|

市场调查报告书

商品编码

1644650

亚太可程式逻辑控制器 (PLC):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia-Pacific Programmable Logic Controller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

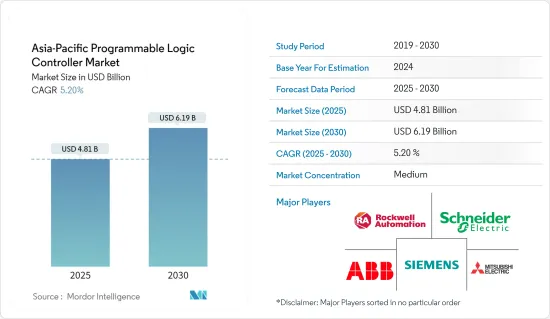

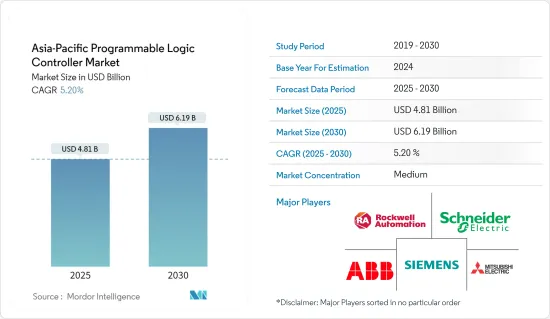

亚太地区可程式逻辑控制器 (PLC) 市场规模预计在 2025 年为 48.1 亿美元,预计到 2030 年将达到 61.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

PLC 是控制自动化机械的主要计算系统。该系统还可以帮助检测错误和缺陷并向技术人员发出警报。由于体积小,PLC 系统也比继电器和开关盒等传统系统更受欢迎。 PLC 的另一个优点是其多功能性,这是由于其可编程的特性,允许它们根据应用用于多种操作。

主要亮点

- 对于任何生产线来说,PLC 都至关重要,随着第四次工业革命的进展,互联网连接的传感器和系统正在与它们协同工作。例如,在生产巧克力或烘焙原料的食品和饮料製造工厂中,追踪混合物中的所有化学物质并监测锅炉故障等关键事件非常重要。近年来,机器人已经能够直接处理精緻的食品。新型改进的夹持器技术和创新视觉系统的出现彻底改变了这个产业。例如,模仿人类触觉的夹持技术的改进使得机器人能够包装水果和蔬菜。

- 工业控制系统的采用,以及许多公司提供多样化的解决方案,正在推动印度市场的扩张,而印度市场则是由最近的技术创新定义的。例如,Delta电子销售一系列自动化产品和解决方案,包括人机介面、感测器和机器人。 2021 年 3 月,ABB 印度公司报告称,其在印度基于 PLC 的太阳能发电厂自动化方面已累积实现 5 吉瓦的里程碑。

- 日本正努力充分利用物联网、人工智慧、巨量资料等第四次工业革命的技术创新,实现「社会5.0」。为了实现这一目标,政府建立了「互联产业」。这是一个新的框架,期望工业透过连结现代生活的各个方面,包括人、机器、系统和商业,为社会问题开发创新的解决方案。这些政策可能会推动所研究的市场。

- 对于高压操作设备的需求使得奈米 PLC 成为离散领域甚至小型企业的热门选择。由于在高电压下易于控制,固定奈米 PLC 被用于转换器、逆变器和其他基础控制器等电子应用。此外,除了即时约束之外,PLC 能够以出色的可靠性和性能执行一系列任务,再加上其承受极端温度、湿度、振动和电气噪音的能力,这些都促进了 PLC 在各种工业应用中的采用。

- 最近的冠状病毒疫情对全球经济造成了严重破坏,大大改变了许多行业的日常业务。随着在家工作通讯协定的实施和就地避难令的持续,相关市场的参与者已经评估并重新评估了他们的网路事件准备和回应策略。对于部署工业控制系统 (ICS) (PLC) 来监控和控制关键设备和流程的企业来说尤其如此。

亚太可程式逻辑控制器 (PLC) 市场趋势

汽车产业正在推动显着成长

- 在汽车领域,PLC 用于以灵活、耐用、易于可程式设计的控制器取代硬连线继电器逻辑系统。例如。据日本汽车工业协会称,日本汽车製造商预计2021年在海外生产汽车约1646万辆,高于去年的1538万辆。这比美国产量高出一倍以上。如此巨大的产量可能会为该地区所研究的市场创造成长机会。

- 成功整合汽车製造中的各个自动化阶段将为供应链创造价值,从而带来长期竞争力并降低价格。根据落基山研究所 (RMI) 和 NITI Aayog 的数据,到 2030 年,印度的电动车金融产业规模预计将达到 370 亿印度卢比(500 亿美元)。根据印度能源储存联盟的一项研究,到 2026 年,印度电动车市场预计将以 36% 的复合年增长率成长。

- 现代等品牌一直在大力投资智慧运输解决方案,以保持领先于竞争对手。随着汽车变得越来越聪明、连网程度越来越高,拥有专门从事机器人和人工智慧的公司将在长期内带来巨大的资产。 2021年6月,现代汽车宣布从Softbank Corporation手中收购了波士顿动力公司的控股权。该交易对这家美国机器人开发商的估值为 11 亿美元,现代持有80% 的股份,Softbank Corporation仍持有20% 的股份。这将使当地企业能够开发新产品或将新功能融入现有产品以满足客户需求。

- 机器停机时间是影响汽车製造业效率的关键因素之一。根据 ISA.org(国际自动化协会)的资料,停机时间占营运期间生产损失的 5-20%。使用自动化 PLC 系统可将机器停机时间从 20% 减少到 4%。减少系统停机时间的需求日益增长,推动了市场的成长。它的功能使得 PLC 比传统的个人电脑 (PC) 和工作站领域更具独特性。 PLC 可实现公司内部和公司之间的快速资料共用。这种快速的资料共用有助于减少停机时间,因为 PLC 可以自动化 FTP、Web 伺服器、国际资料库和电子邮件传输。

- I/O 模组是一种与电脑(例如 PLC)之间传输资料的装置。感测器和致动器等现场设备的增加增加了对 I/O 模组的需求。感测器讯号代表製程变数(例如液体流量),由输入 I/O 模组转换并存储在 PLC 中。致动器从 I/O 模组接收操作讯号。

中国是推动市场发展的地区之一

- 该地区的公司正在开发新产品以满足广泛的客户需求。例如,2021年7月,上海宝信软体股份有限公司推出了自主研发的巨型可程式逻辑控制器(PLC)产品。宝信软体自主研发的巨型PLC产品是工业控制系统的关键元件。经过10年的潜心研究,宝信终于掌握了精密控制、高速通讯的技术难题。

- 此外,该地区的公司正在增强产品系列,以满足不同终端用户的需求。例如,SINOVO PLC 是一种可程式逻辑记忆体控制器,在许多应用中使用。工具工具机、纺织、包装、印刷、塑粒、造纸、製药、石油、工业、电梯、提昇机、电缆、陶瓷、楼宇自控、风扇泵、车辆、轨道运输、CNC工具工具机等系统与控制设备均采用SINOVO电气产品。

- 所研究的市场受到工业生产和电脑及软体投资的严重影响。这些 PLC 系统传统上一直是製程和离散工厂自动化的基础。工业 4.0 在各个工业领域的日益广泛应用正在扩大所研究的市场。

- 工厂自动化的需求包括对自动化生产线和供应链的需求,这推动了工厂自动化产业的发展,并得到有利的投资支持。该国有多项投资,主要主要企业在该地区设立机构,创业投资向潜在的新兴企业注入资金,以进一步促进所研究市场的成长。例如,2021 年 4 月,生产工业机器人的新兴企业Yuibot 在由Softbank Corporation亚洲创投公司和其他公司主导的资金筹措中完成了 1,547 万美元的投资。该公司 80% 的年收益来自中国,并计划利用这笔资金资助研发。

- 2021年12月,中国发布智慧製造五年规划,承诺2025年完成大规模製造业的数位化。依规划,到2025年,中国70%以上的大型企业要数位化,在全国打造500家以上製造业示范基地。 《策略》也指出,智慧製造设备、工业软体技术水准及市场竞争力明显提升,市场满足率分别达70%以上、50%以上。

亚太可程式逻辑控制器 (PLC) 产业概况

亚太地区可程式逻辑控制器(PLC)市场是一个中等竞争的市场。市场参与者正在透过合作、合併和大量的研发投资来创新先进的产品。

- 2022年1月-自动化专家ABB与中国主要汽车零件供应商华域汽车宣布成立合资企业,推动中国汽车产业下一代智慧生产。该合资企业将在两家公司现有的成功伙伴关係关係的基础上进一步发展,为华域汽车中国业务的灵活和永续汽车零件生产带来重大发展。

- 2021年2月-Honeywell与山东电力建设公司(SEPCO)签署合同,为萨勒曼国王国际海事工业和服务综合体造船厂提供综合控制、通讯、安全和安保系统。包括 ControlEdge 可程式逻辑控制器 (PLC)、资料集中器、安全管理器 SC 和 Experion 製程知识系统 (PKS) 监控和资料撷取 (SCADA) 系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 价值链分析

- 评估新冠肺炎对市场的影响

第五章 市场动态

- 市场驱动因素

- 汽车产业越来越多地采用可程式逻辑控制器 (PLC) 系统

製造业的技术进步

- 市场限制

- 部署成本高

第六章 市场细分

- 按类型

- 硬体和软体

- 大型 PLC

- 奈米PLC

- 小型 PLC

- 中型PLC

- 软体

- 其他类型

- 按服务

- 硬体和软体

- 按最终用户

- 食品、烟草、食物及饮料

- 车

- 化工和石化

- 能源与公共产业

- 纸浆和造纸

- 石油和天然气

- 用水和污水处理

- 药品

- 其他最终用户产业

- 按地区

- 印度

- 中国

- 日本

- 其他亚太地区

第七章 竞争格局

- 公司简介

- ABB Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Rockwell Automation

- Siemens AG

- Honeywell International Inc.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Emerson Electric Co.(GE)

- Hitachi Ltd

- Toshiba International Corporation

第八章投资分析

第九章:未来市场展望

The Asia-Pacific Programmable Logic Controller Market size is estimated at USD 4.81 billion in 2025, and is expected to reach USD 6.19 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

PLC is the primary computing system that controls automated machines. The system also helps detect any errors or flaws and alerts the technician. PLC systems are also preferred over traditional systems, like relays and switch boxes, due to their compact sizes. Another advantage of PLCs is their multi-functionality, owing to their programmable nature that can be used for multiple operations depending on the application.

Key Highlights

- PLCs are crucial to any production line, and as the fourth industrial revolution, more internet-connected sensors and systems are interfacing with PLCs. For instance, in a food and beverage manufacturing facility that produces ingredients for chocolate or baking, it is important to track all chemicals in a mixture and monitor critical events, such as a faulty boiler. In recent years it has become possible for robots to handle delicate food items directly. The arrival of new and improved gripper technology and innovative vision systems has transformed the industry. For instance, improvements in gripper technology that mimics human touch make it possible for robots to pack fruits and vegetables.

- The adoption of industrial control systems, with many businesses offering diverse solutions, has aided the market's expansion in India, defined by recent innovations. For example, Delta Electronics sells various automation products and solutions, such as human-machine interfaces, sensors, and robots. In March 2021, ABB India reported that it had attained a cumulative 5-gigawatt milestone in providing PLC-based solar plant automation in India.

- Japan intends to attain "Society 5.0" by fully leveraging the fourth industrial revolution's technology innovation, such as IoT, AI, and Big Data. To achieve this, the government established 'Connected Industries,' a new framework in which industries are expected to develop innovative solutions to societal problems by connecting many aspects of modern life, such as persons, machines, systems, and businesses. Such policies will drive the studied market.

- Due to the demand for high-voltage operating devices, Nano PLCs have also been a popular choice among discrete sectors and small businesses. Because of its simplicity of control at high voltages, fixed nano PLCs are employed in electronic applications like converters, inverters, and other base controllers. Furthermore, PLCs' ability to perform a single set of tasks with superior reliability and performance, except under real-time constraints, combined with their ability to withstand extreme temperatures, humidity, vibration, and electrical noise, has propelled PLCs' adoption in a variety of industrial applications.

- The recent coronavirus outbreak has been causing significant disruption to the global economy and has drastically changed how many industries operate daily. With work-from-home protocols implemented and shelter-in-place orders continue to propagate, allied market players evaluated and revised their preparedness and response strategies for cyber-incidents. This is particularly evident for players that have implemented industrial control systems (ICS) (PLC) to monitor and control critical equipment and processes.

APAC Programmable Logic Controller Market Trends

Automotive Industry Driving Significant Growth

- PLCs are used in the automotive sector to replace hard-wired relay logic systems with flexible, durable, and easily programmable controllers. For instance. According to Japan Automobile Manufacturing Association, In 2021, Japanese automakers are expected to produce roughly 16.46 million automobiles outside of Japan, up from 15.38 million in the previous year. This was more than double the amount produced in the United States. Such Huge production will create an opportunity for the studied market to grow in the region.

- Successful integration of different automation stages in the automobile manufacturing industry leads to value creation in the supply chain, which ensures a long-term competitive edge and price reduction for the domain. India's EV finance industry is expected to reach INR 3.7 lakh crore (USD 50 billion) by 2030, according to Rocky Mountain Institute (RMI) and NITI Aayog. According to a survey by the India Energy Storage Alliance, the EV market in India is expected to grow at a CAGR of 36% until 2026.

- A brand like Hyundai has been investing heavily in smart mobility solutions to stay ahead of its competitors. With cars becoming smarter and more connected, having a company specializing in robotics and AI can be a great asset in the long run. In June 2021, Hyundai Motor Company recently confirmed that they had bought a controlling interest in Boston Dynamics from SoftBank. According to the deal, the American robotics developer has been valued at USD 1.1 billion, and Hyundai has 80 % shares while SoftBank still owns 20%. This will provide local players to develop new products or incorporate new features in the existing products to cater to the need of the customer.

- Machine downtime is one of the significant factors that impact the automobile manufacturing efficiency of an industry. According to data from ISA.org ( International Society of Automation), it has been observed that downtime is responsible for 5-20% of the manufacturing losses incurred during operation. Machine downtime can be reduced from 20% to 4% by using automated PLC systems. The increased need for reducing system downtime is driving the growth of the market studied. Their capabilities make PLCs more exclusive than conventional personal computers (PCs) and workstation arenas. The PLCs can share data rapidly within and between companies. This rapid data sharing has helped reduce downtime as PLCs can automate the FTP and web servers, international databases, and email sending.

- I/O modules are devices that transfer data to or from a computer, such as a PLC. The growing field devices such as sensors and actuators drive the need for I/O modules. The sensor signal representing a process variable such as liquid flow is converted by an Input I/O module and stored in the PLC. The actuator receives an operating signal from an I/O module.

China is one of the Region Driving the Market

- The Firms in the region are developing new products to carter the wide range needs of the customer. For instance, in July 2021, Shanghai Baosight Software Co Ltd launched a huge programmable logic controller product that was created in-house. Baosight Software independently studied and created the huge PLC product, a crucial component in industrial control systems. Baosight has finally conquered the technology problems in precise control and high-speed communication after a decade of dedicated research.

- Furthermore, The companies in the region are enhancing their product portfolio to meet the demands of different end users. For Example, SINOVO PLC is a programmable logic memory controller with many applications. Machine tool, textile, package, printing, plastic cerement, paper-making, pharmacy, petroleum, chemical industry, elevator, hoisting machines, cables, ceramics, building automation, fan pumps, vehicles, rail transit, CNC machine tools, and other systems and control equipment all use SINOVO electric products.

- The market studied is strongly impacted by the industrial output and the investment funneled into computers and software. These PLC systems have traditionally been the foundation of process and discrete factory automation. The growing adoption of Industry 4.0 across the industrial verticals augmented the market studied.

- The demand for factory automation includes the demand for automated production lines and supply chain and has driven it towards the factory automation sphere and has been supported by favorable investments. Several investments mark the country to further the growth of the studied market, with major key players expanding into the region and the injection of funds by venture capitalists into the emerging start-ups with potential. For instance, in April 2021, Youibot, a start-up company that makes industrial robots, closed an investment of USD 15.47 million in the funding round led by SoftBank Ventures Asia alongside others. The company generates 80% of its annual revenue in China and has plans to spend the raised funds on research and development.

- In a drive to boost the sector's technology and market competitiveness in a new phase of severe global competition in advanced manufacturing, In December 2021, China launched a five-year plan for smart manufacturing, promising that large manufacturers will complete digitalization by 2025. According to the plan, more than 70% of large-scale Chinese firms should be digitalized by 2025, and more than 500 demonstration manufacturing facilities will be created around the country. Also, according to the strategy, intelligent manufacturing equipment and industrial software's technological level and market competitiveness should be significantly increased, with market satisfaction rates exceeding 70% and 50%, respectively.

APAC Programmable Logic Controller Industry Overview

The Asia-Pacific Programmable Logic Controller Market is a moderately competitive market with significant players like ABB Ltd., Mitsubishi Electric Corporation, Schneider Electric SE, Rockwell Automation, etc. The players in the market are innovating advanced products through collaborations, mergers, and extensive R&D investments.

- January 2022- ABB, an automation expert, and HASCO, China's significant automotive components supplier, announced the formation of a joint venture to push China's automotive industry's next generation of smart production. The joint venture will build on the two businesses' current successful partnership, resulting in the vital development of highly flexible and sustainable car parts production within HASCO's China operations.

- February 2021- Honeywell agreed to offer integrated control, telecommunications, safety, and security systems to the King Salman International Complex for Maritime Industries and Services shipyard under a deal with SEPCO Electric Power Construction Corporation (SEPCO). ControlEdgeProgrammable Logic Controllers (PLCs), Data Concentrators, Safety Manager SCs, and Experion Process Knowledge System (PKS) Supervisory Control and Data Acquisition (SCADA) systems are all included.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased deployments of programmable logic controller system in automotive industry.

- 5.1.2

Technological advancements in manufacturing industry.

- 5.2 Market Restraints

- 5.2.1 High Cost of Adoption

6 MARKET SEGEMENATION

- 6.1 By Type

- 6.1.1 Hardware and Software

- 6.1.1.1 Large PLC

- 6.1.1.2 Nano PLC

- 6.1.1.3 Small PLC

- 6.1.1.4 Medium PLC

- 6.1.1.5 Software

- 6.1.1.6 Other Types

- 6.1.2 Services

- 6.1.1 Hardware and Software

- 6.2 By End User

- 6.2.1 Food, Tobacco, and Beverage

- 6.2.2 Automotive

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Energy and Utilities

- 6.2.5 Pulp and Paper

- 6.2.6 Oil and Gas

- 6.2.7 Water and Wastewater Treatment

- 6.2.8 Pharmaceutical

- 6.2.9 Other End-user Industries

- 6.3 By Geography

- 6.3.1 India

- 6.3.2 China

- 6.3.3 Japan

- 6.3.4 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Schneider Electric SE

- 7.1.4 Rockwell Automation

- 7.1.5 Siemens AG

- 7.1.6 Honeywell International Inc.

- 7.1.7 Omron Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 Robert Bosch GmbH

- 7.1.10 Emerson Electric Co. (GE)

- 7.1.11 Hitachi Ltd

- 7.1.12 Toshiba International Corporation