|

市场调查报告书

商品编码

1683168

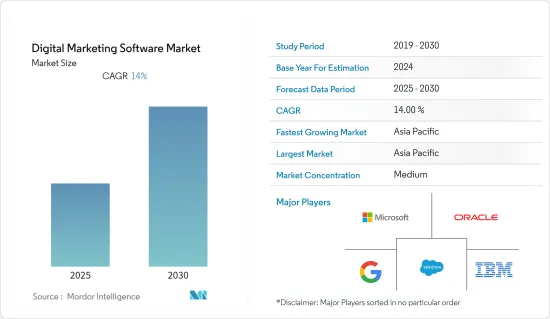

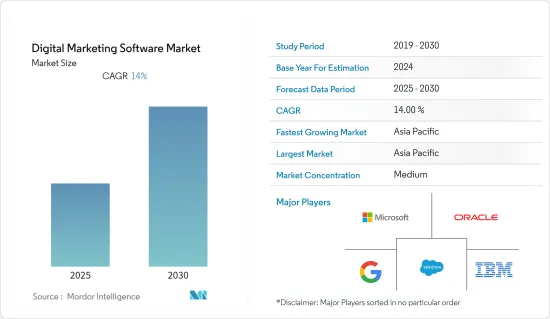

数位行销软体:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Digital Marketing Software Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计预测期内数位行销软体市场复合年增长率将达到 14%。

主要亮点

- 根据谷歌最近的一项研究,48% 的消费者透过搜寻引擎开始查询,33% 的消费者在品牌网站上搜索,26% 的消费者在行动应用程式内搜寻。企业已经准备好并愿意在任何数位平台上、使用不同的设备以及可以追踪和分析习惯的数位行销软体与客户互动。

- 巨量资料分析在数位行销中的广泛应用以及透过消除位置限製而提高的购买便利性预计将为市场成长创造机会。由于企业寻求在 Facebook 和 Twitter 等社交网站上与客户互动以推广其品牌和产品,因此社群CRM解决方案预计将在预测期内变得越来越重要。

- 然而,行销软体技术纯熟劳工的短缺预计会抑制市场的成长。由于缺乏合格的实务专家,软体开发的固定成本很高。

- 为了应对最近世界上的技术变革,行销经理正在策略性地投资于自动化行销流程和解决方案,以采用最新的数位行销趋势。从社群媒体行销到搜寻引擎优化和内容行销,行销经理正在投入大量资金来支持和促进销售。报导《广告时代》杂誌报道,2021 年行销服务总支出预计将达到 2,507 亿美元,其中大部分来自促销。

- 由于疫情迫使每个人大部分时间都待在家里,无论是必需品或非必需品,网路购物都变得越来越重要。但由于杂货配送时段难以获得,并且大多数物品需要更长时间才能运送,因此也出现了 ABM(基于帐户的营销)解决方案的激增,这些解决方案通过电话和互动来个性化和增强客户服务。

数位行销软体市场趋势

电子邮件行销占很大市场占有率

- 全球电子邮件用户接近 35 亿,电子邮件行销是主要的行销管道之一。世界各地的企业都使用电子邮件行销。向潜在客户或消费者发送电子邮件并将其转化为销售被视为电子邮件行销。

- 通常,电子邮件行销包括发送广告或新闻通讯、进行销售邀请、请求捐赠或透过电子邮件招揽业务。

- 过去几年来,电子邮件行销发生了巨大的变化。随着电子商务和智慧型手机的出现,过去十年中使用电子邮件服务的用户数量有所增加,从而提高了电子邮件行销的覆盖范围。

- 由于现在有如此多的用户资料可用,企业正在转向自动化资料库来简化流程并寻找扩大电子邮件行销的新方法。这为企业提供了探索自动化电子邮件行销的机会。

- 网路安全是人们最关心的问题,越来越多的电子邮件帐户受到网路钓鱼诈骗和电子邮件附件中的恶意软体的攻击。结果,消费者对电子邮件行销失去信心,合法电子邮件可能永远不被报告或被阻止。

亚太地区占较大市场占有率

- 印度和中国等国家的网路普及率不断提高,已使大量人口接入网路。这有望为数位行销创造有利可图的机会。

- 上述因素将导致社交媒体的存在感增强以及基于社交媒体的营销宣传活动的激增。

- 在过去的几年里,印度已经发展成为一个非常成熟的数位领域投资市场,尤其是对于帮助企业转型为数位领域的顾问公司。

- 随着「数位印度」策略的成形,「云端优先」的方法非常明确。该计划旨在将旧有系统和内部系统转变为云端基础的整合模型。此举将推动印度采用云端基础行销软体。

- 新兴国家的新兴企业正透过寻求支持其发展的参与者的投资,逐步将业务扩展到全球战场。例如,2022 年 1 月,Moon Karl 收购了 April & June Digital Private Limited,这是一家巴基斯坦数位行销机构,致力于提供高端跨国电子商务、网站开发、应用程式开发和全面数位行销解决方案。

数位行销软体产业概况

数位行销软体市场竞争激烈,由几家大公司组成。每家公司都在透过赢得新契约和开拓新市场来扩大其市场占有率。

- 2021 年 1 月——万事达卡在其亚太地区的大部分网站上为中小企业推出了一个数位化支援微网站,其中包含数位化和高效运营业务的信息,重点关注电子商务平台、数位行销服务、网路安全和推出漏洞的工具。

- 2021年1月,Bloomreach宣布投资1.5亿美元收购CDP(消费者资料平台)和行销自动化供应商Exponaire。 Bloomreach 专注于商业体验,利用深度产品资料和人工智慧帮助人们找到合适的产品并在电子商务网站上提供良好的体验。 2020 年电子商务和数位行销的快速成长促成了这一决定。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 调查前提条件

第二章调查方法

- 研究阶段

- 分析方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 引入市场驱动因素与限制因素

- 市场驱动因素

- 扩大数位媒体的使用

- 云端技术的采用日益广泛

- 日益需要改善客户电子体验

- 市场限制

- 评估正确的数位行销解决方案

- 评估新冠肺炎对产业的影响

第五章 市场区隔

- 按部署

- 本地

- 云

- 按类型

- 搜寻引擎软体

- 内容行销软体

- 社群媒体行销

- 电子邮件行销

- 行动行销

- 行销自动化软体

- 其他类型

- 按最终用户产业

- 资讯科技和电信

- 媒体与娱乐

- BFSI

- 零售

- 製造业

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Adobe Systems Incorporated

- SAP SE

- Salesforce.com Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Google LLC

- SAS Institute Inc.

- Marketo Inc

- HubSpot Inc.

- Teradata Corporation

- Infor Inc.

- Criteo SA

第七章投资分析

第八章 市场机会与未来趋势

简介目录

Product Code: 56811

The Digital Marketing Software Market is expected to register a CAGR of 14% during the forecast period.

Key Highlights

- A recent study by Google found that 48% of consumers start their inquiries on search engines, while 33% search brand websites and 26% search within mobile applications. Businesses are ready and willing to engage with their customers on every digital platform with different devices, using digital marketing software, where habits can be tracked and analyzed.

- The proliferation of Big Data analytics in digital marketing and the increasing ease of purchasing by removing location constraints are expected to create opportunities for market growth. Social CRM solution is expected to garner high significance over the forecast period as organizations try to engage with customers on social sites, such as Facebook and Twitter, to publicize the brand and product.

- However, the lack of skilled labor in handling marketing software is expected to restrain the market growth. The shortage of qualified working professionals has resulted in a high fixed cost of software development.

- To keep businesses updated with the recent technological disruptions worldwide, marketing managers are strategically spending on automating their marketing processes and solutions to adopt the latest digital marketing trends. From social media marketing to SEO or content marketing, marketing managers are investing significantly to support and boost their sales. According to a published article by Advertising Age, in 2021, the full marketing services spending may amount to an estimated sum of USD 250.7 billion, out of which the majority was attributed to sales promotion.

- As the pandemic forced everyone at home most of the time, online shopping gained importance for both essential and non-essential items. However, with difficulty getting delivery time slots for groceries and slower shipping times for most items, there has also been a spike in ABM (Account-based marketing) solutions to personalize and enhance customer service through calls and interactions.

Digital Marketing Software Market Trends

Email Marketing to Hold a Significant Market Share

- Email marketing is one of the primary marketing channels, considering the number of email users is close to 3.5 billion. Businesses across the world have utilized email marketing. Broadcasting an email to a potential client or consumer that could help in closing the sale is considered email marketing.

- Generally, email marketing involves sending advertisements, and newsletters, soliciting sales, requesting donations, and requesting businesses via emails.

- Email marketing has evolved drastically over the past few years. With the advent of e-commerce and smartphones, the number of users utilizing email services has grown in the previous decade, improving email marketing reach.

- With the vast amount of user data available, companies are focusing on automating the database to streamline the process and explore new ways of email marketing. This has provided an opportunity for companies to explore automated email marketing.

- Cybersecurity poses the biggest concern, as more email accounts are compromised by phishing scams and malware contained in email attachments. As a result, consumers are less confident in email marketing, and legitimate emails may be permanently reported or blocked.

Asia-Pacific to hold a Major Market Share

- The rise in internet penetration in countries such as India and China has brought a significant region population online. This is expected to result in a profitable opportunity for digital marketing.

- The factor mentioned above is set to result in a growth of social media presence, leading to a surge in social media-based marketing campaigns.

- Over the last few years, India has evolved into a market remarkably suited for investment in the digital space, particularly for consulting firms that assist with transitioning to the digital sphere.

- As the Digital India strategy continues to take shape, it is very clear about a "cloud first" approach. The initiative aims to move legacy and on-premise systems to a cloud-based or integrated model. This initiative would result in the country's cloud-based digital marketing software adoption.

- Startups from developing countries are slowly expanding operations onto the global battlefield through investments from players intending to herald their growth. For instance, in January 2022, The Moon Carl acquired April and June Digital Private Limited, a digital marketing agency based in Pakistan that dabbles in delivering high-end multinational e-commerce, web development, app development, and full-spectrum digital marketing solutions.

Digital Marketing Software Industry Overview

The digital marketing software market is highly competitive and consists of several major players. Companies are increasing their market presence by securing new contracts and tapping new markets.

- In January 2021 - Mastercard launched digital acceleration of small businesses microsites across most of its Asia-Pacific websites with information on digitizing and running businesses efficiently, focusing on e-commerce platforms, digital marketing services, cybersecurity, and tools to reduce vulnerabilities.

- In January 2021 - Bloomreach announced a USD 150 million investment and the acquisition of a CDP (Consumer Data Platform) and Marketing Automation Provider Exponea. Bloomreach majors in commerce experience, with deep product data and AI to help people find the right product and deliver great experiences on e-commerce sites. The astonishing growth of e-commerce and digital marketing over 2020 led to this decision.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

- 2.1 Research Phases

- 2.2 Analysis Methodology

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Market Drivers

- 4.4.1 Increased Utilization of Digital Media

- 4.4.2 Rising Trend in Adoption of Cloud Technology

- 4.4.3 Increasing Need to Improve Customer E-experience

- 4.5 Market Restraints

- 4.5.1 Evaluating the Right Kind of Digital Marketing Solution

- 4.6 Assessment of COVID-19 impact on the industry

5 MARKET SEGMENTATION

- 5.1 DEPLOYMENT

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 TYPE

- 5.2.1 Search Engine Software

- 5.2.2 Content Marketing Software

- 5.2.3 Social Media Marketing

- 5.2.4 E-mail Marketing

- 5.2.5 Mobile Marketing

- 5.2.6 Marketing Automation Software

- 5.2.7 Other Types

- 5.3 END-USER INDUSTRY

- 5.3.1 IT and Telecom

- 5.3.2 Media and Entertainment

- 5.3.3 BFSI

- 5.3.4 Retail

- 5.3.5 Manufacturing

- 5.3.6 Healthcare

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Adobe Systems Incorporated

- 6.1.2 SAP SE

- 6.1.3 Salesforce.com Inc.

- 6.1.4 IBM Corporation

- 6.1.5 Microsoft Corporation

- 6.1.6 Oracle Corporation

- 6.1.7 Google LLC

- 6.1.8 SAS Institute Inc.

- 6.1.9 Marketo Inc

- 6.1.10 HubSpot Inc.

- 6.1.11 Teradata Corporation

- 6.1.12 Infor Inc.

- 6.1.13 Criteo SA

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219