|

市场调查报告书

商品编码

1644821

北美交流 (AC) 马达:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Alternating Current (AC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

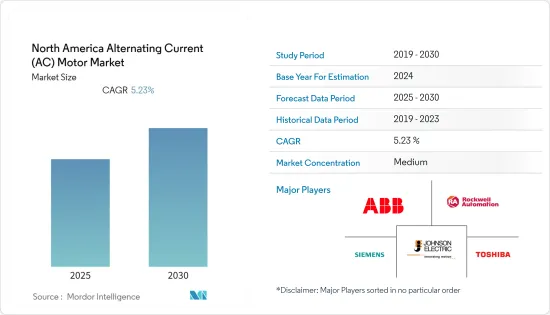

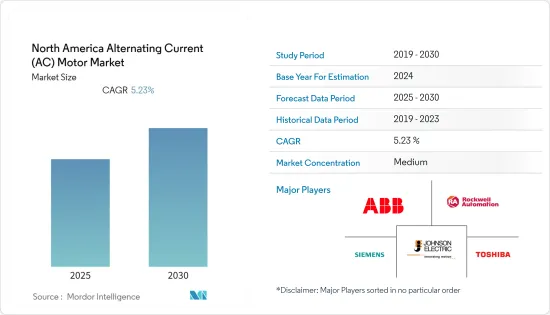

预测期内,北美交流电机市场预计复合年增长率为 5.23%

关键亮点

- 该地区自动化程度的不断提高对交流马达市场的需求做出了巨大的贡献。由于贸易紧张和新冠肺炎疫情的影响,製造业正在离客户更近。公司正在寻求透过自动化进行近岸外包来解决供应链问题。

- 美国统计数据显示自动化如何帮助企业恢復工作。根据美国先进自动化协会(A3)统计,2021年第三季美国机器人订单较2020年同期成长了35%。非汽车领域订单占比超过一半。

- 食品业製造商越来越多地使用自动化来遵守行业法规和要求,以维持产品品质。例如,食品药物管理局的《食品安全现代化法案》(FSMA)颁布立法,要求主要食品製造商遵守预防措施和现行良好生产规范(CGMPS)标准。

- 新冠肺炎疫情为商人带来了征兆:製造业衰退。中国交流电机销售大幅放缓,扰乱了一系列应用领域的供应链,包括设备、包装材料、原材料和其他工厂供应。

北美交流马达市场趋势

预计石油和天然气产业将占主要份额

- 石油和天然气行业是 2021 年市场的主要股东,由于交流马达的大量部署,预计在预测期内将保持其地位。在石油和天然气产业中,陆上和海上钻井作业依靠钻井设备从储存中提取石油和天然气。

- 钻井设备使用马达作为动力来源,这些马达必须承受石油和天然气环境中特有的振动、极端温度、持续衝击、腐蚀环境和其他恶劣条件。在陆上和海上钻井作业中,感应电动机和同步发电机为各种用途提供电力。

- 过去十年,石油和天然气行业对自动化的依赖不断增加,导致该行业多次宣布裁员,并导致市场相关人员技术纯熟劳工短缺。因此,美国石油和燃气公司越来越依赖自动化来确保流程顺利完成。近年来,美国原油、液化天然气(LNG)和成品油出口持续成长,符合新政府「美国能源主导」的口号。

- 2018年,美国超越沙乌地阿拉伯成为全球最大原油生产国,并维持此地位至2020年。美国和其他国家生产的原油由美国炼油厂获得。原油由多家公司供应至全球市场。

- 大约有 100 个国家生产原油。 2021年,五个国家占全球原油产量的51%左右,其中美国占14.5%。美国32 州和沿海水域均产有原油。 2021年,五个州的原油产量占美国原油总产量的71%以上。 (资料来源:美国能源资讯署)

- 此外,美国是该地区工业机器人的最大消费国,占该地区总安装量的79%。预计这些因素将在预测期内大幅推动该国的市场成长率。

预计美国将实现大幅成长

- 美国是 2021 年市场的主要股东,由于拥有各种製造业,分析认为在预测期内美国将保持其地位。分析认为,食品饮料、化工石化、离散製造业的大规模投资和扩张将带动交流马达的需求。

- 食品和饮料行业使用的马达通常在肉类、家禽、鱼类、乳製品和烘焙食品等领域以及研磨机、搅拌机和输送机等应用领域具有专门且严格的标准。此外,在整个生命週期内,机器必须长期无故障运行,并具有最高的能源效率。

- 预计预测期内国内食品和饮料行业的成长将推动市场成长率。例如,2022年美国食品和饮料企业的每月零售额出现了大幅成长。例如,根据美国人口普查局的数据,2022 年 2 月,食品和饮料店的零售额为 780.99 亿美元。除此之外,食品和饮料包装公司正致力于采用永续标籤和标记。

- 2021年7月,美国农业部宣布将向美国救援计画基金投资5亿美元,用于扩大肉类和家禽加工能力,为农民、牧场主和消费者提供更多市场选择。美国也宣布提供超过 1.5 亿美元的资金,帮助现有的小型和超小型加工厂获得 COVID、参与市场竞争和寻找新客户所需的帮助。

- 此外,雀巢于2021年7月宣布将扩建位于美国南卡罗来纳州的冷冻食品工厂。该公司最知名的两个品牌 Stouffer's Lean Cuisine 将从这笔 1 亿美元的投资中受益。

北美交流 (AC) 电机产业概况

由于市场参与者越来越注重克服新产品开发的现有缺陷,预计北美交流电机市场在预测期内仍将保持竞争力。参与企业也注重伙伴关係和併购,以扩大消费群。市场的主要参与企业包括罗克韦尔自动化、ABB 有限公司、西门子股份公司、德昌电机和东芝国际公司。

- 2022 年 5 月 - WEG 推出其 W51 HD 马达系列,该系列兼具效率与长期永续性。 W51 高密度 (HD) 马达结构紧凑、适应性强,适用于广泛的应用,可提供更高的性能和耐用性。 W51 HD 马达采用了符合市场对紧凑、轻巧、高效产品和合理利用自然资源的期望的尖端概念。适用于低电压和中压、IEC 315-450 或 NEMA 5,000-7,000 框架。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 政府法规推动能源效率需求

- 智慧汽车的普及

- 市场限制

- 购买新设备和升级现有设备的前期投资较高

第六章 市场细分

- 按类型

- 感应交流电机

- 单相

- 变形怪

- 同步交流电机

- 直流励磁转子

- 永久磁铁

- 磁滞马达

- 磁阻电动机

- 感应交流电机

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 发电

- 用水和污水

- 发电

- 金属与矿业

- 饮食

- 离散製造业

- 其他的

- 按国家

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Siemens AG

- Johnson Electric

- Rockwell Automation

- ABB Ltd.

- Toshiba International Corporation

- Nidec Motor Corporation

- WEG Electric Corporation

- Sinotech, Inc.

- TECO-Westinghouse

- Yaskawa Electric Corporation

第八章投资分析

第 9 章:未来趋势

The North America Alternating Current Motor Market is expected to register a CAGR of 5.23% during the forecast period.

Key Highlights

- The growing adoption of automation in the region is majorly contributing to the demand for the AC motors market. Manufacturing is moving closer to the customer as a result of trade tensions and COVID-19. Companies are considering nearshoring with automation as a solution to supply-chain concerns.

- One particular statistic from the United States demonstrates how automation is assisting firms in resuming operations. Robot orders in the third quarter of 2021 in the United States were up 35% over the same period in 2020, according to the Association for Advancing Automation (A3). Non-automotive sectors account for more than half of the orders.

- Manufacturers in the food business are increasingly using automation to comply with industry rules and requirements for maintaining product quality. The Food Safety Modernization Act (FSMA) of the Food and Drug Administration, for instance, established laws requiring large food manufacturers to adhere to preventive measures and Current Good Manufacturing Practice (CGMPS) standards.

- The outbreak of COVID-19 has been a harbinger for industrialists, i.e., a manufacturing recession. A significant slowdown in the sales of AC motors from China disrupted the supply chain across applications, such as equipment, packaging materials, ingredients, and other plant supplies.

North America Alternating Current (AC) Motor Market Trends

Oil and Gas Industry is Analyzed to Hold Major Share

- The oil and gas industry is the major shareholder of the market in 2021 and is analyzed to maintain its position throughout the forecast period owing to the significant deployment of AC motors. Onshore and offshore drilling operations rely on drilling rig equipment to extract oil and natural gas from reservoirs in the oil and gas industry.

- Drill rig equipment employs motors as their power source, and these motors must be able to survive vibration, extreme temperatures, consistent hits, corrosive environments, and other harsh circumstances characteristic of oil and gas settings. Throughout onshore and offshore drilling operations, induction motors and synchronous generators supply power for various purposes.

- The dependence of the oil and gas industry on automation has grown in the last decade, and many rounds of industry layoffs were announced that left market players with less skilled workers. This led to the increasing dependence of the United States oil and gas companies on automation to complete processes without any delay. In the last few years, the United States exports of crude and LNG (liquefied natural gas) and refined products continued to grow, which aligned with the new administration's motto of 'energy dominance for the United States.

- In 2018, the United States surpassed Saudi Arabia as the world's leading crude oil producer, a position it held until 2020. Crude oil generated in the United States and other countries is obtained by US oil refineries. Crude oil is supplied to the global market by a variety of companies.

- Crude oil is produced by almost 100 countries. In 2021, five countries accounted for around 51% of global crude oil production, with the United States holding 14.5% of the share. Crude oil is produced in 32 states and coastal waters off the coast of the United States. Five states accounted for over 71% of total crude oil output in the United States in 2021. (Source: US Energy Information Administration).

- Further, with 79% of the region's total installations, the United States is the region's top industrial robot consumer. These factors are significantly boosting the market growth rate in the country during the forecast period.

United States is Expected to Register the Major Growth Rate

- The United States is the major shareholder of the market in 2021 and is analyzed to maintain its position throughout the forecast period owing to the presence of various manufacturing industries. The significant investments and expansions in food and beverage, chemical and petrochemical, and discrete industries are analyzed to bolster the demand for AC motors.

- Motors used in the food and beverage industries frequently have specific and demanding criteria in sectors such as meat, poultry, fish, dairy, and baking items, and applications such as grinders, mixers, and conveyors. Machines must also perform faultlessly, for longer periods, and at the highest feasible level of energy efficiency throughout the lifecycle.

- The growing food and beverage sector in the country is set to boost the market growth rate during the forecast period. For instance, monthly retail sales of US food & beverage stores have witnessed a significant surge in 2022. For instance, according to US Census Bureau, in February 2022, the retail sales of food & beverage stores accounted for USD 78,099 million. With this, the food and beverage packaging companies are focusing on incorporating sustainable labels or tags.

- USDA stated in July 2021 that it would invest USD 500 million in American Rescue Plan money to expand meat and poultry processing capacity, giving farmers, ranchers, and consumers more options in the market. USDA also announced more than USD 150 million in funding for existing small and very small processing facilities to assist them in dealing with COVID, competing in the market, and obtaining the help they need to reach new customers.

- Further, Nestle announced in July 2021 that it is expanding its frozen food factory in South Carolina, United States. Stouffer's Lean Cuisine, two of the company's most well-known brands, will benefit from the USD 100 million investment.

North America Alternating Current (AC) Motor Industry Overview

The market for North America AC motors is estimated to be highly competitive over the forecast period, as the players in the market are increasingly working on new product development with a sharp focus on overcoming the shortcomings of the prosecutor. The players are also focusing on partnerships and mergers and acquisitions in order to expand their consumer base. Major players in the market include Rockwell Automation, ABB Ltd., Siemens AG, Johnson Electric, and Toshiba International Corporation, among others.

- May 2022- WEG has introduced the W51 HD motor range, which combines efficiency and long-term sustainability. The W51 High Density (HD) motors are compact, adaptable, and ideal for a wide range of applications, giving improved performance and durability. The W51 HD motors feature a modern concept in accordance with market expectations for highly efficient goods and rational use of natural resources due to their reduced size and weight. They are available in low and medium voltage, in IEC 315 to 450 or NEMA 5000 to 7000 frames.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand For Energy Efficiency Owing To Government Regulations

- 5.1.2 Growing Shift Towards Smart Motors

- 5.2 Market Restraints

- 5.2.1 High Initial Investment For Procuring New Equipment And Upgrading Existing Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Induction AC Motors

- 6.1.1.1 Single Phase

- 6.1.1.2 Poly Phase

- 6.1.2 Synchronous AC Motors

- 6.1.2.1 DC Excited Rotor

- 6.1.2.2 Permanent Magnet

- 6.1.2.3 Hysteresis Motor

- 6.1.2.4 Reluctance Motor

- 6.1.1 Induction AC Motors

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Power Generation

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 Food & Beverage

- 6.2.8 Discrete Industries

- 6.2.9 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens AG

- 7.1.2 Johnson Electric

- 7.1.3 Rockwell Automation

- 7.1.4 ABB Ltd.

- 7.1.5 Toshiba International Corporation

- 7.1.6 Nidec Motor Corporation

- 7.1.7 WEG Electric Corporation

- 7.1.8 Sinotech, Inc.

- 7.1.9 TECO-Westinghouse

- 7.1.10 Yaskawa Electric Corporation