|

市场调查报告书

商品编码

1644663

安全应用影像感测器:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Image Sensor for Security Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

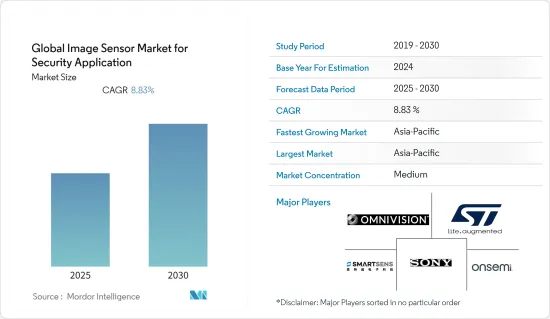

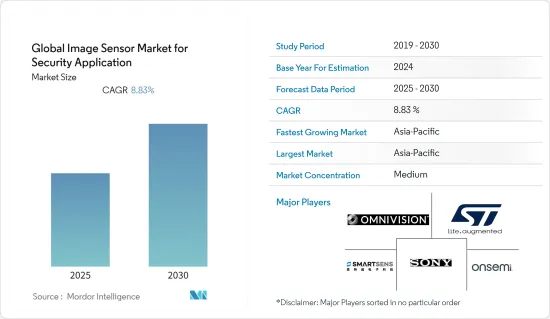

预测期内,全球安全应用影像感测器市场预计将以 8.83% 的复合年增长率成长。

政府机构和军队长期以来一直采用高速影像来实现更好的监视。此外,各地区犯罪率的大幅上升也是推动市场成长率的主要因素之一。

多CIS摄影机、人工智慧(AI)和3D感测的快速应用正在提高摄影机产品的价值。门禁、智慧门锁、脸部认证付款、人数统计和防追踪功能都受益于安全影像。处理和计算方面需要更小的微影术特征,以提供足够的运算能力和可接受的功耗。产品创新的大幅增加将进一步推动安全应用对影像感测器的需求。

例如,领先的先进数位成像技术製造商 Omnivison Technologies, Inc. 推出了其 OS02G10 安全影像感测器,该感测器为需要 1080p 解析度和卓越低照度像素性能的主流、大容量保全摄影机提供产品。 OS02G10 具有 2.8 微米像素和 OmniPixel 3-HS 架构,可提供高量子效率和出色的信噪比,从而提供一流的低照度影像。与OmniVision上一代主流安防感测器相比,其SNR1提高了60%,功耗降低了40%。此影像感测器采用 12 吋晶圆製造,而不是通常用于 2MP、1080p 感测器的供不应求的8 吋晶圆。随着消费级物联网保全摄影机和低端工业和商业监控系统市场的不断发展,这将有助于确保这种最受欢迎的解析度的效率。

由于新冠疫情导致的全球供应链中断,为製造业带来了负面影响,进而影响了家用电子电器与产业领域。 COVID-19 疫情对 CIS 行业影响不大,在某些情况下甚至使它们受益,例如安全和计算。 COVID-19 疫情刺激了对 2.5D 和 3D 成像系统等非接触式门禁解决方案的需求,从而导致智慧建筑显着增长,甚至增加了商业和消费领域对智慧门锁的兴趣。

安防应用影像感测器的市场趋势

智慧城市需求不断成长

摄影机和处理平台不断改进,为广泛的行业提供可靠且经济高效的嵌入式视觉解决方案。为了提高自动化程度,成像解决方案被应用于各种应用领域。智慧城市和智慧监控是其两个主要应用。在智慧城市中,摄影机将用于监控轨道和隧道状况、监控停车场、侦测抢劫、控制交通、监视人员和车辆等。例如,SONY基于人工智慧的影像感测器正在远景能源在罗马开展的三个智慧城市试点计画中使用。

科技先进的城市正在使用物联网 (IoT) 平台来监控城市基础设施并管理从交通流量和停车到水和空气品质的一切。这些城市正在利用由此产生的智慧资料来制定以环境永续性为中心的长期规划决策。随着世界走向都市化,我们可以预见在不久的将来会看到许多智慧城市计画和计划出现。

由于都市化加快以及管理基础设施和资产的需要,世界各国都在投资智慧城市计划。印度的智慧城市计画在 2021-22 年联邦预算中获得了 8.68 亿美元的拨款,高于 2021 财年的 4.57 亿美元。

此外,边缘分析是伺服器或云端基础的分析的有用补充。使用影像感测器的相机内分析可以在捕捉影像后快速分析影像,从而提高速度和准确性,同时还可以产生有用的元资料。透过将其与影像资料结合併在资料中心或云端进行评估,可以发现大量新的见解。

亚太地区可望创下最快成长

由于拥有大型製造业,亚太地区是全球安全影像感测器市场成长最快的地区。中国、日本、台湾和韩国是少数主导半导体製造业并因此影响市场的国家。中国经济和全球电子市场份额不断扩大,是亚太地区成长速度最快的国家。中国是电子产品生产大国和消费大国。

在政府倡议的推动下,印度的智慧城市也正在兴起。据预测,智慧城市将包括监视、维护、监控等电子解决方案。根据smartcities.gov.in报道,中央政府已拨款9.77亿美元用于建造60个这样的智慧城市。

根据IoT News报道,到2030年,亚太地区将占全球智慧家庭的25%以上,销售额将达1,200亿美元。日本目前是该地区的市场领导之一。该地区对CMOS影像感测器的需求预计将受到智慧家庭发展的推动。

韩国也安装各种监控设备,加强安全保障。每年,政府都会出于安全原因在公共场所安装CCTV摄影机。据韩国行政安全部称,2021 年全国公共场所共安装了 187,883 台新CCTV摄影机。随着监视录影机系统变得越来越普及,对影像感测器的需求预计会增加。

安全应用影像感测器产业概述

安全应用影像感测器市场竞争激烈,许多公司都向国内和国际市场供应产品。为了在竞争中生存并扩大市场范围,知名公司正在实施产品创新、业务扩展和合作等策略。主要参与者包括 Omnivision、STMicroelectronics NV、Sony Corporation、SK Hynix, Ltd 和安森美半导体公司。最近的市场发展包括:

2022年1月-SK海力士开始量产0.7吋影像感测器,使其在全球影像感测器产业与SONY和三星电子并驾齐驱。该公司最近开始量产与SONY产品类似的0.75百万像素影像感测器。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 波特五力分析

- 购买者和消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 边缘运算的出现是安全产业的关键

- 智慧城市需求不断成长

- 市场限制

- 大型晶片影像感测器製造成本高

第六章 市场细分

- 按应用

- 消费级相机

- 商务用相机

- 基础设施摄影机

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Omnivision Technologies Inc.

- ST Microelctronics

- Semiconductor Components Industries, LLC

- Sony Semiconductor Solutions Corporation

- SmartSens Technology(Shanghai)Co., Ltd.

- SK Hynix Inc.

- Galaxycore

- Canon Inc.

- Panasonic Holdings Corporation

- Toshiba Corporation

第八章投资分析

第 9 章:未来趋势

The Global Image Sensor Market for Security Application Industry is expected to register a CAGR of 8.83% during the forecast period.

Government agencies and military forces have long employed high-speed imagery for better surveillance. The significant growth in the crime rates across the regions is also one of the primary factors contributing to the market growth rate.

The rapid penetration of multiple-CIS cameras, artificial intelligence (AI), and 3D sensing is improving the value of camera products. Access control, smart door locks, face payments, people counting, and anti-tailgating features have all benefited from security imaging. Smaller lithographic features are required on the processing and computing sides to provide appropriate calculation power at tolerable power consumption. The significant rise in product innovations are further set to boost the demand for image sensors in security applications.

For instance, Omnivison Technologies, Inc., a prominent manufacturer of advanced digital imaging technologies, has launched the OS02G10 security image sensor, which provides products for mainstream, high-volume security cameras that require 1080p resolution and exceptional low-light pixel performance. The OS02G10 contains a 2.8-micron pixel built on the OmniPixel 3-HS architecture, which features high quantum efficiency and an excellent signal-to-noise ratio for best-in-class low-light images. It boasts a 60% higher SNR1 and a 40% lower power consumption than OmniVision's previous-generation mainstream security sensor. This image sensor is made with 12" wafers, rather than the 8" wafers that are in short supply but are generally used for 2MP, 1080p sensors. This enables the firm to better ensure the efficiency of this resolution, which continues to be the most popular in the constantly developing market for consumer-grade IoT security cameras and low-end industrial and commercial surveillance systems.

With the disruption in the global supply chains due to COVID-19, the manufacturing sector has had a negative impact, which has subsequently impacted the consumer electronics and industrial sectors. The COVID-19 scenario had little impact on the CIS industry, and in some cases, such as security and computing, it even benefited. The COVID-19 pandemic has spurred demand for touchless access control solutions, such as 2.5D and 3D imaging systems, resulting in strong growth in smart buildings and even a growing interest in smart door locks in both commercial and consumer sectors.

Image Sensor for Security Application Market Trends

Growing Demand From Smart Cities

Cameras and processing platforms are continually improving to provide dependable and cost-effective embedded vision solutions in a variety of industries. To improve automation, imaging solutions are used in a variety of applications. Smart cities or smart surveillance are two of the main uses. In smart cities, cameras are used to monitor track and tunnel conditions, monitor parking lots, detect burglars, control traffic, and monitor people and cars. For instance, Envision's three smart city trials in Rome are powered by Sony AI-based image sensors.

The Internet of Things (IoT) platforms are being used by technologically advanced cities to monitor city infrastructures and manage everything from traffic flows and parking to water and air quality. These cities are tackling longer-term planning decisions centered on environmental sustainability using the smart data generated as a result. As the world moves toward urbanization, many smart city initiatives and projects will emerge in the near future.

As a result of increasing urbanization and the necessity to manage infrastructure and assets, countries all over the world are investing in smart city projects. The Smart Cities Mission in India has been granted USD 868 million in the Union Budget 2021-22, up from USD 457 million in FY21.

Additionally, Edge analytics is a useful addition to server and cloud-based analytics. While analytics in the camera deploying image sensors improves speed and accuracy by analyzing images rapidly after they are captured, it also generates useful metadata. Numerous new insights can be discovered when this is integrated with image data and evaluated in a data center or the cloud.

Asia-Pacific Region is Expected to Register the Fastest Growth Rate

Asia-Pacific is the fastest-growing area in the global image sensor market for security applications due to the presence of a large manufacturing sector. China, Japan, Taiwan, and South Korea are among a few countries that dominate the semiconductor manufacturing industry, thereby impacting the market. China has the fastest growth rate among Asia-Pacific countries, owing to its expanding economy and global electronics market share. China is a major producer and consumer of electronic goods.

As a result of government initiatives, India is also seeing an increase in the number of smart cities. Electronic solutions for surveillance, maintenance, monitoring, and other reasons are projected to be included in smart cities. According to smartcities.gov.in, the central government has allocated USD 977 million to the development of 60 such smart cities.

According to IoT news, the Asia-Pacific area will account for more than 25% of worldwide smart homes by 2030, with sales reaching USD 120 billion. Currently, Japan is one of the region's market leaders. The region's need for CMOS image sensors is projected to be driven by the deployment of smart homes.

South Korea has also been rendered secure through the installation of a range of monitoring devices. Every year, the country's government installs CCTV cameras in public locations for safety reasons. According to the Ministry of Interior and Safety (South Korea), 187,883 new CCTV cameras were installed in public places in the country in 2021. The need for image sensors is expected to rise as surveillance camera systems become more prominent.

Image Sensor for Security Application Industry Overview

The image sensors market for security applications is competitive due to the existence of numerous companies in the industry who supply their products in both domestic and international markets. To remain ahead of the competition and expand their market reach, prominent businesses are implementing strategies such as product innovation, expansions, and partnerships. Omnivision, STMicroelectronics NV, Sony Corporation, SK Hynix, Ltd, and ON Semiconductor Corporation are among the major participants. The following are some recent market developments:

January 2022-SK Hynix began mass-production of 0.7 image sensors, putting it in rivalry with Sony and Samsung Electronics in the global image sensor industry. The company has recently started mass production of 0.7 50-million-pixel image sensors, which are similar to Sony goods.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Emergence of Edge Computing is Key for the Security Industry

- 5.1.2 Growing Demand from Smart Cities

- 5.2 Market Restraints

- 5.2.1 High Manufacturing Costs of Large Chip Image Sensors

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Consumer Cameras

- 6.1.2 Commercial Cameras

- 6.1.3 Infrastructure Cameras

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Omnivision Technologies Inc.

- 7.1.2 ST Microelctronics

- 7.1.3 Semiconductor Components Industries, LLC

- 7.1.4 Sony Semiconductor Solutions Corporation

- 7.1.5 SmartSens Technology (Shanghai) Co., Ltd.

- 7.1.6 SK Hynix Inc.

- 7.1.7 Galaxycore

- 7.1.8 Canon Inc.

- 7.1.9 Panasonic Holdings Corporation

- 7.1.10 Toshiba Corporation