设施管理服务的需求。从新兴国家最近的发展也可以看出这一点。例如,2021 年 8 月,Google在柏林-勃兰登堡开设了一个新的 Google Cloud 区域,并正在推进其可再生能源投资计画。该公司计划进一步投资德国向数位化和永续经济的转型。该公司计划在 2030 年之前在数位基础设施和清洁能源方面投资约 10 亿欧元。

- 此外,快速的基础设施发展和对综合设施管理服务的日益关注预计将在未来几年对德国设施管理市场产生积极影响。

- 此外,设施经理的角色越来越受到关注,并且正在从业务角色转变为策略角色。 COVID-19 疫情为设施管理者提供了一个机会,让他们将新的办公环境和员工在家工作的需求融入公司文化。但也希望供应商能更遵守规定。重点可能更多地放在品质和结果上,而不是固定的时间表上。

德国设施管理市场趋势

对客製化解决方案的需求不断增加

- 外包设施管理的潜在收入庞大,但欧洲各地服务的商品化使得有机成长变得困难。专注于生产力、使用者体验和永续性的服务整合和高级咨询服务可能会主导这项业务。据世邦魏理仕集团称,科技正在推动人们对託管工作空间和共同工作的兴趣,60%的占用者认为服务式办公室将在未来三年内在管理他们的住宿需求方面发挥作用。

- 共享办公室类似于託管工作空间,由第三方提供空间和设施,涉及多个组织、企业和个人共用一个空间。共享办公室革命反映了专业人士和创意人士对自主性、非等级制、灵活性和社区性日益增长的需求。

- 德国设施管理服务的成长是由对客製化内部和外包设施管理解决方案的不断增长的需求所推动的。此外,大城市商业大楼和住宅数量的增加也推动了全国对设施管理服务的需求。基础设施的快速发展和对整合性机构管理服务的日益关注预计将对市场产生积极影响。

- 此外,2021年7月,英特尔宣布将投资200亿美元,于2021年初在比利时、德国、法国和荷兰开始兴建8座晶片製造工厂。这些发展为供应商提供设施管理保全服务创造了更多机会。总体而言,该地区的製造业正在扩张,预计将推动设施管理的需求。

扩大商业设施投资

- 据房地产公司第一太平戴维斯称,2021 年上半年,德国商业房地产投资额约为 229 亿欧元。第二季的投资额为130亿欧元,为德国自新冠疫情爆发以来的第二高季度水平,但仍比疫情爆发前五年的季度平均水平低17%左右。

- 因此,商业房地产投资的不断增长预计将增加该地区对设施管理服务的需求。从该地区最近的发展就可以看出这一点。例如,2021年8月,Google在柏林-勃兰登堡开设了一个新的Google Cloud区域,并计划投资可再生能源。该公司计划进一步投资德国向数位化和永续经济的转型。该公司计划在 2030 年之前在数位基础设施和清洁能源方面投资约 10 亿欧元。

- 儘管围绕着混合工作方式存在着许多争论,但拥有长期租户的现代化办公室仍然受到投资者的追捧。行业领袖的商业敏锐度不断提高,以及经济从汽车行业向其他管道的多元化,预计将增加该国对设施管理服务的需求。

- 此外,2021年10月,能源和通讯领域独立的多技术服务供应商SPIE与西门子能源续签了未来三年的伙伴关係。这家多技术服务供应商将负责西门子能源占用的385,000平方公尺办公室和生产空间的技术设施管理。

德国设施管理产业概况

德国设施管理市场竞争激烈,公司规模各异。随着各组织继续进行策略性投资以抵消目前正在经历的经济放缓,预计该市场将见证多起合作、合併和收购。该地区的客户正在采用 FM 服务来提高其业务营运的便利性。该市场包括主要的解决方案和服务供应商,例如 Strabag SE、Bilfinger SE、Dussmann Group、Wisag Facility Service Holding GmbH 和 Compass Group PLC。

- 2022 年 2 月-Bilfinger 与 Rocktech Lithium 签署谅解备忘录,在德国建立工厂。根据备忘录,比尔芬格将承担工程、采购和施工管理服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 设施管理商品化的趋势日益明显

- 加大商业设施投入

- 市场挑战

- 宏观环境持续变化

第六章 市场细分

- 设施管理类型

- 内部设施管理

- 外包设施管理

- 单调频

- 捆绑 FM

- 整合调频

- 依产品类型

- 硬体维修

- 软调频

- 按最终用户

- 商业的

- 公共利益

- 公共/基础设施

- 产业

- 其他的

第七章 竞争格局

- 公司简介

- Strabag SE

- Bilfinger SE

- Dussmann Group

- Compass Group PLC

- Wisag Facility Service Holding GmbH

- Vinci SA

- Spie Group

- Aramark

- Cushman & Wakefield PLC

- ISS Facilities Services Inc.

- Sodexo Inc.

- Apleona GmbH

- Kotter GmbH & Co. KG

- Koberl Group

- VertiGIS

第八章投资分析

第九章:市场的未来

The Germany Facility Management Market is expected to register a CAGR of greater than 3.5% during the forecast period.

Key Highlights

- The growing investments in commercial properties are expected to increase the region's demand for facility management services. It is quite evident with the recent developments happening in the country. For instance, in August 2021, Google is opening a new Google Cloud region in Berlin-Brandenburg, with investment plans in renewable energy. The company plans to further invest in Germany's transition to a digital and sustainable economy. The company plans to invest approximately EUR 1 billion in digital infrastructure and clean energy by 2030.

- Additionally, rapid infrastructure development and the rising focus on integrated facility management services are anticipated to positively influence the German facility management market over the coming years.

- Further, the facility manager's role is growing more notable and changing from operational to strategic. This COVID-19 pandemic is an opportunity for the facility manager to consolidate the new office environment and the demands of employees in terms of working from home in the corporate culture. Though, more compliance is anticipated, also concerning suppliers. The focus will be more on quality and results and smaller on a fixed schedule.

Germany Facility Management Market Trends

Increasing Demand for Customized Solutions

- Despite the tremendous income potential of outsourced FM, services are becoming more commoditized across Europe, and organic growth is difficult to come by. Service integration and advanced advisory services focusing on productivity, user experience, and sustainability will become the norm in the business. According to CBRE Group, technology is fueling interest in managed workspace and co-working, with 60% of occupiers believing serviced offices will play a part in managing their accommodation needs in the next three years.

- Co-working will entail numerous organizations, businesses, and individuals sharing space, similar to managed workspace, where a third party provides space and facilities. As it has been labeled, the co-working revolution reflects a growing demand among professionals and creatives for autonomy, a lack of hierarchy, flexibility, and community.

- The growth in German facility management services is attributed to the increasing demand for customized in-house and outsourced facility management solutions. Moreover, the rising number of commercial and residential buildings in major cities pushes the demand for facility management services across the country. Rapid infrastructure development and the rising focus on integrated facility management services are anticipated to positively influence the studied market.

- Further, in July 2021- Intel announced to invest of USD 20 billion to begin constructing eight chip plant facilities in Belgium, Germany, France, and the Netherlands in early 2021. Such developments are driving more opportunities for vendors to have security services for facility management. Overall, with increased expansion of manufacturing facilities in the region is expected to drive the demand for facility management.

Growing Investments in Commercial Properties

- According to Savills, a real estate company, approximately EUR 22.9 billion was invested in German commercial property during the first half of 2021. With EUR 13 billion, the investment volume in Q2 was the second-highest of any quarter since the country's outbreak of the Covid-19 pandemic but remained around 17% below the five-year average quarterly volume before the pandemic.

- Thus, the growing investments in commercial properties are expected to increase the region's demand for facility management services. It is quite evident with the recent developments happening in the region. For instance, in August 2021, Google is opening a new Google Cloud region in Berlin-Brandenburg with investment plans in renewable energy. The company plans to further invest in Germany's transition to a digital and sustainable economy. The company plans to invest approximately EUR 1 billion in digital infrastructure and clean energy by 2030.

- Modern offices with long-term tenants remain highly sought-after by investors despite all the discussions surrounding hybrid working. The growing business acumen among industry leaders and diversification of the economy from automobile industries to other avenues is expected to increase the demand for facility management services in the country.

- Moreover, in October 2021, SPIE, an independent multi-technical services provider in energy and communications, renewed its partnership with Siemens Energy for the coming three years. The multi-technical service provider will be responsible for the technical facility management of 385,000 square meters of office and production space occupied by Siemens Energy.

Germany Facility Management Industry Overview

The Germany Facility Management Market is moderately competitive with diverse firms of different sizes. This market is anticipated to encounter several partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns they are experiencing. The clients in this region are employing FM services to increase the ease of their business operations. The market comprises key solutions and service providers, such as Strabag SE, Bilfinger SE, Dussmann Group, Wisag Facility Service Holding GmbH, and Compass Group PLC.

- February 2022 - Bilfinger signed a memorandum of understanding (MoU) with Rock Tech Lithium on the construction of the German facility. According to the MoU, Bilfinger would be overtaking engineering, procurement, and construction management services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend Toward Commoditization of Facility Management

- 5.1.2 Growing Investments in Commercial Properties

- 5.2 Market Challenges

- 5.2.1 Ongoing Changes in Macro-environment

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offering Type

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Strabag SE

- 7.1.2 Bilfinger SE

- 7.1.3 Dussmann Group

- 7.1.4 Compass Group PLC

- 7.1.5 Wisag Facility Service Holding GmbH

- 7.1.6 Vinci SA

- 7.1.7 Spie Group

- 7.1.8 Aramark

- 7.1.9 Cushman & Wakefield PLC

- 7.1.10 ISS Facilities Services Inc.

- 7.1.11 Sodexo Inc.

- 7.1.12 Apleona GmbH

- 7.1.13 Kotter GmbH & Co. KG

- 7.1.14 Koberl Group

- 7.1.15 VertiGIS