|

市场调查报告书

商品编码

1645112

全球内燃机 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Internal Combustion Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

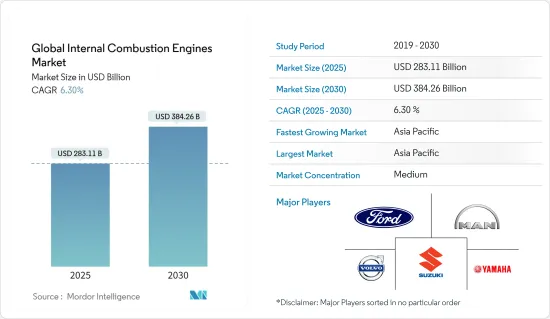

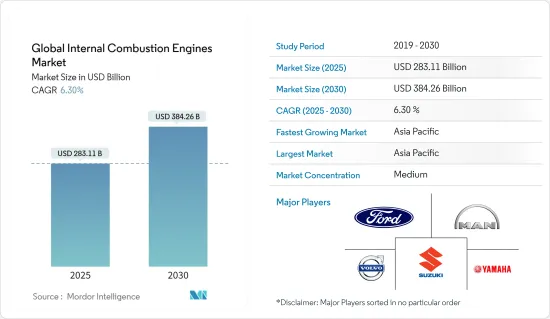

2025 年全球内燃机市场规模预计为 2,831.1 亿美元,预计到 2030 年将达到 3,842.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.3%。

关键亮点

- 预计预测期内亚太地区对汽车和两轮车的需求不断增加将推动市场发展。

- 然而,对非温室气体排放汽车的不断增长的需求以及引入替代燃料汽车的支持政策预计会阻碍市场成长。

- 预计在预测期内,内燃机设计的不断研发和技术进步将为市场提供巨大的成长机会。

- 由于工业和商业活动的增加,预计亚太地区将占据市场的大部分份额,这将导致预测期内汽车销量增加。

全球内燃机市场趋势

柴油市场预计将出现强劲成长

- 柴油引擎是最重要的内燃机之一,自 19 世纪 70 年代开始使用。该引擎的设计目的是燃烧空气-柴油混合物后产生机械能。它不使用火星塞等任何辅助部件来点燃空气和柴油混合物,而是利用空气的升高温度,然后由引擎缸体内移动的活塞压缩。

- 这些引擎以前是为动力来源火车和工厂而设计的。然而,多年来它已被用于各种应用,包括发电、汽车、建筑和农业机械。

- 柴油引擎的一大优点是比汽油引擎更节省燃料。它的零件比汽油引擎少,因此维护问题也更少。柴油引擎比汽油引擎具有更好的加速性、牵引力和牵引力。柴油引擎的设计可承受高压缩和重负荷运行,因此使用寿命长。

- 随着柴油引擎进行技术创新以实现更高的效率,预计预测期内柴油消费量将会增加。根据美国能源资讯署的数据,2023 年 12 月美国柴油总消费量为每天 375 万桶。由于柴油引擎技术的进步,预计消费量将会增加。

- 2023年2月,康明斯宣布将于2026年在北美推出下一代燃料无关引擎(X10)。该引擎预计将符合美国环保署 2027 年的规定。该引擎的柴油版本将首先推出。

- 因此,由于技术发展和柴油消费量的增加,预计该领域将显着增长。

亚太地区可望主导市场

- 亚太地区拥有印度、中国和日本等一系列新兴国家,这些国家正在经历快速的都市化和工业化。随着这些国家经济的发展,电子商务产业也崛起,从而产生了对内燃机的需求。

- 过去五年来,电子商务产业取得了长足发展,这主要归功于新冠疫情。电子商务在人们的日常生活中发挥着重要作用。它正在重新定义世界各地的商业。除了电子商务领域外,汽车在旅行和其他用途的使用也在增加。汽车使用量的增加预计将推动对内燃机的需求,因为内燃机是汽车的初级能源。

- 根据国际汽车工业理事会的预测,2023年亚太地区汽车产量将达55,115,837辆,与前一年同期比较年增长率约为10%。该地区汽车产量的上升预计将推动对内燃机的需求。

- 根据汽车製造商 Stellantis 在 2023 年 9 月发布的公告,内燃机汽车 (ICE) 预计将在道路上行驶到 2050 年,并且需要抑制二氧化碳排放,直到全电动汽车最终取代它们。

- 因此,由于电子商务领域的发展和汽车使用的增加,尤其是在新兴国家,预计亚太地区将在预测期内占据市场主导地位。

全球内燃机产业概况

全球内燃机市场规模减少了一半。该市场的一些主要企业包括沃尔沃汽车公司、曼恩汽车公司、雅马哈摩托车公司、铃木汽车公司和福特汽车公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 汽车需求增加

- 摩托车需求不断增加

- 限制因素

- 对无温室气体排放汽车的需求不断增加

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 容量

- 50~200 cm3

- 201~800 cm3

- 801~1,500 cm3

- 1,501~3,000 cm3

- 燃料类型

- 汽油

- 柴油引擎

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 西班牙

- 俄罗斯

- 土耳其

- 北欧国家

- 挪威

- 德国

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 马来西亚

- 印尼

- 泰国

- 越南

- 其他亚太地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 奈及利亚

- 卡达

- 埃及

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Volvo AB

- Man SE

- Yamaha Motor Co. Ltd

- Suzuki Motor Corp

- Ford Motor Company

- Volkswagen Group

- Toyota Motor Corporation

- Hyundai Motor Company

- Ducati Motor Holding SpA

- Fiat Chrysler Automobiles NV

- 市场排名/份额(%)分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 加强内燃机设计的研究、开发和技术进步

简介目录

Product Code: 50002227

The Global Internal Combustion Engines Market size is estimated at USD 283.11 billion in 2025, and is expected to reach USD 384.26 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for automobiles and two-wheeler vehicles in Asia-Pacific is expected to drive the market during the forecast period.

- On the other hand, rising demand for non-GHG-emitting vehicles and supportive policies to adopt alternate fuel vehicles are expected to hamper the market's growth.

- Nevertheless, the increasing research & development and technological advancements in the internal combustion engine design are expected to present significant growth opportunities for the market during the forecast period.

- Asia-Pacific is expected to have a significant share of the market due to increasing industrial and commercial activities, which will translate to more vehicle sales during the forecast period.

Global Internal Combustion Engines Market Trends

The Diesel Segment is Expected to Witness Significant Growth

- Diesel engines are among the most significant internal combustion engines that have been in use since the 1870s. These engines are designed to generate mechanical energy after the combustion of an air-diesel mixture. No auxiliary component, such as a spark plug, is used to ignite the air-diesel mixture; instead, the elevating temperature of the air is used, which is compressed by a piston moving inside an engine block.

- These engines were earlier designed to power trains and factories. However, over the years, they have been used in several applications, such as power generation, automotive, construction, and agriculture equipment.

- The significant advantage of diesel engines is that they are more fuel-efficient than gasoline engines. They have fewer components than gasoline engines and, hence, have fewer maintenance issues. Diesel engines provide better acceleration, towing, and hauling potential than gasoline engines. They are designed to handle high compression and hard work and, hence, have a long lifespan.

- With increasing technological innovations in diesel engines to achieve better efficiency, the consumption of diesel is expected to increase over the forecast period. According to the Energy Information Administration, the total diesel consumption in the United States in December 2023 was 3.75 million barrels per day. The consumption is expected to increase with technological innovations in diesel engines.

- In February 2023, Cummins Inc. announced that it would launch the next engine in the fuel-agnostic series (the X10) in North America in 2026. The engine is expected to comply with US EPA's 2027 regulations. The diesel version of the engine is expected to be launched first.

- Thus, owing to the technological developments and increasing consumption of diesel, the segment is expected to witness significant growth.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific has various developing countries, such as India, China, and Japan, where urbanization and industrialization are growing rapidly. With the development of the economies of these countries, the e-commerce division is also increasing, thereby generating the need for internal combustion engines.

- The e-commerce sector has grown significantly in the past five years, mainly driven by the COVID-19 pandemic. E-commerce plays a vital role in people's daily lives. It is redefining commercial activities around the world. Apart from the e-commerce sector, the use of automobiles for traveling and other purposes has increased. As internal combustion engines are used as a primary source of energy in automobiles, an increase in the use of automobiles is expected to drive the demand for internal combustion engines.

- According to International Organization of Motor Vehicle Manufacturers, in 2023, motor vehicle production in Asia-Pacific amounted to 55,115,837 units, an annual growth rate of approximately 10% compared to previous year. Increase in the manufacturing of motor vehicle in the region is expected to increase the demand for internal combustion engines.

- According to an announcement by Carmaker Stellantis in September 2023, internal combustion engine (ICE) vehicles are expected to be on the road until 2050, making it necessary to contain carbon emissions until fully electric ones finally replace them.

- Thus, owing to the developments in the e-commerce segment and the rise in automobile usage, especially in developing countries, Asia-Pacific is expected to dominate the market during the forecast period.

Global Internal Combustion Engines Industry Overview

The global internal combustion engine market is semi-fragmented. Some of the key players in this market include Volvo Ab, Man SE, Yamaha Motor Co. Ltd, Suzuki Motor Corp, and Ford Motor Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Automobiles

- 4.5.1.2 Increasing Demand for Two-Wheeler Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Rising Demand for Non-GHG Emitting Vehicles

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 50 cm3 to 200 cm3

- 5.1.2 201 cm3 to 800 cm3

- 5.1.3 801 cm3 to 1500 cm3

- 5.1.4 1501 cm3 to 3000 cm3

- 5.2 Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Spain

- 5.3.2.3 Russia

- 5.3.2.4 Turkey

- 5.3.2.5 Nordic Countries

- 5.3.2.6 Norway

- 5.3.2.7 Germany

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Malaysia

- 5.3.3.5 Indonesia

- 5.3.3.6 Thailand

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 United Arab Emirates

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Nigeria

- 5.3.4.4 Qatar

- 5.3.4.5 Egypt

- 5.3.4.6 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Volvo AB

- 6.3.2 Man SE

- 6.3.3 Yamaha Motor Co. Ltd

- 6.3.4 Suzuki Motor Corp

- 6.3.5 Ford Motor Company

- 6.3.6 Volkswagen Group

- 6.3.7 Toyota Motor Corporation

- 6.3.8 Hyundai Motor Company

- 6.3.9 Ducati Motor Holding SpA

- 6.3.10 Fiat Chrysler Automobiles NV

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research & Development and Technological Advancements in the Internal Combustion Engine Design

02-2729-4219

+886-2-2729-4219