|

市场调查报告书

商品编码

1645124

东南亚邮政服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Southeast Asia Postal Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

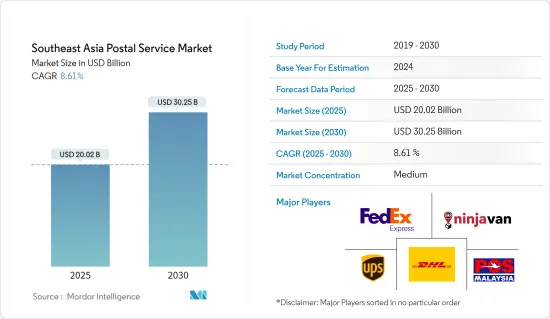

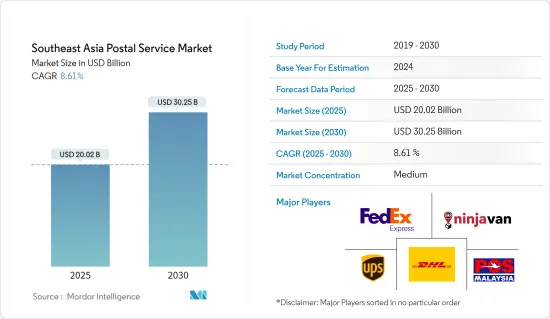

东南亚邮政服务市场规模预计在 2025 年为 200.2 亿美元,预计到 2030 年将达到 302.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.61%。

促进不同使用者群体之间经济和社会交流的平台是东南亚平台经济的一个主要特征。关键领域主要是线上到线下(O2O),包括电子商务、食品配送、物流、叫车、旅游、数位金融服务等。这些平台通常与国家邮政服务合作,对数位付款和物流网路等关键基础设施进行投资,从而推动该地区数位经济和商品交易总额 (GMV) 的成长。

该地区电子商务的快速成长对邮政服务市场产生了重大影响。随着网路购物的兴起,对高效率、可靠的宅配服务的需求也日益增长。 2023 年 12 月,新加坡邮政有限公司与 Google Cloud 达成合作,以加速新加坡邮政的数位转型进程。此次多年合作旨在让新加坡邮政团队更轻鬆地存取和使用人工智慧工具,以简化工作流程、促进与外部合作伙伴的合作并减少重复劳动。

由于东南亚靠近大型製造地且是全球贸易枢纽,跨境物流在东南亚受到越来越多的关注。该地区的邮政服务一直致力于加强其国际航运和清关能力。在SFF2023上,新加坡金融管理局与印尼央行建立了两国之间的跨国QR CODE支付连结。未来,每年数百万往返新加坡和印尼的旅客也将能够使用跨境QR CODE支付。

东南亚邮政服务市场趋势

物流技术创新不断提升

在东南亚,人们越来越多地透过更多样化的管道在网路上购买各种各样的产品。该地区的供应链正在发生变化,以适应这些日益增长的履约要求。需要新的物流技能,预计这一转变的最大受益者将来自现有的物流运营商和拥有现有技术的新进入者。

2024 年 2 月,泰国邮政与 BIG 和泰国电力生产公共有限公司 (EGCO 集团) 合作,开发氢能在邮政提供的物流服务中的使用。此次伙伴关係旨在提高能源管理标准,加强永续递送小包裹和邮件的能力,与该国 2065 年实现净零排放的目标保持一致。

2023 年 11 月,Pos Indonesia 与中国移动机器人专家力标机器人伙伴关係,提供自订的机器人分类解决方案。该公司在泗水 Pos Bloc 安装了机器人分类和 RFID 频率识别系统,印尼国有企业部长 Erick Thohir 见证了这项仪式。

新加坡的国际邮政服务

由于数位通讯的兴起导致全球传统邮件数量下降,新加坡邮政的策略转型帮助其管理了充满挑战的物流部门。

Sympos International执行长李宇表示,董事会和经营团队早就意识到需要改变。他认为,到 2023 年,物流将占企业收益的 70% 以上,而 2020 年初这一比例还不到 38%。透过在澳洲的收购、跨境国际业务以及对数位化创新的投资,该公司已发展成为电子商务物流领域的重要参与者。

2023年11月,新加坡邮政有限公司的子公司Freight Management Holdings Pty Ltd与Border Express的股东签订了有条件的买卖协议。 Border Express 是澳洲第六大托盘和小包裹物流公司。该合约的购买价格定为2.1亿美元,即1.83亿欧元。

东南亚邮政业概况

进入东南亚邮政服务市场的障碍包括建立基础设施、分类设施和运输网路所需的高额初始资本。其他障碍包括政府法规、许可要求和现有邮政服务的品牌影响力。然而,新进业者可能会选择专注于对特定行业或市场产生影响的创新解决方案,部分原因是受到技术发展和电子商务的推动。传统邮政服务正面临数位化和不断发展的通讯技术的威胁。东南亚邮政服务市场由DHL Express、UPS和FedEx主导。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 科技趋势

- 产业价值链分析

- 政府法规和倡议

- COVID-19 对市场的影响

第五章 市场动态

- 驱动程式

- 电子商务的兴起

- 快速都市化和人口成长

- 限制因素

- 最后一哩配送的挑战

- 机会

- 利用科技提高效率

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/购买者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 按类型

- 快捷邮件专递服务

- 标准邮件

- 按项目

- 信

- 小包裹

- 目的地

- 国内的

- 国际的

- 按国家

- 印尼

- 马来西亚

- 新加坡

- 泰国

- 其他东南亚地区

第七章 竞争格局

- 公司简介

- DHL Express

- UPS

- FedEx

- Ninja Van

- Pos Malaysia

- Singapore Post Limited

- GD Express

- Pos Indonesia

- JNE Express

- Thailand Post

- 其他公司

第八章 市场机会与未来趋势

第 9 章 附录

The Southeast Asia Postal Service Market size is estimated at USD 20.02 billion in 2025, and is expected to reach USD 30.25 billion by 2030, at a CAGR of 8.61% during the forecast period (2025-2030).

Platforms facilitating economic and social interactions between different user groups are an important feature of the Platform Economy in Southeast Asia. Primarily Online-to-Offline (O2O), key sectors include e-commerce, food delivery, logistics, ride-hailing, travel, and digital financial services. Platforms, including investments in key infrastructure such as digital payments and logistics networks, often in partnership with national postal services, are driving regional digital economy growth, not only through Gross Merchandise Value (GMV).

The fast growth of e-commerce in the region had a significant impact on the postal services market. The demand for efficient and dependable parcel delivery services has grown as a result of the increasing number of online shopping. In December 2023, Singapore Post Ltd and Google Cloud formed a collaboration to accelerate the digital transformation process of SingPost. The multi-year collaboration aims to empower SingPost's team with easy access and use of AI-powered tools to streamline work procedures, facilitate cooperation with external partners, and reduce duplicative tasks.

Southeast Asia's proximity to large manufacturing centers and its position as a world trade hub has given rise to an increased focus on cross-border logistics in the region. Postal services in the region have worked on strengthening their international shipping and customs clearance capabilities. At SFF 2023, the Monetary Authority of Singapore and Bank Indonesia established a cross-border QR payment link between the two countries. In the future, QR payments across borders will also be possible for millions of visitors coming from Singapore to Indonesia, and vice versa, every year.

Southeast Asia Postal Service Market Trends

Rise in Logistical Technology Innovation

More people are buying a wider range of products online across Southeast Asia through more diversified channels. The region's supply chain is changing to cope with this increased range of fulfillment requirements. There will be a need for new logistics skills, and the greatest benefits of these shifts are expected to come from existing logistical operators and newcomers who have them.

In February 2024, Thailand Post partnered with BIG and Electricity Generating Public Company Limited (EGCO Group) to develop the use of hydrogen energy in the logistics services provided by the post. This partnership aims to elevate energy management standards, bolster the capacity to deliver parcels and postal items sustainably and align with the country's net-zero objective by 2065.

In November 2023, Pos Indonesia entered a partnership with China's mobile robotics specialist, Libiao Robotics, to provide a custom robotic sorting solution. The company installed a robotic sorting and RFID frequency identification system in Pos Bloc Surabaya, with Indonesia's Minister for State-owned enterprises, Erick Thohir, attending the launch.

Singapore Postal Services is Going International

Given the decline in conventional mail volumes worldwide as a result of digital communications, Singapore Post has been successful in managing its challenging logistics sector through strategic transformation.

According to SinPos International's CEO, Li Yu, the board and management have recognized that transformation is necessary for a long time. He claims that logistics accounted for more than 70% of the company's revenue in 2023 compared to less than 38% at the beginning of 2020. With acquisitions in Australia, a cross-border international business, and investment in digitalization innovation, the company has expanded to become an important player in the e-commerce logistics sector.

In November 2023, Freight Management Holdings Pty Ltd, a subsidiary of Singapore Post Limited, entered a conditional sale and purchase agreement with the shareholders of Border Express. In Australia, Border Express is the 6th largest provider of pallet and parcel distribution. The purchase price for the agreement was set at USD 210 million, i.e., EUR 183 million.

Southeast Asia Postal Service Industry Overview

Entry barriers in the Southeast Asian postal services market include high initial capital requirements for the establishment of infrastructure, sorting facilities, and transport networks. Other barriers include government regulations, licensing requirements, and the established brand presence of existing postal services. However, new entrants can choose to concentrate on specific areas or innovative solutions that will have an impact on the market in part due to technological developments and e-commerce. Traditional mail services are threatened by digitalization and the evolution of communication technology. The leaders in the Southeast Asian postal services market are DHL Express, UPS, and FedEx.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Expansion of Ecommerce

- 5.1.2 Rapid Urbanization and Population Growth

- 5.2 Restraints

- 5.2.1 Last-Mile Delivery Challenges

- 5.3 Opportunities

- 5.3.1 Leveraging Technology to Enhance Efficiency

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers / Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Express Postal Services

- 6.1.2 Standard Postal Services

- 6.2 By Item

- 6.2.1 Letter

- 6.2.2 Parcel

- 6.3 By Destination

- 6.3.1 Domestic

- 6.3.2 International

- 6.4 By Country

- 6.4.1 Indonesia

- 6.4.2 Malaysia

- 6.4.3 Singapore

- 6.4.4 Thailand

- 6.4.5 Rest of Southeast Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 DHL Express

- 7.2.2 UPS

- 7.2.3 FedEx

- 7.2.4 Ninja Van

- 7.2.5 Pos Malaysia

- 7.2.6 Singapore Post Limited

- 7.2.7 GD Express

- 7.2.8 Pos Indonesia

- 7.2.9 JNE Express

- 7.2.10 Thailand Post*

- 7.3 Other Companies