|

市场调查报告书

商品编码

1683524

越南汽车租赁:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Vietnam Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

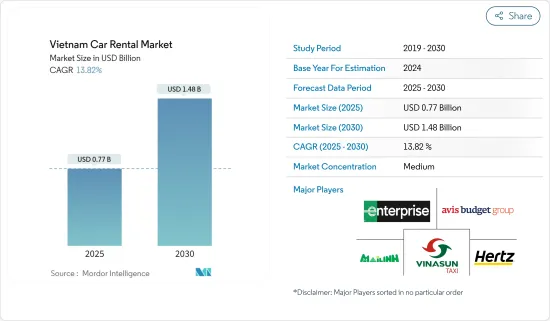

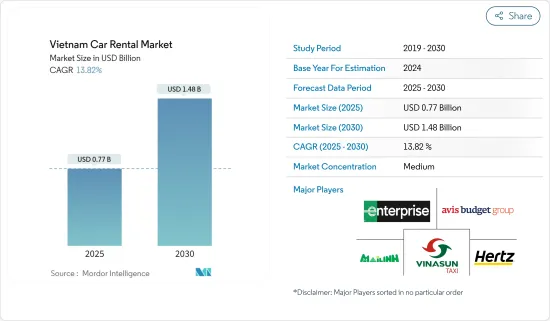

预计2025年越南汽车租赁市场规模为7.7亿美元,预计到2030年将达到14.8亿美元,预测期内(2025-2030年)的复合年增长率为13.82%。

从长远来看,随着越南都市化的快速发展和中产阶级的崛起,汽车租赁有望成为城市交通行业最突出的服务之一,包括当地使用、机场接送和郊区旅行。由于网路普及率和有组织产业的稳定成长,越南的汽车租赁市场正在迅速成长。

技术进步也是汽车设备租赁市场的主要驱动力,汽车租赁公司越来越多地利用物联网 (IoT) 和巨量资料等数位技术来改善客户服务、降低营运成本并改善车队管理。公司正在向市场推出附加价值服务并加强其在越南的影响力。

此外,最重要的发展之一是电动和自动驾驶汽车的日益普及。随着越来越多的汽车製造商投入这些技术的研发中,汽车租赁业很可能必须适应这些新型车辆。例如

主要亮点

- 2024年1月,以永续成长为目标于2023年初推出的新交通品牌Xanh SM推出了名为「Xanh SM Rentals」的短期自动驾驶汽车租赁服务。该公司提供具有诱人定价政策的电动车租赁套餐,推出后仅八个月就吸引了超过 1,500 万名客户。

- 同样,2023 年 4 月,绿色智慧移动股份公司 (GSM) 成立并推出,作为越南多平台绿色交通模式。它由 100% 电动车驱动。

Hertz Corporation 和 VinFast 等主要公司都使用 GSM。 VinFast 等公司正在使用联网汽车技术来提供资料,以便更好地了解客户需求和偏好并提供个人化的租赁解决方案。

然而,高额的电动车进口关税正在阻碍越南汽车租赁市场的成长。越南政府已采取倡议扩大电动车製造厂和充电基础设施,例如《国家汽车发展战略(2021-2050年)》和越南工业协会(VAMA),计划到2040年将电动汽车年产能提高到350万辆,旨在刺激製造业并大幅提高电动车的普及率。

越南汽车租赁市场趋势

线上部分占比最高

- 网路用户数量的增加和线上租赁服务的便利性是决定该细分市场成长的关键因素。

- 根据世界银行资料,到2023年越南网路用户数将超过80%,这将成为线上预订管道份额快速上升的主要因素。

- 智慧型手机和网路技术的发展为旅游和运输业带来了重大变化。乘客可以透过线上平台或应用程式预订车辆,将乘客与汽车连接起来。例如

- 根据越南统计总局的数据,河内的平均人口约为 843 万人。预计到 2025 年,河内至少 95% 的家庭将拥有至少一部智慧型手机。

- 同样,邮政和通讯基础设施发展计划推动了河内的数位转型计划,直至 2025 年,并着眼于 2030 年。河内智慧型手机用户的增加和互联网技术的采用率的上升可归因于该省行动服务的成长。

- 此外,网上租赁越来越受到消费者的欢迎,因为省去了前往实体店并比较价格和车型的麻烦。网路媒体还可以帮助消费者在做出决定之前扩大选择范围。

- 越南旅游业的扩张也推动了汽车租赁需求的增加。因为外国游客可以透过网路媒介预订他们想要的车辆。

- 随着政府对发展和改善该地区旅游业的战略投资,预计未来几年透过线上方式进行汽车租赁的需求将很大。

- 越南政府预计到 2025 年将吸引 1,800 万国际游客和 1.2 亿国内游客。该国正在采取措施使其旅游业更加永续,这也可能促进该国的经济发展。

- Momondo 和 Avis 等多家公司提供线上预订服务,您可以在河内、胡志明市和岘港等地预订不同类型的汽车,从 SUV 到掀背车。其他功能包括使用该应用程式锁定和解锁您的汽车以及查看行车记录器拍摄的画面。

通勤占很大比重

- 越南正在经历快速都市化,人口快速成长。随着人们为了更好的生活水准而迁移到都市区寻找就业,对便利交通途径的需求也日益增加。

- 人们正在采用汽车租赁服务进行日常通勤和购物,这对市场产生了积极的影响。此外,对永续交通以实现净零排放目标的关注正在为计程车公司创造稳定且不断增长的基本客群。

- 例如,越南运输部(MoT)正在就一项拟议政策寻求意见,该政策旨在透过向电动车购买者提供 1,000 美元的补贴来促进电动车(EV)产业的发展。

- 越南的各种汽车租赁公司,例如 Grab 的交通服务,正在透过提供满足不同品味的多种选择来改变城市通勤方式,并允许用户选择最适合他们需求和预算的选项,透过各种车辆选择确保舒适的旅程。

- 随着叫车平台的采用等技术进步的发展,越南的计程车服务覆盖范围不断扩大。该平台提供的各种功能包括即时追踪、驾驶员评级和安全的无现金交易系统。其他服务,例如加速穿越交通拥堵,已成为越南人日常通勤的重要组成部分。

- 当地计程车也被认为是一种安全合理的交通方式,非常适合不熟悉所游览地区的游客。

- 考虑到成长,新Start-Ups专注于增加车辆的尺寸和容量以扩大用户群,并选择资金筹措方案。

- 此外,预计汽车租赁服务提供者将进行大量投资,扩大其车队,以满足日益增长的电动车需求。这些公司提供多种领域的电动车,从掀背车到BMW X5 等豪华 SUV。

- 例如,2024 年 1 月,Be Group 宣布已从 VPBank Securities 获得 7,395 亿越南盾(4,040 万美元)的资金,以完成其网路扩张。

越南汽车租赁业概况

越南的汽车租赁市场由知名的全球和区域参与者巩固和主导。为了维持市场地位,公司正在采取新产品发布、合作和合併等策略。

例如,2023 年 3 月,VinFast 在越南成立了一家新的电动车和Scooter租赁公司。 VinFast 是越南大型企业集团 VinGroup 的一部分,该集团也在利用其 VinFast 电动车推动绿色交通。

市场的主要企业包括 Avis Budget Group、The Hertz Corporation、Hertz、Enterprise Holdings、Vinasun Corp.、Mai Linh Group 和 VN Rent a Car。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 扩大租赁燃油电动车的使用

- 市场限制

- 替代交通选择阻碍市场成长

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔(市场规模:金额)

- 按预订类型

- 在线的

- 离线

- 按租赁期限

- 短期

- 长期

- 按应用

- 观光

- 通勤

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Vietnam Sun Corporation(Vinasun)

- Mai Linh Group

- Vina(Vietnam)Rent A Car

- Grab Holdings Inc.

- PT Gojek

- Hertz Corporation

- Enterprise Holdings

- Avis Budget Group

- Green and Smart Mobility JSC(GSM)

第七章 市场机会与未来趋势

The Vietnam Car Rental Market size is estimated at USD 0.77 billion in 2025, and is expected to reach USD 1.48 billion by 2030, at a CAGR of 13.82% during the forecast period (2025-2030).

Over the long term, with the rapid urbanization and rise of the middle class in Vietnam, car rental is expected to become one of the best-known services available in the urban transportation industry for local use, airport transportation, and out-of-town travel. The Vietnamese car rental market has grown quickly as a result of the increased internet penetration and the steady growth of the organized sector.

Technological advancement is also a key driver of the automotive equipment rental market, as car rental companies are increasingly utilizing digital technologies like the Internet of Things (IoT) and big data to enhance customer service, lower operational costs, and better manage their fleet. Companies are launching their value-added services in the market and strengthening their footprint in Vietnam.

Moreover, one of the most significant developments is the increasing popularity of electric and autonomous vehicles. As more car manufacturers invest in the research and development of these technologies, it is expected that the car rental industry will need to adapt to accommodate these new types of vehicles. For instance,

Key Highlights

- In January 2024, Xanh SM, which is a new transportation brand launched in early 2023 focusing on sustainable growth, launched a short-term self-driving car rental service, Xanh SM Rentals. The company offers electric car rental packages with appealing price policies, attracting more than 15 million customers after only eight months of launch.

- Similarly, in April 2023, Green and Smart Mobility JSC (GSM) was established and launched in Vietnam as a multi-platform green transportation model. It operates with a fleet of 100% electric vehicles.

The major players such as The Hertz Corporation. VinFast, and others use connected car technologies as they provide data that can be used to understand their customers' needs and preferences better and offer personalized rental solutions.

However, heavy import duty taxes on electric vehicles are hindering the growth of the car rental market in Vietnam. The government is taking initiatives to expand EV manufacturing plants and charging infrastructure, such as the National Automobile Development Strategy (2021-2050) and the Vietnam Automobile Manufacturers Association (VAMA), which aims to stimulate manufacturing and significantly increase the use of e-vehicles with a planned annual production capacity of 3.5 million electric vehicles by 2040.

Vietnam Car Rental Market Trends

Online Segment Holds the Highest Share

- Rising internet users, coupled with the convenience of availing online services for rental services, serve as significant determinants for the growth of this market segment.

- According to the World Bank Data, the number of internet users in Vietnam was more than 80% in 2023, which acts as a major factor for the exponential rise in the share of online booking channels.

- The developments in smartphones and internet technology have brought considerable changes in the travel and transportation industry. It uses an online platform and apps to book the ride, and this helps to connect passengers and cars. For instance,

- According to the General Statistics Office of Vietnam, the average population in Hanoi amounted to approximately 8.43 million people. At least 95% of total households in Hanoi are expected to use at least one smartphone by 2025.

- Similarly, the postal-telecommunications infrastructure development plan drives the city's digital transformation program to 2025 with a vision for 2030. The growing number of smartphone users and rising adoption of internet technology in Hanoi is attributed to the growth of mobility services in the province.

- Furthermore, online renting is increasingly preferred by consumers as they can avoid the hassle of visiting physical locations and comparing prices, car makes, and models. Online mediums also assist in expanding the choice base of consumers before deciding.

- The expanding tourism sector across Vietnam also contributes to the increasing demand for car rental services since international tourists can avail of online mediums to pre-book their desired vehicles.

- With the strategic government investment to develop and improve the region's tourism sector, a massive demand is expected for renting cars through the online segment in the coming years.

- The government of Vietnam estimates 18 million international visitors and 120 million domestic tourists by 2025. The country is taking steps to make the tourism sector more sustainable, which may also boost its economy.

- Various companies, such as Momondo and Avis, are offering online booking services to locations like Hanoi, Ho Chi Minh City, and Da Nang to book various types of vehicles, from SUVs to hatchbacks. The other features include locking/unlocking cars via an app and watching the dash camera.

Commuting Holds the Highest Share

- Vietnam has witnessed an exponential rise in population growth with rising urbanization. There is a growing demand for convenient transportation options as people migrate to urban cities to seek employment for better living standards.

- People are adopting car rental services for daily commuting and shopping trips, which creates a positive impact on the market. Moreover, the focus on sustainable transportation to meet net zero emission goals is creating a consistent and growing customer base for taxi companies.

- For instance, the Vietnamese Ministry of Transport (MoT) has sought feedback on a proposed policy to boost the electric vehicle (EV) industry by offering a USD 1,000 subsidy to electric car buyers, a move that could accelerate the shift toward green, eco-friendly energy in the country.

- The various car rental companies in Vietnam, such as Grab's Transportation Service, are making transitions in urban commuting, offering choices of diverse preferences and ensuring comfortable rides with a wide variety of vehicle choices, which allows users to select the option that best suits their needs and budget.

- The growth in technological advances, like the adoption of ride-hailing platforms, is improving the reach of taxi services in Vietnam. The various features offered by platforms include real-time tracking, driver ratings, and a secure, cashless transaction system. The other services, like quicker trips through traffic, have become an integral part of daily commuting in Vietnam.

- A local metered taxi is also considered a safe and reasonable way to travel as it is great for tourists who do not know about the area they are visiting.

- Considering the growth, new startup companies are focusing on increasing their fleet size and capacity to expand their user base and opting for funding options as well.

- Moreover, heavy investments from car rental service providers are expected to cater to the growing demand for electric vehicles by expansion of its fleets. The companies offer electric vehicles in different segments ranging from hatchbacks to high-end SUVs like BMW X5.

- For instance, in January 2024, Be Group announced that it received VND 739.5 billion (USD 40.4 million) in funding from VPBank Securities to complete its network expansion.

Vietnam Car Rental Industry Overview

The Vietnamese car rental market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

For instance, in March 2023, VinFast established a new electric car and scooter rental company in Vietnam. VinFast is part of a large Vietnamese conglomerate named VinGroup, which also uses VinFast EVs to promote green mobility.

Some of the major players in the market include Avis Budget Group, The Hertz Corporation, Hertz, Enterprise Holdings, Vinasun Corp., Mai Linh Group, and VN Rent a Car.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Penetration of Electric Vehicles for Rental Fuels

- 4.2 Market Restraints

- 4.2.1 Alternative Mode of Transport Options Hinder the Market's Growth

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD million)

- 5.1 By Booking Type

- 5.1.1 Online

- 5.1.2 Offline

- 5.2 By Rental Duration

- 5.2.1 Short-term

- 5.2.2 Long-term

- 5.3 By Application Type

- 5.3.1 Tourism

- 5.3.2 Commuting

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Vietnam Sun Corporation (Vinasun)

- 6.2.2 Mai Linh Group

- 6.2.3 Vina(Vietnam) Rent A Car

- 6.2.4 Grab Holdings Inc.

- 6.2.5 PT Gojek

- 6.2.6 Hertz Corporation

- 6.2.7 Enterprise Holdings

- 6.2.8 Avis Budget Group

- 6.2.9 Green and Smart Mobility JSC (GSM)