|

市场调查报告书

商品编码

1645098

欧洲内燃机市场:份额分析、产业趋势与统计、成长预测(2025-2030 年)Europe Internal Combustion Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

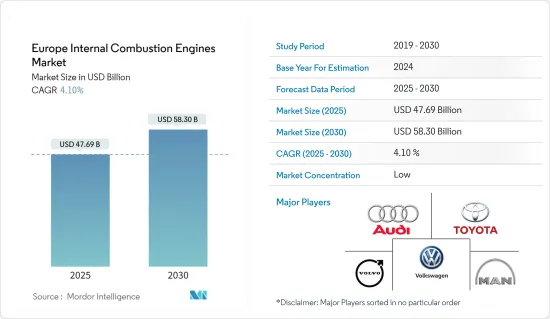

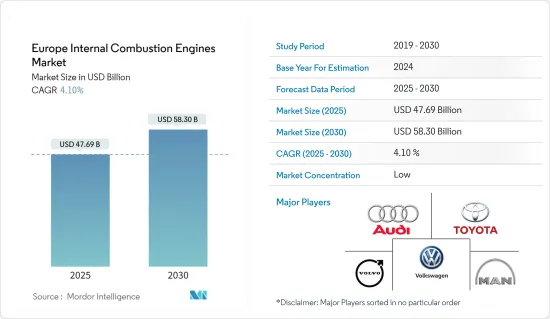

预计 2025 年欧洲内燃机市场规模将达到 476.9 亿美元,到 2030 年预计将达到 583 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.1%。

关键亮点

- 从中期来看,预计对 ICE 两轮车的需求不断增加以及插电式混合动力内燃机汽车 (PHEV) 的兴起将在预测期内推动欧洲内燃机车市场的成长。

- 另一方面,预测期内电池电动车市场的兴起以及绿色气候目标对无污染燃料的采用需求预计将阻碍欧洲内燃机市场的成长。

- 预计预测期内,插电式混合动力汽车的技术创新和最新技术的采用将为欧洲内燃机市场创造机会。

- 德国占据市场主导地位,并可能在预测期内实现最高成长率。

欧洲内燃机市场趋势

柴油占据了很大的市场份额

柴油引擎是最重要的内燃机之一,自 19 世纪 70 年代开始使用。这些引擎的设计目的是燃烧空气-柴油混合物后产生机械能。它不使用火星塞等任何辅助部件来点燃空气-柴油混合物,而是依靠引擎缸体内部移动的活塞压缩空气的温度升高。

柴油内燃机比汽油引擎更省油,加速性、牵引力和牵引力都更强。这使得柴油引擎成为欧洲相当常见且受欢迎的燃料来源。

儘管欧盟努力采用更清洁的能源来源,但柴油仍然是欧洲重要的运输燃料。 2023年,欧洲13.6%的新註册车辆将配备柴油内燃机,代表强大的欧洲基本客群。

柴油内燃机车市场很大一部分份额集中在公车(商用和私人)、政府车辆、卡车和厢型车上。根据欧洲汽车工业协会(ACEA)的数据,到2023年,柴油客车仍将是欧盟最受欢迎的客车类型,占新客车销售量的62.3%。

2023年,柴油引擎在欧洲卡车领域也获得了重要而牢固的立足点。根据欧洲汽车工业协会的数据,欧盟新註册卡车中95.7%为柴油引擎卡车,1.5%为电动车。此外,欧洲的卡车产量也有所增加。 2023年,欧洲卡车产量为603,437辆,商用车总产量与前一年同期比较增加约20.3%。

2023年10月,全球最大的快递公司联邦快递集团的子公司联邦快递欧洲公司宣布,将在英国开始试运行加氢植物油(HVO)可再生柴油作为其五辆自有卡车的燃料。这将鼓励柴油引擎市场的参与企业修改其产品以适应可再生柴油,从而提供安全的未来前景。

因此,未来几年,这种情况很可能在柴油引擎中占据很大份额。

德国可能主导市场

近年来,德国所有商用和私人车辆,包括巴士、汽车、摩托车和卡车,都从石化燃料向电动车进行了重大转变。然而,由于 PHEV 领域的技术进步,这些新兴市场的发展并未对市场产生负面影响。

PHEV,即插电式混合动力电动车,是一种混合动力电动车,将柴油或汽油引擎与马达以及可以在电动车充电站充电的大容量电池组相结合。传统的 PHEV 配有马达和电池组,但其所有动力均来自汽油或柴油。

德国动力来源汽油和柴油作为动力的内燃机汽车数量正在增加,这些汽车同时使用石化燃料燃料和非石化燃料。

除插电式混合动力汽车外,德国共用大量柴油和汽油内燃机汽车。根据德国联邦运输署(KBA)预测,2023年德国新车销量将比2022年销售资料成长7.3%,其中汽油车销量增幅最大,达13.3%至97.9万辆,汽油和柴油车的市场占有率整体提升。

2023年3月,欧盟与德国宣布达成协议,允许在2035年后销售部分内燃机,包括乘用车和卡车的汽油和柴油引擎。这项决定为德国市场相关人员提供了强劲的未来前景。

根据德国联邦运输局(KBA)的数据,到2023年12月,新四轮乘用车註册量中柴油和汽油引擎汽车的总合销量将占所有动力传动系统汽车总销量的45.5%。

总体而言,预计德国将在预测期内主导欧洲内燃机市场。

欧洲内燃机产业概况

欧洲内燃机市场规模减少了一半。该市场的主要企业包括奥迪、大众汽车集团、沃尔沃汽车公司、曼恩汽车公司、德国汽车公司、现代汽车、丰田汽车公司等(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 内燃机摩托车需求增加

- 插电式混合动力内燃机汽车 (PHEV) 的兴起

- 限制因素

- 电动车市场成长

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 按容量

- 50~200 cm3

- 201~800 cm3

- 801~1,500 cm3

- 1,501~3,000 cm3

- 按燃料类型

- 汽油

- 柴油引擎

- 其他的

- 按地区

- 英国

- 义大利

- 法国

- 德国

- 俄罗斯

- 北欧的

- 土耳其

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- 市场参与企业

- Volkswagen Group

- Volvo AB

- MAN SE

- Bayerische Motoren Werke AG

- Hyundai Motors

- Toyota Motor Corporation

- 市场参与企业

- 市场排名分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 插电式混合动力汽车的技术创新与最新技术的采用

The Europe Internal Combustion Engines Market size is estimated at USD 47.69 billion in 2025, and is expected to reach USD 58.30 billion by 2030, at a CAGR of 4.1% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing demand for ICE two-wheelers and the rise of plug-in hybrid ICE vehicles (PHEV) are expected to drive the growth of the Europe Internal Combustion Engines Market during the forecast period.

- On the other hand, the rising battery electric vehicle market and demand for the adoption of cleaner fuels in regard to the green climate goals are expected to hinder the growth of Europe's internal combustion engine market during the forecast period.

- Nevertheless, technological innovation and adaptation of the latest technologies in plug-in hybrid vehicles are likely to create opportunities for the European internal combustion engine market during the forecast period.

- Germany dominates the market and is also likely to witness the highest grwoth during the forecast period.

Europe Internal Combustion Engines Market Trends

Diesel to have Significant Share in the Market

Diesel engines are one of the most significant internal combustion engines that have been in use since the 1870s. These engines are designed to generate mechanical energy after the combustion of an air-diesel mixture. No auxiliary component like a spark plug is used to ignite the air-diesel mixture; instead, it uses the elevating temperature of the air, which is compressed by a piston moving inside an engine block.

Diesel ICE engines are fuel-efficient and have better acceleration, towing, and hauling potential than gasoline engines. Thus, they have been quite a familiar and popular fuel source in Europe.

Diesel has been an important transportation fuel in Europe despite the European Union's initiatives to adopt cleaner energy sources. In 2023, 13.6 % of the newly registered vehicles in Europe had internal combustion engines that used diesel, thus accounting for a strong customer base in Europe.

A fair share of the diesel ICE engine market can be seen in the buses (commercial and private), government vehicles, trucks, and vans. According to the European Automobile Manufacturers' Association (ACEA), in 2023, diesel-powered buses remained the most popular in the EU, accounting for 62.3% of all new bus sales.

In 2023, diesel-powered ICE engines also saw a significant and strong base in the European trucking sector. According to ACEA, 95.7% of all newly registered trucks in the European Union run on diesel, while 1.5% were electric. Further, truck production increased in the European region. In 2023, nearly 603437 trucks were manufactured in Europe, which increased the total commercial vehicle production by around 20.3%, as compared to the previous year.

In October 2023, FedEx Corp. subsidiary company FedEx Express Europe, the world's largest express transportation company, announced the beginning of trialing hydrotreated vegetable oil (HVO) renewable diesel to fuel five of its company-owned trucks in the United Kingdom. This will provide a safe future outlook for the diesel engine market players, making changes in their products to adapt to renewable diesel.

Hence, such a scenario is likely to have a significant share of diesel engines in the coming years.

Germany to Likely to Dominate the Market

In recent years, Germany has seen a huge transition from Fossil fuels to Electric vehicles in all commercial and private vehicles, including Buses, Cars, Two-wheelers, and Trucks. Still, these developments have not negatively affected the market due to technological advancements in the PHEV sector.

A PHEV or a plug-in hybrid electric vehicle is a type of hybrid EV that combines a diesel or gasoline engine with a large battery pack and an electric motor that an EV charging station can recharge. Conventional PHEV automobiles have an electric motor and battery pack but derive all their power from gasoline or diesel.

The growing popularity among the nations' family households and the use of Plug-In Hybrid Electric vehicles in public transport and commercial heavy vehicles is key to the growth of Gasoline and Diesel powered ICE engines in Germany, showing a resonant use of both Fossil and Non-Fossil use.

Even apart from the PHEVs, Germany shares a significant number of diesel- and petrol-ICE-powered cars. According to the German KBA Federal Transport Authority, new sales of cars in Germany marked a rise of 7.3% in 2023, when compared to 2022 sales data, in which Petrol vehicle sales saw the most significant boost, rising by 13.3% to 979,000, leading to an overall market share increase for petrol and diesel-powered cars.

In March 2023, the European Union and Germany announced having reached an agreement allowing some internal combustion engines, including petrol and diesel engines, for Passenger cars and Trucks to be sold beyond 2035. The decision thus provides a strong future outlook for the market players in Germany.

According to the German KBA Federal Transport Authority, among the registration of new four-wheeler passenger vehicles in December 2023, the combined share of diesel and gasoline-powered vehicles was 45.5% of the total cars sold of all powertrains.

Thus, on the basis of the above points, Germany will dominate the European internal combustion engine market during the forecast period.

Europe Internal Combustion Engines Industry Overview

The Europe Internal Combustion Engines Market is semi-fragmented. The key players in this market include(in no particular order) Audi, Volkswagen Group, Volvo AB, MAN SE, Bayerische Motoren Werke AG, Hyundai Motors, and Toyota Motor Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing demand for ICE two-wheelers

- 4.5.1.2 Rise of plug-in hybrid ICE vehicles (PHEV)

- 4.5.2 Restraints

- 4.5.2.1 Rising Battery electric vehicle market

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By capacity

- 5.1.1 50 cm3 to 200 cm3

- 5.1.2 201 cm3 to 800 cm3

- 5.1.3 801 cm3 to 1500 cm3

- 5.1.4 1501 cm3 to 3000 cm3

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Italy

- 5.3.3 France

- 5.3.4 Germany

- 5.3.5 Russia

- 5.3.6 NORDIC

- 5.3.7 Turkey

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Market Players

- 6.3.1.1 Volkswagen Group

- 6.3.1.2 Volvo AB

- 6.3.1.3 MAN SE

- 6.3.1.4 Bayerische Motoren Werke AG

- 6.3.1.5 Hyundai Motors

- 6.3.1.6 Toyota Motor Corporation

- 6.3.1 Market Players

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological innovation and adaptation of the latest technologies in plug-in hybrid vehicles