|

市场调查报告书

商品编码

1644868

阀门:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

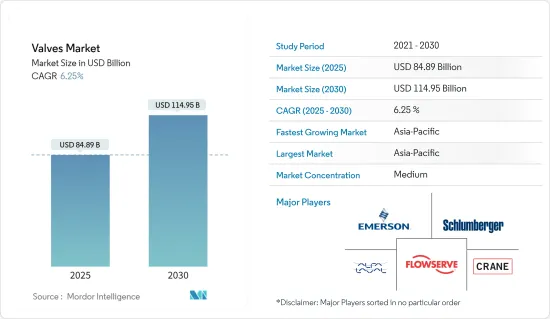

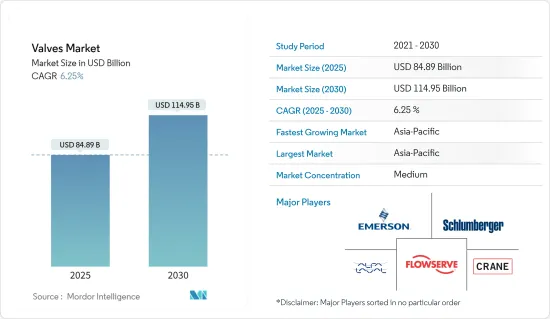

阀门市场规模预计在 2025 年为 848.9 亿美元,预计到 2030 年将达到 1149.5 亿美元,在市场估计和预测期(2025-2030 年)内以 6.25% 的复合年增长率增长。

阀门控制系统或製程内的流量和压力。它是输送液体、气体、蒸气、浆液等的管道系统中必不可少的组成部分。因此,对基础设施建设和工业自动化的投资不断增加正在推动所研究市场的成长。预计石油和天然气领域管道基础设施投资的增加将推动工业阀门的安装。

主要亮点

- 此外,许多新兴国家的政府供水和卫生计划正在增加,这可能会促进家用和农业工业阀门的销售。此外,由于阀门广泛应用于用水和污水和污水处理厂以及配水管道,各国加大对水和用水和污水基础设施建设的投资也是推动市场发展的主要因素。

- 全球阀门市场由多家公司主导,它们针对不同终端用户产业的应用提供各种解决方案。这大大增加了供应商之间的竞争,并鼓励他们开发创新的解决方案并采用独特的商务策略来扩大其市场占有率。因此,预计预测期内日益激烈的市场竞争将进一步推动研究市场的成长。

- 许多公司正在利用人工智慧 (AI) 和工业物联网 (IIoT) 等新技术来最大限度地减少阀门故障和其他不良事件造成的非计划性停机时间。配备感测器的阀门也变得越来越普遍,以减少故障和整体维护成本。预计这些先进价值观的采用将在预测期内进一步提振市场。

- 然而,市场参与者需要遵守各种区域阀门製造认证和政策,由于阀门在多个终端用户行业中的广泛应用,导致产品规格多样化。由于公司必须根据当地政策生产产品,这限制了市场成长,因此很难实现理想的安装成本。

阀门市场趋势

石油和天然气产业占大部分市场占有率

许多石油和天然气业务,包括精製和发行,都依赖管道系统。因此,基础设施和可靠的控制系统对这项业务至关重要。油气阀门是确保管路安全的重要零件。阀门系统是任何管道系统的重要组成部分。它可以控制流量、隔离和保护设备以及引导和指挥原油精製。例如,闸阀是一种用于打开和关闭流体流动的线性运动装置,通常用于许多管道和管线应用。

石油和天然气探勘和生产(E&P)活动的增加是市场的主要成长趋势。此外,许多国家都在大力投资勘探非传统资源,这为全球阀门市场带来了乐观的前景。由于对石油产品的需求不断增加,石油和天然气行业正在不断扩张,并且在这个市场运营的供应商正在推出针对石油和天然气行业应用的创新解决方案。

所有类型阀门在所有石油和天然气行业基础设施中的广泛使用都支持了市场的成长,其中包括石油和天然气行业中最常用的闸阀。当使用闸门系统完全打开或关闭管道并需要控制流速时,它是适用的。当致动器将阀门完全打开时,流路畅通无阻,甚至原油等泥浆状流体也可以轻鬆流动。

阀门具有管理压力、调节流量和控制整个工业领域资源流动的能力,在维持营运连续性和确保石油和天然气工业正常运作方面发挥着至关重要的作用。这证实了其在维持营运稳定方面的重要作用,这可能会在预测期内刺激市场成长。

全球对邮轮油的需求不断增长,受到石油和天然气行业上游、中游和下游活动以及公共和私人对该行业发展生产和加工能力的投资的支持,正在支持世界各地精製和石油产品工厂的工业增长,这可能会在未来推动阀门市场的发展。

亚太市场预计将大幅成长

亚太地区由于各行业製造和研发活动的不断发展而占有较高的市场占有率。此外,加大力度确保化学、石油和天然气等行业工人的安全也支持了该地区市场的成长。

印度是成长最快的製造业和机械工业国家之一,对工业阀门的需求庞大。印度政府正在为设立製造工厂的公司提供设施。政府也推出了各种政策来促进製造业的发展。例如,2024年2月,印度政府宣布计划在天然气供应链上投资670亿美元,以满足印度日益增长的能源需求。该计划预计将支持该国供应链和天然气分配中阀门的采用,从而刺激亚太地区的市场成长。

此外,由于全部区域工业活动的不断增加以及石油和天然气、化学品和水处理等製造工厂数量的不断增加,中国继续占据相当大的市场占有率。这导致对能够承受高压的工业阀门的需求增加。例如,苏伊士集团订单了一份为期30年的合同,透过当地的合资企业,在中国常熟建设和运营一座工业污水处理厂。合资企业将设计、建造和营运该污水处理厂,并计划于 2024 年开始营运。

发电设施需要能够承受高温、高压和腐蚀环境等恶劣操作条件的阀门。锅炉给水系统、一次蒸气隔离、给水流量调节和涡轮机控制中使用的阀门显示了亚太地区的市场需求,这与预测期内发电行业的工厂自动化趋势一致。

包括印度、中国、日本、韩国和其他东南亚国家在内的新兴经济体的工业领域正在显着增长,以支持其经济发展,这将有助于亚太地区的工业建设,并推动未来阀门市场的成长,因为阀门应用于工厂基础设施以控制蒸气、水、冷却剂等各种流体的流动。

阀门行业概况

全球阀门市场的特点是竞争力适中,且拥有多家领导企业。这些主要企业在国际上拥有相当大的市场占有率和不断增长的基本客群。这些行业巨头正在建立策略联盟,以扩大市场份额并提高盈利。着名的市场参与者包括艾默生电气公司、斯伦贝谢有限公司、阿法拉伐公司、福斯公司和克兰公司。

2023 年 12 月-自动化技术与软体公司艾默生电气 (Emerson Electric) 被韩国锂离子电池回收专家 SungEel HiTech 选中。此次合作旨在提高位于全北群山市水力中心综合设施内的 SungEel 最先进的锂离子回收设施的永续生产和营运效率。根据协议,艾默生将提供先进的仪器和阀门解决方案,以满足 SungEel HiTech 自主开发的先进湿法冶金製程的严格要求,帮助该公司发展阀门业务。

2023 年 11 月 - 福斯公司推出 Worcester 低温系列,直角回转浮动球阀,因其在 LNG、氢气和工业气体应用中的可靠性而闻名。此系列有两种配置:三件式设计(CF44 系列)和法兰选项(CF51/CF52 系列)。它具有高强度阀桿和升级的活载阀桿密封,以确保对逸散排放进行卓越的控制。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 新冠肺炎疫情对产业的影响

第五章 市场动态

- 市场驱动因素

- 基础建设相关发展增加

- 采用新技术

- 市场挑战

- 缺乏标准化政策

第六章 市场细分

- 按类型

- 球

- 蝴蝶

- 门/手套/检查

- 插头

- 控制

- 其他类型

- 按行业

- 石油和天然气

- 发电

- 化学

- 用水和污水

- 矿业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Rotork plc

- IMI Critical Engineering

- Samson Controls Inc.

- KITZ Corporation

- Spirax Sarco Limited

第八章投资分析

第九章:市场的未来

The Valves Market size is estimated at USD 84.89 billion in 2025, and is expected to reach USD 114.95 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

Valves control the flow and pressure within a system or process. It forms an essential piping system component that conveys liquids, gases, vapors, slurries, etc. Hence, the growing investment in infrastructure development and the automation of industries are driving the growth of the studied market. Rising investments in pipeline infrastructure in the oil and gas sector are expected to boost the installation of industrial valves.

Key Highlights

- Additionally, many developing countries are witnessing increased government water supply and sanitation projects, which will likely propel the sales of industrial valves for domestic and agricultural applications. Furthermore, the growth in investments made by various countries to develop the water and wastewater infrastructure is another major factor driving the studied market's growth, as valves are widely used in water and wastewater plants and distribution pipelines.

- The global valve market has many players offering various solutions targeting applications across various end-user industries. This significantly drives competition among the vendors, encouraging them to develop innovative solutions and adopt unique business strategies to expand their market presence. Hence, the growing market competitiveness is anticipated to drive the studied market's growth further during the forecast period.

- Many companies are leveraging emerging technologies such as artificial intelligence (AI) and industrial Internet of Things (IIoT) to minimize unplanned downtime and other unfavorable incidents due to valve failures. Valves equipped with sensors are also being increasingly adopted to reduce failures and overall maintenance costs. The adoption of these advanced values is expected to boost the market further over the forecast period.

- However, the market players need to comply with the various certifications and policies of different regions concerning valve manufacturing, resulting in diversity in product specifications due to the widespread application of valves in several end-user industries. This acts as a restraint for market growth as the companies have to manufacture products according to the regional policies, making it difficult for them to achieve an ideal installation cost.

Valves Market Trends

Oil and Gas Vertical Accounts for a Major Market Share

Many oil and gas operations, such as refining and distribution, rely on pipeline systems. Therefore, infrastructure and trustworthy control systems are crucial in the business. Oil and gas valves are essential to ensure the safety of pipeline industrial operations. Valve systems are important parts of any piping system. They can control flow rates, isolate and protect equipment, and guide and direct crude oil refining. For instance, gate valves, which are linear motion devices used to open and close fluid flow, are commonly used in many piping and pipeline applications.

Increasing oil and gas exploration and production (E&P) activities is a major market growth trend. Many countries also invest heavily in drilling activities to tap unconventional resources, creating a positive outlook for the global valves market. With the oil and gas industry expanding owing to a growing demand for petroleum products, vendors operating in the market are launching innovative solutions targeting oil and gas industry applications.

The broad usage of all types of valves in the infrastructure of any oil and gas industry supports the market's growth, including gate valves, which could be the most commonly used in the oil and gas industry. It uses a gate system to open or close a pipeline entirely and is suitable if the flow rate needs to be controlled. When the actuator completely opens the valve, the channel is unobstructed, allowing even slurry fluids like crude oil to flow more easily, showing the usage of valves in the oil and gas industries.

Valves play an instrumental role in sustaining operations' continuity and ensuring that the oil and gas industry functions due to their ability to manage pressure, regulate flow, and control the movement of resources across this industrial domain. This supports their pivotal role in maintaining operational stability, which would fuel the market's growth during the forecast period.

The growth of cruise oil demand worldwide, supported by the upstream, midstream, and downstream activities of the oil and gas sector and public and private investments in the sector to develop production and processing capabilities, is supporting the industrial growth of oil refineries and petroleum product plants worldwide, which will fuel the valve market in the future.

Asia-Pacific Market is expected to Grow Significantly

The region holds a high market share due to the growing development in manufacturing and R&D activities in various industries across Asia-Pacific. Further, the rising number of initiatives taken to ensure the safety of workers in industries such as chemicals, oil, and gas also support the market growth in the region.

India is one of the fastest-growing countries in manufacturing sectors and machinery, creating a significant demand for industrial valves. The Indian government provides benefits to companies setting up manufacturing units. It has also outlined various policies to boost the manufacturing sector. For instance, in February 2024, the government of India announced a USD 67 billion investment plan for the natural gas supply chain to meet India's surging energy demands. This plan would support the adoption of valves in the supply chain and the distribution of natural gas in the country and fuel the market growth in Asia-Pacific.

Furthermore, China continues to account for a significant market share due to the growing industrial activities across the region and the rise in the number of manufacturing plants for oil and gas, chemical, and water, among others. This has increased the demand for industrial valves that can handle high pressure. For instance, SUEZ was awarded a 30-year build-and-operate contract for an industrial wastewater treatment plant in Changshu, China, through a local joint venture. The SUEZ joint venture is responsible for designing, constructing, and operating the wastewater treatment plant, which is expected to be commissioned in 2024.

Power generation facilities require valves that withstand harsh operating conditions, such as high temperatures, pressures, and corrosive environments. Valves used in boiler feedwater systems and primary steam isolation, as well as to regulate feed water flow rate and turbine control, show the demand for the market in Asia-Pacific, which is in line with the factory automation trend in the power generation industries during the forecast period.

The emerging economies, including India, China, Japan, South Korea, and other Southeast Asian countries, have been registering significant growth in their industrial sector to support their economic progress, which would help the construction of industries in the Asia-pacific region and can fuel the market growth of Valves in the future due to the application of Valves in the factories' infrastructure for controlling the flow of various fluids, such as steam, water, and cooling agents, among others.

Valves Industry Overview

The global valves market is characterized by moderate competitiveness and several influential players. These key actors hold significant market shares and are expanding their customer bases internationally. These industry leaders engage in strategic collaborations to bolster their market presence and enhance profitability. Notable market players include Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co.

December 2023 - Emerson Electric Co., a company in automation technology and software, has been chosen by SungEel HiTech Co. Ltd, a Korean expert in lithium-ion battery recycling. The collaboration aims to enhance sustainable production and operational efficiency at SungEel's latest lithium-ion recycling facility within the Hydro Center complex in Gunsan, Jeollabuk-do. Under this agreement, Emerson will deliver advanced instrumentation and valve solutions tailored to meet the stringent demands of SungEel HiTech's advanced proprietary hydrometallurgical processes, underscoring the growth in the company's valve business.

November 2023 - Flowserve Corporation introduced the Worcester Cryogenic series, showcasing quarter-turn floating ball valves known for reliability in LNG, hydrogen, and industrial gas applications. The series offers two configurations: a three-piece design (CF44 series) and a flanged option (CF51/CF52 series). The features include a high-strength stem and an upgraded live-loaded stem seal, ensuring superior control over fugitive emissions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Infrastructure-Related Developments

- 5.1.2 Adoption of Emerging Technologies

- 5.2 Market Challenges

- 5.2.1 Lack of Standardized Policies

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 By End-User Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Water and Wastewater

- 6.2.5 Mining

- 6.2.6 Other End User Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Rotork plc

- 7.1.7 IMI Critical Engineering

- 7.1.8 Samson Controls Inc.

- 7.1.9 KITZ Corporation

- 7.1.10 Spirax Sarco Limited