|

市场调查报告书

商品编码

1644871

社群媒体聆听:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Social Media Listening - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

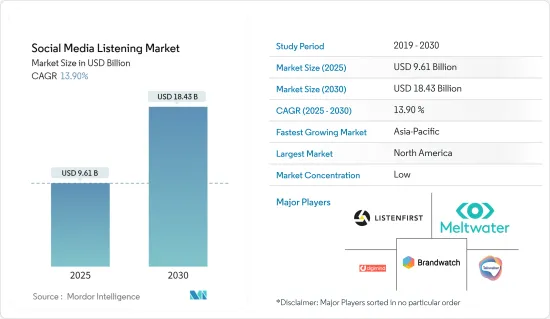

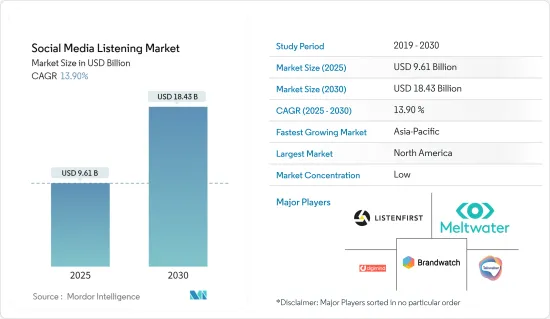

社群媒体监听市场规模在 2025 年估计为 96.1 亿美元,预计到 2030 年将达到 184.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 13.9%。

企业在社群媒体监听工具上的支出增加、政府机构采用这些工具、各种品牌采用社群监听解决方案来确立自己作为市场参与企业、以及社群媒体使用量的增加等因素都是推动受访市场发展的一些预期因素。此外,任何想要在竞争中保持领先的企业都必须先了解他们的客户——他们是谁、他们的行为方式以及他们的灵感来源。实现这一目标的方法之一是让自己沉浸在最新趋势中并了解正在发生的事情。社群媒体聆听是一种帮助企业与目标/受众建立联繫的技术。倾听客户的意见有助于您了解他们如何彼此沟通以及与您的品牌的沟通。

关键亮点

- 根据 Meltwater 的《社交聆听现状》研究报告,该报告基于来自一系列行业专家的 650 多份调查回复,Meltwater 旨在更好地了解企业如何进行聆听工作,他们认为此类工作有多大用处,以及他们认为可以如何改进。根据调查结果,超过 61% 的公司已经实施社交聆听系统来监控社群媒体提及。近 80% 的品牌旨在追踪品牌提及,其中工业社交媒体监听和主题标籤是第二大常见功能。这可能表明大多数公司并不专注于向外部展示他们的思想领导力。

- 此外,根据社交智慧实验室去年发布的社交聆听报告,该报告调查了全球超过 350 名社交聆听专业人士,包括美国、英国、欧洲、亚洲、中东和拉丁美洲,超过 80% 的受访者使用多种社交聆听工具。三分之一的人在社交聆听上花费超过10万美元。此外,大多数受访者(55%)表示他们使用两到三种工具。不到 20% 的人只使用一种工具来满足他们的社交智慧需求。

- 政府机构正在采用社交聆听解决方案来更快地分析情况。例如,去年 9 月,世界卫生组织 (WHO) 创建了公共卫生分类法,以帮助监测资讯流行病并从猴痘对话中得出见解。本技术论文概述如何将社交聆听应用于猴痘对话以获取有关公共卫生应对的情报见解。分类法用于更好地组织和建构分析,特别是在整合不同品质和类型的资料来源时。

- 此外,许多大品牌已经在使用社交聆听来宣传他们的产品。例如,欧莱雅利用社交聆听来了解市场趋势并发现消费者的需求。虽然数百万品牌依靠社交聆听来改进他们的产品,但欧莱雅却将其作为品牌选择的关键部分。当欧莱雅面临生产哪种美髮产品的问题时,他们求助于社群媒体来寻找最有前景的趋势。我们专注于用户生成的内容,并将消费者的声音发布到社群媒体上。

- 另一方面,社交聆听程式对某些网站的存取资料受到限制,因为每个网站都有不同的隐私权和资料收集政策。此外,一些着名的社交网路正在限制资料交换。因此,这些平台的工具只能显示其收集的部分资料。这些结论是基于不充分的资料而得出的。此外,Discord、Clubhouse 和 WhatsApp 等私人聊天频道无法使用社交聆听技术。了解这些地点正在发生的事情的唯一方法是作为个人参与并观察。此外,根据去年的社交智慧实验室社交聆听报告,资料准确性和品质往往是代理商面临的更大问题(31% 对比品牌方的 19%)。然而,对于品牌而言,需要一个组织范围内的社交聆听愿景似乎更具挑战性(29% 对比 18% 的代理商)。

- 在新冠肺炎疫情期间,社会聆听方法在人道主义和卫生应对、风险沟通和社区参与(RCCE)以及「资讯疫情」管理中的应用出现了前所未有的增长。虽然出于人道主义和健康目的的社交聆听并不是什么新鲜事,但由于在实施紧急公共卫生和社会措施 (PHSM) 时亲自到达社区面临挑战,疫情成倍地加速了它的使用。这种日益增长的兴趣促使人道主义和卫生组织产生了一系列社会倾听成果,并透过多个风险沟通和社区参与 (RCCE) 国家、地区和全球空间进行传播。

社交聆听市场趋势

社群媒体用户的增加预计将推动市场

- 世界各地的社群媒体用户每天都会共用影片、讯息和连结。在欧洲,由于个人化资讯推送应用程式的使用日益增多,社群媒体用户数量预计会增加。此外,印度对加密、自毁通讯型社群应用的需求日益增长,推动了社群媒体公司的蓬勃发展。沙乌地阿拉伯对视讯聊天服务的需求不断增长,也推动了业务成长。此外,基于应用程式内收费的社交网路应用程式的轻鬆存取使世界变得更有吸引力。此外,根据DemandSage的预测,今年全球社群媒体用户将超过49亿人。典型的社群媒体用户每月会在六到七个平台之间切换。

- 据欧盟统计局称,欧盟许多企业都使用社群媒体。超过一半的企业(59%)报告近年来使用过至少一个社群媒体平台,比 2015 年(37%)上升了 22 个百分点。社群媒体使用率最高的是马耳他(84%),其次是瑞典、荷兰(皆为 80%)和芬兰(79%),社群媒体使用率最低的是罗马尼亚(36%)、保加利亚(39%)和斯洛伐克(45%)。该地区社群媒体用户的增加将为社群媒体监听解决方案提供者创造机会,以开发新的解决方案来占领市场占有率。

- 此外,根据印度电子和资讯技术部 (MeITY) 的数据,YouTube 在印度拥有约 44.8 亿用户,WhatsApp 拥有超过 5,300 万用户,Facebook 拥有约 4,100 万用户,Instagram 拥有约 2,100 万用户。此外,根据宏盟集团的调查,YouTube 是去年印度最受欢迎的线上媒体,媒体消费者平均每天在其上花费 108 分钟。短影片应用程式TikTok的使用频率最低,用户每天在该应用程式上花费的时间仅20分钟以上。

- 据 Meta Platforms 称,Facebook 是全球最受欢迎的线上社交网络,截至去年第四季度,每月活跃会员约为 29.6 亿。 2017 年第二季度,该平台有效用户数突破 20 亿,仅需 13 年多就实现这项壮举。截至去年 1 月,印度是 Facebook 用户最多的国家,约有 3.3 亿,其次是美国,约有 1.79 亿。该平台在印尼和巴西也颇受欢迎。去年,Facebook 是美国用户每天花费最多时间的平台。在 Facebook 上花费的平均时间为 33 分钟,其次是 TikTok (32 分钟)和 Twitter (31 分钟)。社群媒体用户的增加可能会推动市场的需求。

- 此外,据爱立信称,去年全球智慧型手机行动网路用户数量已超过 66 亿,预计到 2028 年将达到 78 亿。行动网路智慧型手机订阅数量最多的国家是中国、印度和美国。行动订阅数量的大幅成长可能会增加市场上社群媒体用户的数量,从而极大地推动对社群媒体监听解决方案的需求。

预计北美将占据较大的市场占有率

- 北美是社群媒体监听市场成长突出的地区之一。由于数位广告预算的增加,预计北美将有更多公司推动市场发展。就数位经销店而言,社交媒体可能是您最好的选择。具体研究表明,许多品牌现在选择社交管道来吸引消费者,而不是过去依赖的传统展示网络。改进的参与度资料和对目标受众的深入了解是推动这一转变的关键因素之一。社群聆听可以帮助行销人员创建更具吸引力的社群广告,或至少创建更相关、更及时的广告,从而大幅提高参与度。

- 例如,使用社群聆听输入的北美品牌可以开发利用 Facebook 的客製化广告体验等工具的广告。此工具可协助负责人根据目标受众,使用不同的格式(轮播、收藏)和号召性用语,动态地接触目标受众。该品牌能够根据社交聆听洞察提供客製化广告,这也促使其最近推出了 Instagram Shopping。 LinkedIn 也采用了动态广告。最终,所有社群媒体网路都可能会加入。

- 此外,各个行业都在采用社交列表策略来更好地服务客户。 Taco Bell 是一家在社群媒体上非常活跃的速食连锁店。该公司因其社交聆听策略而闻名。我们即时倾听客户的意见,即时回应,并透过社群媒体与他们沟通。他们的首要任务是客户服务。我们也利用社交聆听来提供最好的服务。他们转发有关自有品牌的任何正面评价。为了提高她在社群媒体上的知名度,她经常与网友互动。我们不仅重视消费者的意见,也会回应消费者的问题。例如,塔可钟在社交媒体上收到顾客对其玉米墨西哥芝士馅饼上的起司的申诉。塔可钟已向受影响的餐厅发送电子邮件,提醒他们遵循食谱以确保顾客满意。

- 此外,随着对社交聆听解决方案的需求不断增长,本地企业正在提供一系列解决方案来帮助他们获得市场占有率并扩大影响力。例如,Awarious 的社群媒体 API 及其搜寻机器人每天抓取 130 亿个网页,以便在社群网路(Twitter、Facebook、Instagram、YouTube、Reddit)、部落格、新闻、评论和网路上的任何其他地方找到有关您的品牌的所有提及。 Awario 超越了普通的搜寻。使用者可以在设定监控警报时利用搜寻参数,透过布林搜寻缩小或扩大结果范围。

- 网路上充满了品牌透过社交聆听促进真正创新的例子。透过应用基于社交聆听资料的策略,您的品牌未来可以取得的突破将没有限制。例如,雅芳研究了超过 100 万条关于睫毛膏的线上评论,以打造出他们所称的同类产品中的终极旗舰产品。透过持续的社交聆听,Netflix 发现一些用户在观看节目时睡着了。儘管人们在看电视时睡着是很常见的,但 Netflix 认识到这是一个机会,可以表明他们在倾听客户的意见,并且像一个伟大的品牌一样进行创新。

社群聆听产业概览

社群媒体监听市场细分化,有许多知名参与企业,如 Talkwalker、Brandwatch、Meltwater 和 Digimind。我们不断投资于策略合作伙伴关係和产品开发,以扩大市场占有率。以下是一些最近的市场趋势。

2023 年 3 月,Digimind 推出了首个社交聆听解决方案。该解决方案结合了两个强大的人工智慧引擎,为消费者提供有关其在线状态的完整洞察。该系统结合了 Digimind AI Sense 和 OpenAI ChatGPT,描述了一种收集、分析和处理线上讨论的简化方法。 DigimindAI Sense 是一位资料科学家,可以识别峰值并告知消费者他们的需求。同时,ChatGPT 将以业务分析师的身份彙编资料见解。

2022 年 9 月,客户参与软体和服务供应商 Khoros 和消费者智慧和深度聆听Start-UpsTalkwalker 宣布合作,为品牌提供世界一流的社群媒体管理、智慧和深度聆听。这项策略伙伴关係关係为公司提供了所需的资源,使其能够从洞察到行动,与市场趋势和受众动向保持同步。 Khoros 消费者现在可以透过深度聆听获得更深入的见解。 Talkwalker 客户还可以获得完整的社群媒体管理系统,包括根据大规模洞察采取行动的工具以及无论身在何处都能与客户互动和会面的能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 社群媒体用户增加

- 为改善客户体验,对社群媒体测量的需求日益增加

- 市场问题

- 缺乏社群媒体分析的标准指标

- 缺乏单一解决方案来管理日益增长的非结构化资料

第六章 市场细分

- 按行业

- BFSI

- 零售与电子商务

- 资讯科技和电信

- 媒体与娱乐

- 其他行业(教育、旅游和酒店、医疗保健等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章 竞争格局

- 公司简介

- Talkwalker

- Brandwatch

- Digimind

- ListenFirst

- Meltwater

- NetBase Quid

- Sprinklr

- Synthesio

- Zignal Labs

- Awario

- Keyhole

- Mention

- Agorapulse

- Synthesio

- Mentionlytics

第 8 章供应商定位分析

第九章:市场的未来

The Social Media Listening Market size is estimated at USD 9.61 billion in 2025, and is expected to reach USD 18.43 billion by 2030, at a CAGR of 13.9% during the forecast period (2025-2030).

Factors such as increased spending by firms on social media listening tools, government bodies' adoption of the tool, various brands incorporating social listening solutions to establish themselves as market players, and a rise in social media usage are some expected elements to propel the studied market. Further, any firm that wants to stay ahead of the competition must first understand its customers-who they are, how they behave, and what inspires them. One method to accomplish this is to immerse themselves in the most recent trends, demonstrating an understanding of what is happening. Social media listening is a technique that will help businesses connect with their target audience. It will assist the industry in listening to the voice of customers to understand how they communicate with one another and with brands.

Key Highlights

- According to Meltwater's survey report on the state of social listening in the previous years, based on more than 650 survey responses from various industry professionals, the company aimed to better understand how companies approach listening activities, how useful they believe such efforts are, and how they think they could be improved. According to survey results, over 61% of organizations have implemented a social listening system and are monitoring for keyword mentions. Almost 80% of brands aim to track brand mentions, with industry keywords and hashtags as the second most prevalent features. Fewer firms follow relevant thinking leaders in their area or employee mentions; this likely suggests that most businesses do not look to display their thought leaders externally, which would naturally place more attention on this component.

- Further, according to the social intelligence lab social listening report of the last year, which polled over 350 social listening professionals worldwide, including those from the United States, the United Kingdom, and countries in Europe, Asia, the Middle East, and Latin America, over 80% of respondents utilized multiple social listening tools. One-third spend more than USD 100,000 on their social listening stack. Most respondents (55%) also stated that they utilize two or three tools. Less than 20% of people exclusively use one tool for their social intelligence needs.

- Government bodies are adopting social listening solutions to analyze situations much faster. For instance, in September last year, the World Health Organization (WHO) created a public health taxonomy to aid in infodemic monitoring and the creation of insights from monkeypox dialogues. The technical document outlines how social listening can be applied to monkeypox talks to yield informational insights for public health responses. Taxonomies are used to better organize and structure analytics, particularly when merging data sources of diverse quality and kind.

- Further, many well-known brands already use social listening to fuel product creation. L'Oreal, for example, uses social listening to identify market trends and discover what consumers want. Although millions of brands rely on social listening to improve their goods, L'Oreal incorporates social listening into some essential brand choices. When L'Oreal was confronted with deciding which hair product to produce, they turned to social media to find the most promising trend. The organization investigated user-generated content and made its consumers' voices heard on social media.

- On the flip side, as each site has different privacy and data collection policies, social listening programs have limited access to data from some. Several prominent social networks also restrict data exchange. As a result, the tools for those platforms can only display a subset of the data they collect. These findings are based on insufficient data. Furthermore, private chat channels such as Discord, Clubhouse, and WhatsApp are inaccessible to social listening technologies. The only way to find out what's going on on these sites is to join as an individual and observe. Further, according to last year's Social Intelligence Lab social listening report, data accuracy and quality tend to be more of an issue for agencies (31% vs. 19% of brands). However, the need for an organizational-wide vision for social listening appears more difficult for brands (29% vs. 18% for agencies).

- The application of social listening approaches for humanitarian and health response, risk communication and community engagement (RCCE), and "infodemic" management increased unprecedentedly during the COVID-19 pandemic. While social listening for humanitarian and health objectives were not new, the pandemic drastically boosted its use because of the difficulties involved with in-person community participation when emergency public health and social measures (PHSM) were in effect. This increasing focus resulted in various social listening outputs created by humanitarian and health organizations and communicated through several Risk Communication and Community Engagement (RCCE) national, regional, and global spaces.

Social Listening Market Trends

Rising Number of Social Media Users is Expected to Drive the Market

- Social media users worldwide routinely share videos, messages, and links. The increased use of personalized feed-based apps in Europe will likely drive the number of social media users. Furthermore, the growing desire in India for encrypted and self-destructive messaging-based social apps is propelling the social media company's growth. Again, the rising demand for video chat services in Saudi Arabia is boosting business growth. Furthermore, the ease of access to in-app purchase-based social networking apps is increasing their global appeal. Moreover, according to DemandSage, over 4.9 billion social media users will be worldwide in the current year. The typical social media user switches between 6 and 7 platforms every month.

- According to Eurostat, many businesses use social media in the EU. Over half of the companies (59%) reported utilizing at least one social media platform in recent years, representing a 22% point increase from 2015 (37%). Social media use was most prevalent in Malta (84%), followed by Sweden, the Netherlands (both 80%), and Finland (79%), while it was least prevalent in Romania (36%), Bulgaria (39%), and Slovakia (45%). Such a rise in social media users in the region would create an opportunity for social media listening solution providers to develop new solutions to capture market share.

- Additionally, YouTube has about 44.8 crore users in India, while WhatsApp has over 53 crore users, according to the Ministry of Electronics and Information Technology (MeITY) (India).Facebook has approximately 41 crore, whereas Instagram has approximately 21 crore. Further, according to Omnicom, YouTube was the most popular online medium in India last year, with media consumers spending up to 108 minutes a day on average. TikTok, a short video format app, had the least frequent usage, with users spending just over 20 minutes daily on the platform.

- According to Meta Platforms, Facebook is the world's most popular online social network, with around 2.96 billion monthly active members as of the fourth quarter of last year. In the second quarter of 2017, the platform exceeded two billion active users, a feat accomplished in just over 13 years. As of January last year, India had the most extensive audience base on Facebook, with almost 330 million users, followed by the United States, which had approximately 179 million users. The platform is also quite popular in Indonesia and Brazil. Facebook was the platform on which US users spent the most time daily before last year. The average time spent on Facebook was 33 minutes, followed by TikTok at 32 minutes and Twitter at 31 minutes daily. Such a rise in social media users would drive demand for the studied market.

- Moreover, Ericsson says the global number of smartphone mobile network subscriptions reached over 6.6 billion in the last year and is expected to hit 7.8 billion by 2028. The countries with the most smartphone mobile network subscriptions are China, India, and the United States. Such a huge rise in mobile subscriptions would raise the number of social media users in the market, which could significantly drive the demand for social media listening solutions.

North America is Expected to Hold a Significant Market Share

- North America is one of the prominent regions for the growth of the social media listening market; due to the rise in digital advertising budgets, even more significant corporations in the North American region are expected to drive the market. And, in terms of digital outlets, social media will be their best bet. According to specific surveys, many brands increasingly choose social channels to generate engagement over the traditional display networks they have relied on. The availability of improved engagement data and deeper insights into targeted audiences is one of the primary elements driving this shift. Social listening will assist marketers in creating more engaging social ads that convert-or, at the very least, create more relevant and timely ads that will increase engagement by a large percentage.

- For example, brands in North America that use social listening inputs might develop ads utilizing tools like Facebook's tailored ad experiences. This tool assists marketers in dynamically reaching out to their target audience by changing formats (carousel, collection) and calls-to-action depending on who is delivered to. The brand's capacity to provide tailored advertisements based on social listening insights also prompted the recent release of Instagram shopping. LinkedIn, too, has adopted dynamic advertisements. Eventually, all social media networks would get on board.

- Moreover, various industries are adopting social listing strategies to provide better service to their customers, for instance. Taco Bell is a fast-food chain with an active social media presence. The firm is well known for its social listening strategy. They listen to their clients in real-time, respond in real-time, and communicate with them through social media. Their foremost priority is customer service. They also use social listening to provide the finest service possible. They retweeted everything positive expressed about their brand. They frequently interact with netizens to enhance their social media presence. They not only cherish their consumers' opinions, but they also respond to their problems. Taco Bell, for example, has received complaints from customers on social media regarding the cheese in the quesadilla. They emailed the concerned establishment and reminded them to follow the recipe for ensuring customer satisfaction.

- Further, with the rise in demand for social listening solutions, regional firms are providing various solutions that would help capture market share and expand their presence. For example, Awarious' social media APIs and its search bots crawl 13 billion web pages daily to locate all mentions of users' brands on social networks (Twitter, Facebook, Instagram, YouTube, Reddit), blogs, news, reviews, and the rest of the web. Awario goes beyond ordinary searches. Users can use a boolean search to narrow or broaden results by utilizing search parameters when configuring a monitoring alert.

- The internet is flooded with examples of brands fostering true innovation through social listening. There are no limitations to the future breakthroughs that brands can make by applying strategies based on social listening data. For example, Avon created a product that it claims is the ultimate flagship product in its category by studying over a million comments on mascara online. Netflix discovered several users fell asleep while viewing shows through persistent social listening. Although it is typical for people to fall asleep while watching television, Netflix recognized an opportunity to demonstrate that they listen and are as innovative as a great brand should be.

Social Listening Industry Overview

The social media listening market is fragmented, with many prominent players such as Talkwalker, Brandwatch, Meltwater, Digimind, and other corporations continually spending on strategic partnerships and product development to increase market share. The following are some recent market developments:

In March 2023, Digimind introduced the first social listening solution, which combines two robust artificial intelligence engines to provide consumers with complete insight into their online presence. The system combines Digimind AI Sense and OpenAI ChatGPT, providing a streamlined method for gathering, analyzing, and acting on online discussions. DigimindAI Sense is the operation's data scientist, recognizing peaks and supplying consumers with the required information. Meanwhile, ChatGPT summarizes the data findings as the business analyst.

In September 2022, Khoros, a customer engagement software and services firm, and Talkwalker, a consumer intelligence and deep listening startup, announced a collaboration to provide brands with world-class social media management, intelligence, and deep listening. The strategic partnership will provide businesses with the necessary resources to sync with market trends and audience movements, from insights to action. Khoros consumers now have access to in-depth insights due to deep listening. Customers of Talkwalker also have access to a complete social media management system that includes tools for taking action on insights at scale and the capability to engage with and meet customers wherever they are active.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Number of Social Media Users

- 5.1.2 Rising Need for Social Media Measurement to Enhance the Customer Experience

- 5.2 Market Challenges

- 5.2.1 Lack of Standard Measures for Social Media Analytics

- 5.2.2 Lack of a Single Solution to Manage the Increasing Unstructured Data

6 MARKET SEGMENTATION

- 6.1 By Industry Vertical

- 6.1.1 BFSI

- 6.1.2 Retail & E-commerce

- 6.1.3 IT & Telecom

- 6.1.4 Media & Entertainment

- 6.1.5 Other Industry Verticals (Education, Travel & Hospitality, Healthcare etc.)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Talkwalker

- 7.1.2 Brandwatch

- 7.1.3 Digimind

- 7.1.4 ListenFirst

- 7.1.5 Meltwater

- 7.1.6 NetBase Quid

- 7.1.7 Sprinklr

- 7.1.8 Synthesio

- 7.1.9 Zignal Labs

- 7.1.10 Awario

- 7.1.11 Keyhole

- 7.1.12 Mention

- 7.1.13 Agorapulse

- 7.1.14 Synthesio

- 7.1.15 Mentionlytics