|

市场调查报告书

商品编码

1644936

德国海上风力发电-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Germany Offshore Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

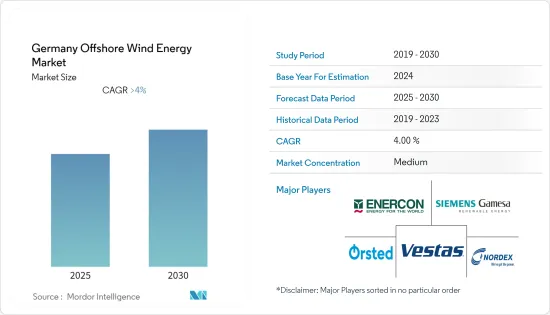

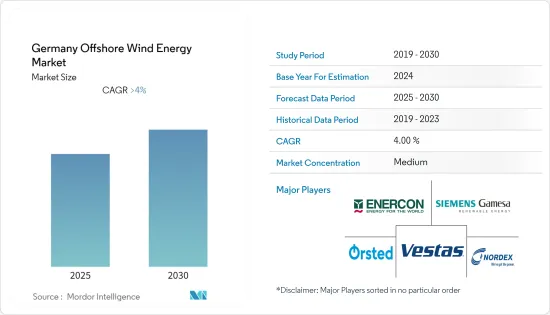

预测期内,德国海上风力发电市场预计将以超过 4% 的复合年增长率成长。

2020 年,新冠疫情对市场产生了负面影响。现在,市场可能会达到疫情前的水准。

关键亮点

- 从中期来看,清洁能源来源需求的增加预计将刺激市场成长。此外,政府支持计划和可再生能源技术的进步也有望推动所调查市场的成长。

- 另一方面,预计在预测期内,太阳能等替代清洁能源的采用和石化燃料的供应将抑制德国海上风力发电市场的发展。

- 到 2035 年将风力发电扩大到 40 吉瓦,到 2045 年扩大到 70 吉瓦的雄心勃勃的计划可能会在预测期内为德国海上风力发电市场创造丰厚的成长机会。

德国海上风力发电市场趋势

即将进行的计划和投资将推动市场需求

- 德国拥有丰富的优质、具成本竞争力的风力发电资源蕴藏量。因此,德国持有欧洲最大的风电装置容量,2021年总设备容量达63.76吉瓦。这一装置容量相当于约340万户家庭的用电需求。

- 随着对廉价、可靠、清洁和多样化电力的需求不断增长,全国各地的政府和公用事业公司都开始将风力发电作为解决方案。此外,该国拥有无与伦比的风能资源,有充足的机会最大限度地实现风力发电开发的经济和环境效益。

- 2021年5月,RWE和BASF计画投资49亿美元用于离岸风力发电计划。作为该计划的一部分,RWE计划在2030年建造一个2GW的离岸风力发电电场。该计划旨在为BASF位于路德维希港的化工综合体提供能源。

- 2021年11月,Google签约50MW风电,由丹麦能源巨头Orsted在德国北海建造的离岸风力发电电场供应。为期 12 年的企业购电协议 (CPPA) 将有助于Google实现到 2030 年所有资料中心都使用无碳能源的承诺。

- 2022 年 8 月,新加坡企业集团吉宝企业宣布,计划斥资 3.147 亿美元联手一家公司收购一家特殊目的公司 (SPV) 50.01% 的股份,该 SPV 拥有德国离岸风力发电电场 Borkum-Lifgrund 2 50% 的股份。

- 因此,在预测期内,增加对海上风力发电计划的投资和即将实施的计划可能会推动德国海上风力发电市场的成长。

5MW及以上将显着成长

- 随着能源需求的增加,各大国家和企业纷纷转向可再生能源,尤其是风力发电,来提供清洁能源。技术先进的离岸风力发电受到许多国家和企业的关注,并进行了大量的投资。

- 由于风速高于陆上风速,离岸风力发电安装正成为一个利润丰厚的市场。因此,预计预测期内离岸风力发电装置容量将大幅成长。

- 在此期间,离岸风力发电装置容量大幅成长,从 2009 年的 35 兆瓦增加到 2021 年的 7,747 兆瓦。 2021年德国陆域风电装置容量将达56,013兆瓦。

- 2021 年 11 月,BASF与 Orsted 签署了一份为期 25 年的固定价格购电协议 (CPPA),根据该协议,BASF将从 Orsted 计划在德国北海的 Borkum Riffgrund 3 海上风电场购买 186 兆瓦的产出。

- 2021 年 11 月,RWE 宣布计画在 2030 年投资 500 亿欧元(570 亿美元)。此项投资的目标是将绿色能源产量翻一番,达到 50 吉瓦(GW)。这预计将为德国离岸风力发电市场创造庞大的商机。

- 2022年9月,能源巨头RWE AG旗下的RWE Renewables Offshore HoldCo Four GmbH在一场竞争性竞标中赢得了在德国北海N-7.2区开发980兆瓦离岸风力发电的合约。

- 因此,基于上述因素,预计预测期内 5 兆瓦以上部分将显着成长,并增加德国离岸风力发电市场的需求。

德国离岸风力发电产业概况

从本质上来说,德国海上风力发电市场是适度细分的。市场的主要企业(不分先后顺序)包括 Nordex SE、Enercon GmbH、Vestas Wind Systems A/S、Orsted A/S 和 Siemens Gamesa Renewable Energy, SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2027年离岸风力发电装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- PESTLE分析

第五章 市场区隔

第六章 基本类型

- 固定基础

- 浮动基础

第 7 章 基本型别容量

- 少于5MW

- 超过5MW

第八章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Nordex SE

- Enercon GmbH

- General Electric Company

- Vestas Wind Systems A/S

- Orsted A/S

- Siemens Gamesa Renewable Energy, SA

- RWE AG

- Suzlon Energy Limited

- PNE AG

第九章 市场机会与未来趋势

简介目录

Product Code: 93217

The Germany Offshore Wind Energy Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, the growing demand for clean energy sources is expected to stimulate market growth. Furthermore, supportive government programs and advancements in renewable energy technologies are also expected to drive the growth of the market studied.

- On the other hand, the increasing adoption of alternate clean power sources, such as solar, and the availability of fossil fuels is expected to restrain Germany Offshore Wind Energy Market during the forecast period.

- Nevertheless, the ambitious plans to expand wind energy to 40 GW by 2035 and 70 GW by 2045 are likely to create lucrative growth opportunities for the Germany Offshore Wind Energy Market in the forecast period.

Germany Offshore Wind Energy Market Trends

Upcoming Projects and Investments Driving the Market Demand

- Germany has vast reserves of high-quality, cost-competitive wind energy resources. Therefore, Germany held the first-largest installed wind power capacity in the European region, with a total installed capacity of 63.76 GW in 2021. This installed capacity is enough to power approximately 3.4 million homes in the country.

- With the increasing need for an affordable, reliable, clean, and diverse electricity supply, the government and utilities across the nation are increasingly considering wind power as a solution. Moreover, with the country's unparalleled wind resources, ample opportunities exist to maximize wind energy development's economic and environmental benefits.

- In May 2021, RWE and BASF planned to invest USD 4.9 billion in offshore wind power projects. As part of the project, RWE intends to build a 2 GW offshore wind park by 2030. The project aims to supply energy to BASF's Ludwigshafen chemical complex.

- In November 2021, Google signed up for 50 MW of wind power to be delivered from an offshore wind farm built by Danish energy giant Orsted in the German North Sea. The 12-year corporate power purchase agreement (CPPA) will contribute to Google's commitment to operating all data centers with carbon-free energy by 2030.

- In August 2022, Singaporean conglomerate Keppel Corporation announced plans to spend USD314.7 million along with a unit for a 50.01 percent stake in a particular purpose vehicle (SPV) that owns 50 percent of Borkum Riffgrund 2, an offshore wind farm in Germany.

- Therefore, the increasing investments and upcoming projects in offshore wind energy projects are likely to drive the growth of the Germany Offshore Wind Energy Market during the forecast period.

Greater Than or Equal to 5 MW to Witness Significant Growth

- As energy demand is rising, major countries and companies are turning toward the adoption of renewable energy sources, especially wind energy, as they can provide clean energy. The adoption of offshore wind energy with advanced technologies attracted many countries and companies for high investments.

- Installation of wind farms in the offshore area is becoming a lucrative market because of the higher wind speed compared to onshore wind speed. Thus, offshore wind power generation capacity is expected to witness significant growth during the forecast period.

- Offshore wind energy capacity has significantly increased during this period, rising from just 35 megawatts in 2009 to 7,747 megawatts in 2021. Germany's onshore wind energy capacity reached 56,013 megawatts in 2021.

- In November 2021, BASF and Orsted concluded a 25-year fixed-price corporate power purchase agreement (CPPA), under which BASF will offtake the output of 186 MW from Orsted's planned Borkum Riffgrund 3 Offshore Wind Farm in the German North Sea.

- In November 2021, RWE announced plans to invest EUR 50 billion (USD 57 billion) by 2030. The investment aims to double its green energy to 50 gigawatts (GW). This is expected to create significant opportunities for Germany offshore wind energy market.

- In September 2022, RWE Renewables Offshore HoldCo Four GmbH, a unit of energy major RWE AG, secured a contract in the competitive auction to develop a 980-MW offshore wind farm in the N-7.2 zone in the German North Sea.

- Therefore, based on the above-mentioned factors, the Greater Than or Equal to 5 MW segment is expected to witness significant growth, increasing the German offshore wind energy market demand during the forecast period.

Germany Offshore Wind Energy Industry Overview

The Germany Offshore Wind Energy Market is moderately fragmented in nature. Some of the major players in the market (not in particular order) include Nordex SE, Enercon GmbH, Vestas Wind Systems A/S, Orsted A/S, and Siemens Gamesa Renewable Energy, S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Offshore Wind Energy Installed Capacity and Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

6 Foundation Type

- 6.1 Fixed Foundation

- 6.2 Floating Foundation

7 Capacity

- 7.1 Less Than 5 MW

- 7.2 Greater Than or Equal to 5 MW

8 COMPETITIVE LANDSCAPE

- 8.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 8.2 Strategies Adopted by Leading Players

- 8.3 Company Profiles

- 8.3.1 Nordex SE

- 8.3.2 Enercon GmbH

- 8.3.3 General Electric Company

- 8.3.4 Vestas Wind Systems A/S

- 8.3.5 Orsted A/S

- 8.3.6 Siemens Gamesa Renewable Energy, S.A.

- 8.3.7 RWE AG

- 8.3.8 Suzlon Energy Limited

- 8.3.9 PNE AG

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219