|

市场调查报告书

商品编码

1683458

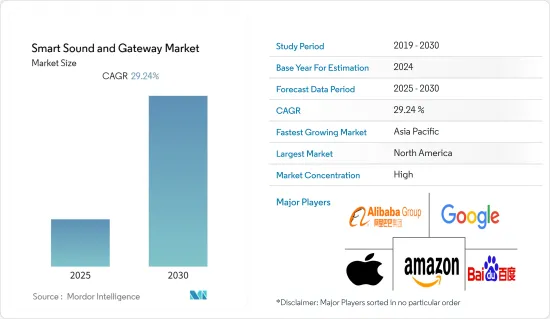

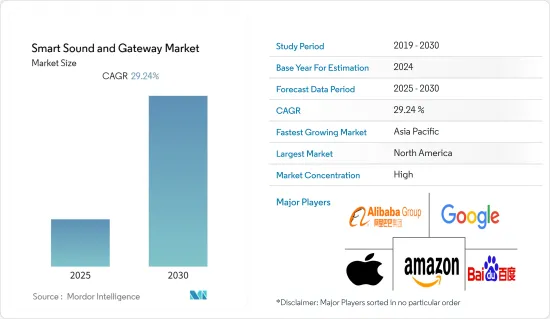

智慧声音与网关市场 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Sound and Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预测期内,智慧音响和网关市场预计将实现 29.24% 的复合年增长率

关键亮点

- 随着智慧型手机和高速网路的普及,全球对智慧音箱的需求呈指数级增长。 2019年,美国和英国等英语国家对内建虚拟语音助理的智慧音箱的需求明显更高,但此后需求转移到中国、德国和印度等非英语国家。

- 从数位语音助理的整体需求来看,苹果的Siri和Google Assistant凭藉其在智慧型手机市场的渗透率引领了整体市场需求。然而,说到智慧音箱,亚马逊的 Alexa 已经引领了市场。由于透过语音搜寻进行的产品查询不断增加,Alexa 占据了智慧扬声器市场的很大份额。

- 由于人们对智慧家庭设备与虚拟助理的认识和相容性不断提高,美国市场目前占据了需求的大部分份额。此外,根据Loup Ventures的研究,2019年美国智慧音箱家庭普及率为35%,预计2025年将达到75%,美国已成为各大厂商重点布局的市场之一。

- 预计未来几年智慧音箱将成为各种智慧家居设备的主要控制设备。考虑到这一点,市场上各种知名供应商都在尝试在这一领域占有一席之地。此外,带有显示器的智慧扬声器预计将在未来几年获得发展动力,因为它们可以为控制各种其他设备提供一个集中的平台。

- 除此之外,随着消费者使用耳机的趋势日益增长,全球对可听设备的需求也日益增长。 JBL、Sony和 Bose 是全球领先的可听设备供应商,各大智慧型手机供应商已与这些公司合作,以增强其可听设备产品。

- 自从新冠肺炎疫情爆发以来,人们待在家里的时间越来越多。隔离初期,消费者被困在家中近三到四个月,导致全球媒体消费和网路使用量增加,尤其是在北美、欧洲和亚太地区。随着语音助理和智慧音箱的普及,2020 年第一季亚马逊、谷歌和苹果等供应商的出货量增加,其中亚马逊仍保持第一的位置,谷歌则位居第二。

智慧声音和网关市场趋势

Google Assistant 占据领先地位

- Google Assistant 已覆盖全球 90 多个国家/地区,每月为智慧音箱、智慧显示器、手机、电视和汽车等超过 5 亿用户提供支援。该公司受益于其适用于所有 Android 智慧型手机的优势。此外,该公司早期在语音辨识方面的进展使得人们能够更好地理解当地语言,从而得到更广泛的接受。

- Google Assistant 目前的主要趋势包括个人化、最终用途特定用例和安全性。例如,2020 年 6 月,该公司宣布所有支援 Google Assistant 的装置都能够分辨出谁在与它们说话。

- 随着消费者需求的变化,Google Assistant 的使用方式也在改变。基于此,Google Assistant 不断改进,为您提供搜寻和地图中的准确资讯。此外,Duplex 的对话技术也用于联繫企业并更新超过 50 万个企业名单。

- 近日,Google与法国零售连锁店家乐福推出了以语音为基础的杂货店购物服务。顾客需要使用 Google Assistant 透过他们的个人资料搜寻和购买杂货。语音购物体现了该零售商更大的电子商务策略,该策略预计到 2020 年将投资 28 亿欧元。

中国市场占有率大幅扩大

- 所调查市场的产品创新率高、本土供应商的製造成本低以及国内消费不断增长是中国成为全球智慧音响和网关市场领先新兴国家之一的关键因素。该国的市场供应商提供各种各样的产品,而且大多价格实惠,这进一步提高了其在该国的渗透率。

- 高通表示,2019年中国消费者追求更好的音质、更高音量播放时不失真的能力、语音助理的长电池待机时间以及价格实惠,而中国的智慧音箱最能满足这些需求。在中国,阿里巴巴天猫精灵(连接方式:Wi-Fi 2.4GHz、蓝牙4.0)和小米小爱同学(连接方式:蓝牙Mesh网关技术)等音箱占据了中国智慧音箱市场一半以上的份额。

- 人工智慧辅助设备等先进技术正在市场上兴起。例如,2019年9月,小米推出了小爱系列两款全新AI智慧音箱。这些扬声器由 Hi-Fi 音讯处理器驱动,并具有 DTS 音讯调谐以及 360 度音场。该公司表示,这些智慧扬声器还将充当智慧家用电子电器的智慧枢纽,可控制多达 5,000 种智慧家庭产品。近日,小米也宣布,2020年迄今其智慧音箱出货量已超过2,200万台。

- 5G 网路的建立和自然语言处理 (NLP) 的进步进一步支持了该国对智慧声音和网关的需求。

智慧声音与网关产业概览

扬声器和可听设备市场在亚马逊、谷歌、苹果等许多知名供应商之间竞争激烈。在这里,供应商正在不断扩展和增强其设备的功能、功能性、准确性以及连接相容设备的能力。主要企业之间不断的产品创新,导致竞争激烈。

- 2020 年 7 月—Amazon.com 为想要编写 Alexa 技能的开发人员宣布了一系列新功能。该团队发布了 31 项新功能。

- 2020年5月,阿里巴巴集团推出四款智慧AI新品,分别是10吋家庭智慧萤幕CC10、音质领先的智慧音箱X5、高性价比的Sugar2产品、以及针对女性用户的「丝绒蓝版」智慧美妆镜。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场趋势

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 竞争对手之间的竞争

- COVID-19 对智慧音箱市场的影响

- 市场驱动因素

- 智慧家庭的兴起

- 消费者对连网型设备的偏好日益增加

- 市场问题

- 对连网型设备的安全担忧

第五章智慧网关/枢纽市场评估

- 当前市场状况 - 趋势、发展、市场估计与预测、2019-2025 年预测

- 推动门户/枢纽成长的因素

- 阻碍门户/枢纽机场成长的因素

- 智慧家庭通讯协定市场现状及方向

第六章 市场细分

- 虚拟助手

- Alexa

- Google Assistant

- Siri

- 鳄鱼

- 小艾

- 多个支援虚拟助理的扬声器

- 其他虚拟助手

- 解决方案

- 智慧扬声器(仅限硬体)

- 可听设备(仅限硬体)

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 其他亚太地区

- 其他的

- 北美洲

第七章 竞争格局

- 公司简介

- Amazon.com Inc.

- Google LLC(Alphabet Inc.)

- Apple Inc.

- Alibaba Group Holding Limited

- Baidu Inc.

- Xiaomi Inc.

- Samsung Electronics Co. Ltd

- Sonos Inc.

- Bose Corporation

- Plantronics Inc.

- 投资分析

- 市场机会与未来趋势

简介目录

Product Code: 71710

The Smart Sound and Gateway Market is expected to register a CAGR of 29.24% during the forecast period.

Key Highlights

- The global demand for smart speakers is growing at an exponential rate, owing to the growing access to smartphones and high-speed internet. In 2019, the demand for smart speakers built with virtual voice assistants was significantly higher in English-speaking nations, such as the United States and the United Kingdom, since then, the demand shifted to other non-English speaking nations, such as China, Germany, and India.

- Among the overall demand for digital voice assistants, overall market demand was led by Apple's Siri and Google Assistant, owing to their penetration in the smartphone market. However, in terms of smart speakers, the market was led by Amazon's Alexa. Alexa commands a prominent share of the smart speaker market, owing to the growing product queries made via voice searches.

- The US market currently commands a prominent share of the demand, owing to the growing awareness and increasing compatible smart home devices with a virtual assistant. Furthermore, according to a study by Loup Ventures, the US smart speaker household penetration in 2019 was valued at 35%, and it is expected to reach 75% by 2025. Thus, the US is one of the major focal points for prominent vendors.

- Smart speakers are expected to be the primary control devices of various smart home devices over the coming years. With this in mind, various prominent vendors in the market are looking to spread their presence in the segment. Furthermore, over the coming years, the smart speakers with a display are expected to gain traction, as they can offer a centralized platform to control various other devices.

- In addition to this, the global demand for hearable is gaining traction, with growing consumer's propensity toward using headphones. JBL, Sony, and Bose are the top vendors of hearable devices across the world, and various smartphone vendors are partnering with these firms to enhance their hearables offerings.

- Since the outbreak of Covid-19, people are increasingly spending time at their homes; during the initial days of quarantine, consumers spent nearly 3-4 months confined to their homes, resulting in increased media consumption and internet usage across the world, especially in the North America, Europe, and Asia-pacific regions. Owing to an increased usage of the voice assistants and smart speakers, the shipments increased during the first quarter of 2020 for vendors such as Amazon, Google, and Apple, with Amazon maintaining its top position and Google retaining its second position.

Smart Sound & Gateway Market Trends

Google Assistant to witness a Significant Market Share

- With google assistant's accessibility to users spanning in more than 90 countries, it has been assisting over 500 million people every month to get things done across smart speakers and smart displays, phones, TVs, and cars, to name a few. The company has been benefiting from its mandatory availability across all the android smartphones. Additionally, its early advancements in speech recognition have enabled a better understanding of vernacular languages, and thus a wider acceptability of the same.

- Some of the current key trends that the Google assistance has been banking on or is expected to feature later in 2020, are based on personalization, specialized end-use applications, and security, to name a few. For instance, in June 2020, the company announced that all Google Assistant-enabled devices would be able to tell who is talking to them.

- With consumer requirements shifting, it is also reflective of how Google Assistant is being used. Based on the same, Google Assistance has been on a continuous improvement spree to help people get accurate information on Search and Maps. In addition, it leveraged Duplex conversational technology to contact businesses and update over half a million business listings.

- More recently, Google and French retail chain, Carrefour launched a voice-based grocery shopping service. Customers need to use Google Assistant to search for and purchase groceries using their personal profile. The voice shopping arrangement is reflective of retailers' larger e-commerce strategy, by investing EUR 2.8 billion across 2020.

Market Share of China to increase significantly

- The high rate of product innovation in the studied market, low manufacturing cost achieved by local vendors, and increased domestic consumption are some of the major factors making China as one of the major emerging countries in the global smart sound and gateway market globally. The market vendors are in the country are offering a wide range of products, mostly at an affordable price, which is further fueling the adoption rate in the country.

- According to Qualcomm, in 2019, the Chinese consumers looked for better sound quality, ability to play at loud volumes without distortion, voice assistant enabled long standby hours on battery, and affordable price and the Chinese smart speakers fit best for these demands. In China, speakers, such as Alibaba Tmall Genie (connectivity: Wi-Fi 2.4 GHz, Bluetooth 4.0) and Xiaomi Xiao Ai (connectivity: Bluetooth Mesh Gateway technology) nearly account for more than half of the smart speakers share in the Chinese market.

- Advanced technologies such as AI-assisted devices are an emerging trend in the' market. For instance, in September 2019, Xiaomi has launched two new AI-powered smart speakers under the XiaoAI series. The speakers are enabled with Hi-Fi audio processors and feature DTS audio tuning along with a 360-degree sound field. According to the company, these smart speakers can also act as a smart hub for smart home appliances and can be used to control up to 5,000 smart home products. Recently, in 2020, Xiaomi also announced that its smart speaker shipments had crossed 22 million units to date.

- The establishment of 5G network and advancement in Natural Language Processing (NLP) are further supporting the demand for smart sound and gateway in the country.

Smart Sound & Gateway Industry Overview

The speaker and hearables market is witnessing an intense rivalry among prominent vendors, such as Amazon, Google, Apple, and many other vendors. Here, vendors are increasingly expanding their device capabilities, accuracy, ability to connect to compatible devices, and enhancing their abilities. The product innovation of leading companies is constant and contributes to the high level of competition.

- Jul 2020- Amazon.com announced a slew of new features for developers who want to write Alexa skills. The team released 31 new features.

- May 2020- Alibaba Group introduced four new smart AI products,namely, the 10-inch home smart screen CC10, the main sound quality of the smart speaker X5, cost-effective Sugar 2 product, and a "velvet blue version" smart beauty mirror for the female users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET IDYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Smart Speaker Market

- 4.4 Market Drivers

- 4.4.1 Increasing Number of Smart Homes

- 4.4.2 Growing Consumer Propensity toward Connected Devices

- 4.5 Market Challenges

- 4.5.1 Security Concerns Pertaining to Connected Devices

5 SMART GATEWAYS/HUBS MARKET ASSESSMENT

- 5.1 Current Market Scenario - Trends, Developments, Market Estimates, and Projections from 2019-2025

- 5.2 Factors Driving the Growth of Gateways and Hubs

- 5.3 Factors Challenging the Growth of Gateways and Hubs

- 5.4 Smart Home Protocol Market Landscape and Direction

6 MARKET SEGMENTATION

- 6.1 Virtual Assistant

- 6.1.1 Alexa

- 6.1.2 Google Assistant

- 6.1.3 Siri

- 6.1.4 AliGenie

- 6.1.5 Xiao AI

- 6.1.6 Multiple Virtual Assistant Support Speakers

- 6.1.7 Other Virtual Assistants

- 6.2 Solution

- 6.2.1 Smart Speaker (Only Hardware)

- 6.2.2 Hearables (Only Hardware)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com Inc.

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Apple Inc.

- 7.1.4 Alibaba Group Holding Limited

- 7.1.5 Baidu Inc.

- 7.1.6 Xiaomi Inc.

- 7.1.7 Samsung Electronics Co. Ltd

- 7.1.8 Sonos Inc.

- 7.1.9 Bose Corporation

- 7.1.10 Plantronics Inc.

- 7.2 INVESTMENT ANALYSIS

- 7.3 MARKET OPPORTUNITIES AND FUTURE TERNDS

02-2729-4219

+886-2-2729-4219