|

市场调查报告书

商品编码

1645101

东南亚氢气生产:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Southeast Asia Hydrogen Generation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

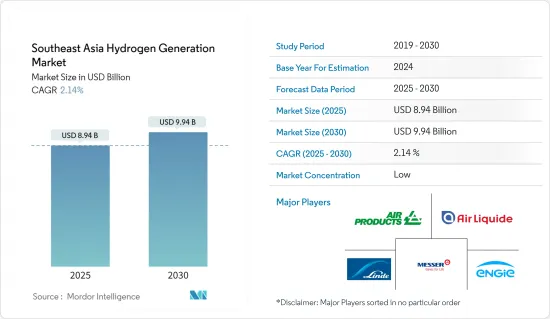

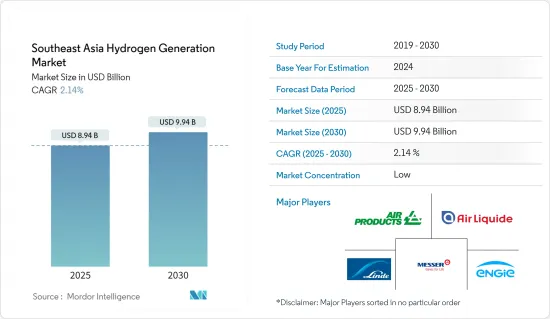

东南亚氢气市场规模预计在 2025 年为 89.4 亿美元,预计到 2030 年将达到 99.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.14%。

主要亮点

- 从中期来看,预计预测期内,政府的支持性政策、脱硫、温室气体排放政策以及鼓励氢气生产和消费等因素将推动东南亚地区的氢气生成市场的发展。

- 同时,氢能能源储存的高生产成本预计将抑制氢气产量的成长。

- 然而,从核能、风能、太阳能、生质能、水力发电和地热能等再生能源来源中提取氢气的技术进步,再加上氢气作为燃料的使用日益增多,可能会为未来几年氢气生成市场提供有利的成长机会。

- 预计预测期内,印尼东南亚氢气生产市场将显着成长。这是得益于政府的支持政策和投资。

东南亚氢气市场趋势

绿色氢气是重要组成部分

- 绿色氢气是透过电解过程产生的,该过程利用电将水分解为氢和氧。过程中使用的电力来自风能、太阳能和水力发电等再生能源来源。因此,生产的氢气是纯粹“绿色”的,并且产生极少的二氧化碳排放。

- 2023年,该地区的氢气产量将达到约360万吨。这种氢主要用于精製过程和氨、甲醇等化学物质的合成。值得注意的是,几乎所有氢气都是透过天然气蒸气重组生产的,没有采用任何碳捕获、利用和储存 (CCUS) 技术。

- 巨额投资证明了东南亚绿氢能的宏伟前景。例如,2024年10月,TTCL公共有限公司赢得了一份价值12亿泰铢的合同,在老挝建立一座绿色氢工厂。该计划旨在透过利用可再生能源来提高老挝的氢气生产能力。

- 2024 年 2 月,马来西亚最大的绿氢计划——位于霹雳州的一座 60 兆瓦浮体式太阳能发电厂,从私人投资者手中获得了 18.8 亿马币(3.936 亿美元)的投资。这些投资凸显了东南亚地区对绿氢日益增长的需求。

- 该地区正试图减少重工业(主要是石化、钢铁和发电)的排放,这导致措施超越了绿色氢气的生产和使用。因此,对绿氢基础设施的投资正在加速,东南亚各地出现了合作计划。预计这一势头将为该地区的脱碳目标和能源转型努力做出重大贡献。

- 2024 年 10 月,Senoko Energy 与 Gentari 签署了一份谅解备忘录,探讨从马来西亚进口氢气到新加坡,目标是到 2029 年将其整合到 Senoko 的燃气涡轮机资产中。此次合作将大幅减少碳排放,支持新加坡实现2050年净零目标。

- 此外,钢铁製造商 Meranti 宣布计划于 2023 年在泰国建造东南亚首家绿色扁平钢厂。该厂将使用氢气取代煤炭,并采用可再生能源电弧炉技术生产绿色钢铁。计画预计于2027年投入运营,年产能达200万吨,每年减少二氧化碳排放400万吨。

- 根据国际可再生能源机构(IRENA)的数据,到2023年,东南亚的可再生能源装置容量将以越南(46,012兆瓦)领先,其次是泰国(12,547兆瓦)、马来西亚(9,052兆瓦)、菲律宾(7,832兆瓦)和新加坡(1,147兆瓦)。广泛的可再生能源基础设施为绿色氢气生产提供了坚实的基础。

- 由于这些因素,预计预测期内绿色氢气领域将对氢气生产市场产生重大影响。

印尼经济快速成长

- 随着印尼转向可再生能源以实现 2060 年净零排放目标,氢能逐渐成为人们关注的焦点。凭藉丰富的资源和优越的地理位置,印尼有望成为氢气生产(尤其是来自可再生能源的绿色氢气)的地区领导者。

- 根据《2024 年印尼氢能展望》的研究结果,由于对氨的需求增加,预计到 2060 年印尼的氢气需求将增加到约 200 万吨/年 (MTPA)。

- 据世界钢铁协会称,印尼的钢铁产量预计将从 2019 年的 856 万吨稳步增长至 2023 年的 1,680 万吨。钢铁产量的成长支撑了不断增长的工业需求,并推动了对传统石化燃料的更清洁替代品(主要是绿色氢气)的需求。

- 印尼正将重点转向可再生能源,以实现其 2060 年净零排放目标。氢能是这转变的核心。印尼利用其丰富的资源和优越的位置,正在将自己打造成为该地区氢气生产的强国,特别是在生产由可再生能源提供的绿色氢气方面。

- 例如,2024 年 10 月,胜科工业透过其子公司胜科公用事业私人有限公司与 PT PLN Energi Primer Indonesia 签署协议,在印尼苏门答腊岛建立绿色氢气生产设施。该厂预计每年生产 10 万吨,成为东南亚最大的绿氢能计画。该计划旨在创建连接苏门答腊、廖内群岛和新加坡的区域绿氢中心。

- 2024 年 10 月,PT Pertamina Power Indonesia(「Pertamina NRE」)、PT Pertamina Geothermal Energy Tbk(「PGE」)和 Genvia 签署了一份谅解备忘录 (MoU),巩固了伙伴关係。两家公司合作的重点是利用先进的固体氧化物电解槽(SOEL) 技术和地热热源生产绿色氢气。该谅解备忘录包括 Jembia 尖端高温 SOEL 技术的技术和经济评估,旨在优化绿色氢气生产的能源消耗。

- 此外,PT Kilang Pertamina Internasional 计划在西巴布亚的宾图尼湾建造一座蓝氨工厂。该工厂计划于2030年开始运营,目标蓝氨生产能力约为875,000 TPA(吨/年),预计将满足约150,000 TPA的蓝氢需求。该设施的设计日处理量为 9,000 万标准立方英尺天然气(MMSCFD)。

- 因此,由于上述因素,预计预测期内印尼将在东南亚氢气生产市场中见证显着成长。

东南亚氢气生产产业概况

东南亚氢气市场正在整合。该市场的主要企业(不分先后顺序)包括林德公司 (Linde PLC)、梅塞尔集团有限公司 (Messer Group GmbH)、液化空气集团 (Air Liquide SA)、空气产品及化学品公司 (Air Products and Chemicals Inc.) 和 Engie SA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 精製和工业领域的需求增加

- 政府优惠政策

- 限制因素

- 氢能能源储存的资本成本高

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 按来源(定性分析)

- 蓝氢

- 绿色氢气

- 灰色氢气

- 依技术分类

- 蒸汽甲烷重整 (SMR)

- 煤炭气化

- 其他技术

- 按应用

- 精製

- 化学处理

- 钢铁生产

- 其他用途

- 按地区

- 印尼

- 马来西亚

- 越南

- 新加坡

- 其他东南亚地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Linde Plc

- Air Liquide SA

- Messer Group GmbH

- Engie SA

- Cummins Inc.

- Air Products and Chemicals Inc.

- Taiyo Nippon Sanso Holding Corporation

- Enapter Srl

- 市场排名/份额分析

- 其他着名公司名单

第七章 市场机会与未来趋势

- 技术进步

简介目录

Product Code: 50002211

The Southeast Asia Hydrogen Generation Market size is estimated at USD 8.94 billion in 2025, and is expected to reach USD 9.94 billion by 2030, at a CAGR of 2.14% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as supportive government policies and regulations for desulphurization, greenhouse gas emissions, and encouraging the production and consumption of hydrogen are likely to drive the hydrogen generation market in the Southeast Asian region during the forecast period.

- On the other hand, the high production costs of hydrogen energy storage are expected to restrain the growth of hydrogen generation.

- Nevertheless, technological advancements in extracting hydrogen from renewable sources including nuclear, wind, solar, biomass, hydro, and geothermal coupled with the rising applications of hydrogen as a fuel, are poised to unlock lucrative growth opportunities for the hydrogen generation market in the years ahead.

- Indonesia is expected to witness significant growth in the Southeast Asian hydrogen generation market during the forecast period. Owing to to supportive goverment policies and investments.

Southeast Asia Hydrogen Generation Market Trends

Green Hydrogen is a Significant Segment

- Green hydrogen is produced through a process called electrolysis, which uses electricity to split water into hydrogen and oxygen. The electricity used in this process comes from renewable sources such as wind, solar, or hydropower. This ensures that the hydrogen produced is genuinely "green" and has minimal carbon emissions.

- In 2023, the region's hydrogen production reached approximately 3.6 million tons. This hydrogen was predominantly utilized in refining processes and the synthesis of chemicals like ammonia and methanol. Notably, almost all of this hydrogen was produced via natural gas steam reforming, which did not incorporate carbon capture, utilization, and storage (CCUS) technology.

- Significant investments evidence the ambitious outlook for green hydrogen in Southeast Asia. For instance, in October 2024, TTCL Public Company Limited secured a THB 1.2 billion contract to establish a green hydrogen plant in Laos. This project aims to enhance Laos's hydrogen production capacity using renewable energy.

- Further, in February 2024, Malaysia's largest green hydrogen project, a 60MW plant in Perak state powered by floating solar, secured 1.88 billion ringgit (USD 393.6 million) from private investors. This kind of investments highlights the rising demand for the green hydrogen market in the Southeast Asia region.

- The region's attempt to minimize emissions, mainly from heavy industries like petrochemicals, iron and steel, and power generation, are resulting in measures to exceed green hydrogen production and usage. As a result, investments in green hydrogen infrastructure are accelerating, and collaborative projects are emerging across Southeast Asia. This momentum is expected to significantly contribute to the region's decarbonization goals and energy transition efforts.

- In October 2024, Senoko Energy and Gentari signed an MoU to explore importing hydrogen gas from Malaysia to Singapore, aiming to integrate it into Senoko's gas turbine assets by 2029. This collaboration seeks to reduce carbon emissions significantly, supporting Singapore's 2050 Net Zero target.

- Moreover, In 2023, Meranti, a steel manufacturer, announced plans to build Southeast Asia's first green flat steel plant in Thailand. The plant will use hydrogen to replace coal and employ electric arc furnace technology powered by renewable energy to produce green steel. Expected to be operational by 2027, the facility will have an annual production capacity of 2 million tons, reducing carbon emissions by 4 million tons annually.

- According to International Renewable Energy Agency (IRENA) In 2023, Southeast Asia saw significant renewable energy capacities, with Vietnam leading at 46,012 MW, followed by Thailand at 12,547 MW, Malaysia at 9,052 MW, the Philippines at 7,832 MW, and Singapore at 1,147 MW. This substantial renewable energy infrastructure provides a strong foundation for green hydrogen production.

- Therefore, owing to such factors, the green hydrogen segment is likely to significantly impact the hydrogen generation market during the forecast period.

Indonesia to Witness Significant Growth

- As Indonesia pivots towards renewable energy to achieve its net-zero emissions goal by 2060, hydrogen energy is emerging as a focal point. With its abundant resources and strategic positioning, Indonesia is poised to become a regional leader in hydrogen production, particularly in green hydrogen, which is derived from renewable sources.

- According to the findings in the Indonesia Hydrogen Energy Outlook 2024, by 2060, Indonesia's hydrogen demand is expected to increase to around 2 million tonnes per annum (MTPA) due to the increasing demand for Ammonia.

- According to the World Steel Association, Indonesia's steel production has steadily increased from 8.56 million tonnes in 2019 to 16.8 million tonnes in 2023. This rising steel production underscores the growing industrial demand, which drives the need for hydrogen, mainly green hydrogen, as a cleaner alternative to traditional fossil fuels.

- Indonesia is shifting its focus to renewable energy in pursuit of its net-zero emissions target for 2060. Central to this transition is hydrogen energy. Leveraging its rich resources and advantageous location, Indonesia is on track to establish itself as a regional powerhouse in hydrogen production, especially green hydrogen sourced from renewables.

- For instance, in October 2024, Sembcorp Industries, through its subsidiary Sembcorp Utilities Pte Ltd, signed an agreement with PT PLN Energi Primer Indonesia to establish a green hydrogen production facility in Sumatra, Indonesia. This facility will produce 100,000 metric tonnes annually, making it Southeast Asia's largest green hydrogen initiative. The project aims to create a regional green hydrogen hub connecting Sumatra, the Riau Islands, and Singapore.

- In October 2024, PT Pertamina Power Indonesia ("Pertamina NRE"), PT Pertamina Geothermal Energy Tbk ("PGE"), and Genvia solidified their partnership by signing a Memorandum of Understanding (MoU). Their collaboration centers on green hydrogen production, utilizing advanced solid oxide electrolyzer (SOEL) technology alongside geothermal heat sources. The MoU includes a technical and economic assessment of Genvia's state-of-the-art high-temperature SOEL technology, with the goal of optimizing energy consumption in green hydrogen production.

- Additionally, PT Kilang Pertamina Internasional planned to construct a blue ammonia facility in Bintuni Bay, West Papua Province. The plant is expected to commence operations in 2030, aiming for a blue ammonia production capacity of around 875,000 TPA (tons per annum) of blue ammonia, which is expected to create a demand for blue hydrogen of around 150,000 TPA. The facility is designed to process 90 million standard cubic feet per day (MMSCFD) of natural gas.

- Therefore, based on the above-mentioned factors, Indonesia is expected to witness significant growth in the Southeast Asia hydrogen generation market during the forecast period.

Southeast Asia Hydrogen Generation Industry Overview

The Southeast Asia hydrogen generation market is consolidated. Some of the major players in the market (in no particular order) include Linde PLC, Messer Group GmbH, Air Liquide SA, Air Products and Chemicals Inc., Engie SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand From Refining And Industrial Sector

- 4.5.1.2 Favourable Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Capital Costs For Hydrogen Energy Storage

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Source (Qualitative Analysis)

- 5.1.1 Blue Hydrogen

- 5.1.2 Green Hydrogen

- 5.1.3 Grey Hydrogen

- 5.2 Technology

- 5.2.1 Steam Methane Reforming (SMR)

- 5.2.2 Coal Gasification

- 5.2.3 Other Technologis

- 5.3 Application

- 5.3.1 Oil Refining

- 5.3.2 Chemical Processing

- 5.3.3 Iron & Steel Production

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Vietnam

- 5.4.4 Singapore

- 5.4.5 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Linde Plc

- 6.3.2 Air Liquide SA

- 6.3.3 Messer Group GmbH

- 6.3.4 Engie S.A.

- 6.3.5 Cummins Inc.

- 6.3.6 Air Products and Chemicals Inc.

- 6.3.7 Taiyo Nippon Sanso Holding Corporation

- 6.3.8 Enapter S.r.l.

- 6.4 Market Ranking/ Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements

02-2729-4219

+886-2-2729-4219