|

市场调查报告书

商品编码

1645119

中东和非洲内燃机市场占有率分析、产业趋势和成长预测(2025-2030 年)Middle East And Africa Internal Combustion Engines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

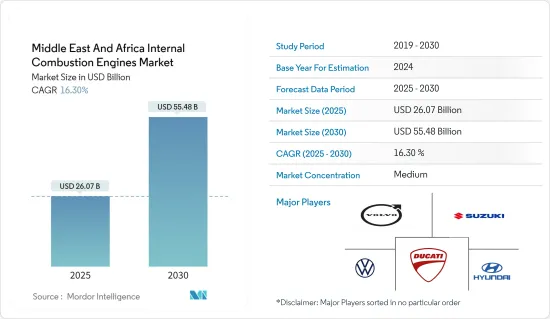

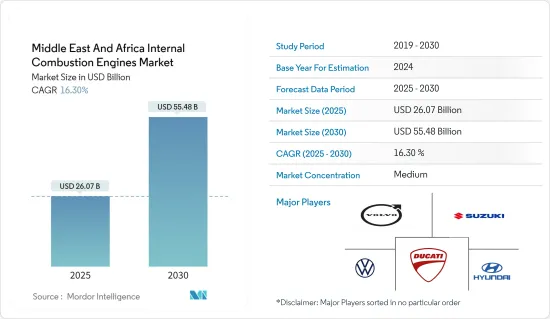

中东和非洲内燃机市场规模预计在 2025 年为 260.7 亿美元,预计到 2030 年将达到 554.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.3%。

关键亮点

- 从中期来看,预计预测期内两轮车需求增加和各地区发电需求上升等因素将推动市场发展。

- 预计对非温室气体排放汽车的需求不断增长将阻碍市场成长。

- 混合内燃机、混合动力动力传动系统和专用车辆的技术进步预计将在未来创造许多市场机会。

- 预计沙乌地阿拉伯将成为预测期内(2024-2029 年)的主要市场。

中东和非洲内燃机市场趋势

柴油型成长强劲

- 柴油汽车使用内燃机和压燃燃油喷射系统,而大多数汽油汽车则使用火星点火系统。柴油,通常称为轻质燃料油或以前称为重质燃料油,是指主要用于柴油引擎的液体燃料。最常见的柴油类型是石油燃料油的独特分馏。

- 近年来,非洲和中东国家柴油内燃机汽车数量增加。需要更大的储备来满足该地区对柴油的需求,这使得该地区的国家更加依赖进口。 2023 年 6 月,沙乌地阿拉伯成为肯亚柴油等石油产品的主要进口来源,对该国的亏损造成了重大影响。

- 肯亚国家统计局发布的资料显示,由于柴油订单增加,3月份肯亚从这个中东最大经济体的进口商品数量几乎增加了两倍,达到 322.7 亿肯亚先令(约合 2.3182 亿美元),高于上个月的 84.4 亿肯亚先令(约合 6,063 万美元)。预计所有这些交易将在预测期内满足对柴油的需求。

- 非洲国家对柴油的需求也达到了历史最高水平,目前各国正致力于建设原油精製基础设施并降低柴油进口价格。 2023年10月,Sonangol与中国化学工程公司(CNCEC)签署了开发安哥拉洛比托炼油厂的协议。根据双方达成的谅解备忘录,签署了涵盖建设、技术援助和监督的最终合约。该炼油厂每天将能够处理多达 20 万桶原油。预计这些发展将在预测期内促进柴油产量的成长。

- 该地区的原油消费量逐年增加。根据《世界能源数据统计评论》预测,2023年日消费量将为1,387.9万桶,与前一年同期比较增长约2.6%。由于最近全部区域混合动力汽车计划的发展,这一数字还有可能增加。例如,2023 年 11 月,福特汽车南非分公司宣布将投资 52 亿南非兰特(2.81 亿美元)在当地生产混合动力汽车。预计这笔巨额投资将在未来几年内推动混合动力发动机生产对内燃机的需求。

- 因此,在国内需求旺盛、近期趋势和即将上马的柴油精製计划的推动下,该地区的市场预计将在预测期内成长。

预计沙乌地阿拉伯将实现显着成长

- 沙乌地阿拉伯是中东和非洲地区汽车工业的关键国家之一。根据运输部统计,截至2018年,该国拥有超过1,200万辆汽车,消耗约91万桶燃料和柴油。预计到2030年,这数字将增加2,600万辆,每天消费量约186万桶燃料和柴油。

- 该地区的原油消费量逐年增加。根据《世界能源数据统计评论》显示,预计2023年日消费量将为405.2万桶,与前一年同期比较增加5.1%。未来几年沙乌地阿拉伯全国的竞争可能会更加激烈。

- 该国致力于支持该行业增加内燃机(ICE)汽车的数量并改善全国的基础设施。例如,2023年10月,该国设定了2030年每年生产30万辆以上汽车的目标,其中包括内燃机汽车。据报道,现代汽车正在兴建一座内燃机汽车工厂。该工厂计划于 2024 年投入运营,并于 2026 年开始生产。

- 沙乌地阿拉伯公司正将更多精力放在开发混合动力汽车动力和汽油汽车的内燃机上。 2023年3月,沙乌地阿拉伯主要石油公司沙乌地阿美与吉利和雷诺签署了新的合资企业协议,生产内燃机(ICE)和混合动力汽车。两家公司将共同开发和生产混合动力汽车动力、汽油和柴油汽车的内燃机、变速箱和其他零件。所有这些发展和协议都可能在预测期内增加对 ICE 引擎汽车的需求。

- 因此,在国内需求旺盛、近期趋势和即将建成的製造工厂的推动下,该地区的市场预计将在预测期内成长。

中东和非洲内燃机产业概况

中东和非洲的内燃机市场处于半分散状态。主要企业包括沃尔沃汽车公司、铃木汽车公司、大众汽车集团、现代汽车公司和杜卡迪汽车控股公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 摩托车需求不断增加

- 发电需求不断成长

- 限制因素

- 非温室气体需求增加

- 驱动程式

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 按容量

- 50~200 cm3

- 201~800 cm3

- 801~1,500 cm3

- 1,501~3,000 cm3

- 按燃料类型

- 汽油

- 柴油引擎

- 其他的

- 2029 年市场规模与需求预测(按地区)

- 阿拉伯聯合大公国

- 科威特

- 卡达

- 奈及利亚

- 埃及

- 沙乌地阿拉伯

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Volvo AB

- Man SE

- Yamaha Motor Co. Ltd

- Ford Motor Company

- Suzuki Motor Corp

- Fiat Chrysler Automobiles NV

- Hyundai Motor Company

- Ducati Motor Holding SpA

- Toyota Motor Corporation

- Volkswagen Group

- 市场排名分析

- 其他知名公司名单

第七章 市场机会与未来趋势

- 混合动力内燃机的技术进步

简介目录

Product Code: 50002236

The Middle East And Africa Internal Combustion Engines Market size is estimated at USD 26.07 billion in 2025, and is expected to reach USD 55.48 billion by 2030, at a CAGR of 16.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, factors such as increasing demand for two-wheelers and rising demand for power production in the regions are expected to drive the market during the forecasted period.

- The rising demand for non-GHG (greenhouse gas) emitting vehicles is expected to hinder the market's growth.

- Technological advancements in hybrid internal combustion engines, hybrid electric powertrains, and specialized vehicles are expected to create several future market opportunities.

- Saudi Arabia is expected to be a major market in the forecast period (2024-2029).

Middle East And Africa Internal Combustion Engines Market Trends

The Diesel Fuel Type Segment to Witness Significant Growth

- Diesel fuel vehicles have internal combustion engines and a compression-ignited injection engine system, unlike the spark-ignited method used in most gasoline vehicles. Diesel fuel, often known as diesel oil or previously heavy oil, refers to any liquid fuel intended primarily for use in a diesel engine. The most prevalent type of diesel fuel is a distinct fractional distillation of petroleum fuel oil.

- The number of diesel fuel internal combustion engine type vehicles increased in the past few years in several African and Middle Eastern countries. The countries in the region are more dependent on imports due to a need for more reserves to fulfill the demand for diesel oil in the region. In June 2023, Saudi Arabia emerged as Kenya's primary source of petroleum product imports, including diesel oil, contributing significantly to the nation's trade deficit.

- According to data issued by the Kenya National Bureau of Statistics, the number of goods imported from the largest economy in the Middle East grew by nearly three times to KES 32.27 billion (USD 231.82 million) in March due to higher orders of diesel oil, which were worth KES 8.44 billion (USD 60.63 million) a month earlier. All these trades are likely to fulfill the demand for diesel oil during the forecast period.

- The demand for diesel oil in African countries is also on record high, and countries are now focusing on building the infrastructure for refining crude oil and cutting down the price of importing diesel oil. In October 2023, a deal was signed by Sonangol and the China National Chemical Engineering Company (CNCEC) toward the development of the Lobito Refinery in Angola. The two parties' memorandum of understanding is followed by the final agreement, which covers construction, technical assistance, and supervision. The refinery will be able to process up to 200,000 barrels of crude oil per day (bopd) of crude oil. All these types of development are likely to increase the diesel oil production during the forecast period.

- The crude oil consumption in the region is increasing on a yearly basis. According to the Statistical Review of World Energy Data, the daily consumption was reported to be 13,879 thousand barrels in 2023, an increase of around 2.6 % as compared to the previous year. The number is likely to increase due to the recent projects of hybrid vehicles across the region. For instance, in November 2023, Ford Motor South African division announced an investment of ZAR 5.2 billion (USD 281 million) to manufacture a hybrid vehicle in the country. This significant investment will increase the demand for IC engines in the manufacturing of hybrid engines in the coming years.

- Hence, driven by high domestic demand, recent developments, and upcoming diesel oil refinery projects, the market is expected to grow in the region during the forecast period.

Saudi Arabia is Expected to Witness Significant Growth

- Saudi Arabia is one of the critical automobile industries in the Middle East and Africa. According to the Ministry of Transport statistics, as of 2018, the country had more than 12 million vehicles that consume about 910,000 barrels of fuel and diesel. This number of vehicles is likely to increase by 26 million by 2030, and daily consumption of fuel and diesel will be around 1.86 million barrels per day.

- Crude oil consumption is increasing on a yearly basis in the region. According to the Statistical Review of World Energy Data, the daily consumption was reported to be 4052 thousand barrels in 2023, an increase of 5.1% as compared to the previous year. The competition is likely to increase in the coming years across Saudi Arabia.

- The country is focusing on increasing the number of internal combustion engine (ICE) automobiles and supporting industries to improve infrastructure across the country. For instance, in October 2023, the country aimed to manufacture more than 300,000 cars annually by 2030, including internal combustion engine automobiles. Hyundai is likely to build the plant for ICE cars. The plant is likely to start operations in 2024, and production is expected to begin in 2026.

- Companies in Saudi Arabia are focusing on developing ICE engines for hybrid and gasoline vehicles at a higher rate. In March 2023, Saudi Aramco, a significant oil company in Saudi Arabia, signed a new joint venture with Geely and Renault to produce internal combustion engines (ICE) and hybrid cars. Companies jointly develop and manufacture internal combustion engines, gearboxes, and other components for hybrid, gasoline, and diesel vehicles. All these types of developments and agreements are likely to increase the demand for ICE engine automobiles during the forecast period.

- Hence, driven by high domestic demand, recent developments, and upcoming manufacturing plants, the market is expected to grow in the region during the forecast period.

Middle East And Africa Internal Combustion Engines Industry Overview

The Middle East and Africa internal combustion engines market is semi-fragmented. Some major players include Volvo ab, Suzuki Motor Corp, Volkswagen Group, Hyundai Motor Company, and Ducati Motor Holding SpA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for for Two-wheelers

- 4.5.1.2 Rising Demand for Power Production

- 4.5.2 Restraints

- 4.5.2.1 Rising Demand for Non-GHG

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Capacity

- 5.1.1 50 cm3 to 200 cm3

- 5.1.2 201 cm3 to 800 cm3

- 5.1.3 801 cm3 to 1500 cm3

- 5.1.4 1501 cm3 to 3000 cm3

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Others

- 5.3 By Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 United Arab Emirates

- 5.3.2 Kuwait

- 5.3.3 Qatar

- 5.3.4 Nigeria

- 5.3.5 Egypt

- 5.3.6 Saudi Arabia

- 5.3.7 Rest of the Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Volvo AB

- 6.3.2 Man SE

- 6.3.3 Yamaha Motor Co. Ltd

- 6.3.4 Ford Motor Company

- 6.3.5 Suzuki Motor Corp

- 6.3.6 Fiat Chrysler Automobiles NV

- 6.3.7 Hyundai Motor Company

- 6.3.8 Ducati Motor Holding SpA

- 6.3.9 Toyota Motor Corporation

- 6.3.10 Volkswagen Group

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Hybrid Internal Combustion Engines

02-2729-4219

+886-2-2729-4219