|

市场调查报告书

商品编码

1644829

欧洲 IT人员编制:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe IT Staffing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

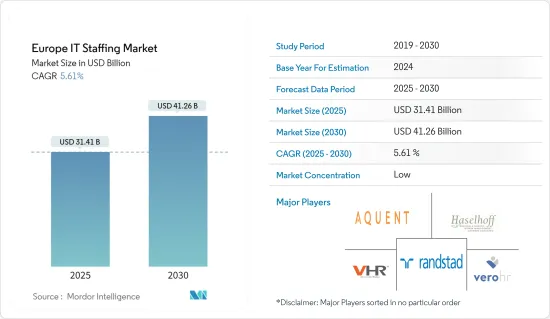

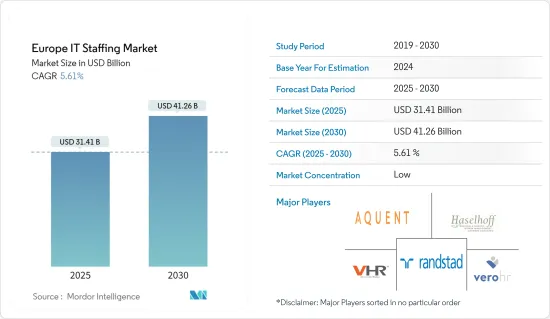

预计 2025 年欧洲 IT人员编制市场规模为 314.1 亿美元,到 2030 年将达到 412.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.61%。

该地区IT人员编制市场成长的主要动力是临时劳动力的成长趋势。大型 IT 公司优先考虑外包某些业务功能,以扩充性、灵活性并降低组织风险。

主要亮点

- 资料分析、机器人、物联网、区块链、人工智慧和机器学习等数位技术的进一步发展,迫使企业采用新的、创造性的计划交付策略。这些业务通常需要单一专家难以掌握的技能。因此,以尽可能低的成本获得最优秀的人才可以推动IT人员编制公司的高效运作。

- 目前,IT人力资源配置的变化使得对IT安全专家的需求日益增加。其中包括安全营运人员、资讯安全官员、分析师、支援工程师、网路防御专家、威胁和漏洞工程师以及网路安全技术人员。

- 根据提案的概念,欧盟的零工工人将不再被视为自营业,而是将获得员工的地位和特权。欧盟委员会的提案将标誌着创建管理零工工人的数位平台迈出重要一步。间接地,这将使欧洲IT人员编制产业受益。

- 该地区的人员配置自动化趋势使得招聘和招聘机构能够在招聘过程中创建自动化和可重复的业务。这些方法是电脑化的,旨在改善候选人和客户的招募体验。欧洲地区的招募自动化是 IT人员编制公司面临的关键挑战,因为人力资源自动化将在未来减少市场占有率。

- 从办公室和其他实体地点开展工作转向远端工作,是企业界受 COVID-19 疫情影响而发生的最大变化之一。随着地理限制的消失,欧洲 IT人员编制公司现在可以为新地区的新客户提供服务,并吸引来自新地区甚至新国家的候选人。另一方面,地理限制的消除意味着新的竞争对手将会出现,从而使人力资源公司现有的客户群面临风险。

- 面对日益复杂的情况,欧洲 IT人员编制公司正在寻找更多机会充当顾问和业务合作伙伴,为客户提供人才选择和策略方面的建议。

欧洲 IT人员编制市场趋势

人工智慧和物联网等技术的出现预计将推动市场成长

- 儘管存在大宗商品价格和利率上涨、供应链瓶颈以及乌克兰危机的影响等因素,但该地区行业的快速数位化正在导致欧洲对 IT人员编制的需求日益增长。人工智慧和物联网的应用在欧洲变得越来越普遍,为IT人员编制公司创造了机会。跨国公司正在该地区投资,以培养科技Start-Ups,帮助扩大 IT人员编制市场。例如,Google新创企业计画最近设立了一项 200 万美元的津贴基金,以支持欧洲数位产业的发展。 40家欧洲新兴企业将获得该基金的资助,资金最终增加了四倍,达到 400 万美元。

- 几乎每个行业,从 BFSI 到零售业,都在转向基于互联网应用程式的业务。对于用户和企业来说它变得越来越实用。应用程式需要定期更新,因此每个部门都需要强大的后端 IT 支援。对 IT 劳动力的需求不断上升,推动了本地 IT人员编制市场的成长。例如,在欧洲,跨境、跨币种资金流动和付款领域的领导者西联汇款已与Marketa合作,将该公司的解决方案整合到西联汇款的下一代即时多币种数位钱包和数位银行平台中。西联汇款服务将可在线上使用,并可利用 Marketa 先进的卡片发行基础架构向实体或虚拟Visa 卡付款。

- 在过去的十年中,B2B付款和流程逐渐转向数位化,金融科技对这项变革产生了重大影响。儘管该地区已明显倾向于采用更具创新性、最重要的是数位化的解决方案来促进 B2B业务和付款,但在欧洲,纸本支票仍然经常用于 B2B付款。这些变化正在间接刺激该地区的IT人才市场。例如,国际付款管道Kapaga 为英国企业提供商业银行帐户和多币种付款服务。

- 此外,微软和西班牙最大的银行 CaixaBank 承诺合作建立人工智慧创新实验室并打造元宇宙混合工作环境。透过新实验室,两家公司将利用人工智慧开发元元宇宙中的混合工作环境和「身临其境型」虚拟环境等解决方案,以增强 CaixaBank 员工和客户之间的互动。巴塞隆纳人工智慧创新实验室将在该银行新成立的 IT 部门 CaixaBank Tech 的支持下开发。这也将对欧洲IT人员编制产业产生正面影响。

- 在整个欧洲,对熟练 IT 人才的需求日益增长,许多金融科技机构纷纷涌现。因此,本地 IT人员编制产业有扩张的机会。例如,总部位于英国的全新金融科技公司 Monty Financial 正在利用人工智慧 (AI) 和真实的人机互动在欧洲推出业务和付款解决方案。该公司的两款主要产品是数位付款闸道系统 Monty Pay 和数位银行服务 My Monty。

英国的成长率最高

- 製造业、旅游和运输业以及零售业对随选人员编制平台的采用正在日益增加。随着企业和组织对于灵活搜寻最佳候选人的需求不断增长,英国对按需人员配置平台的需求也日益增长。

- 未来几年,由于线上招聘中人工智慧的使用越来越多,以及新平台简化了招聘流程,该地区按需人员编制平台的使用可能会增加。

- 此外,随着组织从传统职场转向在家工作场景,全球疫情期间对远距工作的需求激增。从组织网路安全的角度来说,需要仔细考虑这些影响,因为现在越来越多的个人不安全设备可以存取组织网络,从而增加了整个全部区域网路安全受到威胁的风险。

- 例如,2022 年 11 月对 13 个国家的法规环境进行了人员配备高阶主管监管展望 (SERO) 评估。结果显示,未来六个月英国、荷兰和义大利的招募产业将出现负面变化。

- 这导致各行各业对就业人才的需求增加。预计这将支援欧洲按需人员编制平台市场的扩张。

欧洲 IT人员编制产业概况

IT人员编制产业高度分散,有多家公司在其中运作。对接受过人工智慧、物联网和软体开发专门培训的人才的需求不断增长,推动了市场成长,使公司在竞争中占据优势。

2023年10月,全球最大的人力资源公司之一Randstad NV启动「人才伙伴」策略,致力于成为全球最公平、最专业的人力资源公司。

2022年11月,Aquent宣布其招聘业务和Vitamin T品牌将更名为“Aquent Talent”,形成一套全面的解决方案,包括专业招聘、人才体验、创新策略、计划管理、团队绩效、生产力、创新技能和能力以及培训和技能提升,以增强品牌和客户经验,满足对专业远距工作者的大量需求。

2022 年 6 月,据技术投资者 Investcorp Technology Partners 称,总部位于德国的创新人力资源软体解决方案开发商 Soft garden e-recruiting GmbH 被出售给东欧多家招聘广告公司的母公司 Grupa Pracuj。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 人工智慧和物联网等技术的出现

- 人力资源业务外包增加

- 市场限制

- 特定技术人才短缺

第六章 市场细分

- 按最终用户产业

- 电信

- BFSI

- 卫生保健

- 製造业

- 零售

- 按国家

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- AQUENT

- Randstad NV

- Vero HR.

- Haselhoff Groep

- VHR Consulting

- Michael Page

- Pertemps

- MAS Recruiting

- Tiger Recruitment Ltd

- Chronosconsulting

第八章投资分析

第九章:市场的未来

The Europe IT Staffing Market size is estimated at USD 31.41 billion in 2025, and is expected to reach USD 41.26 billion by 2030, at a CAGR of 5.61% during the forecast period (2025-2030).

The trend of an expanding contingent workforce is a major driver of the region's IT staffing market's expansion. Large IT companies prioritize outsourcing specific business functions for their organization's scalability, flexibility and decreased risk.

Key Highlights

- Further digital developments and technologies, such as data analytics, robotics, the internet of things, blockchain, AI, and machine learning, are compelling businesses to adopt fresh and creative project execution strategies. These tasks usually need skills that are hard to obtain in a single specialist. Hence, recruiting workers with the most talent at the lowest cost possible encourages IT staffing companies to run effectively.

- There is currently a greater need for IT security specialists due to changes in IT staffing. This includes the staff members responsible for security operations, information security officers, analysts, support engineers, cyber defense specialists, threat vulnerability engineers, and network security technicians.

- Under a proposed concept, gig workers in the EU would not be regarded as self-employed, but rather would be given the status and privileges of employees. A proposal from the European Commission would make substantial progress in creating digital platforms to manage their gig employees. Indirectly, this will benefit Europe's IT staffing industry.

- The region's tendency toward staffing automation enables staffing and recruiting firms to set up an automated, repeatable operating system in their hiring procedures. These methods are computerized and meant to improve the hiring experiences of the candidates and clients. Because HR automation will reduce their market share in the future, the automation of recruiting in the European region presents a significant challenge for IT staffing providers.

- The transition from work done in offices and other physical locations to work done remotely was one of the most major developments brought about by the COVID-19 pandemic in the corporate sector. When the geographical constraints were removed, European IT staffing companies could service new clients in new regions and draw candidates from recent locales and possibly new countries. On the other hand, as geographical boundaries disappeared, new competitors appeared, endangering a staffing firm's current clientele.

- European IT staffing companies have an additional opportunity to serve as consultants and business partners, advising clients on their talent options and strategies due to the growing complexity.

Europe IT Staffing Market Trends

Emergence of Technologies, such as AI and IoT is Expected to Drive the Market Growth

- The fast digitalization of the region's industries has increased the need for IT staffing in Europe, despite factors such as rising prices and interest rates, supply chain bottlenecks, and the effects of the Ukraine crisis. AI and IoT applications are becoming more popular in Europe, presenting chances for IT staffing firms. Multinational corporations are investing in the area to advance technological start-ups, which will afterward support the expansion of the IT staffing market. As an illustration, Google for Start-ups recently established a USD 2 million grant fund to support the growth of the European digital sector. Forty European tech start-ups will now receive funding from the fund, which was eventually quadrupled to USD 4 million.

- Almost every industry is transitioning to operations based on internet apps, from BFSI to retail. For both users and enterprises, it is becoming more practical. Every sector needs robust backend IT support for this application because it requires regular updates. The need for an IT workforce is growing, driving growth in the local IT staffing market. In Europe, for instance, Western Union, a leader in cross-border, cross-currency money movement and payments, has teamed with Marqeta to integrate its solution into Western Union's next-generation real-time multi-currency digital wallet and digital banking platform. With payments made to a physical or virtual Visa card using Marketa's advanced card issuing infrastructure, Western Union's remittance service will be accessible online.

- Over the past ten years, B2B payments and processes have gradually shifted to digital, and fintech has been a significant factor in this change. Although there has been a noticeable trend toward more inventive and, most crucially, digital solutions that facilitate B2B operations and payments in the region, paper cheques are still regularly utilized for B2B payments in Europe. These changes are indirectly stimulating the IT staffing market in the area. For instance, the international payments platform Kapaga provides business bank accounts and multi-currency payment services to Businesses in the United Kingdom.

- Additionally, Microsoft and Caixa Bank, the biggest bank in Spain, have committed to working together to establish an AI innovation lab and create metaverse hybrid work environments. The two firms will use AI to develop solutions like a mixed work environment in the metaverse and other "immersive" virtual settings to facilitate interactions between Caixa Bank employees and customers through the new laboratory. The AI innovation lab in Barcelona will be developed with assistance from Caixa Bank Tech, the bank's new IT division. Positive effects will result for the European IT staffing industry.

- In the region where the demand for IT personnel with specialized abilities is rising in Europe, many fintech organizations are sprouting up. As a result, there is a chance for the local IT staffing industry to expand. For instance, Monty Financial, a brand-new fintech business based in the UK, has used artificial intelligence (AI) and actual human interaction to introduce its banking and payment solutions across Europe. The company's two main products are Monty Pay, a digital payment gateway system, and My Monty, a digital banking service.

United Kingdom to Witness the Highest Growth Rate

- Adopting on-demand staffing platforms has increased in the manufacturing, travel & transportation, and retail sectors. The need for on-demand staffing platforms is growing in the UK due to the spike in business and organization demand for flexibility in finding the best candidate.

- In the upcoming years, the usage of on-demand staffing platforms in the region will increase due to the expanding use of AI in online recruitment and new platforms for streamlining the hiring process.

- Moreover, during the global pandemic, the demand for remote work surged due to organizations transitioning from conventional workplace methods to work-from-home scenarios. These impacts had to be carefully concerned in the context of the organization's cybersecurity as more and more personal unsecured devices started accessing the organization's network; the risk of compromising network security went up across the region.

- For instance, the Staffing Executive Regulatory Outlook (SERO) assessment of the regulatory environment in 13 countries was conducted in November 2022. According to the results, the staffing industry will experience negative changes in the UK, Netherlands, and Italy during the next six months.

- Because of this, the demand for immediate staff requirements tends to increase across various industries. This is expected to support the Europe on-demand staffing platforms market expansion.

Europe IT Staffing Industry Overview

The IT staffing industry is highly fragmented due to several players operating in the market. The increasing demand for specifically trained personnel in AI, IoT, and Software development fosters market growth to have a competitive edge over others.

In October 2023, Randstad NV, one of the world's largest staffing firm set out a 'partner for talent' strategy to be the world's most equitable and specialized talent company, Where this new specialisation approach ensures that talent receive the focused support that they require and clients receive the specialized skills and expertise that their business needs

In November 2022, Aquent announced, and Recruiting Business, and Vitamin T Brand became 'Aquent Talent' To Address the High Demand for Specialized Remote Workers, together they form a comprehensive set of solutions, including specialty recruiting, talent experience, creative strategy, project management, and training and upskilling to improve team performance, productivity, creative skills and capabilities, and brand and customer experience.

In June 2022, Soft garden e-recruiting GmbH, a developer of innovative HR software solutions based in Germany, has been sold to Grupa Pracuj, the parent company of several Eastern European job board companies, according to Investcorp Technology Partners, a technology investor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of Technologies, such as AI and IoT

- 5.1.2 Increasing Outsourcing of HR activities

- 5.2 Market Restraints

- 5.2.1 Talent Shortages in Specific Technologies

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Telecom

- 6.1.2 BFSI

- 6.1.3 Healthcare

- 6.1.4 Manufacturing

- 6.1.5 Retail

- 6.2 By Country

- 6.2.1 United Kingdom

- 6.2.2 Germany

- 6.2.3 France

- 6.2.4 Spain

- 6.2.5 Italy

- 6.2.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AQUENT

- 7.1.2 Randstad N.V

- 7.1.3 Vero HR.

- 7.1.4 Haselhoff Groep

- 7.1.5 VHR Consulting

- 7.1.6 Michael Page

- 7.1.7 Pertemps

- 7.1.8 MAS Recruiting

- 7.1.9 Tiger Recruitment Ltd

- 7.1.10 Chronosconsulting