|

市场调查报告书

商品编码

1651059

北美邮政服务:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)North America Postal Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

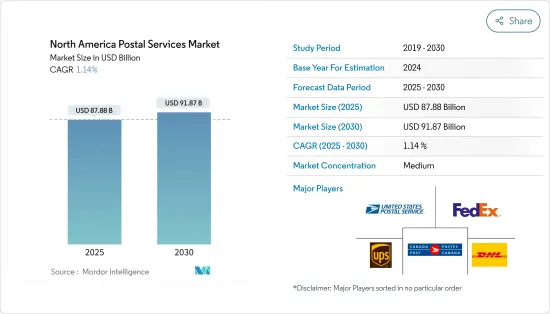

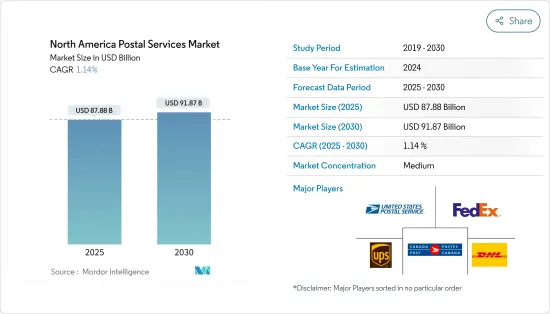

北美邮政服务市场规模预计在 2025 年为 878.8 亿美元,预计到 2030 年将达到 918.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 1.14%。

主要亮点

- 在北美,数位通讯的兴起正在减少传统邮件的数量。同时,电子商务的兴起也刺激了宅配和最后一哩路物流的需求增加。这些相互关联的趋势正在改变邮政业,迫使邮政业者扩大服务并实现业务现代化。美国邮政服务(USPS)是美国官方邮政营业单位。与美国邮政快递直接竞争的联邦快递和联合包裹服务公司 (UPS) 都提供紧急信件和小包裹的全国递送服务。

- 美国邮政局利用其垄断权力,限制其他宅配业者投递非紧急信件,并禁止将其运送到美国住宅和商业地点的邮箱。除少数例外,美国邮政总局对信件投递享有合法垄断权,并受到私人快捷邮件法规的支持,根据该法规,私人邮递员将面临罚款,甚至监禁。在加拿大,加拿大邮政占据主导地位,处理大部分小包裹和传统邮件。该政府营运的服务受到许多加拿大人的信赖,每三个小包裹中就有两个由该政府寄送。

- 2023年,美国小包裹收入将出现七年来首次下降,从2022年的1,984亿美元降至1,979亿美元。儘管小包裹总出货量从 2022 年的 215 亿件小幅增长 0.5% 至 2023 年的 217 亿件,但仍出现了这一下降。根据年度美国宅配运输指数,在四大运输提供商(美国邮政服务、亚马逊物流、UPS和联邦快递)中,仅亚马逊物流录得显着增长,与前一年同期比较增长了15.7%。此外,亚马逊物流在小包裹数量上已经超越联邦快递和UPS,并正在迅速接近市场领导USPS。消息人士称,「其他」类别包括规模较小的承运商,其销量和包裹数量将实现强劲增长,其市场占有率将增加 28.5%,到 2023 年达到约 3%(约 6 亿件小包裹)。消息人士透露,2023年USPS将成为最大的小包裹处理公司,包裹数量为66亿件(与前一年同期比较下降约1%),其次是亚马逊物流,包裹数量为59亿件(比上年增长15.7%),UPS,包裹数量为46亿件(比上年下降10.3%),联邦快递件数量为396.196.1666.666.666.6666.66.66.66.66.66.666.4666.66.46.266.26.26.26.26.26.296.96.26.96)。

- 近年来,北美邮政服务业面临数位化颠覆。随着越来越多的交流转移到线上,传统的邮政投递业务正在稳步下滑。同时,随着电商小包裹市场的不断扩大,产业竞争也愈发激烈。因此,邮政和邮寄营业单位正在从国有垄断企业演变为拥有多元化投资组合的营利性公司。

北美邮政服务市场趋势

美国在市场上有明显优势

疫情爆发后,美国电子商务经历了前所未有的成长,与许多其他国家的趋势相似。美国人口为3.32亿,是继印度和中国之后世界第三人口大国。值得注意的是,近80%的美国网友在网路购物。电子商务的激增为邮政服务带来了巨大的机会。随着消费者越来越多地转向新兴的电子商务平台和传统的线上实体店,对高效的配送和收集管道的需求也日益增长。透过利用其已建立的全国网路和最后一哩投递专业知识,邮政服务将自己定位为这个不断发展的环境中宝贵的合作伙伴。到2024年第二季度,美国电子商务销售额将达到2,916.4亿美元,占零售总额的15.9%。今年上半年美国电子商务销售额飙升至 5,794.5 亿美元,一些预测预计到年终将达到 1.22 兆美元。电子商务的持续成长凸显了邮政服务在支持数位经济方面的重要作用。

信件数量正在下降

美国邮政服务(USPS)是美国官方邮政管理机构。自 2006 年达到约 2,130 亿件的峰值以来,USPS 的邮件数量每年都在持续下降。到 2023 年,包裹递送量将骤降至仅 1,161.5 亿件。下降主要是由于传统邮件、行销资料和出版刊物的数量减少。相较之下,小包裹递送的收入却大幅成长。这种转变的主要催化剂是技术。随着越来越多的美国人使用电子邮件,对传统邮件的需求减少。此外,美国的线上零售额在过去十年中翻了一番,增加了小包裹递送的需求。加拿大官方邮政服务加拿大邮政也反映了这一趋势。

北美邮政服务业概况

目前该行业比较分散。大公司因其广泛的基础设施和服务多样性而具有优势。小企业透过专业化进行竞争。国营邮局通常垄断邮件投递,但面临来自私人包裹投递公司的激烈竞争。竞争营业单位结盟,以发挥彼此的优势。例如,大型快捷邮件公司联邦快递(FedEx)和联合包裹服务公司(UPS)委託某些住宅快递业务外包给美国邮政服务(USPS),而USPS委託空运业务外包给FedEx和UPS。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 当前市场状况

- 市场驱动因素

- 电子商务成长

- 扩大当日及隔日送达服务

- 市场限制

- 人事费用上升

- 网路安全和电子邮件安全

- 市场机会

- 自动化和技术改进

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 快捷邮件专递服务

- 标准邮政服务

- 按项目

- 信

- 小包裹

- 按目的地

- 国内的

- 国际的

- 按地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争格局

- 市场集中度概览

- 公司简介

- USPS

- Canada Post Corporation

- UPS

- DHL

- FedEX

- Purolator

- Correos de Mexico

- Estafeta

- GLS

- APC Postal Logistics

- Santa Lucia Post

- Grenada Postal Corporation

- Paquetexpress

第七章:市场的未来

第 8 章 附录

- 总体经济指标

- 运输和仓储对GDP的贡献

The North America Postal Services Market size is estimated at USD 87.88 billion in 2025, and is expected to reach USD 91.87 billion by 2030, at a CAGR of 1.14% during the forecast period (2025-2030).

Key Highlights

- In North America, the rise of digital communication has diminished the volume of traditional mail. At the same time, the flourishing e-commerce sector has spurred greater demand for parcel delivery and last-mile logistics. These interconnected trends are transforming the industry, prompting postal operators to expand their services and modernize their operations. The United States Postal Service (USPS) is the official postal entity in the USA. FedEx and UPS, in direct competition with USPS's Express Mail, provide nationwide delivery services for urgent letters and packages.

- Leveraging its monopoly, USPS restricts other U.S. couriers from delivering non-urgent letters and prohibits them from shipping to U.S. mailboxes at residential and business locations. With few exceptions, USPS maintains a legal monopoly on letter delivery, backed by the Private Express Statutes, which impose fines and potential imprisonment on private letter carriers. In Canada, Canada Post is the dominant player, overseeing the majority of both package and traditional mail shipments. This government-run service enjoys the trust of many Canadians, managing the shipment of two out of every three parcels.

- In 2023, US parcel revenue saw its first dip in seven years, falling from USD198.4bn in 2022 to USD197.9bn. This decline came despite a modest 0.5% uptick in total parcel volume, which rose from 21.5 billion in 2022 to 21.7 billion in 2023. The annual US Parcel Shipping Index reveals that among the four primary carriers (USPS, Amazon Logistics, UPS, and FedEx), only Amazon Logistics registered a significant year-over-year (YoY) volume surge of 15.7%. Moreover, Amazon Logistics has surpassed both FedEx and UPS in parcel volumes and is rapidly approaching the market leader, USPS. Sources indicate that the 'others' category, which includes smaller carriers, saw a substantial uptick in both revenue and volume, enhancing their market share by 28.5% in 2023, bringing it to nearly 3%, or about 0.6 billion parcels. According to the sources, in 2023, USPS led in parcel volume with 6.6 billion parcels (a nearly 1% YoY decline), followed by Amazon Logistics at 5.9 billion parcels (a 15.7% increase), UPS with 4.6 billion parcels (a 10.3% decrease), and FedEx at 3.9 billion parcels (down 6.1%).

- In recent years, North America's postal service industry has faced disruptions from the digital landscape. As communication increasingly migrates online, the traditional mail delivery business is witnessing a decline. Concurrently, the industry is grappling with fierce competition in the expanding e-commerce parcel market. As a result, postal and mailing entities are evolving from state-owned monopolies to commercial firms with diversified portfolios.

North America Postal Services Market Trends

United States exhibits a clear dominance in the market

In the wake of the pandemic, e-commerce in the United States has experienced unprecedented growth, mirroring trends seen in many other countries. With a population of 332 million, the U.S. ranks as the world's third most populous nation, trailing only India and China. Notably, nearly 80% of American internet users engage in online shopping. This surge in e-commerce presents a significant opportunity for postal services. As consumers increasingly turn to both emerging e-commerce platforms and traditional brick-and-mortar stores transitioning online, the demand for efficient delivery and collection channels has intensified. Leveraging their established national networks and expertise in last-mile delivery, postal services are positioning themselves as valuable partners in this evolving landscape. By Q2 2024, e-commerce sales in the U.S. reached USD 291.64 billion, constituting 15.9% of the nation's total retail sales. In the first half of the year, U.S. e-commerce sales soared to USD 579.45 billion, with projections suggesting a climb to USD 1.22 trillion by year's end. The continued growth of e-commerce underscores the critical role of postal services in supporting the digital economy.

Letter Volume is on Decline

The U.S. Postal Service (USPS) stands as the official postal authority in the United States. After peaking at approximately 213 billion units in 2006, USPS has witnessed a consistent annual decline in mail volume. By 2023, deliveries had plummeted to a mere 116.15 billion units. This decline is primarily due to reduced volumes in traditional mail, marketing materials, and periodicals. In contrast, revenue from package shipping has surged. Technology is the primary catalyst for this transformation. An increasing number of Americans are turning to email, leading to a reduced appetite for traditional mail. Additionally, U.S. online retail sales have doubled in the last decade, heightening the demand for package deliveries. Canada Post, Canada's official postal service, mirrors this trend.

North America Postal Services Industry Overview

The industry is currently fragmented. Large companies have advantages in widespread infrastructure and diversity of services. Small companies compete by specializing. Government-owned postal agencies typically have a monopoly on mail delivery but face heavy competition from private package delivery companies. The competing entities form partnerships to capitalize on each other's strengths. For instance, major express delivery companies Federal Express (FedEx) and United Parcel Service (UPS) contract certain residential deliveries to the US Postal Service (USPS), while the USPS contracts air transportation out to FedEx and UPS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Rise In Ecommerce

- 4.2.2 Expansion of Same Day and Next- Day Delivery

- 4.3 Market Restraints

- 4.3.1 Rising Labor Costs

- 4.3.2 Cybersecurity and Mail Security

- 4.4 Market Opportunities

- 4.4.1 Increased Automation and Technology

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Express Postal Services

- 5.1.2 Standard Postal Services

- 5.2 By Item

- 5.2.1 Letter

- 5.2.2 Parcel

- 5.3 By Destination

- 5.3.1 Domestic

- 5.3.2 International

- 5.4 By Geography

- 5.4.1 US

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 USPS

- 6.2.2 Canada Post Corporation

- 6.2.3 UPS

- 6.2.4 DHL

- 6.2.5 FedEX

- 6.2.6 Purolator

- 6.2.7 Correos de Mexico

- 6.2.8 Estafeta

- 6.2.9 GLS

- 6.2.10 APC Postal Logistics

- 6.2.11 Santa Lucia Post

- 6.2.12 Grenada Postal Corporation

- 6.2.13 Paquetexpress*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Contribution of Transportation and Storage to GDP