|

市场调查报告书

商品编码

1683409

印度电子商务包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India E-Commerce Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

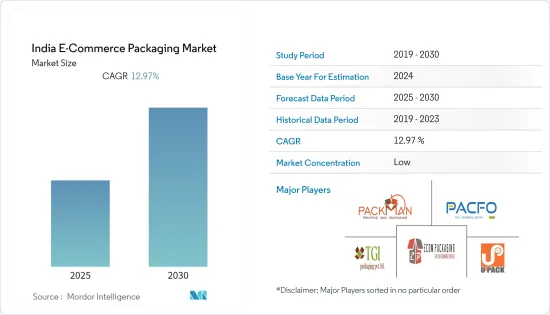

预计预测期内印度电子商务包装市场复合年增长率将达到 12.97%。

主要亮点

- 电子商务市场的快速成长主要受到消费性电子、时尚、服装和个人护理行业的推动。对消费电子产品、个人护理以及时尚服饰的大量投资为扩大包装机会创造了空间。

- 全通路经营模式的兴起也推动了电子商务市场的发展,这种模式允许顾客在线上和线下购物。 Shoppers Stop Ltd 和 Infiniti Retail Limited Croma 等全通路零售商的销售额有所成长。我们还确保从城市内的线下商店发货,这意味着更便宜的包装运费和更快的送货速度。

- 为鼓励外资参与电子商务,印度政府将电子商务市场模式的外商直接投资(FDI)限额提高至100%(B2B模式)。

- 电商包装业务的拓展需要解决农村地区认知度低的问题,而对网路平台的不信任也影响网路产品的购买。这一趋势阻碍了电子商务包装行业的成长。基础薄弱和缺乏技术专长阻碍了电子商务包装行业的扩张。

- 受新冠疫情影响,印度实施封锁措施,导致电商包装产业成长大幅下滑。这一因素限制了电子商务商品的流动,并扰乱了国内供应链。

印度电子商务包装市场的趋势

保护性包装市场大幅成长

- 由于电子商务上电子产品销售的快速成长,印度电子商务产业对保护性包装的需求将出现前所未有的成长。根据IBEF统计,家用电器目前是印度线上零售额的最大贡献者,为市场成长贡献了48%的份额。

- 这些保护性包装产品的设计和构造旨在保护货物免受大气、磁性、静电、振动、衝击和其他损害。保护性包装可保护机械、设备和工业产品在储存和运输过程中免受损害。它们还透过填充空隙、包裹、柔性缓衝、阻挡和支撑、防御性遏制和表面防御来提供安全保障。

- 保护性包装用于各种应用,包括食品、电子、化妆品和製药业。产品包括盒子、储存容器、包装材料、衬垫和垫片。空气枕、纸填充物、气泡膜和邮寄袋等柔性产品预计将成为蓬勃发展的电子商务市场的主要受益者。

- 用于寄送行动电话、配件、盒子等的保护气囊在电子商务领域被广泛使用,因为它们有助于保护货物在运输过程中免受损坏。 Vijay Packaging System 等公司就提供这种类型的包装。有适合电子商务领域的聚丙烯材料可供选择。该公司的气管袋是用于运输罐子、瓶子和容器的充气气囊,特别是用于化妆品的气囊。

时尚服饰占很大市场占有率

- 在媒体曝光、认知度不断提高和可支配收入不断增加的推动下,印度消费者要求获得全球时尚品牌。由于品牌透过实体店的覆盖范围有限,小城市为线上零售商提供了机会。

- 由于该领域的大量投资和网路使用者数量的快速成长,印度的电子零售市场预计将以全球最快的速度发展。据IBEF称,其在印度服装和生活方式(包括鞋类、箱包、皮带、钱包、手錶和珠宝)的份额约为29%。

- 根据Apparel Sourcing Week报道,到2027年,印度时尚零售市场的规模预计将达到1,150亿美元,这可能会推动电子商务包装的成长。瓦楞纸箱随处可见,坚固耐用,是服装电商行业广泛使用的包装材料。

- 例如,Arihant Agencies 为电子商务平台的服装部门提供瓦楞纸箱(棕色外箱),以确保其产品在储存和运输过程中的安全。此二次包装具有多种尺寸、样式和其他规格。

- 该公司还提供旨在保护产品并将其运送到目的地的宅配袋。这些包重量轻、防水且价格实惠。它还具有生物分解性、防篡改、透明和可回收等特点。

印度电商包装产业概况

印度电子商务包装市场较为分散,导致竞争对手之间的竞争加剧。然而,设计、技术和应用的创新带来了可持续的竞争优势。时尚、服饰和家电行业不断增长的需求带来了多个市场的开放,使得行业竞争更加激烈。 Packman Packaging 和 Oji India Packaging Pvt Ltd 是主要企业。

- 2022年8月-Storopack推出新型气垫膜:AIRplus Bio Home可堆肥薄膜。薄膜采用可再生天然资源淀粉作为生物基材料,可在家中堆肥。极轻的气垫透过巩固自然循环,有助于减少运输重量和塑胶废弃物。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 网路零售的兴起与全通路的出现

- 市场限制

- 缺乏有关塑胶使用的法规和良好的生产规范

第六章 市场细分

- 按类型

- 盒子

- 保护性包装

- 其他包装

- 按最终用户产业

- 服装与时尚

- 家电

- 饮食

- 个人保健产品

- 其他最终用户产业

第七章 竞争格局

- 公司简介

- Packman Packaging

- U-Pack

- Ecom Packaging

- Avon Pacfo Services LLP

- TGI Packaging Pvt. Ltd

- Kapco Packaging

- Total Pack

- Storopack Ind Pvt. Ltd

- Oji India Packaging Pvt. Ltd

- Astron Packaging Ltd

- B&B Triplewall Containers Limited

第八章投资分析

第九章:市场的未来

The India E-Commerce Packaging Market is expected to register a CAGR of 12.97% during the forecast period.

Key Highlights

- This rapid growth in the e-commerce market is principally driven by the consumer electronics, fashion, apparel, and personal care industries. Considerable investments in consumer electronics, personal care, and fashion and apparel are creating scope for the expansion of packaging opportunities.

- The rising omnichannel business model in the country, where one can shop online and offline, has also boosted the e-commerce market. Omnichannel retailers, such as Shoppers Stop Ltd and Infiniti Retail Limited Croma, are experiencing growth in their sales. They also provide faster delivery with lower shipping costs of packaging as they can ensure delivery from their offline stores in the city.

- To boost the participation of foreign players in the e-commerce landscape, the Indian government hiked the limit of foreign direct investment (FDI) in the e-commerce marketplace model up to 100% (in B2B models).

- The expansion of the e-commerce packaging business needs to be improved by a lack of awareness in rural areas, and online platform distrust also affects goods purchases made online. This trend is preventing the e-commerce packaging sector from growing. A weak foundation and a lack of technological expertise hinder the expansion of the e-commerce packaging sector.

- With the COVID-19 outbreak, the Indian e-commerce packaging industry witnessed a significant decline in growth due to the lockdown in the country. This factor restricted the movement of e-commerce goods and disrupted the supply chain in the country.

India E-Commerce Packaging Market Trends

Protective Packaging to Witness Significant Market Growth

- The demand for protective packaging in the Indian e-commerce industry is set to witness unprecedented growth due to the rapid strides in consumer electronics sales in e-retailing. According to IBEF, consumer electronics is currently the most significant contributor to online retail sales in India, with a 48% share contributing to the market's growth.

- These protective packaging products are designed and constructed to protect the goods from atmospheric, magnetic, electrostatic, vibration, or shock damage. Protective packaging protects machinery, equipment, and industrial goods from harm while being stored and transported. It also provides security through the void fill, wrapping, flexible cushioning, blocking and bracing, defensive containment, and surface defense.

- Protective packaging is used in various applications, such as food, electronics, cosmetics, and pharmaceutical industries. Products include boxes or storage containers, packing materials, liners, and spacers. Flexible products, such as air pillows, paper fill, bubble packaging, and mailers, are expected to be the primary product beneficiaries of rapid growth in the e-commerce market.

- Protective airbags for sending mobile phones, accessories, boxes, etc., are widely used in the e-commerce segment as they help protect goods from damage during transit. Companies, such as Vijay Packaging System, provide these types of packaging. They are made of polypropylene for the e-commerce segment. The company's air tube bags are inflatable airbags used for transporting jars, bottles, and containers, especially for use in cosmetic products.

Fashion and Apparel Accounts for Significant Market Share

- With media exposure, rising awareness, and increasing disposable income, Indian consumers are looking to get access to global fashion brands. The limited reach of brands through brick-and-mortar retail outlets in smaller cities provides an opportunity for online retailers.

- India's e-retail market is anticipated to develop at one of the quickest rates in the world because of significant investment in the area and a sharp rise in internet users. According to IBEF, apparel and lifestyle comprise a share of approximately 29% (including footwear, bags, belts, wallets, watches, and jewelry) in India.

- According to Apparel Sourcing Week, the Indian fashion retail market is set to account for USD 115 billion by 2027, which may aid the growth of e-commerce packaging. Corrugated boxes are ubiquitous and are widely used packaging materials for the e-commerce industry in the apparel segment, as the material is solid and highly durable.

- For instance, Arihant Agencies provides a corrugated box (outer brown box) for the apparel sector in an e-commerce platform, which keeps the product safe and secure while storing and shipping. This secondary packaging is available in different sizes and styles and with other specifications.

- The company also provides courier bags designed to protect products and deliver them to the desired destination. These bags are lightweight, water-resistant, and cost-effective. They are also biodegradable, tamper-proof, transparent, and recyclable.

India E-Commerce Packaging Industry Overview

The Indian e-commerce packaging market is fragmented, thus increasing competitive rivalry in the market. However, design, technology, and application innovation can lead to a sustained competitive advantage. Several developments have been made in the market due to the rising demand from the fashion, garment, and consumer electronics industries, giving the industry a highly competitive position. Packman Packaging and Oji India Packaging Pvt Ltd are the major players.

- August 2022 - Storopack announced a new air cushion film, AIRplus Bio Home Compostable film, which increases the focus on sustainability, as it fulfills the definitions of bioplastics. It is partly bio-based, using the natural and renewable resource starch, and home compostable. The extremely lightweight air cushions reduce shipping weight and plastic waste by closing the natural cycle.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence

- 5.2 Market Restraints

- 5.2.1 Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Boxes

- 6.1.2 Protective Packaging

- 6.1.3 Other Types of Packaging

- 6.2 By End-user Industry

- 6.2.1 Fashion and Apparel

- 6.2.2 Consumer Electronics

- 6.2.3 Food and Beverage

- 6.2.4 Personal Care Products

- 6.2.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Packman Packaging

- 7.1.2 U-Pack

- 7.1.3 Ecom Packaging

- 7.1.4 Avon Pacfo Services LLP

- 7.1.5 TGI Packaging Pvt. Ltd

- 7.1.6 Kapco Packaging

- 7.1.7 Total Pack

- 7.1.8 Storopack Ind Pvt. Ltd

- 7.1.9 Oji India Packaging Pvt. Ltd

- 7.1.10 Astron Packaging Ltd

- 7.1.11 B&B Triplewall Containers Limited