|

市场调查报告书

商品编码

1683149

南美作物保护市场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)South America Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

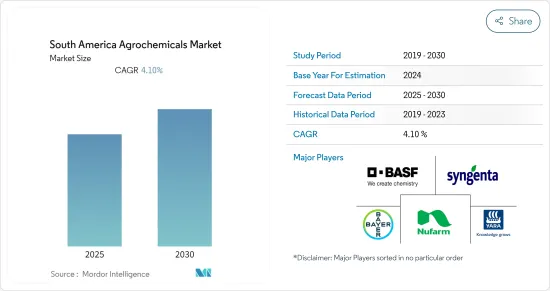

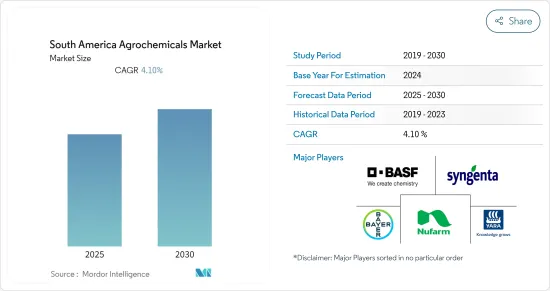

预测期内,南美作物保护市场预计复合年增长率为 4.1%

南美洲农化市场趋势

农业部门成长

近年来,昆虫、害虫和植物寄生线虫对作物保护化学物质等农药产生了相当大的抗药性。巴西和阿根廷是世界上成长最快的两个作物保护市场。该地区的有机农业逐年增长,其中阿根廷占据市场主导地位。阿根廷农业的很大一部分采用垂直整合系统,有机农业遍布全国。国际有机农业运动联盟(IFOAM)在南美洲的永续农业和粮食安全努力中发挥关键作用。随着有机农地的增加,该地区对生物农药的需求也预计将增加。儘管目标害虫的特异性有限,但它为该行业提供了许多机会,以促进永续农业,实现更健康的未来。微生物农药各有其独特之处,不仅在生物体和有效成分方面,而且在宿主、应用环境以及生产和控制的经济性方面也各有不同。推动这些国家成长的主要作物是大豆和玉米。寻找可持续的方式来养活快速增长的人口,同时满足日益壮大的中阶不断变化的多样化饮食需求,是南美洲可以利用的机会。因此,农药供应在该地区发挥着至关重要的作用。

巴西占市场主导地位

巴西是经济快速成长的国家之一,也是全球最大的农化市场。该国作物保护化学品市场的快速成长归因于对玉米和大豆出口的需求不断增加,这导致这些作物的种植面积增加,从而导致作物保护化学品的使用量增加。由于亚洲銹病的不断加剧,巴西成为2016年杀菌剂销售量最大的国家。由于农药非法贸易,2016 年该类别的销售额与前一年同期比较有所下降。巴西从世界各地进口农药,中国是巴西最大的农药出口国。紧随中国之后的是美国、印度、阿根廷等国家。

主要企业主导巴西作物保护市场,其中先正达在巴西作物保护销售方面处于领先地位。拜耳和BASF分别位居第二和第三。先正达的 Viptera 增加了巴西玉米保护市场的参与企业。随着人口不断增长,国内粮食消费量也随之增加,从而带来农作物作物和相关投入的增加。更多采用高价值种子技术和购买相关种子保护产品作为保险。

南美洲农药产业概况

新产品发布、併购和伙伴关係是市场主要企业采用的关键策略。这些公司还注重投资创新、合作和扩张,以增加市场占有率。作物保护化学品市场主要分为主要企业:先正达公司、拜耳作物科学公司、雅苒巴西公司、BASF公司和 Nufarm 公司。 2017年,陶氏与杜邦合併顺利完成。我们两家公司的合併不仅代表着今天的巨大实力,也代表着未来的巨大机会。我们的综合能力和生产创新引擎使我们能够更快地将更广泛的产品推向市场。此类活动可能会带来市场整合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 肥料

- 农药

- 佐剂

- 植物生长调节剂

- 应用

- 以作物为基础

- 粮食

- 豆类和油籽

- 水果和蔬菜

- 非农作物

- 草坪和观赏草

- 其他非农作物

- 以作物为基础

- 地区

- 巴西

- 阿根廷

- 南美洲其他地区

第六章 竞争格局

- 最受欢迎的竞争策略

- 市场占有率分析

- 公司简介

- Syngenta

- Bayer CropScience AG

- BASF SE

- Corteva Agriscience

- Archer-Daniels-Midland(ADM)

- FMC Corporation

- Agrium

- Potash Corporation of Saskatchewan

- Nufarm Ltd

- FMC

- Yara International

第七章 市场机会与未来趋势

第八章 新冠肺炎疫情的影响

The South America Agrochemicals Market is expected to register a CAGR of 4.1% during the forecast period.

South America Agrochemical Market Trends

Growth of The Agriculture Sector

In recent years, insects, pests, and plant-parasitic nematodes became immensely resistant against agrochemicals like the crop protection chemicals. Brazil and Argentina are the world's two fastest-growing agrochemical markets. Organic farming in the region is increasing year-after-year and Argentina holds the major share in the market followed by Uruguay and Brazil. An important part of agriculture in Argentina is organized in a vertically-integrated system and organic farming is found throughout the country. The International Federation of Organic Agriculture Movements (IFOAM) America Latina is playing a vital role in sustainable agriculture and food security initiatives in South America. With the increased organic farmland, demand for biological chemicals is also expected to increase in the region. Despite its limited target pest specificity, it offers many opportunities for industries to boost sustainable agriculture for a healthier future. Each microbial pesticide is unique, not only in an organism or active ingredient but also with the host, the environment in which it is being applied, and the economics of production and control. The main crops driving growth in these countries are soybeans and corn. Finding sustainable ways to feed the rapidly increasing population while satisfying the evolving and diverse dietary needs of the growing middle class is an opportunity that can be utilized by South America. Therefore, the provision of agrochemicals plays an important role in the region.

Brazil Dominates the Market

Brazil is one of the fastest-growing economies and the largest crop protection markets in the world. The rapid growth of the crop protection market in the country can be attributed to an increase in the export demand for corn and soybeans has increased the acreage of these crops, thus increasing the use of crop protection products. Due to the increased attack of Asian Rust in Brazil, fungicides constituted the most sold products in 2016. Due to the illegal trade of insecticides, the category witnessed a drop in sales in 2016 as compared to the previous year. Brazil also imports agrochemicals from across the globe in which China is the top-most exporter of agrochemicals in Brazil. China is followed by the United States, India, Argentina, etc.

Key players occupy the majority of the Brazilian agrochemical market with Syngenta leading the sales of agrochemicals in Brazil. Bayer and BASF occupy the second and third positions. Syngenta's Viptera led to an increase in its participation in the market for the protection of corn in Brazil. An increase in domestic food consumption by the expanding population increases produced crops and the associated inputs. Increase in the adoption of high-value seed technology and the related seed protectant products purchased as insurance policies.

South America Agrochemical Industry Overview

New product launches, mergers & acquisitions, and partnerships are the major strategies adopted by these leading companies in the market. These companies are also focusing on making an investment in innovations, collaborations, and expansions, in order to increase their market share. The agrochemicals market is fragmented, with key players being Syngenta AG, Bayer CropScience, Yara Brasil SA, BASF SE, and Nufarm. In 2017, Dow and DuPont merger was successfully completed. The merger of both companies is the biggest strength as of now as well as a great opportunity for the future. The combined capabilities and highly productive innovation engine will enable the company to bring a broader suite of products to the market faster. Such activities are likely to bring consolidation in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Fertilizers

- 5.1.2 Pesticides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.2 Application

- 5.2.1 Crop Based

- 5.2.1.1 Grains and Cereals

- 5.2.1.2 Pulses and Oilseeds

- 5.2.1.3 Fruits and Vegetables

- 5.2.2 Non-Crop Based

- 5.2.2.1 Turf and Ornamental Grass

- 5.2.2.2 Other Non-crop Based

- 5.2.1 Crop Based

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Competitor Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Syngenta

- 6.3.2 Bayer CropScience AG

- 6.3.3 BASF SE

- 6.3.4 Corteva Agriscience

- 6.3.5 Archer-Daniels-Midland (ADM)

- 6.3.6 FMC Corporation

- 6.3.7 Agrium

- 6.3.8 Potash Corporation of Saskatchewan

- 6.3.9 Nufarm Ltd

- 6.3.10 FMC

- 6.3.11 Yara International