|

市场调查报告书

商品编码

1644920

亚太地区抽水蓄能:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Pumped Hydro Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

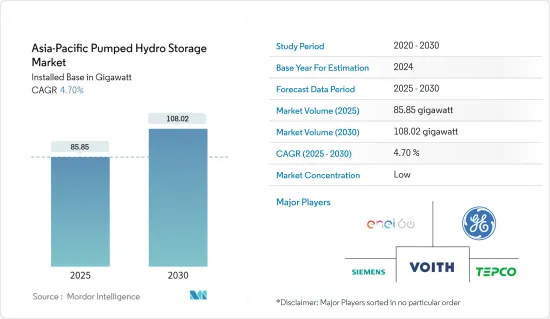

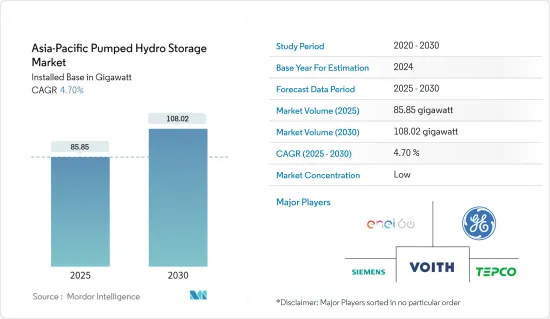

亚太地区抽水蓄能发电市场预计将从 2025 年的 85.85 GW 扩大到 2030 年的 108.02 GW,预测期内(2025-2030 年)的复合年增长率为 4.7%。

关键亮点

- 从中期来看,受可再生能源日益普及以及政府支持政策等因素影响,亚太地区抽水蓄能发电市场预计将实现成长。

- 另一方面,其他能源储存技术的竞争预计将威胁该地区抽水蓄能市场的成长。

- 预计抽水蓄能技术的不断进步将在预测期内为市场创造重大机会。

- 由于政府努力增加抽水蓄能容量,预计未来几年中国将占据最大的市场占有率。儘管如此,抽水蓄能技术的不断进步预计将在预测期内为市场创造重大机会。

- 由于政府努力增加抽水蓄能容量,预计未来几年中国将占据最大的市场占有率。

亚太地区抽水蓄能电力市场趋势

闭合迴路部分预计将显着成长

- 在闭合迴路系统中,抽水蓄能电站的建造方式是,一个或两个水库都是人工建造的,并且没有自然的水流入。封闭回路型抽水蓄能具有高度的灵活性、可靠性和高功率。闭合迴路蓄能係统对环境的影响比开放回路抽水蓄能係统小,因为它们不与现有的河流系统相连。此外,它们可以安装在需要电网支援的位置。

- 根据国际可再生能源机构预测,2022年亚洲纯抽水蓄能装置容量将达80,988兆瓦,为全球最高。由于该地区对封闭回路型蓄能电站的需求不断增长,过去五年来其容量一直在稳步增加。

- 例如,2023 年 5 月,Rewa Ultra Mega Solar Ltd (RUMSL) 启动了一项提案请求 (RFP) 流程,为中央邦总合13.8 吉瓦的抽水蓄能 (PHS)计划分配场地。该提案总合涉及 12 个站点,开发商可以在这些站点安装 600MW 至 2GW 的 PHS 容量。

- 澳洲调查团队得出结论,封闭回路型抽水蓄能电站有可能在不久的将来超越开放回路型PSH电站,因为它们克服了为抽水蓄能电站寻找合适位置的难题,并且具有对水资源没有环境影响等优势。

- 此外,闭合迴路蓄能具有高度的灵活性、可靠性和电力输出。选择这种方式的另一个主要原因是它不会干扰现有的河流系统或水流,从而更容易获得经营许可证和许可证。

- 这些因素为预测期内封闭回路型抽水蓄能发电市场明显发展动能铺平了道路。

中国可望主导市场

- 中国引领全球水力发电市场,截至 2022 年,可再生水力发电装置容量约 3,677 万千瓦。水力发电约占总发电量的16%。中国也正在努力发展抽水蓄能水力发电,特别是製定了新的政策和计划目标。

- 2022年,全国净抽水蓄能发电装置容量约4,579万千瓦,位居亚洲国家之首。在政府和民间组织的努力下,这项技术将在中国进一步蓬勃发展。

- 例如,2022年6月,中国电力建设集团宣布,已开工兴建200座抽水蓄能电站,至2025年新增抽水蓄能容量2,700万千瓦。预计将使中国的储能装置容量增加约10%,全球能源储存装置容量增加约170%。

- 此外,2022年1月,中国在河北省运作世界上最大的抽水蓄能电站。 360千万瓦抽水蓄能电站由12台30万千瓦可逆式水泵发电机组组成,总储能发电量为66亿千瓦时。

- 2023年11月,国家电网公司位于中国西北新疆维吾尔自治区的阜康抽水蓄能电厂完工投产。该计划将采用三台30万千瓦风力涡轮机,总发电量为120万千瓦。这是中国西北地区第一座此类发电厂。

- 预计此类发展将在不久的将来推动该国抽水蓄能电力市场的发展。

亚太抽水蓄能产业概况

亚太地区抽水蓄能电力市场呈现细分化。主要企业(不分先后顺序)包括 Enel SpA、通用电气公司、西门子股份公司、Voith GmBH & Co. KGAa 和东京电力公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2028年装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 可再生能源整合

- 政府支持措施和政策

- 限制因素

- 与其他能源储存技术的竞争

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 开放回路

- 闭合迴路

- 2028 年市场规模与需求预测(按地区)

- 中国

- 韩国

- 印度

- 日本

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Enel SpA

- General Electric Company

- Siemens AG

- Voith GmBH & Co. KGaA

- Tokyo Electric & Power Company

- Stantec

- Black & Veatch Holding Company

- Andritz AG

第七章 市场机会与未来趋势

- 不断提高的技术进步

简介目录

Product Code: 93141

The Asia-Pacific Pumped Hydro Storage Market size in terms of installed base is expected to grow from 85.85 gigawatt in 2025 to 108.02 gigawatt by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing adoption of renewable energy coupled with supportive government policies are projected to thrive in the Asia-Pacific pumped hydro storage market.

- On the other hand, the competition from other energy storage technologies is expected to threaten the growth of the pumped hydro storage market in the region.

- Nevertheless, the growing technological advancements in pumped hydro storage technology are expected to create significant opportunities for the market during the forecasted period.

- China is predicted to capture the largest market share in the coming years due to government initiatives to increase the pumped hydro storage capacity.Nevertheless, the growing technological advancements in pumped hydro storage technology are expected to create significant opportunities for the market during the forecasted period.

- China is predicted to capture the largest market share in the coming years due to government initiatives to increase the pumped hydro storage capacity.

Asia-Pacific Pumped Hydro Storage Market Trends

Closed-loop Segment is Expected to Witness Significant Growth

- In closed-loop systems, pumped hydro storage plants are created so that one or both the reservoirs are artificially built, and no natural water inflow is involved with either of them. Closed-loop pumped hydro storage offers high flexibility, reliability, and high-power output. Since the closed-loop pumped-hydro systems are not connected to existing river systems, their impact on the environment is less compared to open-loop pumped hydro storage systems. Moreover, they can be positioned where support for the grid is required.

- According to the International Renewable Energy Agency, the capacity of installed pure pumped hydro storage in Asia was recorded at 80,988 MW in 2022, the highest among all the regions across the world. The capacity grew consistently in the last five years due to the growing demand for closed-loop pumped hydro storage plants in the region.

- For instance, in May 2023, Rewa Ultra Mega Solar Ltd (RUMSL) initiated a Request for Proposal (RFP) process to allocate locations for a combined 13.8 GW of pumped hydro storage (PHS) projects in Madhya Pradesh. The offering includes a total of 12 sites where developers can establish PHS capacities ranging from 600 MW to 2 GW.

- A research team from Australia has concluded through a research study that the closed-loop pumped hydro storage plants may overshadow the open-loop PSH plants in the near future due to the benefits they provide, like overcoming the problem of finding suitable sites for pumped hydro storage plant location, and no environmental effects on water resources.

- Furthermore, closed-loop pumped hydro storage offers high flexibility, reliability, and power output. The other major factor for their preference is the certainty of gaining an operating license or permit since they do not interfere with the existing river systems or any water streams.

- Such factors pave the way for an explicitly visible momentum for the closed-loop pumped hydro storage market during the forecast period.

China is Expected to Dominate the Market

- China led the global hydropower market with around 36.77 GW of renewable hydropower capacity as of 2022. Hydro sources constitute about 16% of the total electricity generation mix. The country is also strenuously working on a lucid pumped hydro storage development, particularly with new policies and project goals.

- In 2022, the country's pure pumped hydro storage installed capacity was around 45.79 GW, the highest among all the Asian countries. The technology is set to bloom even more in China due to the efforts made by the government and private entities.

- For example, in June 2022, the Power Construction Corporation of China announced that it had started working on the new 270 GW of pumped hydro storage capacity to be added to the country's electricity mix, with the installation of 200 pumped hydro storage plants by 2025. It is expected to raise China's installed capacity by around 10% and the world's energy storage capacity by about 170%.

- Furthermore, in January 2022, the country commissioned the world's largest pumped hydro storage plant in China's Hebei province. The 3.6 GW pumped hydro storage facility consists of 12 reversible pumps generating sets with 300 MW each and possesses a power generation capacity from storage of 6.6 billion kWh.

- In November 2023, the State Grid Corporation of China inaugurated the Fukang pumped-storage power station in northwest China's Xinjiang region. The project features three 300 MW turbines with a total capacity of 1.2 GW. The facility is the first of its kind in northwestern China.

- Such developments are projected to drive the pumped hydro storage market in the country in the near future.

Asia-Pacific Pumped Hydro Storage Industry Overview

The Asia-Pacific pumped hydro storage market is fragmented. Some of the key players (in no particular order) include Enel SpA, General Electric Company, Siemens AG, Voith GmBH & Co. KGAa, and Tokyo Electric & Power Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Renewable Energy Integration

- 4.5.1.2 Supportive Government Policies and Regulations

- 4.5.2 Restraints

- 4.5.2.1 Competition with Other Energy Storage Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Open Loop

- 5.1.2 Closed Loop

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.2.1 China

- 5.2.2 South Korea

- 5.2.3 India

- 5.2.4 Japan

- 5.2.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Enel SpA

- 6.3.2 General Electric Company

- 6.3.3 Siemens AG

- 6.3.4 Voith GmBH & Co. KGaA

- 6.3.5 Tokyo Electric & Power Company

- 6.3.6 Stantec

- 6.3.7 Black & Veatch Holding Company

- 6.3.8 Andritz AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Advancements

02-2729-4219

+886-2-2729-4219