|

市场调查报告书

商品编码

1683153

欧洲杀软体动物剂市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Molluscicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

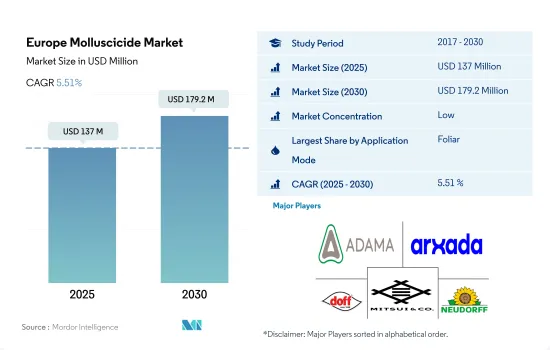

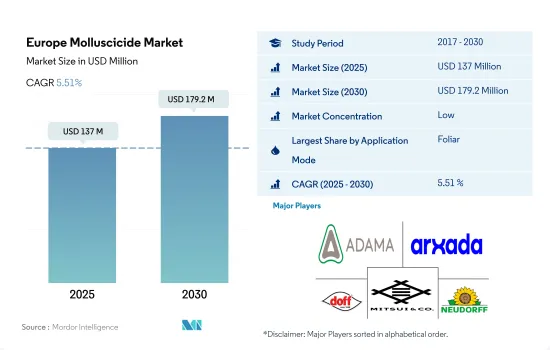

预计 2025 年欧洲杀软体动物剂市场规模将达到 1.37 亿美元,到 2030 年将达到 1.792 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.51%。

叶面喷布占市场主导地位

- 欧洲的气候条件和土壤类型多种多样,适合种植多种作物。主要作物是小麦,其次是大麦和黑麦。然而,蜗牛和蛞蝓等软体动物的侵扰对作物生产构成了重大风险,导致产量下降、农民经济损失和粮食安全担忧。

- 该地区采用各种喷洒方法来控制虫害。 2022 年,叶面喷布占以金额为准份额最高,为 52.5%。叶面喷布聚乙醛和硫双威是适合作为蜗牛综合害虫管理的组成部分之一,并且已被证明在该地区非常有效。

- 此外,土壤处理方法在 2022 年的以金额为准份额位居第二,为 32.2%。事实证明,向土壤喷洒杀软体动物剂是最简单、最安全、最有效的害虫防治方法。使用系统性杀软体动物剂处理土壤将会杀死土壤中的软体动物。

- 使用叶面杀虫剂对于消费者、工人和环境健康有几个缺点。化学农药的使用十分方便,成本低廉,并且消除了叶面喷布杀软体动物剂的一些通用缺点。以以金额为准, 2022 年化学灌溉占 12.9%。

- 为了找到最安全、最有效的使用方法,研究和创新不断加强,再加上农民对正确使用杀软体动物剂的有效性的认识不断提高,预计市场在预测期内(2023-2029 年)的复合年增长率将达到 5.3%。

蜗牛数量的增加和农作物损失的增加促使人们使用杀软体动物剂

- 蛞蝓是一种软体动物,是对土壤最有害的动物之一,因为它们能够对田间作物造成严重破坏,尤其是在春季到秋季的潮湿时期。灰蛞蝓是造成欧洲大部分农作物损失的主要蛞蝓种类之一。就2022年的消费量,法国占有最大份额,为15.4%。

- 2022年,俄罗斯占欧洲杀软体动物剂市场总量的14.3%。俄罗斯凉爽潮湿的气候使情况更加糟糕,一平方码的耕地里生活着多达200隻蜗牛,每隻蜗牛每年产下400颗圆形的白色卵。由于蜗牛繁殖率高,因此很难消灭。

- 在义大利,蜗牛给柑橘园造成了重大的经济损失,因为它们以成熟和部分成熟的水果、嫩叶甚至幼树的树皮为食。此外,蜗牛的存在还会堵塞喷灌和灌溉系统,扰乱灌溉管理,进一步加剧了农民面临的挑战。

- 金属盐,例如四聚乙醛、氯硝柳胺、磷酸铁(III)、硫酸铝和乙二胺四乙酸铁钠是该地区常用的杀软体动物剂,可以以多种方式使用。

- 为了提高杀软体动物剂对蜗牛和蛞蝓的针对性和有效性,正在努力开发更有效的杀软体动物剂型,以增加诱饵的吸引力、偏好和稳定性。由于这些因素,欧洲国家的杀软剂市场预计将受到农民采用率提高的推动。

欧洲杀软体动物剂市场趋势

软体动物族群增加导致每公顷扩散率增加

- 2022年,义大利成为每公顷杀软剂使用量最大的国家,用量为40.8公克。蜗牛和蛞蝓等害虫会破坏植物的种子、幼苗、根茎、叶子和果实。当幼苗受到危害时,它们常常会死亡,产量会大大降低。大麦、菜籽和豆类等作物尤其容易受到影响。义大利白蜗牛与其他物种一样,是一种害虫,其严重性在于它会在收穫期间污染谷物,也会堵塞和损坏收割机械。

- 在欧洲,荷兰每公顷杀软体动物剂消费量排名第二,2022 年为每公顷 25.7 克。各种蔬菜特别容易受到蛞蝓的破坏。尤其是抱子甘蓝、蓝甘蓝和白菜,它们受到蛞蝓的危害,无法在市场上买到。蛞蝓和蜗牛最多可以产下 400 个卵,因此必须使用杀软体动物剂。

- 2022年,德国、法国和西班牙每公顷将分别使用16.3克、14.3克和10.3克的杀软体动物剂。大蜗牛,又称罗马蜗牛或勃根地蜗牛,是一种对德国农业有潜在破坏力的物种。众所周知,这些大型陆地蜗牛以多种作物为食,包括蔬菜、水果和观赏植物。这种蜗牛的摄食习性会破坏收穫农产品的外观和质量,从而为农民带来经济损失。这引发了人们对蜗牛对德国以及其分布的中东和非洲其他地区农业影响的担忧。

金属醛和磷酸铁基杀软体动物剂最常用于控制蛞蝓和蜗牛。

- 杀软体动物剂用于杀死多种软体动物,包括血吸虫生命週期中的中间宿主蜗牛。已经开发出几种用于控制作物环境中蛞蝓和蜗牛的杀软体动物剂,通常以颗粒形式放置在植物根部周围。

- 2022 年,甲醛价格为每吨 52,500 美元。它广泛用于田间作物、花园和温室,并以液体、颗粒、喷雾、粉尘和颗粒/颗粒诱饵等各种形式使用,可有效对抗蛞蝓、蜗牛和其他花园害虫。市售的诱饵通常含有少于 4% 的甲醛作为活性成分,儘管一些颗粒状诱饵可含有高达 5-10% 的甲醛。在欧洲,有些诱饵含有高达50%的甲醛。

- 磷酸铁的 2022 年价格为每吨 52,000 美元,是一种高效且环保的杀软体动物剂。它对人类、动物、非目标昆虫、植物或土壤微生物无害,在农业生态系统中稳定且无反应。磷酸铁是英国农业中唯一仍在使用的杀软体动物剂。它会抑制胃中的钙代谢,导致软体动物停止进食,并通常导致地下死亡。将其以颗粒形式与蜗牛和蛞蝓诱饵一起撒在土壤上。

- 蛞蝓是最具破坏力且最难控制的害虫之一。蛞蝓是许多蔬菜和花卉幼苗最喜欢的目标,导致作物难以生长。当蛞蝓在收穫前以水果和蔬菜为食时,它们会造成伤口以及真菌和细菌污染,从而导致作物腐烂。由于这些挑战,欧洲农民已转向使用甲醛和磷酸铁等合成化学物质来控制蛞蝓。

欧洲杀软体动物剂产业概况

欧洲杀软体动物剂市场细分化,前五大公司占据8.73%的市场。市场的主要企业是 ADAMA Agricultural Solutions Ltd.、Arxada、Doff Portland Ltd、Mitsui & (Certis Belchim) 和 W. Neudorff GmbH KG。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 价值链与通路分析

第五章 市场区隔

- 应用模式

- 化学灌溉

- 叶面喷布

- 熏蒸

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 欧洲其他地区

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- Arxada

- Doff Portland Ltd

- Farmco Agritrading Ltd

- Mitsui & Co. Ltd(Certis Belchim)

- W. Neudorff GmbH KG

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 54929

The Europe Molluscicide Market size is estimated at 137 million USD in 2025, and is expected to reach 179.2 million USD by 2030, growing at a CAGR of 5.51% during the forecast period (2025-2030).

The foliar application dominates the market

- Europe has diverse climatic conditions and soil types, which allow for the cultivation of a wide range of crops. The main crop is wheat, followed by barley and rye. However, there is a significant risk to crop production due to the infestations of mollusks, such as snails and slugs, that result in reduced yields, financial losses for farmers, and concerns about food security.

- Various application methods are adopted in the region to manage pest and disease attacks. Foliar application occupied the highest share of 52.5% by value in 2022. It has been observed that foliar spraying of metaldehyde and thiodicarb is suitable as one of the components of integrated pest management of snails and has been quite effective in the region.

- Additionally, the soil treatment method occupied the second-highest share of 32.2% by value in 2022. It has been observed that molluscicide application on soil appeared to be the easiest, safest, and most efficient way of controlling pests. If soil is treated with a systemic molluscicide, it kills mollusks that live in the soil.

- Nevertheless, there are several drawbacks to the health of consumers, workers, and the environment from using foliar pesticides. Chemigation of pesticides can be fairly utilized, making it cost-effective and removing several drawbacks common to foliar molluscicide applications. Chemigation occupied a share of 12.9% by value in 2022.

- Owing to the increase in research and innovation, which are aimed to bring out the safest and most effective method of application, along with the increased awareness among the farmers regarding the effectiveness of the proper application of molluscicides, the market is anticipated to register a CAGR of 5.3% during the forecast period (2023-2029).

Increasing snail population and the growing damage to crops are boosting the usage of molluscicides

- Slugs are a class of mollusks that are among the most harmful to soil due to their ability to inflict extensive damage on field crops, particularly during wet conditions of the spring and fall months. The grey slug is one of the major species of slugs, which is responsible for the majority of crop damage in Europe. France accounted for a major share of 15.4% in 2022 in terms of the consumption of molluscicides in the region.

- Russia accounted for 14.3% of the total European molluscicides market in 2022. The cool, humid climates of Russia make the situation even worse as the number of snails may be as high as 200 slugs on every square yard of cultivated farm, with each one capable of producing 400 round white eggs annually. The higher reproduction rate makes it very difficult to control the snails.

- In Italy, snails feed on ripe and ripening fruit, young tree leaves, and even the bark of young trees, leading to significant economic losses in citrus orchards. Additionally, their presence can disrupt irrigation management by clogging sprinkler heads and irrigation systems, further exacerbating the challenges faced by farmers.

- Metaldehyde, niclosamide, and metal salts such as iron (III) phosphate, aluminum sulfate, and ferric sodium EDTA comprise commonly used molluscicides in the region and can be applied through different methods.

- Advancements are being made in developing more effective molluscicide formulations to enhance bait attractiveness, palatability, and stability to improve the targeting and efficacy of molluscicides against snails and slugs. These factors are anticipated to drive the market for molluscicides in European countries, with higher adoption by farmers.

Europe Molluscicide Market Trends

The increasing mollusk population is leading to higher application per hectare

- In 2022, Italy emerged as the foremost consumer of molluscicides on a per-hectare basis, utilizing 40.8 grams. Pests like snails and slugs inflict harm on plant seeds, young plants, underground tubers, foliage, and fruits. The harm caused to young plants often leads to their demise, resulting in substantial reductions in production. Notably vulnerable are crops such as barley, canola, and pulses. The significance of the white Italian snail as a pest, like other species, is that they contaminate grain during harvest while also cogging and damaging harvest machinery.

- In Europe, the Netherlands ranks second in per-hectare molluscicide consumption, recording 25.7 grams per hectare in 2022. A wide range of vegetables are particularly susceptible to slug infestations. Notably, Brussels sprout buds and green and white cabbage often fall affected by slug nibbling, rendering them unsuitable for market sale. Slugs and snails lay insane amounts of eggs, up to 400, creating a situation that demands the use of molluscicides.

- Germany, France, and Spain were other prominent countries using molluscicides at the rate of 16.3 grams, 14.3 grams, and 10.3 grams per hectare, respectively, in 2022. Helix pomatia, also known as the Roman snail or Burgundy snail, is a species that can cause damage to agriculture in Germany. This large land snail is known to feed on various crops, including vegetables, fruits, and ornamental plants. Its feeding habits can lead to economic losses for farmers as the snails can damage the appearance and quality of the harvested produce. This makes Helix pomatia a concern for agricultural practices in Germany and other regions where it is found.

Metaldehyde and ferric phosphate-based molluscicides are most commonly used to control slugs and snails

- Molluscicides are used to kill various mollusk species, including intermediate host snails involved in the lifecycle of schistosomes. Several molluscicides have been developed to control slugs and snails in crop environments, typically deployed as pellets placed around the plant base.

- In 2022, metaldehyde was valued at USD 52.5 thousand per metric ton. Widely used in field crops, gardens, and greenhouses, it is applied in various forms such as liquid, granules, sprays, dust, or pelleted/grain bait to effectively combat slugs, snails, and other garden pests. Commercial baits usually contain 4% or less metaldehyde as the active ingredient, while some granule baits may contain up to 5-10% metaldehyde. In Europe, bait with up to 50% metaldehyde is available.

- Ferric phosphate, priced at USD 52.0 thousand per metric ton in 2022, stands as a highly effective and environmentally friendly molluscicide. It poses no harm to humans, animals, non-target insects, plants, or soil microbes and exhibits stability and non-reactivity in the agroecosystem. Ferric phosphate remains the only molluscicide employed in UK agriculture. It acts by interfering with stomach calcium metabolism, causing mollusks to cease feeding, leading to their typical subterranean death. It is applied to soil in pellet form with bait to attract snails and slugs.

- Slugs represent one of the most destructive and challenging pests to manage. They preferentially target seedlings of numerous vegetables and flowers, posing difficulties in crop establishment. Preharvest feeding by slugs on fruits and vegetables results in wounds that can lead to fungal and bacterial contamination, spoiling the crop. Due to these challenges, European farmers rely on synthetic chemicals like metaldehyde and ferric phosphate for slug control.

Europe Molluscicide Industry Overview

The Europe Molluscicide Market is fragmented, with the top five companies occupying 8.73%. The major players in this market are ADAMA Agricultural Solutions Ltd., Arxada, Doff Portland Ltd, Mitsui & Co. Ltd (Certis Belchim) and W. Neudorff GmbH KG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Ukraine

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 Arxada

- 6.4.3 Doff Portland Ltd

- 6.4.4 Farmco Agritrading Ltd

- 6.4.5 Mitsui & Co. Ltd (Certis Belchim)

- 6.4.6 W. Neudorff GmbH KG

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219