|

市场调查报告书

商品编码

1683432

德国瓷砖市场:市场占有率分析、行业趋势和成长预测(2025-2030 年)Germany Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

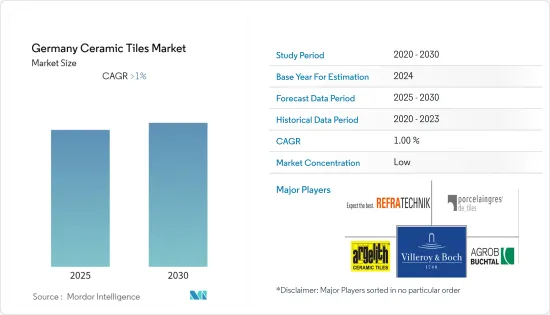

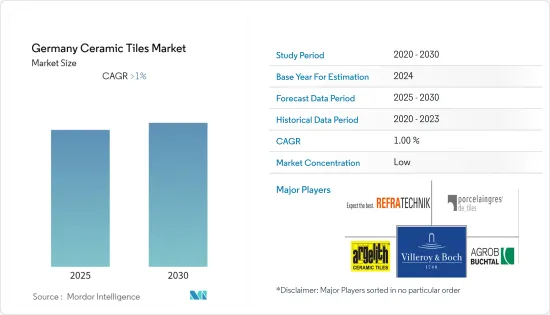

预计预测期内德国瓷砖市场的复合年增长率将超过 1%。

德国是欧洲领先的瓷砖市场之一。该国受益于高度开发和先进的陶瓷产品,例如屋顶瓦片、砖块和卫浴设备。此外,消费者在住宅建筑上的高支出也推动了市场的成长。建筑业的繁荣得益于国家投资和低利率。新住宅基础设施的需求不断增加是影响德国瓷砖市场成长的主要因素。德国是欧洲主要的高岭土生产国之一。

在德国,瓷砖市场也在成长。 2020年磁砖进口量成长9.8%,总合1.136亿平方公尺。根据统计,平均进口价格在每平方公尺4.00欧元至13.85欧元之间。通常,购买的数量越多,价格越低。义大利的进口量维持稳定在6,020万平方公尺左右,其次是土耳其(1,470万平方公尺)、西班牙(1,120万平方公尺)、波兰(1,120万平方公尺)和捷克共和国(750万平方公尺)。进口量增加的原因是,其他国家的製造商在本土市场崩坏后转向更稳定的德国市场。同时,这种转变意味着,约三分之一的产品用于出口的德国製造商在某些情况下失去了重要的出口市场。

德国瓷砖市场的趋势

建设活动的增加推动市场

建筑支出的增加正在推动德国瓷砖市场的发展。室内建筑业对瓷砖的高采用率和地砖的高收益预计将推动德国瓷砖市场的成长。由于德国建筑业前景看好,预计预测期内对瓷砖的需求将会加速。快速的工业化和都市化导致住宅、商业和工业建设活动的增加,从而增加了对瓷砖的需求。在德国,2007年至2020年间,住宅建筑许可证的总数增加。在此期间,发放的许可证总数从18.2万份增加到36.8万多份,增幅超过100%。

地板板块引领市场

陶瓷砖由细密的粘土製成,并在极端温度下烧製,使其具有出色的耐用性,适合用于人流量大的地板材料。新产品的开发和便利的应用技术正在推动商务用地板材料瓷砖市场的发展。陶瓷地板材料具有抗菌、防滑和防水的特性,正在成为医疗保健和机构建筑等各个领域的经济高效且环保的解决方案。消费者对时尚而又实惠的地板材料的需求以及对高品质地砖的需求不断增加等因素推动了德国瓷砖市场的成长。

德国瓷砖行业概况

本报告介绍了在德国瓷砖市场中运作的国际主要参与者。从市场占有率来看,目前少数几家大公司占据着市场主导地位。然而,随着技术进步和产品创新,中小企业正在透过赢得新契约和开拓新市场来扩大其市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 市场限制

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察产业技术趋势

- COVID-19 市场影响

第五章 市场区隔

- 产品

- 釉药

- 瓷

- 无刮痕

- 其他的

- 应用

- 地砖

- 墙砖

- 其他磁砖

- 建筑类型

- 新建筑

- 更换和翻新

- 最终用户

- 住宅

- 商业

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Villeroy & Boch

- Agrob Buchtal

- Argelith Ceramic Tiles Inc

- Porcelaingres GmbH

- Refratechnik Ceramics GmbH

- Golem

- Alois Korzilius Interbau.

- klingenberg dekoramik gmbh

- Tonality gmbh

- Steuler Fliesen GmbH*

第七章 市场机会与未来趋势

第八章 免责声明及发布者

The Germany Ceramic Tiles Market is expected to register a CAGR of greater than 1% during the forecast period.

Germany is one of the European region's major markets for ceramic tiles. The country has the benefits of highly developed and most advanced ceramic products like roof tiles, bricks, sanitary ware, etc. The significant consumer expenditure on residential and housing construction is another factor that benefits the market growth. The booming prospects of the construction sector are attributed to state investments and low-interest rates. The rising demand for new residential infrastructures is the principal factor influencing the German ceramic tiles market growth. Germany is one of the significant producers of kaolin in the European region.

In Germany, the ceramic tile market has grown similarly. Imports of tiles in 2020 climbed by 9.8%, totaling 113.6 million square meters. According to statistics, average import prices range from 4.00 to 13.85 euros per square meter. Frequently, a larger volume was purchased at a lower price. Italy's imports remain stable at roughly 60.2 million square meters, followed by Turkey (14.7 million square meters), Spain (11.2 million square meters), Poland (11.2 million square meters), and the Czech Republic (7.5 million square meters). The increased imports can be explained by the fact that after their home market collapsed, manufacturers in other countries shifted to the stable German market. At the same time, this shift means that German manufacturers, who export around a third of their products, have lost a significant export market in some situations.

Germany Ceramic Tiles Market Trends

Rising Construction Activities are Driving the Market

Increasing construction spending is the key factor in driving the ceramic tiles market in Germany. The high adoption rate of ceramic tiles in the interior construction industry and high revenue generation from the floor tiles are anticipated to boost the German ceramic tiles market growth. Due to the promising construction industry in Germany, the demand for ceramic tiles is expected to accelerate over the projected period. Rapid industrialization and urbanization have resulted in increased residential, commercial, and industrial construction activities, thereby escalating the demand for ceramic tiles. Germany had a general increase in the total number of permits issued for residential property construction between 2007 and 2020. In that period, the total number of permits issued increased from 182 thousand to over 368 thousand, an increase of over 100%.

Floor Segment is Driving the Market

Ceramic tiles are made from fine, denser clay and fired at extreme temperatures, offering superior durability to the flooring with exposure to high traffic. Developing new products and hassle-free installation techniques have considerably driven the ceramic tiles market in commercial flooring. Ceramic floorings are emerging as cost-effective and eco-friendly solutions in various sectors, including healthcare and institutional buildings, owing to the product's antibacterial, anti-slip, and water-resistant properties. Factors such as consumers seeking stylish and less expensive flooring options and escalating demand for high-quality floor tiles will contribute to the growth of the German ceramic tiles market.

Germany Ceramic Tiles Industry Overview

The report covers major international players operating in the German Ceramic Tiles Market. Regarding market share, some of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Trends in the Industry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Others

- 5.2 Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Tiles

- 5.3 Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 End User

- 5.4.1 Residential

- 5.4.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Villeroy & Boch

- 6.2.2 Agrob Buchtal

- 6.2.3 Argelith Ceramic Tiles Inc

- 6.2.4 Porcelaingres GmbH

- 6.2.5 Refratechnik Ceramics GmbH

- 6.2.6 Golem

- 6.2.7 Alois Korzilius Interbau.

- 6.2.8 klingenberg dekoramik gmbh

- 6.2.9 Tonality gmbh

- 6.2.10 Steuler Fliesen GmbH*