|

市场调查报告书

商品编码

1644883

中国网路安全:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

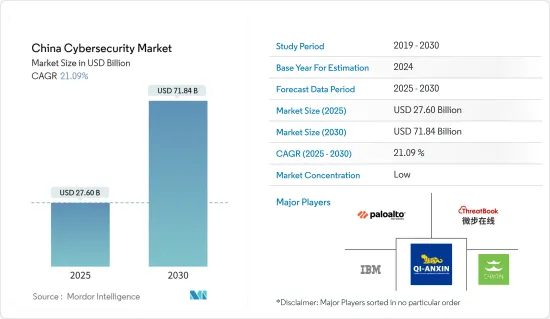

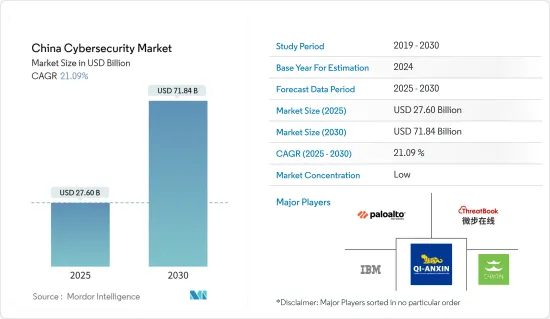

2025年中国网路安全市场规模预估为276亿美元,预估至2030年将达718.4亿美元,预测期间(2025-2030年)复合年增长率为21.09%。

随着数位化进程的推进和网路威胁的增加,中国的网路安全市场正在快速成长。中国政府积极加强网路安全措施,保护关键基础设施、敏感资料和企业免受网路攻击。

主要亮点

- 中国的技术进步正在增加连网设备的数量。随着 5G 设备的发展,设备互联互通也呈指数级增长。因此,连网设备的数量将会增加,进而大幅增加安全产品的市场需求。

- 随着物联网的兴起,工业革命 4.0 将有助于跨产业的蜂巢式连接。机器对机器的连结也正在推动市场的发展。根据CNNIC预测,到2023年12月,中国约有23.3亿网路用户可使用蜂巢式物联网服务。智慧公共、製造业和运输业占物联网终端用户的一半以上。

- 网路攻击增加的主要原因之一是各行业缺乏熟练的网路安全人才。在中国,与安全专业人员相比,经验丰富的网路安全专家非常稀缺,他们被要求解决金融机构、政府机构和私人企业/产业的网路威胁。

- 大型企业正在为安全和销售部署更多资料驱动的人工智慧解决方案。网路安全专家正在利用地理空间资料来加强他们的防线。透过将地理空间资料纳入现有的安全系统,公司可以增强紧急管理、国家情报、基础设施保护和防御平台。

- 自新冠肺炎疫情以来,包括中国在内的许多国家组织已转向远距工作环境。包括恶意软体和勒索软体在内的网路攻击的增加迫使组织采用网路安全解决方案。因此,随着在家工作趋势的日益增长,中国的网路安全市场预计将显着增长。

中国网路安全市场趋势

云端部署领域预计将占据重要市场占有率

- 随着企业越来越认识到将资料迁移到云端而不是创建和维护新的资料储存可以节省成本和资源,对云端基础的解决方案的需求以及随之而来的按需安全服务的使用成长也随之而来。由于这些优势,云端基础的解决方案正被中国大大小小的企业频繁采用。

- 企业越来越意识到将资料迁移到云端而不是建置和维护新的资料储存对于节省成本和资源的重要性,这推动了对云端基础的解决方案的需求。鑑于其多种优势,云端平台和生态系统有望成为未来几年爆发数位创新速度和规模的发射台。

- 随着 IT 交付从内部部署转向外部部署,安全性在云端引进週期的每个阶段都变得至关重要。中小型企业更愿意采用云端运算,因为它允许他们将有限的网路安全资金集中在核心竞争力上,而不是投资于安全基础设施。此外,随着公有云服务的使用扩大了组织的信任边界,安全性成为云端基础设施的重要组成部分。然而,云端基础方案的广泛使用大大简化了企业的网路安全工作。

- Google Drive、Dropbox 和 Microsoft Azure 等云端服务的日益普及,以及这些工具成为业务流程不可或缺的一部分的出现,迫使企业解决敏感资料失控等安全性问题。这就是为什么按需网路安全解决方案的采用日益增多的原因。

- 云端基础的解决方案还具有降低资本支出要求的好处,使商业案例更加强大。透过采用云端基础的服务,企业可以大幅减少资本支出需求,因为他们不需要投资硬体元件。云端解决方案还可以使应用程式成本更加可预测,因此公司不必花费太多的前期成本来部署该技术。硬体和 IT 支援方面的节省使得云端基础的解决方案更加经济实惠。

- 考虑从内部部署软体迁移到云端基础的解决方案的公司主要会检查潜在解决方案在关键安全功能(例如标准合规性、入侵防御和检测)方面的功能。

- CNNIC于2023年6月进行的一项调查发现,20%的中国网路使用者曾成为网路诈骗的受害者。

资料安全产品领域预计将占据相当大的市场占有率

- 金融业被公认为采用监管框架并建立适当资讯和资料安全标准的领先产业。这确保了货物和服务的可靠交付、我们的系统安全处理资料以及负责任地使用您的个人资料。

- 资料安全降低了保护敏感资料免受威胁所带来的风险,并帮助组织保持合规性。资料安全平台提供资料风险分析、资料监控、保护解决方案,保护组织资料免受资料库漏洞的影响。各国政府正在加强资料安全监管,并要求企业使用网路安全解决方案。这一趋势包括使用防毒和反间谍软体,预计将在未来几年内创造一个蓬勃发展的网路解决方案市场。合规性有望成为预防资料外泄解决方案的主要驱动力。然而,企业的数位转型策略,特别是云端运算采用、巨量资料分析和物联网支持,也在推动该地区的企业安全团队采用这些产品,在整个组织内识别和分类关键资料,并主要根据资讯的关键性重新分配资料安全控制。

- 随着企业不断实现业务数位化并应对日益复杂的资料保护挑战,投资有效的资料安全措施对于保护敏感资讯、维持法规合规性和保护企业声誉至关重要。

- 随着数位转型的加速和资料保护问题变得更加复杂,组织必须投资正确的安全措施来保护敏感资料,满足监管要求并保护其品牌形象。由于资料量的增加、资料保护条例的变化以及客户相关担忧,对资料安全解决方案的需求预计会增加。

- 根据CNNIC 2023年6月的调查显示,网路诈骗是中国网友面临的最常见的网路安全问题。约有 38% 的受访者曾遭遇网路抽奖或乐透中奖诈骗。

中国网路安全产业概况

中国的网路安全市场较为分散,领先的公司包括Palo Alto Networks、ThreatBook、IBM Corporation、奇安信科技集团有限公司和北京长亭未来科技等。市场参与者正在采取合作和收购等策略来增强其产品供应并获得永续的竞争优势。例如

- 2024 年 4 月,全球网路安全领导者 Palo Alto Networks 和 Google Cloud 宣布扩大伙伴关係,并承诺提供十位数的多年期资金。 Palo Alto Networks 选择 Google Cloud 作为其 AI 和基础设施供应商。 Google Cloud 早已将 Palo Alto Networks 视为其首选的新一代防火墙 (NGFW) 供应商,而此次扩展的协议巩固了这种关係。此次合作也凸显了人工智慧平台自动化和整合多种解决方案以提供近乎即时的安全解决方案的关键重要性。

- 2023 年 10 月,IBM 宣布其託管检测和响应服务的改进,利用 AI 技术自动升级或关闭高达 85% 的警报,缩短客户的安全响应时间。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 宏观经济因素如何影响市场

第五章 市场动态

- 市场驱动因素

- 企业面临的网路钓鱼和恶意软体风险日益增加

- 增加云端基础的服务的使用

- 日益增长的 M2M/IoT 连线要求企业加强网路安全

- 市场限制

- 网路安全专家短缺和最新设备的安全挑战

- 组织面临预算限制、准备不足以及对传统身分验证方法的高度依赖

- 市场机会

- 物联网、BYOD、人工智慧和机器学习在网路安全领域的发展趋势

- 改变传统防毒软体产业

第六章 市场细分

- 按服务

- 安全类型

- 云端安全

- 资料安全

- 身分和存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他类型

- 按服务

- 安全类型

- 按部署

- 云

- 本地

- 按最终用户

- BFSI

- 卫生保健

- 製造业

- 政府和国防

- 资讯科技/通讯

- 其他最终用户

第七章 竞争格局

- 公司简介

- Palo Alto Networks

- ThreatBook

- IBM Corporation

- QI-ANXIN Technology Group Inc.

- Beijing Chaitin Future Technology Co. Ltd

- CoreShield Times

- River Security

- Tophant Inc.

- iJiami

- IDsManager

第八章投资分析

第九章:未来市场展望

The China Cybersecurity Market size is estimated at USD 27.60 billion in 2025, and is expected to reach USD 71.84 billion by 2030, at a CAGR of 21.09% during the forecast period (2025-2030).

China's cybersecurity market has been rapidly growing with the country's increasing digitization and the corresponding rise in cyber threats. The Chinese government has been actively enhancing its cybersecurity measures to protect critical infrastructure, sensitive data, and businesses against cyber attacks.

Key Highlights

- The number of connected devices has increased in China due to technological advancements. The interconnectivity of the devices also grows exponentially with 5G-enabled devices. As a result, there are more connected devices, which immediately increases the market's need for security products.

- Industrial Revolution 4.0 aids cellular connectivity throughout the industry with the rise of IoT. Machine-to-machine connections have also been instrumental in driving the market. According to CNNIC, in December 2023, approximately 2.33 billion internet users in China had access to cellular Internet of Things (IoT) services. Smart public utility, manufacturing, and transportation accounted for over half of the IoT end users.

- One of the major causes of growing cyberattacks is the lack of skilled cybersecurity personnel in each industry. In China, experienced cybersecurity professionals are less than security professionals, who are required to handle cyber threats for financial institutes, government organizations, and private sector/industrial businesses.

- Large businesses are implementing more data-based AI solutions for security and sales. Cybersecurity experts have turned to geospatial data to shore up the lines of defense. Companies can strengthen emergency management, national intelligence, infrastructure protection, and national defense platforms by implementing geospatial data into pre-existing security systems.

- Many organizations in various countries have switched to remote work environments after COVID-19, including China. The rising cyber-attacks involving malware and ransomware are forcing organizations to adopt cybersecurity solutions. Therefore, the Chinese cybersecurity market is anticipated to experience significant growth as a result of the growing work-from-home trend.

China Cyber Security Market Trends

Cloud Deployment Mode Segment is Expected to Hold Significant Market Share

- The need for cloud-based solutions and subsequent growth in the use of on-demand security services is driven by businesses' growing awareness of the value of saving money and resources by transferring their data to the cloud rather than creating and maintaining new data storage. Due to these advantages, major businesses and SMEs in China adopt cloud-based solutions more frequently.

- The increasing realization among enterprises about the importance of saving money and resources by moving their data to the cloud instead of building and maintaining new data storage drives the demand for cloud-based solutions. Owing to multiple benefits, cloud platforms and ecosystems are anticipated to serve as a launchpad for an explosion in the pace and scale of digital innovation over the next few years.

- As IT provision has shifted from on-premise to outside the boundaries of the business, security has been crucial at every stage of the cloud adoption cycle. SMEs prefer cloud deployment because it frees them up to concentrate on their core skills rather than investing their limited cybersecurity funds in security infrastructure. Furthermore, using public cloud services expands the organization's confidence boundary, making security an essential component of the cloud infrastructure. However, the increasing usage of cloud-based solutions has significantly simplified enterprises' adoption of cybersecurity practices.

- With the increased adoption of cloud services, such as Google Drive, Dropbox, and Microsoft Azure, and with these tools emerging as an integral part of business processes, enterprises must deal with security issues, such as losing control over sensitive data. This gives rise to the increased incorporation of on-demand cybersecurity solutions.

- Cloud-based solutions also benefit from lower capital expenditure requirements, thus making the business much more compelling. Deploying cloud-based services can significantly reduce the Capex requirement as the companies need not invest in hardware components. Cloud solutions also enable better prediction of the cost of an application, and companies do not need to incur as much upfront cost to incorporate the technology. The hardware and IT support savings make cloud-based solutions much more affordable.

- Companies considering moving from on-premise software to a cloud-based solution are primarily checking the potential solutions for their capabilities concerning key security features, including standards compliance, intrusion prevention, and detection.

- A CNNIC survey conducted in June 2023 found that a troubling 20% of internet users in China have been victims of online fraud.

Data Security Offering Segment is Expected to Hold Significant Market Share

- The financial sector has been recognized as a prime adopter of regulatory frameworks to implement adequate information and data security standards. These ensure a reliable provision of products and services, safe data processing by its systems, and responsible use of personal data.

- Data security helps reduce risks associated with protecting sensitive data from threats and helps organizations maintain compliance. The data security platforms provide data risk analytics, data monitoring, protection solutions, and protection of the organization's data from database vulnerability. Governments are tightening the mandates on data security, requiring companies to use cybersecurity solutions. This trend, including the use of antivirus and antispyware software, is expected to create a booming market for cyber solutions in the coming years. Compliance is expected to be the key driver of data loss prevention solutions. However, an enterprise's digital transformation strategies, most notably cloud adoption, Big Data analytics, and IoT enablement are also driving enterprise security teams in the region to adopt these products to identify and classify crucial data throughout the organization and reallocate data security controls primarily based on the criticality of the information.

- As organizations continue to digitize their operations and deal with increasingly complex data protection challenges, investment in effective data security measures will be essential to safeguard sensitive information, maintain regulatory compliance, and protect their reputation.

- As digital transformation accelerates and data protection issues become more complex, organizations must invest in adequate security measures to protect sensitive data, meet regulatory requirements, and save their brand image. Increasing data volumes, changing data protection regulations, and the necessity of customers' related concerns are expected to create robust demand for data security solutions.

- A CNNIC survey conducted in June 2023 found that online fraud is the most common internet security issue faced by internet users in China. Around 38% of respondents encountered prize or lottery-winning scams online.

China Cyber Security Industry Overview

The Chinese cybersecurity market is fragmented, with the presence of major players like Palo Alto Networks, ThreatBook, IBM Corporation, QI-ANXIN Technology Group Inc., and Beijing Chaitin Future Technology Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage. For instance,

- In April 2024, Palo Alto Networks, one of the global cybersecurity leaders, and Google Cloud announced the expansion of their partnership with a ten-figure, multi-year commitment. Palo Alto Networks named Google Cloud its AI and infrastructure provider of choice. Google Cloud has long considered Palo Alto Networks its preferred next-generation firewall (NGFW) provider and the expanded agreement solidified that relationship. The collaboration also underscores the critical importance of platformization fueled by AI to automate and consolidate multiple solutions and deliver near-real-time security resolutions.

- In October 2023, IBM unveiled the evolution of its managed detection and response service offerings with AI technologies, including automatically escalating or closing up to 85% of alerts and accelerating security response timelines for clients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Phishing and Malware Risks among Businesses

- 5.1.2 Rising Utilization of Cloud-Based Services

- 5.1.3 Rising M2M/IoT Connections Requiring Enhanced Cybersecurity in Businesses

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Experts and Security Challenges with Modern Devices

- 5.2.2 Budgetary Restrictions faced by Organizations, Low Preparedness, and High Reliance on Traditional Authentication Methods

- 5.3 Market Opportunities

- 5.3.1 Growing Trends in IoT, BYOD, AI, and Machine Learning in Cybersecurity

- 5.3.2 Traditional Antivirus Software Industry Transformation

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government & Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Palo Alto Networks

- 7.1.2 ThreatBook

- 7.1.3 IBM Corporation

- 7.1.4 QI-ANXIN Technology Group Inc.

- 7.1.5 Beijing Chaitin Future Technology Co. Ltd

- 7.1.6 CoreShield Times

- 7.1.7 River Security

- 7.1.8 Tophant Inc.

- 7.1.9 iJiami

- 7.1.10 IDsManager