|

市场调查报告书

商品编码

1685869

非洲农药 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Africa Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

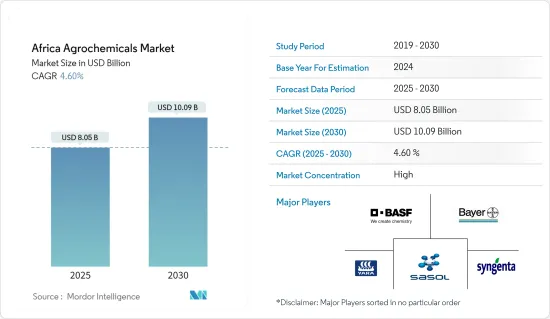

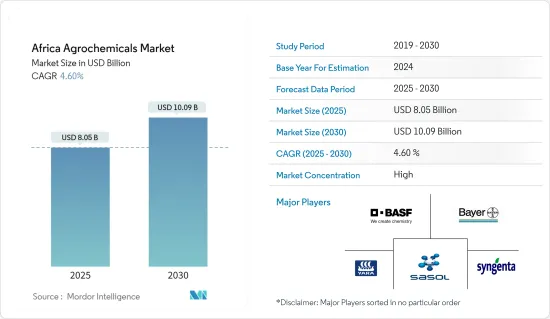

预计 2025 年非洲农业化学品市场规模为 80.5 亿美元,到 2030 年将达到 100.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.6%。

主要亮点

- 气候变迁正在彻底改变非洲的农业。加州大学气候危害中心(CHC)的调查团队指出,2024年1月下旬至3月中旬,非洲的降雨量将不到往年的一半。这些天气模式的变化是气候变迁的直接结果,它不仅改变了害虫的分布和发展,也影响了它们的族群动态。这些变化可能为本地物种和入侵物种更容易传播铺平道路。例如,在干旱期间,农民增加使用杀虫剂对付蚜虫等害虫。为了适应气候变迁并维持生产,农民比以往任何时候都更依赖杀虫剂。

- 对于该地区的农民来说,获得化肥和杀虫剂等基本农业投入至关重要。有鑑于此,非洲各国政府正在加强农业方面的力度。例如,非洲国家透过非洲农业综合发展计画(CAADP)制定了旨在消除饥饿和贫穷的2063年议程。实现这一目标的方法是将至少10%的国家预算分配给农业和农村发展,并实现每年6%的成长率。政府为提高生产力所做的努力直接推动了农药市场的发展。

非洲农药市场趋势

人口成长导致粮食需求增加

- 非洲农村人口正稳定成长。根据世界银行的资料,2020年至2023年间,撒哈拉以南非洲农村人口将成长5%,复合年增长率为1.6%。人口增长产生了对农田的需求。非洲绿色革命联盟 2023 年发布的一份报告警告称,到 2030 年,非洲不断增长的人口可能面临粮食不安全危机,威胁营养和健康。小农户生产了非洲大陆 80% 的粮食,他们面临提高产量的压力。因此,许多农民增加了农药和化学肥料的使用。值得注意的是,粮食及农业组织报告称,遭受严重粮食不安全的人数将从 2020 年的 3.05 亿增加到 2022 年的 3.418 亿,凸显了粮食生产对非洲大陆的重要性。

- 国际货币基金组织(IMF)指出,到2050年,非洲人口将达到25亿,其粮食需求预计将增加一倍以上。需求激增的原因是人口成长、收入增加、快速都市化以及区域向优质生鲜食品和加工食品的转变。需求的成长不仅将为非洲农民创造新的机会,也将加速农药在农业中的应用。与非洲绿色革命联盟一起,八国集团粮食安全与营养新联盟等组织正加强应对非洲大陆的粮食安全挑战。

提高土地生产力和政府行动的必要性

- 随着非洲人口的成长,对粮食的需求也随之成长。然而,非洲大陆正面临着有限的可耕地无法满足日益增长的需求的挑战。非洲拥有全球60%的未开垦土地,但主要谷物作物的产量还不到潜在产量的25%。在一些地区,跨界病虫害进一步降低了农业生产力。粮食产量低加剧了粮食不安全、贫穷和营养不良的挑战,尤其是在人口持续成长的情况下。令人担忧的是,玉米等主要作物的种植面积正在减少。粮农组织的资料显示,玉米收穫面积将从2021年的4,290万公顷下降到2022年的4,170万公顷。这种模式凸显了提高土地生产力的迫切需求。

- 为了因应这些挑战,国内外政府正加大对小农和边际农户的支持。例如,在肯亚,世界银行主导推出化肥电子券补贴,允许符合资格的农民以折扣价向私人零售商购买化肥。这项措施不仅使生产率提高了50%以上,还促进了作物多样化并增强了私营部门的力量。预计非洲的食品和农业市场规模将从 2023 年的 2,800 亿美元成长到 2030 年的 1 兆美元。在政府干预和提高农业生产力的迫切需求下,非洲的农业化学品产业将在未来几年迎来显着成长。

非洲农化产业概况

2023年,非洲农化市场将呈现明显整合趋势,大型企业将占据主导市场。主要公司如下:Sasol Limited、Yara International、Bayer、Syngenta 和BASF SE 在市占率上领先。最近,拜耳和科迪华合併,为作物保护领域引入了创新产品。此外,拜耳也与 Chimetic 和 M2i Group 合作,预示着未来农业化学品领域将取得良好进展。在加强研发中心的支持下,农化产业企业正积极创新,壮大农化产业。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 气候挑战和害虫抗性

- 人口成长

- 政府政策及补贴

- 气候挑战和害虫抗性

- 市场限制

- 小农户高成本,负担能力低

- 监管挑战

- 小农户高成本,负担能力低

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 产品类型

- 肥料市场

- 农药市场

- 佐剂市场

- 植物生长调节剂市场

- 应用

- 谷物和谷类

- 豆类和油籽

- 水果和蔬菜

- 经济作物

- 地区

- 刚果

- 马拉威

- 莫三比克

- 尚比亚

- 其他非洲国家

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Bayer Crop Science AG

- Syngenta International AG

- Adama Agricultural Solutions

- FMC Corporation

- Corteva Agrisciences

- Yara International

- UPL

- BASF SE

- Sumitomo Corporation

- Nufarm

第七章 市场机会与未来趋势

The Africa Agrochemicals Market size is estimated at USD 8.05 billion in 2025, and is expected to reach USD 10.09 billion by 2030, at a CAGR of 4.6% during the forecast period (2025-2030).

Key Highlights

- Climate change is significantly reshaping Africa's agricultural landscape. Researchers from the Climate Hazards Center (CHC) at the University of California have highlighted that from late January to mid-March 2024, Africa experienced only half or less of its typical rainfall. These changing weather patterns, a direct consequence of climate change, are not only altering the distribution and development of insect pests but also affecting their population dynamics. Such changes may pave the way for both native and foreign species to spread more easily. For instance, during droughts, farmers ramped up pesticide use to tackle pests like aphids, a practice they didn't adopt during regular rainfall periods. To adapt to these climatic shifts and sustain production, farmers are turning to agrochemicals more than ever.

- Access to essential agricultural inputs, such as fertilizers and pesticides, is crucial for regional farmers. In light of this, African governments are intensifying their agricultural commitments. For instance, through the Comprehensive African Agricultural Development Programme (CAADP), African nations have set a 2063 agenda aiming to combat hunger and poverty. This is to be achieved by channeling at least 10% of their national budgets into agriculture and rural development, with a target growth rate of 6% annually. Such governmental initiatives to boost productivity are directly fueling the agrochemicals market, as these inputs are essential for cultivating fertilizer-responsive crops that meet the region's consumption demands.

Africa Agrochemicals Market Trends

Growing Food Demand With Population Growth

- Africa's rural population is steadily increasing. According to World Bank data, from 2020 to 2023, Sub-Saharan Africa's rural population grew by 5%, averaging an annual growth rate of 1.6%. This rising population is intensifying the demand for agricultural land. A, 2023 report from AGRA (Alliance for a Green Revolution in Africa) cautions that by 2030, Africa's burgeoning population may face a food scarcity crisis, jeopardizing nutrition and health. Smallholder farmers, who account for 80% of the continent's food production, are under pressure to enhance their yields. Consequently, many are turning to increased use of pesticides and agrochemicals. Notably, the Food and Agricultural Organization reported a rise in severely food-insecure individuals from 305 million in 2020 to 341.8 million in 2022, underscoring the critical nature of food production on the continent.

- By 2050, Africa's food demand is set to more than double, aligning with a projected population of 2.5 billion, as highlighted by the International Monetary Fund. This demand surge is driven by population growth, rising incomes, swift urbanization, and a regional shift towards premium fresh and processed foods. Such increasing demand not only presents fresh opportunities for African farmers but also accelerates the adoption of pesticides in agriculture. To tackle the continent's food security challenges, organizations like the G8's New Alliance for Food Security and Nutrition, alongside AGRA, are intensifying their efforts.

Need for Improving Land Productivity and Government Initiatives

- As Africa's population grows, so does its demand for food. Yet, the continent grapples with a challenge, its limited arable land can't keep pace with this surging demand. Africa holds 60% of the world's uncultivated arable land, yet its primary cereal crops yield less than 25% of their potential. In some areas, transboundary pests and diseases further dampen agricultural productivity. These stagnant yields intensify challenges like food insecurity, poverty, and malnutrition, especially as the population continues to swell. Alarmingly, the harvested area for crucial crops, including maize, is shrinking. FAO data reveals this concerning trend: maize harvesting fell from 42.9 million hectares in 2021 to 41.7 million hectares in 2022. Such patterns highlight the urgent need to enhance land productivity.

- In response to these challenges, both national and international governments are rallying to assist small and marginal farmers. For instance in Kenya, a World Bank initiative is rolling out fertilizer e-voucher subsidies, enabling eligible farmers to purchase fertilizer at discounted rates from private retailers. This initiative has not only spurred a productivity boost of over 50% but has also championed crop diversification and bolstered the private sector. Looking ahead, the African Development Bank paints an optimistic picture, Africa's food and agriculture market, valued at USD 280 billion in 2023, is projected to leap to a staggering USD 1 trillion by 2030. With these governmental interventions and the pressing demand for heightened agricultural productivity, Africa's agrochemical industry stands on the brink of substantial growth in the years to come.

Africa Agrochemicals Industry Overview

In 2023, the African agrochemicals market witnessed significant consolidation, with major players commanding a dominant share. Key players such as Sasol Limited, Yara International, Bayer, Syngenta, and BASF SE led the market in terms of share. Recently, Bayer and Corteva merged, introducing innovative products in the crop protection segment. Furthermore, Bayer has partnered with Kimetic and M2i Group, signaling promising advancements in crop protection. Companies in the crop protection domain, bolstered by their R&D centers, are diligently innovating to enhance the agrochemicals sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Climate Challenges and Pest Resilience

- 4.2.1.1 Population Growth

- 4.2.1.1.1 Government Policies and Subsidies

- 4.2.1 Climate Challenges and Pest Resilience

- 4.3 Market Restraints

- 4.3.1 High Cost and Unaffordability by Marginal Farmers

- 4.3.1.1 Regulatory Challenges

- 4.3.1 High Cost and Unaffordability by Marginal Farmers

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Fertilizer Market

- 5.1.2 Pesticides Market

- 5.1.3 Adjuvants Market

- 5.1.4 Plant Growth Regulators Market

- 5.2 Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops

- 5.3 Geography

- 5.3.1 Congo

- 5.3.2 Malawi

- 5.3.3 Mozambique

- 5.3.4 Zambia

- 5.3.5 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer Crop Science AG

- 6.3.2 Syngenta International AG

- 6.3.3 Adama Agricultural Solutions

- 6.3.4 FMC Corporation

- 6.3.5 Corteva Agrisciences

- 6.3.6 Yara International

- 6.3.7 UPL

- 6.3.8 BASF SE

- 6.3.9 Sumitomo Corporation

- 6.3.10 Nufarm