|

市场调查报告书

商品编码

1683092

亚太杀软体动物剂市场:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia Pacific Molluscicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

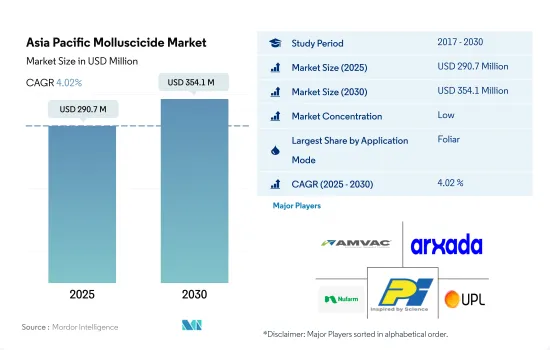

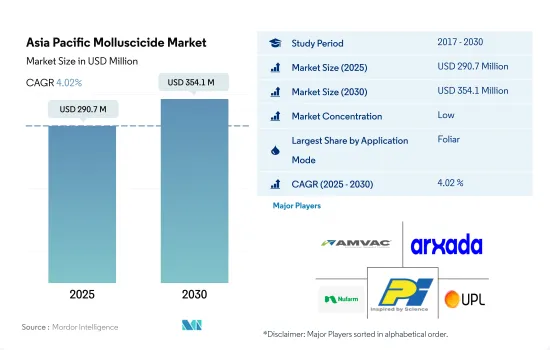

亚太地区杀软体动物剂市场规模预计在 2025 年为 2.907 亿美元,预计到 2030 年将达到 3.541 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.02%。

由于叶面喷布作用迅速,在杀软体动物剂的使用上占据主导地位。

- 蛞蝓和蜗牛以多种阔叶植物和草类为食,包括大多数作物和多种杂草。它们会杀死幼苗、阻碍幼苗生长以及损坏幼苗的叶子,从而危害作物。因此,蛞蝓管理对于提高易感作物的产量至关重要。 2022 年亚太地区杀软体动物剂市场价值为 2.563 亿美元,预计预测期结束时将达到 3.436 亿美元。

- 棕色花园蜗牛、非洲大蜗牛、稻田蛞蝓、中国蛞蝓和水龟蛞蝓是一些主要的蛞蝓和蜗牛物种,它们会对亚太地区的作物生产造成重大挑战。常用的杀软体动物剂有四聚乙醛、磷酸亚铁、甲硫威、乙二胺四乙酸铁钠等。

- 杀软体动物剂有多种使用方法。在亚太地区,叶面喷布将占据杀软体动物剂应用领域的主导地位,到 2022 年将占据 54.8% 的最大市场占有率。叶面喷布杀软体动物剂可以快速控制软体动物族群。当杀软体动物剂施用于叶子上时,害虫在接触到杀软体动物剂后很容易吸收它。这将使它们很快就会死去。

- 2022年亚太杀软体动物剂市场中,土壤处理占第二大市场占有率,为30.4%。近期,高可湿性粉末、颗粒和诱饵的开发趋势正在推动土壤处理的发展,这些产品的稳定性、黏附性以及对蜗牛和蛞蝓的吸引力都有所提高。预计预测期内(2023-2029 年),市场复合年增长率为 4.1%。

水稻等主要作物对杀软体动物剂的需求不断增加,推动了市场

- 亚太地区杀软体动物剂市场在过去一段时间内一直保持稳定成长,预计到 2022 年将占据全球杀软体动物剂市场第二大份额,以金额为准26.0%。

- 在亚洲,蜗牛养殖失败了,因为蜗牛会破坏正在生长的水稻作物,造成严重的经济损失,因为水稻是该地区的主要食物和收入来源。福寿螺(Pomacea canaliculata)被引进亚洲国家,并意外地发展成水稻害虫。大多数农民依靠化学控制,包括使用杀软体动物剂,并采用综合蜗牛管理措施。

- 米是亚洲迄今为止最重要的作物,全球 90% 的产量和消费量都发生在该地区。亚太地区是全球大米等主食谷物的最大出口地和生产地,因此杀软体动物剂在该地区谷物和谷类食品中被广泛使用。到 2022 年,该部分的以金额为准份额将达到 55.5%。

- 同样,该地区软体动物对水果作物的攻击也有所增加,导致农民采用化学防治方法来保护作物。 2022 年,水果和蔬菜的以金额为准占比为 17.5%。

- 该地区迫切需要控制策略,但研究人员指出,农民需要对蜗牛生态有适当的了解,才能采取适当的杀软体动物剂应用策略。同时,由于政府的倡议和製造商的技术创新,该地区的杀软体动物剂市场预计在预测期内(2023-2029 年)以 4.2% 的复合年增长率增长。

亚太地区杀软体动物剂市场趋势

软体动物族群增加导致每公顷扩散率增加

- 日本将是每公顷杀软体动物剂消费量最高的国家,到2022年将达到100.0克。蜗牛是日本常见的害虫,会为害多种作物。然而,入侵的苹果蜗牛对日本,尤其是九州地区的水稻种植构成了重大威胁。苹果蜗牛被认为是直播水稻种植的一大障碍。为了解决这个问题,农民越来越多地使用杀软体动物剂和驱虫剂,这已被证明是减少苹果蜗牛侵扰影响的有效策略。

- 澳洲是亚太地区每公顷使用杀软体动物剂最多的国家,2022 年每公顷使用量为 13.2 克。非洲大蜗牛(Lissachatina fulica)被认为是澳洲的主要害虫,因为它繁殖迅速,以多种植物为食,包括农作物、观赏植物和本地植物。它们贪婪的胃口对花园、农作物和自然栖息地造成了广泛的破坏,并带来了严重的经济损失。

- 2022 年,菲律宾、越南和中国是杀软剂的最大使用者,用量分别为每公顷 9.9 克、8.4 克和 7.1 克。根据国际稻米实验室介绍,福寿螺对这些国家的水稻生产构成了重大威胁,因为它会从根部折断稻秆,毁掉整株稻株,使产量减少高达 50%,尤其是在灌溉田。

- 像福寿螺这样的蜗牛生长和繁殖都很快,因此很难控制,导致亚太国家增加了杀软体动物剂的使用。

市场的主要驱动因素包括杀虫剂的使用增加和亚洲稻田中福寿螺的侵扰。

- 蛞蝓通常在土壤表面上方和下方进食,破坏种子、嫩芽和根。对于某些作物来说,主要问题出现在种植时,而其他问题可能出现在生长季节或收穫期间。这些软体动物是农业的主要威胁之一,造成巨大的损失。这些物种主要存在于谷类和园艺作物中,例如小麦、大麦和燕麦。 Deroceras、Milax、Tandonia、Limax和Arion被认为是对农作物造成经济损失的重要软体动物。

- 甲醛可作为田地、花园和温室中多种蔬菜和作物的杀软体动物剂。它以液体、颗粒、撒播剂、粉末和颗粒状/颗粒状诱饵的形式使用,以杀死蛞蝓和蜗牛。 2022 年甲醛价格为每吨 52,500 美元。

- 磷酸铁是一种用于谷物、油菜籽、马铃薯和多种园艺作物的杀软体动物剂,2022 年其价值为每吨 52,000 美元。磷酸铁会抑制蛞蝓体内的钙代谢,最终导致蛞蝓的作物和肝臟胰腺发生细胞病理学变化。这个过程从进食到死亡一般需要3-6天左右。

- 该市场的主要驱动因素包括杀虫剂的使用增加、对高价值园艺作物的需求不断增长以及亚洲稻田中苹果蜗牛的侵扰。此外,农民对杀软体动物剂控制意识的不断增强以及创新杀软体动物剂产品的引入预计将在预测期内为该市场提供成长机会。

亚太地区杀软体动物剂产业概况

亚太地区杀软体动物剂市场较为分散,前五大公司占了14.89%的市占率。该市场的主要企业包括 American Vanguard Corporation、Arxada、Nufarm Ltd、PI Industries 和 UPL Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 缅甸

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 价值链与通路分析

第五章 市场区隔

- 应用模式

- 化学灌溉

- 叶面喷布

- 熏蒸

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 缅甸

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 其他亚太地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- American Vanguard Corporation

- Arxada

- Nufarm Ltd

- PI Industries

- UPL Limited

- Zagro

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 47094

The Asia Pacific Molluscicide Market size is estimated at 290.7 million USD in 2025, and is expected to reach 354.1 million USD by 2030, growing at a CAGR of 4.02% during the forecast period (2025-2030).

Foliar application dominates molluscicide applications owing to its quick action

- Slugs and snails eat a wide array of broadleaf plants and grasses, including most crops and many weeds. They harm crops by killing seedlings, causing poor stands, and damaging leaves on young plants. Hence, the management of slugs is of utmost importance to get better yields in the susceptible crops. The Asia-Pacific molluscicide market was valued at USD 256.3 million in 2022 and is anticipated to reach USD 343.6 million by the end of the forecast period.

- Brown garden snails, giant African snails, rice field slugs, Chinese slugs, and keelback slugs are some of the major slug and snail species that can pose significant challenges to crop production in Asia-Pacific. Metaldehyde, iron phosphate, methiocarb, and sodium ferric EDTA are commonly used molluscicides.

- Molluscicides can be applied through different methods. In Asia-Pacific, foliar application dominated in molluscicide application, accounting for the largest market share of 54.8% in 2022. Foliar-applied molluscicides can provide quick control of mollusk populations. When sprayed onto the foliage, the molluscicides can be readily absorbed by the pests as they come into contact with it. This can lead to rapid mortality.

- Soil treatment accounted for the second largest market share of 30.4% of the Asia-Pacific molluscicide market in 2022. Recent advances in the development of enhanced wettable powders, granules, and bait formulations with improved stability, adherence, and attractiveness to snails and slugs will drive the soil treatment. The market is anticipated to register a CAGR of 4.1% during the forecast period (2023-2029).

Increased need for molluscicides in major crops like rice is driving the market

- The molluscicides market in Asia-Pacific witnessed steady growth during the historical period, with the region occupying the second-highest share of 26.0% by value of the global molluscicide market in 2022.

- Snail farming failed in Asia as snails destroyed the growing rice crops, causing severe economic losses as rice farms are the region's major source of food and income. The golden apple snail, Pomacea canaliculata, has been introduced to several Asian countries, where it has unexpectedly developed into a rice pest. Most farmers have resorted to chemical control, including the use of molluscicides, and have adopted integrated snail management practices.

- Rice is by far the most important crop throughout Asia, where 90% of the world's production and consumption occurs in this region. Molluscicides are mostly used in grains and cereals in Asia-Pacific as the region is the largest exporter and producer of staple grains such as rice. The segment occupied a share of 55.5% by value in 2022.

- Similarly, mollusk attacks on fruit crops have also been on the rise in the region, leading to farmers adopting chemical control methods to protect their crops. Fruits and vegetables occupied a share of 17.5% by value in 2022.

- Although control strategies are urgently needed in the region, researchers have suggested that farmers must have a sound knowledge of the ecology of snails to adopt the right application strategy for molluscicides. At the same time, initiatives by governments of various countries and innovations by manufacturers are expected to drive the molluscicide market in the region at a CAGR of 4.2% during the forecast period (2023-2029).

Asia Pacific Molluscicide Market Trends

The increasing mollusk population is leading to higher application per hectare

- Japan is the largest per hectare consumer of molluscicides, with 100.0 grams in 2022. Snails are common pests that feed on a wide range of crops in Japan. However, the apple snail, an invasive species, poses a significant threat to rice cultivation in Japan, particularly in Kyushu. It is considered a major hindrance to the adoption of direct-sowing practices in rice farming. To address this problem, the use of molluscicides and repellents by farmers has increased and proven to be an effective strategy in mitigating the impact caused by the apple snail invasion.

- Australia is by far the second-highest per hectare consumer of molluscicides in Asia-Pacific, with 13.2 grams per hectare in 2022. African giant snail (Lissachatina fulica) is considered a major pest in Australia due to its ability to reproduce rapidly and feed on a wide range of plants, including crops, ornamental plants, and native vegetation. It has a voracious appetite and can cause significant damage to gardens, crops, and natural habitats, leading to severe economic losses.

- The Philippines, Vietnam, and China were other prominent countries using molluscicides at the rate of 9.9 grams, 8.4 grams, and 7.1 grams per hectare, respectively, in 2022. Golden apple snails are the major threat to rice production in these countries as they cut the rice stem at the base, destroying the whole plant and leading to annual yield losses of up to 50%, especially in irrigated rice fields, according to the International Rice Research Institute.

- Few of the snail species like golden apple snails can grow and reproduce quickly, making it very difficult to control, leading to higher usage of molluscicides in the countries of Asia-Pacific.

The major drivers for this market include the increasing adoption of agrochemicals and the infestation of golden apple snails in the rice fields of Asia

- Slugs usually feed above and below the soil surface, damaging seeds, shoots, and roots. In some crops, the main problem time is at planting, while in others, problems occur during the growing season or harvest. These mollusk species have become one of the major threats causing huge agricultural losses. These species are majorly seen in cereal crops such as wheat, barley, oats, and horticultural crops. Deroceras, Milax, Tandonia, Limax, and Arion are recognized as important mollusks causing economic losses in the crops.

- Metaldehyde is a molluscicide used in a variety of vegetables and crops in fields, gardens, and greenhouses. It is applied in the form of liquid, granules, sprays, dust, or pelleted/grain bait to kill slugs and snails. Metaldehyde was valued at USD 52.5 thousand per metric ton in 2022.

- Ferric phosphate is a molluscicide for use in cereals, oilseed rape, potatoes, and a wide range of horticultural crops and was valued at USD 52.0 thousand per metric ton in 2022. Iron phosphate interferes with the calcium metabolism within the slug and eventually causes cellular pathological changes in the slug's crop and hepatopancreas. This process from feeding to dying normally takes about three to six days.

- The major drivers for this market include increasing adoption of agrochemicals, rising demand for high-value horticulture crops, and infestation of golden apple snails in the rice fields of Asia. Further, increasing awareness of mollusk control among farmers and the introduction of innovative molluscicide products are expected to create growth opportunities for this market during the forecast period.

Asia Pacific Molluscicide Industry Overview

The Asia Pacific Molluscicide Market is fragmented, with the top five companies occupying 14.89%. The major players in this market are American Vanguard Corporation, Arxada, Nufarm Ltd, PI Industries and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Australia

- 4.3.2 China

- 4.3.3 India

- 4.3.4 Indonesia

- 4.3.5 Japan

- 4.3.6 Myanmar

- 4.3.7 Pakistan

- 4.3.8 Philippines

- 4.3.9 Thailand

- 4.3.10 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Myanmar

- 5.3.7 Pakistan

- 5.3.8 Philippines

- 5.3.9 Thailand

- 5.3.10 Vietnam

- 5.3.11 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 American Vanguard Corporation

- 6.4.2 Arxada

- 6.4.3 Nufarm Ltd

- 6.4.4 PI Industries

- 6.4.5 UPL Limited

- 6.4.6 Zagro

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219