|

市场调查报告书

商品编码

1644880

西班牙的网路安全:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Spain Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

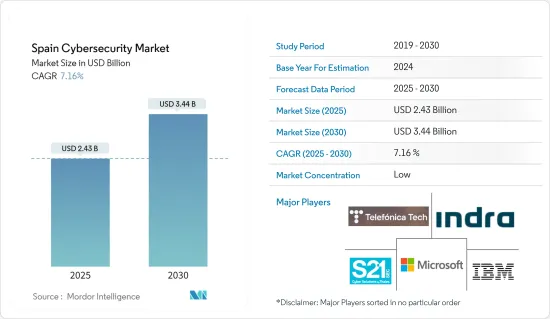

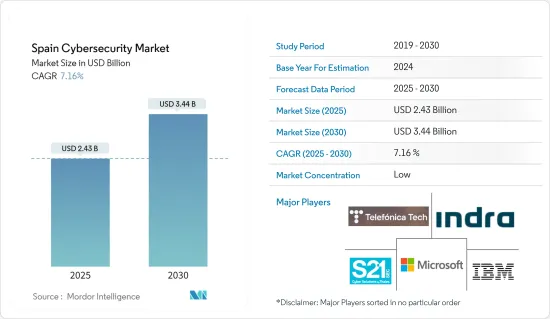

西班牙网路安全市场规模预计在 2025 年为 24.3 亿美元,预计到 2030 年将达到 34.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.16%。

各个商业和业务部门的数位化使营业单位更容易受到资料外洩和网路攻击,从而增加了西班牙对网路安全解决方案和服务的需求。因此,供应商正在开发新的安全产品,为西班牙网路安全市场的使用者提供安全和受保护的体验。

主要亮点

- 西班牙企业正在迅速数位化,以响应全球工业4.0趋势。数位平台正日益跨产业、跨业务领域地融合,并透过网路扩大其影响力。这种自动化和整合使供应链变得脆弱,从而产生了对资料保护和网路安全解决方案的需求,以对抗该国日益增多的网路攻击。

- 数位转型以将数位技术融入所有业务营运为特征,对于寻求更高效率和竞争优势的企业来说至关重要。云端基础设施的扩展、物联网设备的互联互通以及人工智慧的资料分析应用,共同推动企业进入技术复杂的新时代。然而,数位化復兴也扩大了网路威胁面,需要相应扩展网路安全战略。

- 认识到潜在的损害来自于理解对关键基础设施的攻击不仅会造成经济损失。基本服务的中断会对社会产生不利影响,影响公共、国家安全和经济稳定。针对医疗保健组织的勒索软体攻击和旨在破坏电网的复杂网路宣传活动等事件凸显了加强关键基础设施网路安全防御的紧迫性。因此,政府、企业和网路安全解决方案供应商预计将大力投资先进技术和策略,以减轻与此类关键情况相关的风险。

- 市场需要更多技能的劳动力来满足网路安全需求和成长。越来越多知名跨国企业涌入中国,导致潜在网路安全人才大量流失,造成剩余潜在市场的人力资本短缺。根据ISC网路安全人才调查,2023年,西班牙的网路安全专业人员数量为1,82,140人。因此,西班牙对熟练的专业人员和网路安全专家的需求很高,以应对日益增多的网路攻击。

- 新冠疫情增加了网路流量和公民的数位参与。这也增加了网路攻击和资料外洩的风险。自从新冠肺炎疫情爆发以来,西班牙政府遭受了重大网路攻击。这些案例都强调了疫情过后采取有效网路安全措施的必要性,从而为西班牙网路安全市场的新参与企业创造了巨大的需求,也为现有参与者带来了繁荣。

西班牙网路安全市场的趋势

网路安全提供领域预计将占据较大的市场占有率

- 传统的网路安全工具会根据预先定义的安全规则监控和控制入站和出站网路流量。这些系统监控网路流量是否有可疑活动或违规行为或预先设定的安全策略。

- 在西班牙,5G网路虚拟、网路切片和软体定义网路(SDN)的使用日益增多,这刺激了网路安全解决方案的采用,因为5G安全正在开发中,以保护5G基础设施和支援5G的设备免受网路攻击、资料遗失、恶意软体、骇客和其他威胁,使它们容易受到网路攻击。

- 由于俄罗斯与欧盟的衝突,西班牙的网路攻击增加,增加了该国企业和政府服务层面对网路安全解决方案的需求,从而刺激了市场成长。例如,2023 年 10 月,西班牙政府报告称,据称由亲俄骇客发起的分散式拒绝服务 (DDoS) 攻击针对了许多公共和私人网站,包括格拉纳达市的公交服务应用程序,这表明网络安全解决方案对该国应用程序、网络和基础设施安全的重要性,预计将在预测期内推动西班牙采用网络安全解决方案。

- 各产业的互联互通和数位转型力度的加大,对网路安全的需求显着增加。联网设备、物联网 (IoT) 的激增以及新兴技术的采用正在扩大网路格局。

- 物联网、5G 和连网装置的扩充增加了潜在的攻击面,需要强而有力的安全措施来防止未授权存取和潜在的漏洞。网路安全在保护现代企业所依赖的复杂互联繫统、设备和应用程式方面发挥着至关重要的作用。

- 5G 将推动具有高速、低延迟连接能力的行动和物联网设备的普及。因此,对行动安全解决方案的需求日益增加,包括行动装置管理 (MDM)、行动威胁防御 (MTD) 和安全容器化,以保护行动装置上的敏感资料和应用程式。根据欧洲5G观察站的数据,2023年9月西班牙5G人口覆盖率将达82.3%。

IT 和通讯终端用户领域预计将占据市场占有率

- 资讯科技 (IT) 和通讯在西班牙公司、政府部门和组织中发挥关键作用。随着我们对互联网、云端运算和数位通讯的依赖日益增加,强有力的网路安全措施的需求变得至关重要。 IT 和电讯终端用户寻求保护其敏感资料、网路和通讯免受不断演变的网路威胁,他们构成了西班牙网路安全市场的重要组成部分。

- 西班牙网路安全市场在 IT 和电讯领域正经历强劲成长,主要受以下几个关键因素推动:首先,针对IT和电讯基础设施的网路威胁日益频繁且复杂,大大推动了该领域的组织加强其网路安全措施。

- 此外,由于业界越来越意识到全面云端安全解决方案的必要性,预计云端部署将在市场上获得青睐。 2024 年 2 月,微软计划将其在西班牙对人工智慧(AI)和云端基础设施的投资增加四倍,未来两年内投入 19.5 亿欧元(21 亿美元)。

- 此外,2024年4月,IBM与西班牙政府合作推动国家人工智慧战略,并建构世界领先的西班牙语人工智慧模式。此次战略合作将加强西班牙开放和道德的人工智慧倡议,并振兴其经济和技术努力。

- 万事达卡表示,西班牙遭受网路攻击最多的产业是科技和服务业,2021 年 1 月至 2023 年 8 月期间共发生 32 起攻击。同时,西班牙的战略部门——能源产业是 2022 年西班牙记录的网路安全事件最多的产业,共发生约 203 起事件,而税务和金融系统则位居第二,同年共发生 95 起事件。

西班牙网路安全产业概况

西班牙网路安全市场较为分散,既有全球参与者,也有中小型企业。市场的主要参与者包括 Telefonica Cybersecurity &Cloud Tech SLU、微软、Indra Sistemas SA、IBM Corporation 和 Grupo S21Sec Gestion SAU。市场参与者正在采取合作和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2024年2月,微软将把对西班牙人工智慧和云端基础设施的投资增加四倍,以加强该国的网路安全,并推动企业和政府负责任、安全地采用人工智慧。

- 2023 年 11 月,Accenture收购了 Innotec Security,扩大了在西班牙的能力和影响力,Innotec Security 是一家专门从事网路安全即即服务、网路弹性和网路风险管理的私人公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 由于企业数位化、电子商务和IT基础设施扩展而导致的需求增加

- 支持数位业务和网路安全的经济追赶效应

- 西班牙大型国防和安全公司推动成长

- 市场限制

- 网路安全人才短缺

- 市场机会

- 加强人工智慧应用力度,增强网路安全和风险预测能力

第六章 市场细分

- 透过奉献

- 安全类型

- 云端安全

- 资料安全

- 身分和存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他类型

- 按服务

- 安全类型

- 按部署

- 云

- 本地

- 按最终用户

- BFSI

- 卫生保健

- 製造业

- 政府和国防

- 资讯科技/通讯

- 其他最终用户

第七章 竞争格局

- 公司简介

- Telefonica Cybersecurity & Cloud Tech SLU

- Microsoft

- Indra Sistemas SA

- IBM Corporation

- Grupo S21Sec Gestion SAU

- Acuntia SAU(Axians)

- Titanium Industrial Security SL

- Alias Robotics SL

- S2 Grupo

- Outpost24(BlueLiv)

- Evolium Technologies SLU(Redtrust)

第八章投资分析

第九章:市场的未来

The Spain Cybersecurity Market size is estimated at USD 2.43 billion in 2025, and is expected to reach USD 3.44 billion by 2030, at a CAGR of 7.16% during the forecast period (2025-2030).

Digitalization of different business and operational sectors exposes entities to data breaches and cyber-attacks, creating demand for cybersecurity solutions and services in Spain. Therefore, vendors are developing new security offerings to provide users with a secure and protected experience in the Spanish cybersecurity market.

Key Highlights

- Enterprises in Spain are undergoing rapid digitalization, following the global Industry 4.0 trends. There is a rising integration of digital platforms among industries and different business sectors, expanding their reach through the Internet. Such automation and integration have made the supply chain vulnerable, creating demand for data protection and cybersecurity solutions to cater to the growing cyber attacks in the country.

- Digital transformation, characterized by integrating digital technologies into all business operations, has become crucial for organizations seeking enhanced efficiency and competitive advantage. The expansion of cloud-based infrastructure, the interconnectedness of IoT devices, and the utilization of AI for data analytics have collectively propelled businesses into a new period of technological sophistication. However, this digital renaissance has also expanded the attack surface for cyber threats, necessitating a proportional growth in cybersecurity strategies.

- Recognizing the high potential damages arises from realizing that attacks on critical infrastructure extend beyond financial losses. Disruptions in essential services can negatively influence society, impacting public safety, national security, and economic stability. Incidents like ransomware attacks targeting healthcare institutions or sophisticated cyber campaigns aimed at disrupting energy grids emphasize the urgency of strengthening the cybersecurity defenses of critical infrastructure. Consequently, governments, enterprises, and cybersecurity solution providers are expected to invest significantly in advanced technologies and strategies to mitigate the risks associated with these high-stakes scenarios.

- The market needs a more skilled workforce to tackle the cybersecurity requirements and growth. The heavy influx of more prominent multinational business companies in the country removes potential cybersecurity talent, creating a deficit of human capital for the rest of the potential market. According to ISC's Cybersecurity Workforce Study, in 2023, the number of cybersecurity professionals in Spain was 1,82,140. Therefore, Spain is witnessing a growing demand for skilled professionals and cybersecurity experts to address the increasing number of cyber attacks.

- The COVID-19 pandemic augmented the country's population's online traffic and digital participation. Thus, the risks of cyber-attacks and data breaches also increased. The Spanish government has experienced significant cyber attacks since the COVID-19 pandemic. Such instances have propelled the need for effective cybersecurity measures post-pandemic, creating considerable demands for new entrants and flourishment of the existing players in the Spanish cybersecurity market.

Spain Cyber Security Market Trends

Network Security Type Offering Segment is Expected to Hold Significant Market Share

- Traditional network security tools monitor and control incoming and outgoing network traffic based on predetermined security rules. These systems monitor network traffic for suspicious activity, violations, or pre-established security policies.

- The development of 5G security in Spain to protect 5G infrastructure and 5G-enabled devices against cyberattacks, data loss, malware, hackers, and other threats due to the 5G network's increasing use of virtualization, network slicing, and software-defined networking (SDN), making it vulnerable to network attacks, and fueling the adoption of network security solutions.

- The increasing cyberattacks on Spain due to the conflicts between Russia and the European Union have raised the need for cyber security solutions in the country's enterprise and governmental service level, fueling market growth. For instance, in October 2023, the Spanish government reported that many public and private websites, including the city of Granada's bus service application, were targeted in a distributed denial-of-service (DDoS) attack claimed by pro-Russian hackers, showing the importance of cybersecurity solutions for applications, network, and infrastructure security of the country, which is expected to fuel the adoption of cybersecurity solutions in Spain during the forecast period.

- The increasing connectivity and digital transformation initiatives across industries contribute significantly to the demand for network security. The expansion of connected devices, the Internet of Things (IoT), and the adoption of emerging technologies result in expanded network landscapes.

- The expansion of IoT, 5G, and connected devices strengthens the potential attack surface, necessitating robust security measures to safeguard against unauthorized access and potential vulnerabilities. Network security plays a pivotal role in securing the complex web of interconnected systems, devices, and applications that serve as the basis of modern enterprises.

- 5G facilitates the proliferation of mobile and IoT devices with high-speed, low-latency connectivity. Consequently, there is a greater need for mobile security solutions, including mobile device management (MDM), mobile threats defense (MTD), and secure containerization to protect sensitive data and applications on mobile devices. According to the European 5G Observatory, the 5G population coverage in September 2023 in Spain was 82.3%.

IT and Telecommunication End-user Segment is Expected to Hold Significant Market Share

- Information technology (IT) and telecommunications play a vital role in businesses, government agencies, and organizations in Spain. The need for robust cybersecurity measures has become crucial with the increasing reliance on interconnected networks, cloud computing, and digital communication. IT and telecom end users form a substantial portion of the Spanish cybersecurity market as they seek to protect their sensitive data, networks, and communications from evolving cyber threats.

- The IT and telecom sector is experiencing robust growth in the Spanish cybersecurity market, driven by several key factors. Firstly, the rising frequency and complexity of cyber threats targeting IT and telecom infrastructure have significantly driven organizations in this sector to enhance their cybersecurity measures.

- Further, cloud deployment is expected to gain prominence in the market, owing to the industry's increased recognition of the need for comprehensive cloud security solutions. In February 2024, Microsoft planned to quadruple its investments in artificial intelligence (AI) and cloud infrastructure in Spain, spending EUR 1.95 billion (USD 2.1 billion) in the next two years.

- Furthermore, in April 2024, IBM and the government of Spain collaborated to advance the national AI strategy and build the world's leading Spanish language AI models. The strategic collaboration will strengthen Spain's open and ethical AI initiatives to stimulate economic and technical efforts.

- According to Mastercard, technology and services were the industries with the highest share of cyberattacks in Spain, accounting for 32 occurrences between January 2021 and August 2023. Meanwhile, the energy industry in Spain's strategic sector had the most cybersecurity incidents registered in Spain in 2022, with around 203 occurrences, while the tax and financial systems ranked second, with 95 incidents registered in the same year.

Spain Cyber Security Industry Overview

The Spanish cybersecurity market is fragmented due to the presence of global players and small and medium-sized enterprises. Some of the major players in the market are Telefonica Cybersecurity & Cloud Tech SLU, Microsoft, Indra Sistemas SA, IBM Corporation, and Grupo S21Sec Gestion SAU. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024: Microsoft quadrupled its investment in AI and cloud infrastructure in Spain to promote the deployment of responsible and secure artificial intelligence in companies and public administration with the reinforcement of national cybersecurity.

- November 2023: Accenture acquired Innotec Security, a privately held company specializing in cybersecurity-as-a-service, cyber resilience, and cyber risk management, expanding its capabilities and footprint in Spain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from Digitalization, E-commerce, and Scaling IT Infrastructure for Businesses

- 5.1.2 Economic Catch-Up Effect Supporting Digital Businesses and Cybersecurity

- 5.1.3 Large Spanish Defense and Security Firms Driving the Growth

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Workforce

- 5.3 Market Opportunities

- 5.3.1 Increasing Use of AI for Enhancing Cybersecurity and Risk Prediction Capabilities

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government and Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Telefonica Cybersecurity & Cloud Tech SLU

- 7.1.2 Microsoft

- 7.1.3 Indra Sistemas SA

- 7.1.4 IBM Corporation

- 7.1.5 Grupo S21Sec Gestion SAU

- 7.1.6 Acuntia SAU (Axians)

- 7.1.7 Titanium Industrial Security SL

- 7.1.8 Alias Robotics SL

- 7.1.9 S2 Grupo

- 7.1.10 Outpost24 (BlueLiv)

- 7.1.11 Evolium Technologies SLU (Redtrust)